bauhaus1000

Apple (NASDAQ:AAPL) is one of the most important companies around, with a peak value of over $3 trillion. It makes up about 1/12th of the entire value of the US stock market.

Apple is worth more than all of America’s regional banks combined.

Its sales of $400 billion per year are twice the GDP of New Zealand.

In 2022, Apple bought back $109 billion in stock. Today, 117 companies in the world are worth that much.

Apple did the equivalent of buying Medtronic last year via buybacks.

These are just a few incredible examples of why Apple is such a dominant company, arguably the most important globally, at least to investors.

But I think it’s important to remember that even the mightiest titans can stumble, fall, or even fail.

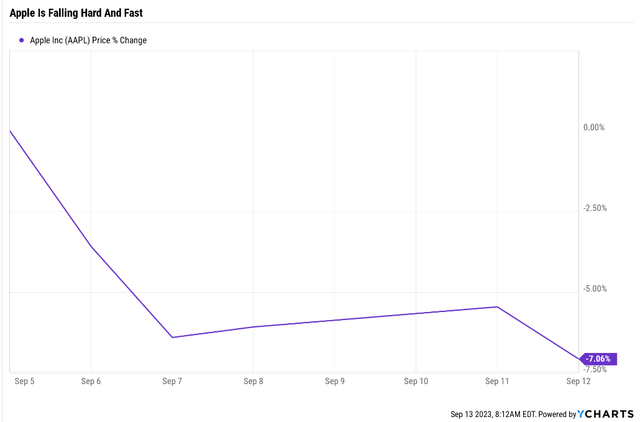

YCharts

Apple wiped out more than $200 billion in market cap in about two days.

Prayers that the iPhone 15 launch would stem the tide of pain have thus far gone unanswered.

Several have asked me to do an update on Apple, specifically what its growth prospects and valuation look like now.

So let me look at the good, bad, and ugly about Apple’s $200 billion crash to see whether it’s still worth buying this company and at what price.

Apple Was Priced As If Nothing Would Ever Go Wrong…

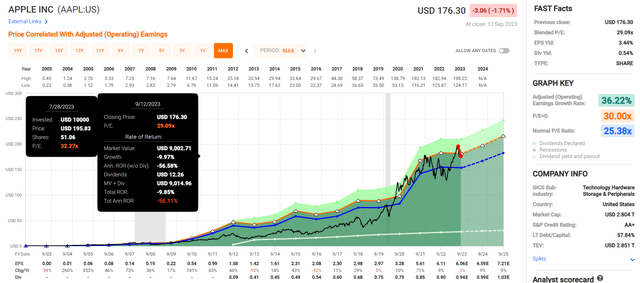

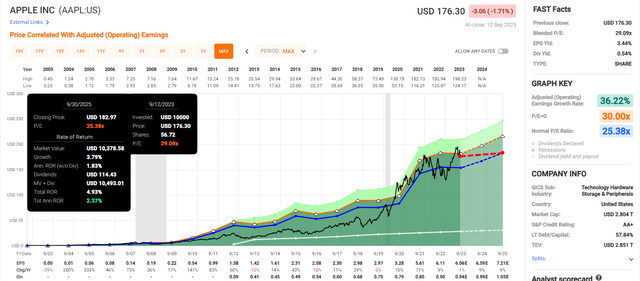

FAST Graphs, FactSet

Apple is worth about 25 to 26X earnings. That’s the average PE for 20 years, similar to the 25X that MSFT, GOOG, Meta, and AMZN (cash flow) trade at.

Big tech is worth about 25X. That’s what objective market fact tells us, based on over a decade of pricing these companies’ good, bad, and ugly.

Arguing that Apple was a good buy at 32X earnings was pure speculation. It was speculation that plenty of professional Apple analysts were happy to do.

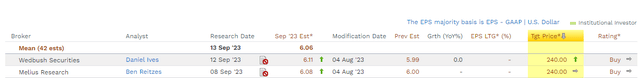

FactSet Research

Danny Ives of Wedbush has long been the Thomas Lee of Fundstrat. But where Mr. Lee can always come up with a wildly bullish thesis for the S&P (like how it could soar 700% within a decade), Mrs. Ives is the top permabull on Apple.

