Justin Sullivan

On the 12th of September, Apple Inc. (NASDAQ:AAPL) launched the iPhone 15 and its associated variants. While some media reports and die-hard Apple enthusiasts have been positive, it bears remembering that the smartphone market is a crowded space with significant global fragmentation and a myriad of varieties tailored for different budgets and utilization parameters.

In the company’s coverage published nearly a year ago, it was postulated that the company’s revenues were trending to run at par with the previous year’s. Therefore, the contextualization of this device’s release and what it could mean for the company’s fortunes is in order.

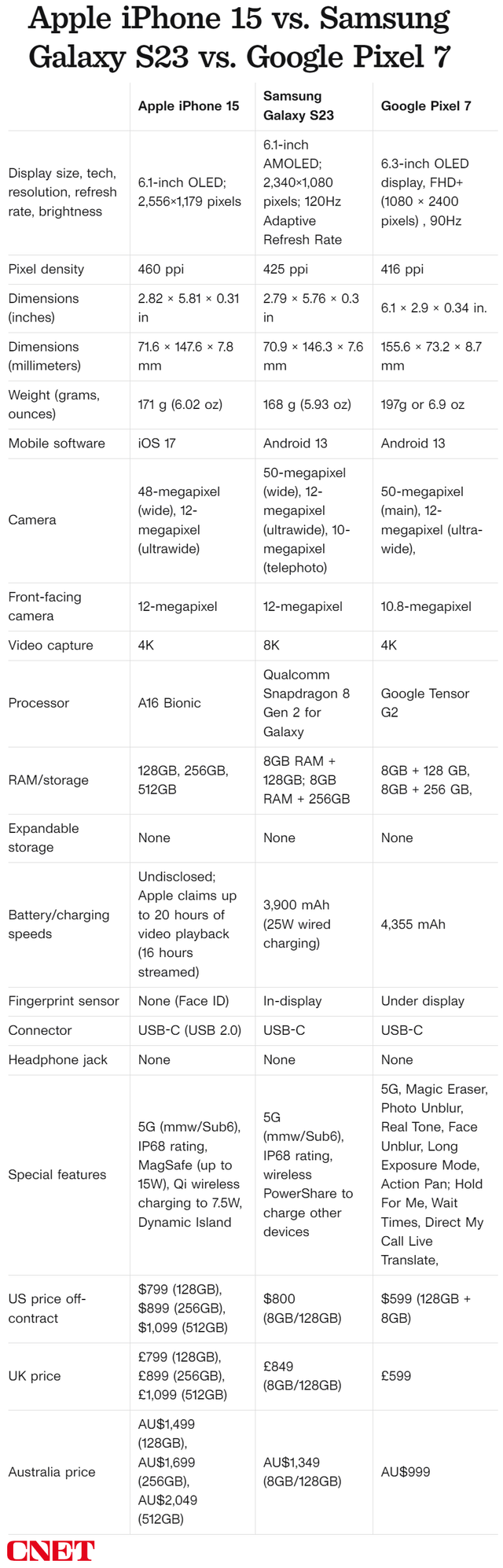

iPhone vs. Other Flagship Models

Over the past few years, the company’s iPhone family has seen two ascendant rivals: the Galaxy family by Samsung (OTCPK:SSNLF, OTCPK:SSNNF) and the Pixel family by Google (GOOG, GOOGL). An overall feature comparison with these two rivals doesn’t seem to give the iPhone any substantial advantages.

Outside a slight superiority in display resolution, there isn’t much else to the iPhone 15’s advantage for the average user. Overall, the Pixel 7 ends up miles ahead while the Galaxy S23 runs at par in terms of price.

Some reports tout the iPhone 15 as having a number of groundbreaking features. However, as a tech magazine outlined, virtually all of them have long been available in other devices. Case in point: the iPhone 15’s “Grade 5 titanium” casing. This already debuted in 2017 via the “Essential Phone” created by the now-defunct Essential Products (which at one time was backed by Amazon, Tencent, and Foxconn). Furthermore, the titanium casing only extends to the frame while still relying on glass for the back.

The “new camera” in the iPhone 15 Pro Max was already featured in the Huawei P30 Pro back in 2019. The 5x Optical Zoom capability matches that of the Pixel 7 Pro and is only half of what the Galaxy S23 Ultra offers.

Two other features are centered around an important factor in the company’s revenue stream: “upselling.” First, the iPhone 15’s 3D Video Recording (or “Spatial Recording”) feature, a version of which had already debuted in 2017 via the HTC EVO 3D. As per the company, users can “capture precious moments in three dimensions and relive those memories with incredible depth on Apple Vision Pro when it is available early next year in the U.S.” Unlike the EVO 3D, users won’t be able to view this content via their devices. It will be viewable via the Apple Vision Pro headset. The headset’s price: a mere $3,000 (starting price).

