Bloomberg reported on Tuesday after the stock market closed, that the Department of Justice (DOJ) had sent Nvidia (NASDAQ:) a subpoena related to a potential antitrust investigation. We speculated that a leak of that information might have caused Tuesday’s selloff. On Wednesday after the close, Nvidia denied that it had received a DOJ subpoena. Go figure.

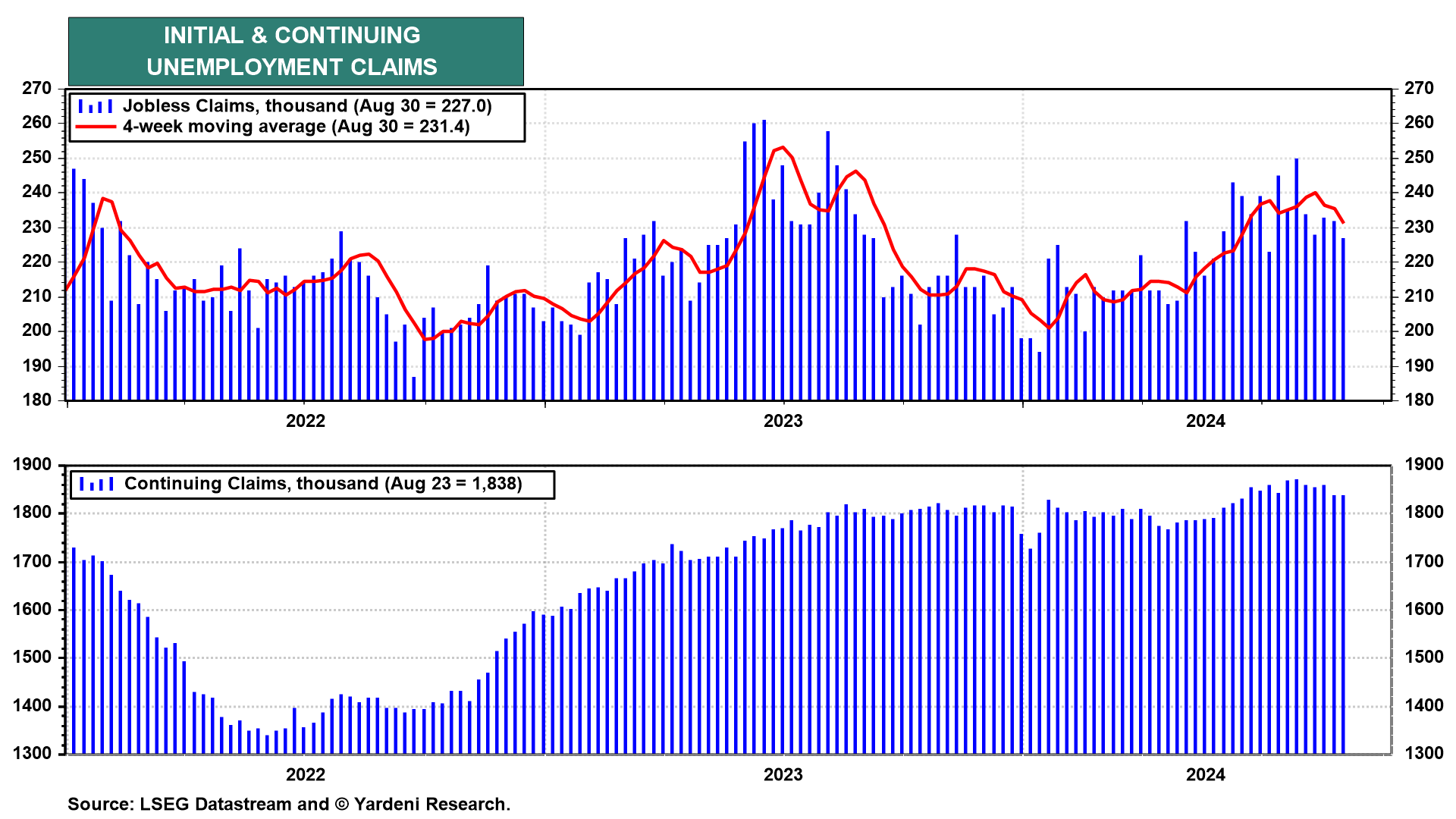

Yesterday’s economic data were consistent with our short-term thesis (i.e., “The Great Normalization”) and our long-term scenario (i.e., “The Roaring 2020s”). Initial and layoffs remain low. Productivity growth was revised up, while unit labor costs inflation was revised down. August’s NM-PMI confirms that the services economy is growing.

On the other hand, August’s payrolls report was weak with a gain of just 99,000. So we are lowering our forecast for today’s report to up 180,000-200,000. (Wish us luck!) Here’s more:

(1) Unemployment claims. Jobless claims are rolling over as bad weather in July and summer layoffs fade. Initial claims fell 4,000 to 227,000 (sa) in the week ended August 31 (chart). Continuing claims dropped 30,000 to 1.838mm.

(2) Challenger layoffs. Layoffs rebounded to nearly 76,000 in the August Challenger data, though they were up just 1% from last August. On a seasonally adjusted basis, hiring and layoffs remain benign over the past year (chart).