He won’t tell you how fast he thinks the company can grow long term. He’ll just tell you the next upgrade cycle is going to be massive and pretend like 32X earnings weren’t already pricing that in.

$240 on Apple within 12 months is Mr. Ives’s forecast (Melius Research, too).

Here’s What $240 In 12 Months Means For Apple’s Valuation

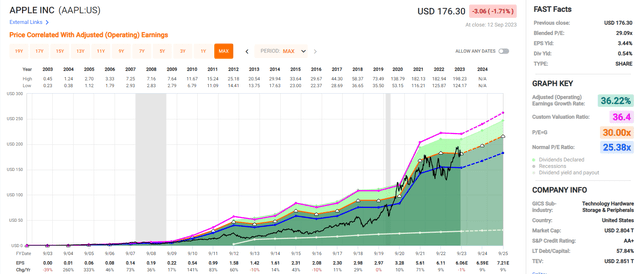

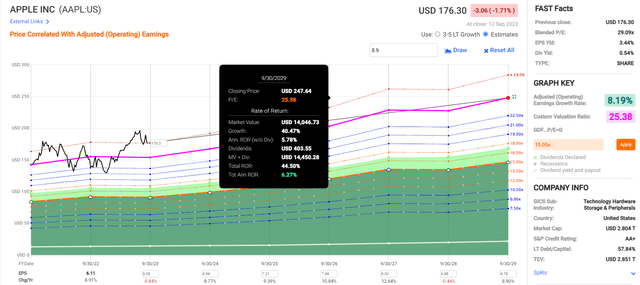

FAST Graphs, FactSet

The only times Apple has traded at 36.4X forward earnings, what $240 in a year would represent, was during the Pandemic tech mania and the 2000 tech bubble peak.

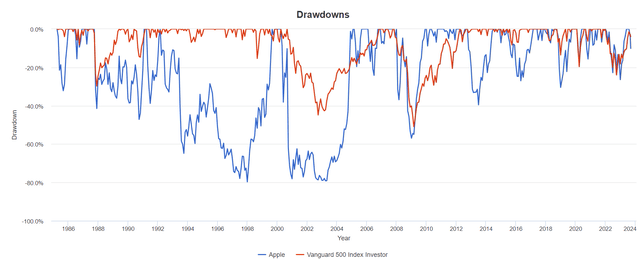

80% Declines... That’s What Happens When You pay 36.4X Earnings For Apple

Portfolio Visualizer Premium

Apple can take 7.5 years to break even from such bubble valuations.

Imagine buying Apple today, as close to God’s own company as it exists, and 7.5 years later, you’ve made no money and lost about 20% due to inflation.

Is Apple a lousy company? Are you kidding me?

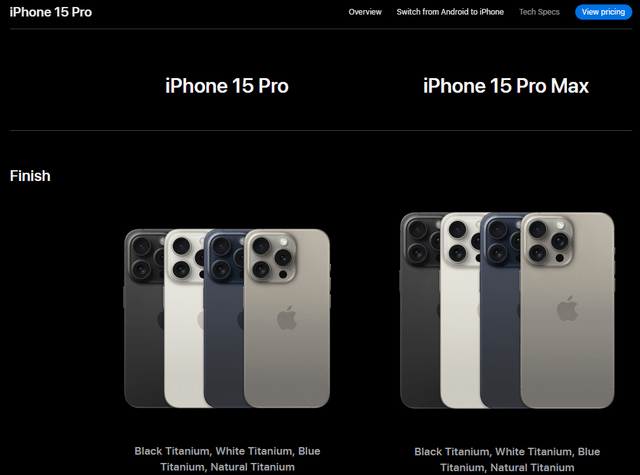

Look what’s in the Phone!

Apple

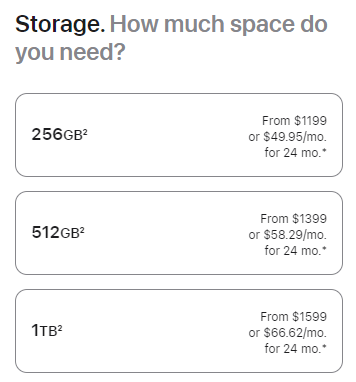

Apple is selling $1,200 phones that can be upsold to $1,600!