Next is the company’s switch from its proprietary “Lightning” charging technology to the more universal USB-C standard. While some quarters hold the opinion that this was unilaterally done by the company to benefit users, the actual truth might be slightly different. The European Union’s (EU) Parliament voted in 2022 to have a common charging port amongst devices. Tablets, phones, and cameras are required to have USB-C by the end of 2024 while laptops are to follow suit with a similar standard by 2026. The EU hopes to address two issues thus:

- Consumers will be freed from the “lock-in” effect, wherein they become dependent on the proprietary technology of a sole Original Equipment Manufacturer (OEM)

- EU residents will save an estimated €250 million a year by no longer having to purchase specific accessories. Standardization will also help reduce an estimated 11,000 tons of electronic waste in Europe.

However, there is some benefit to users: “Lightning” offered a transfer speed of only 480 Mbps while the iPhone 15’s new cable offer 10Gbps. However, this is only half of the 20 Gbps speed capable with the Galaxy S23 series. To get transfer speeds of up to 40Gbps and fast charging up to 100 watts, users are offered the Thunderbolt 4 Pro Cable for $69.

While “upselling” and retaining a monopoly on after-sales purchases has long been an integral part of the company’s revenue streams, the latest movement towards standardization and the lack of a strong technological edge in its products that would compel a switch by users of other devices wouldn’t be supporting sales growth over the next year.

Financial Trends

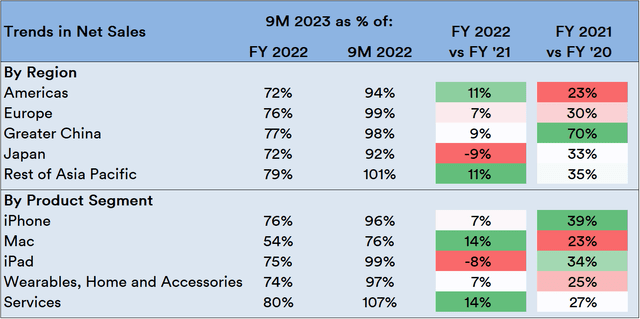

At this point, an examination of line item trends over the past three quarters of FY 2023 (announced in August) versus that of past full financial years (FY) would be in order. Firstly, the examination of net sales trends as per region and product segment:

Source: Created by Sandeep G. Rao using data from Apple’s Financial Statements

Relative to a corresponding period in 2022 as well as the full FY, there doesn’t seem to be a strong surge in demand from any region over the past nine months. For the most part, there seems to be a slight decrease relative to the corresponding period while the comparison relative to the past FY’s figures trends towards a “slightly under par” performance for this FY. FY 2021 was a stalwart year wherein sales surged (particularly in China). The following year (FY 2022), while not as massive, was still a net positive growth.

In FY 2020, the Americas once accounted for over 45% of the company’s Net Sales. This diminished to a little under 43% in FY 2022 which has further shrunk to a little under 42% in the past nine months. China went from a little under 15% in FY 2020 to a little under 19% in FY 2022 to a little over 19% in the past nine months. Europe largely hovers around the 25% mark across all FYs and the past nine months.

The iPhone was, by far, the largest contributor to sales growth in FY 2020: a little over 50% of Net Sales. This continued to increase over the years: a little over 52% in FY 2022 and over 53% in the past nine months. The flattening of revenue growth, thus, could be attributed to declines in sales of Macs and iPads, which went from a little over 19% in FY 2020 to a little under 15% in the past nine months.

The share of “Services” – comprising Advertising, AppleCare, Cloud Services, Digital Content and Payment Services – has also been growing: from a little under 20% in FY 2020 to over 21% in the past nine months.

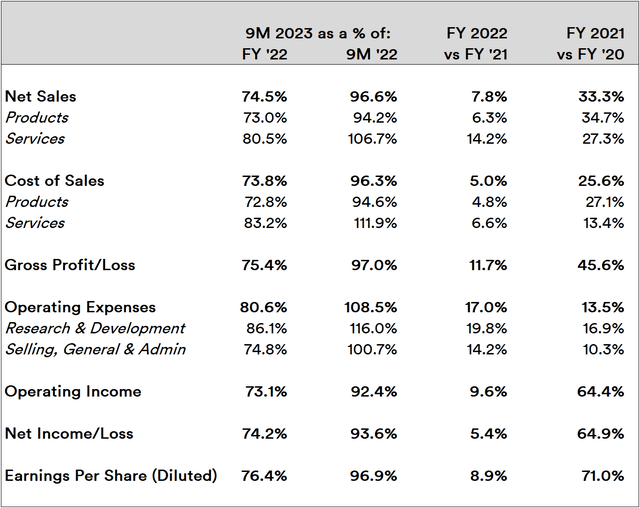

In terms of overall financials, the trends are fairly balanced:

Source: Created by Sandeep G. Rao using data from Apple’s Financial Statements

While operating expenses – particularly Research & Development – are trending a little higher over the past nine months relative to the past FY, overall Net Sales are about par while cost of sales is running a little under par. While net income is running slightly under par, diluted earnings per share are running slightly above par.