Apple

Apple

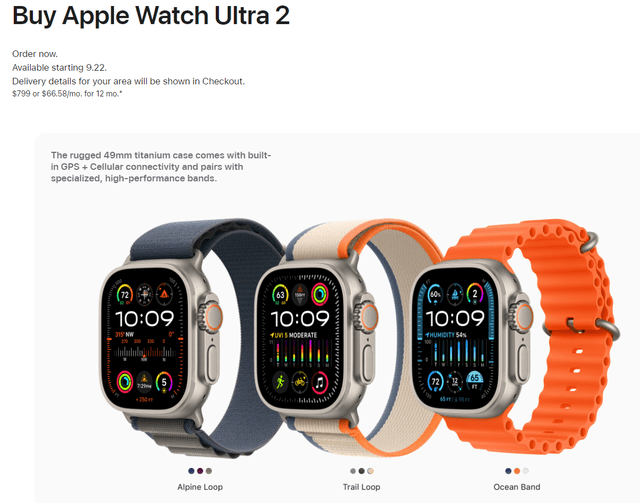

Apple now sells $800 watches that can be upgraded to a Hermes version for $1,250.

I don’t care about watches, yet crave one of these $800 monstrosities! That’s how good Apple’s brand is!

My next phone is an iPhone Pro Max, though I’m not paying for more memory. 256 GB is plenty.

My next watch, replacing my Fitbit, will be an Apple Ultra watch because I’m a sucker for Apple’s brand.

But what I plan to do is immaterial. Here’s what matters.

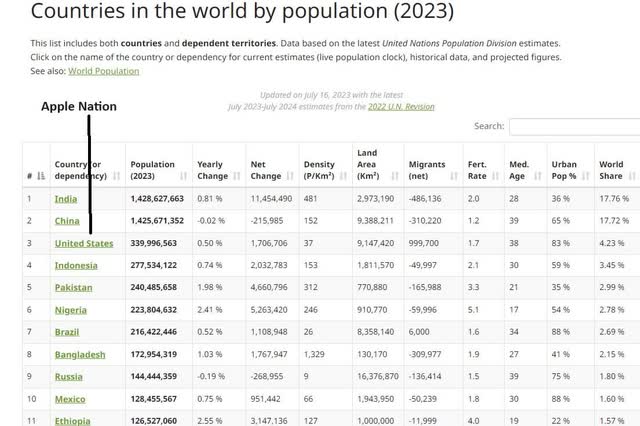

Apple’s ecosystem is more than 100 products strong, with more than 1.4 billion installed devices used by 1 billion customers.

Worldometer

Apple nation is the third-largest nation on earth, with 1/8th of humanity owning its products.

And let’s not forget about Apple’s potential $50 billion in sales that a car might generate by 2030 alone.

What Apple Is Working On Now: The Apple Car

Dall:E

The Apple Car continues secretly, with rumors about 2026 as a potential launch date.

AppleInsider

Look at the brand power of Apple. Tesla, the king of auto cool, with the top customer satisfaction in the industry (despite poor reliability), could lose up to 50% of its customers to a car that hasn’t even been officially announced yet.

A survey of new car buyers reports that a quarter would “definitely consider” an Apple Car, including more than 50% of the Tesla owners asked. – AppleInsider

There’s no questioning that Apple is an incredible luxury brand, and that means its money-minting magic could continue not just for decades but for centuries.

What brands are timeless and seldom worry about losing their moats or aspirational status?

- Yves Saint Laurent was founded in 1961 (62 years old)

- Christian Dior was founded in 1946 (76 years old)

- Fendi 1925 (98 years old)

- Gucci 1921 (102 years old)

- Balenciaga 1919 (104 years old)

- Prada 1913 (110)

- Chanel 1910 (113 years old)

- Rolex 1905 (118 years old)

- Tiffany 1837 (136 years old)

- Burberry 1857 (166 years old)

- Louis Vuitton 1854 (169 years old)

- Hermes 1836 (186 years old)

- Château d’Yquem (oldest LVMH brand) 1593 (430 years old) – $240 to $3000 bottles of wine.