In Conclusion

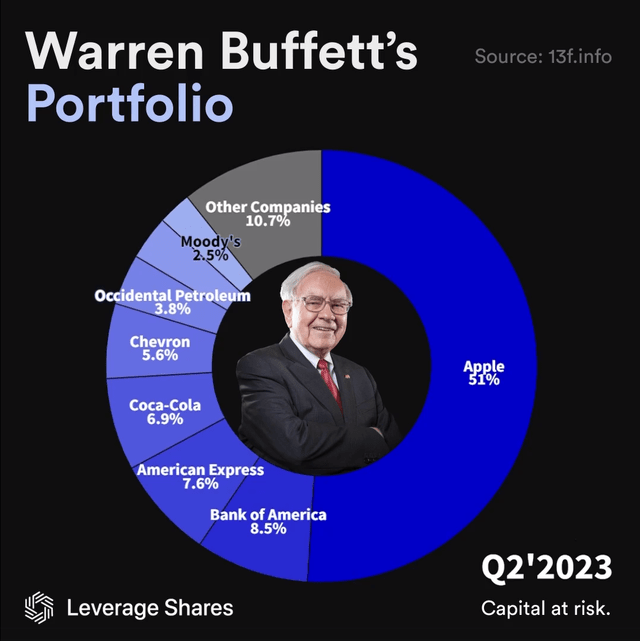

A conversation on Apple would inevitably bring in Mr. Warren Buffett – whose holdings in the company accounted for over 51% of his investment management firm Berkshire Hathaway’s portfolio value (BRK.A, BRK.B) as of Q2 2023.

Source: Leverage Shares and 13F.info

A large portion of this steep imbalance is at least partly attributable to the fact that Apple was one of the “Magnificent Seven” stocks that witnessed significant investor crowding in the Year Till Date (YTD). These seven stocks are presently in the midst of varying cycles of unwinding in the present quarter. Given that Mr. Buffett’s investment philosophy is centered around a “buy-and-hold” strategy, it is unlikely that Berkshire Hathaway would significantly modify its holdings in Apple. Thus, a decline in Apple’s stock price would impact Berkshire Hathaway’s stock price as well.

In terms of overall sales performance as well as key line item trends, the company’s performance could basically be summarized as “so-so”: it will likely keep revenues and earnings somewhere around par relative to last year. As the previous year’s coverage indicated, the company’s essentially banking on a form of “social equity” implied by owning its products. This form of persuasion isn’t compelling enough to create large-scale buy-ins from new users especially when there are no technological edges inherent. The smartphone market, in particular, is a buyer’s paradise with a massive number of choices easily available in most parts of the world.

On the other hand, the growth of “Services” – which includes revenue shares via its podcast network and subscribers via its streaming service – is an interesting factor. However, as of now, the signs of this being a significant revenue stream that could upend the iPhone’s relevance are slight.

In the 36th week of the year (ending September 8th), The S&P 500 Top 25 list by momentum outperformed the S&P 500 index (-1.03% vs. -1.29%). Meanwhile, the Nasdaq 100 Top 25 list outperformed the Nasdaq 100 index (-0.54% vs. -1.36%). In the 35th week, the S&P 500’s Top 25 outperformed the S&P 500 index (+4.49% vs +2.50%) while the Nasdaq 100 Top 25 outperformed the Nasdaq-100 (+5.79% vs. +3.67%). In both cases, tech stocks led market movements. Apple didn’t feature in the Top 25 in either case.

The reason for its absence might simply because there is no particularly strong reason to buy in if one isn’t holding a position in the stock nor, for that matter, drop out if one is. It seems unlikely that the stock’s overall performance for the course of the year will be better than in the past year. In fact, since the 5th of September, the stock’s price has been rationalizing downwards and shedding some overvaluation accrued in the past year.

However, the company does pay regular dividends unlike so many tech companies: as the last article indicated, a dividend-drive strategy is favored by U.S. retail investors in H2 2023.

All things considered, it’s a “Hold.”

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.