Luxury brands are timeless! They don’t just last for years or decades; they can last for centuries.

If there is any company, I’m confident will exist in 400 years, it’s Apple. But longevity and brand power, which Statista estimates is worth $900 billion for Apple, doesn’t mean things can’t go wrong in the future.

And Then Something Went Wrong

On Sept. 7, China declared that central government employees would not be allowed to use iPhones. Apple fell 6% in two days, shedding $200 billion in value. China has since reiterated that it will not ban iPhones or any foreign phone. It just wants to maintain cyber security for government employees.

It’s no different than the US government banning Huawei phones for key government workers.

The US did ban Huawei and ZTE phones and equipment in 2019, citing national security concerns.

So now that the news that iPhones are still safe in China, Apple must be soaring, right? Nope. It’s down another 0.3%.

Remember that Apple was trading at a high premium and a premium its actual growth doesn’t support.

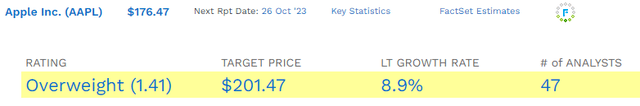

FactSet Research

Please show me a company growing at 9%, barely faster than the S&P 500 overall, that deserves a 36X multiple like Mr. Ives thinks it will get.

The growth consensus range on Apple is 3% to 15%.

For Example, Deutsche Bank thinks Apple’s long-term growth rate in the future is 7.4%.

- 7.4% growth + 0.6% yield = 8% long-term returns

Deutsche Bank thinks that Realty Income will outperform Apple in the future. Not just for a few years, but from now on, decades into the future.

That might not seem very easy to believe, but just look at the short to medium-term outlook from all 47 analysts. Collectively, those 47 analysts know this company better than anyone other than Tim Cook.

| Metric | Historical Fair Value Multiples (all Years) | 2022 | 2023 | 2024 | 2025 |

12-Month Forward Fair Value |

|

| PE | 25.38 | $154.56 | $156.85 | $171.06 | $188.57 | ||

| Average | $154.56 | $156.85 | $171.06 | $188.57 | $166.96 | ||

| Current Price | $175.55 | ||||||

|

Discount To Fair Value |

-13.58% | -11.92% | -2.62% | 6.91% | -5.14% | ||

|

Upside To Fair Value (Including Dividends) |

-11.95% | -10.65% | -2.56% | 7.42% | -4.37% | ||

| 2023 EPS | 2024 EPS | 2023 Weighted EPS | 2024 Weighted EPS | 12-Month Forward PE | 12-Month Average Fair Value Forward PE | Current Forward PE |

Cash-Adjusted PE |

| $6.18 | $6.74 | $1.78 | $4.80 | $6.58 | 25.38 | 26.69 | 21.3 |

Even after its correction, Apple is trading at 27X forward earnings. Adjust for net cash – you get 21X for a company growing at single digits.

Realistic Expectations For Apple Going Forward

Does this look like a growth stock to you?

| Metric | 2022 Growth | 2023 Growth Consensus | 2024 Growth Consensus |

2025 Growth Consensus |

| Sales | 11% | 1% | 6% | 6% |

| Dividend | 7% | 7% | 5% | 1% |

| Earnings | 9% | -1% | 9% | 9% |

| Operating Cash Flow | 21% | 0% | 7% | 7% |

| Free Cash Flow | 24% | -2% | 7% | 4% |

| EBITDA | 12% | 0% | 8% | 6% |

| EBIT | 13% | -1% | 7% | 7% |

(Source: FAST Graphs, FactSet)

Does a 0.6% yield generate much income? Maybe for those who have owned Apple for a decade or two, but not for new investors.

Who should own Apple? Everyone who owns index funds (which should be most people).

Who should buy Apple’s stock? At the moment, I can think of one kind of investor, the speculative trader, hoping Apple does a quick recovery.

Apple 2025 Total Return Consensus

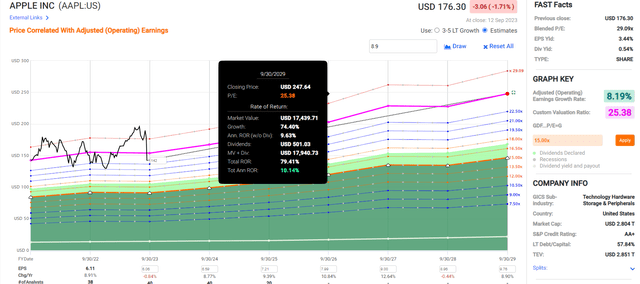

FAST Graphs, FactSet

If Apple grows as analysts expect and returns to objective long-term market-determined fair value, your inflation-adjusted returns through the end of 2025 are about zero.

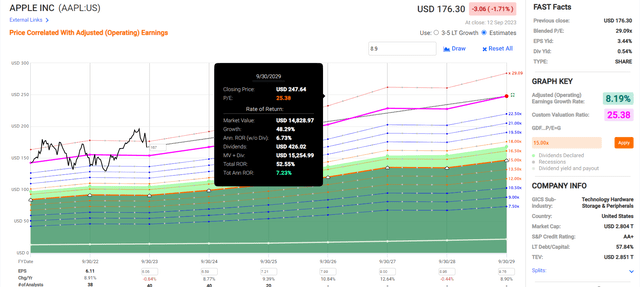

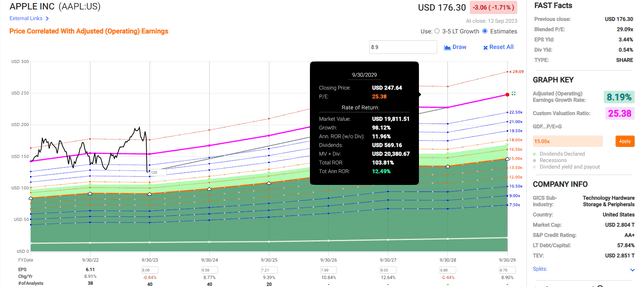

Apple 2029 Total Return Consensus

FAST Graphs, FactSet

Through 2029, analysts collectively think Apple will grow at 8% and deliver 6% annual returns, including dividends.

- yield 0.6%

- LT growth consensus 8.9% per year

- 10-year valuation boost -0.5% per year

- long-term growth consensus: 9.4% per year

- 10-year consensus total return: 8.9% per year = 135% vs 130% S&P 500

Apple is likely to match the market over the next decade, but that’s about it.

OK, but what if Apple keeps falling? Hits fair value? Becomes undervalued?

| Rating | Margin Of Safety For Medium-Risk 13/13 Ultra SWAN Quality | 2023 Fair Value Price | 2024 Fair Value Price | 12-Month Forward Fair Value |

| Potentially Reasonable Buy | 0% | $156.85 | $171.06 | $166.96 |

| Potentially Good Buy | 5% | $149.01 | $162.51 | $158.61 |

| Potentially Strong Buy | 15% | $133.32 | $145.40 | $141.92 |

| Potentially Very Strong Buy | 25% | $111.75 | $128.30 | $125.22 |

| Potentially Ultra-Value Buy | 35% | $101.95 | $111.19 | $108.52 |

| Currently ( hold ) | $174.71 | -11.39% | -2.13% | -4.64% |

| Upside To Fair Value (Including Dividends) | -9.70% | -1.56% | -3.91% |

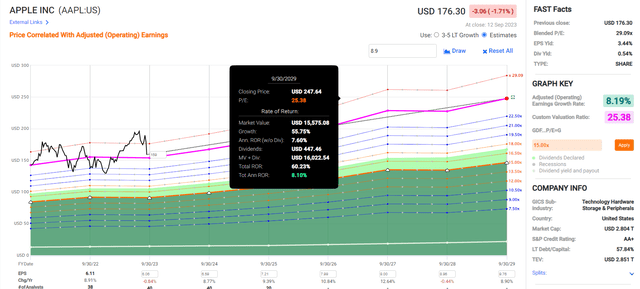

Apple 2029 Total Return Consensus From Fair Value ($167)

FAST Graphs, FactSet

Buying Apple at fair value means your returns will be OK but not great. Apple isn’t likely to beat the S&P in the future if it’s growing at single digits.

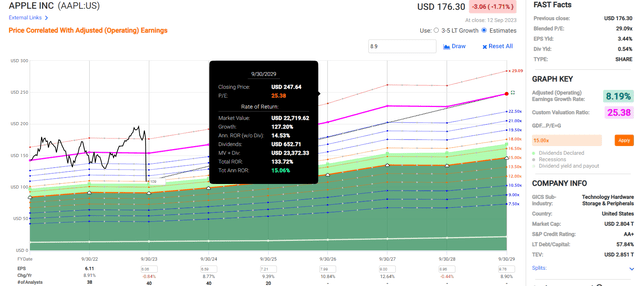

Apple 2029 Total Return Consensus From Potential Good Buy Price ($159)

FAST Graphs, FactSet

Apple is a defensive luxury brand now. Consumers are likely to keep buying its products even in recessions, and at a modest 5% discount, this low-risk option can make decent long-term returns. But you won’t get rich or impress your friends like most utilities.

Apple 2029 Total Return Consensus From Potential Strong Buy Price ($142)

FAST Graphs, FactSet

At a 15% discount, Apple should be able to keep up with the S&P for the next six years or so.

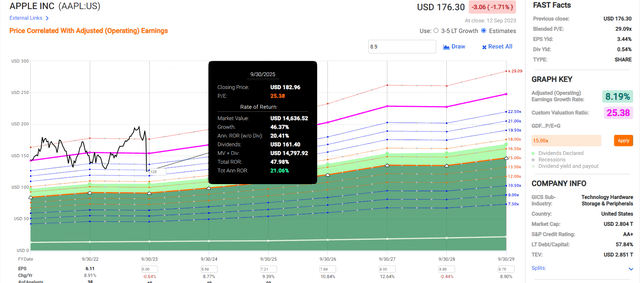

Apple 2029 Total Return Consensus From Potential Very Strong Buy Price ($125)

FAST Graphs, FactSet

If you want to beat the S&P over the next few years, it will take a decent 25% discount to make it happen unless Apple’s growth returns to double digits.

Apple 2029 Total Return Consensus From Potential Ultra Value Buy Price ($109)

FAST Graphs, FactSet

Apple’s growth outlook has slowed so much that to earn the kind of returns investors have come to expect (double every five years) would take a 35% discount.

Bottom Line: It’s Almost Time To Start Buying Apple... But Have Realistic Expectations

I get why some people have fallen in love with Apple. It has made them rich while delivering excellent consumer products they have owned for decades.

It has been a source of joy and prosperity and has become both a tech utility and an aspirational luxury brand that makes them feel rich and belong to something bigger than themselves.

Apple isn’t so much a cult as almost a national identity, Apple nation, with over 1 billion citizens.

But as much as I love Apple and consider it my favorite company in one specific way, we can’t lose sight that even this company would be a bad investment at a ridiculous valuation.

In my last article, I showed precisely how much of a discount (25%) it would take to earn Buffett-like 20% returns in the short-term on Apple.

- 25% discount would do it through 2025

The growth outlook has dropped so significantly that a 25% discount will earn you Buffett-like returns for precisely one year.

FAST Graphs, FactSet

So, does this mean Buffett is going to sell Apple? Nope, probably not. The tax bill would be large and he’s pretty much admitted he’s done trying to beat the S&P.

Should you sell Apple if you bought it years ago and are up several hundred %?

That depends on whether you’re OK matching the S&P from now on with Apple, given its new slower-growth luxury tech utility brand business model.

Should dividend growth investors buy Apple? Not until the yield gets a lot more attractive.

Should growth investors buy Apple? For 9% growth? Costco (COST) is a better growth stock than Apple at the moment.

FactSet Research Terminal

Should index investors buy Apple? It’s the biggest stock in the Nasdaq, S&P, and many other ETFs and mutual funds.

Do I have any plans to buy Apple as an individual company? I don’t see a reason to give the current best available data and facts.

Apple remains an excellent core holding that will be a lynchpin for most investors for years.

But if you think this stock will keep generating returns like in the post-pandemic era, you’re in for a big disappointment.