This Week

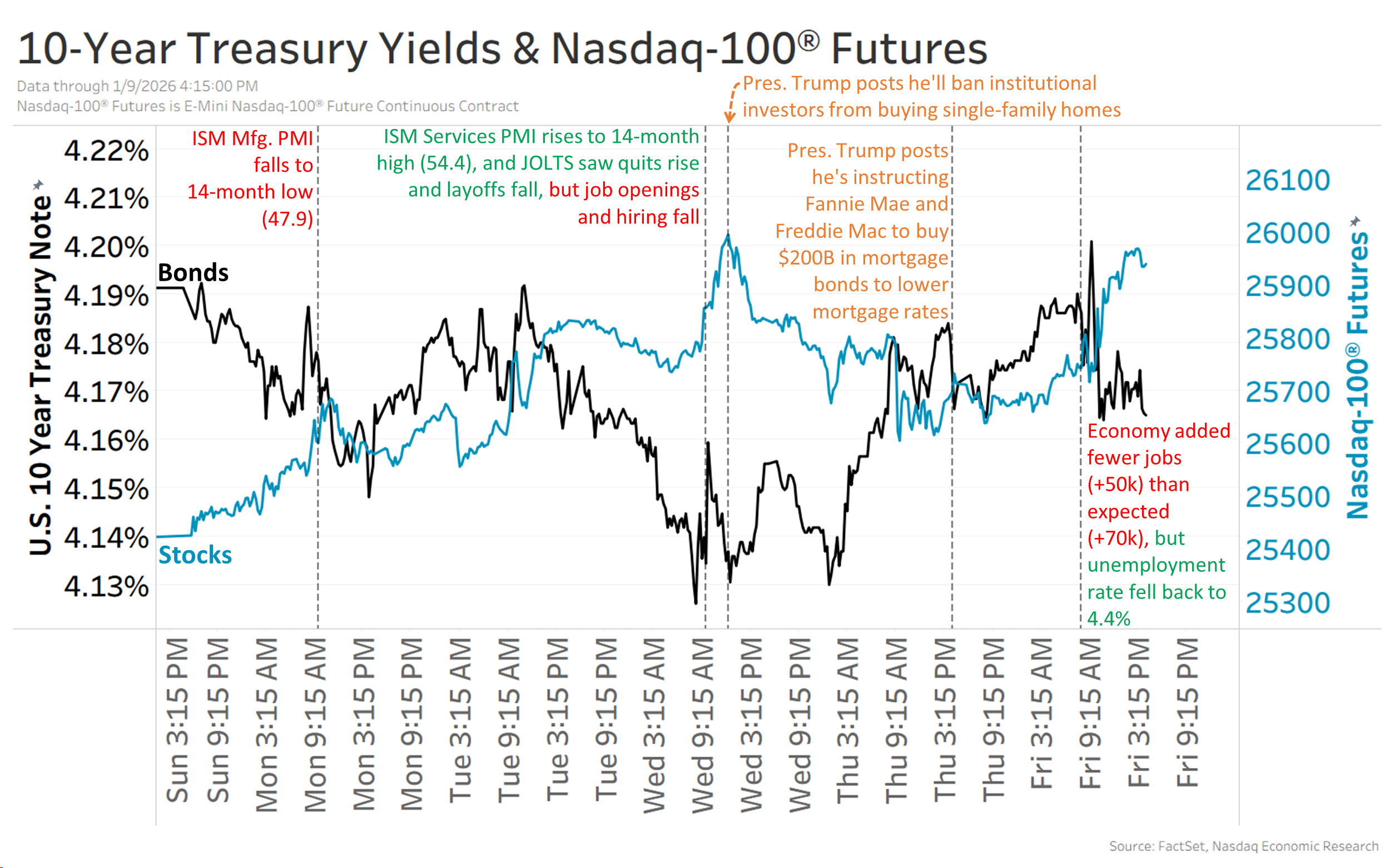

Today was supposed to be the big day for markets this week. We had the December jobs report and there was speculation the Supreme Court could make its decision on the IEEPA tariffs (it didn’t).

The jobs report was not good, but not bad. On the plus side, the unemployment rate fell back to 4.4% from 4.5%. And while the economy added more than 50,000 jobs in December, that was below expectations for +70k. To top it off, the previous two months were revised down by a combined 76,000 jobs.

Still, that was good enough to push down odds of a Fed rate cut later this month to 5% from over 10%.

So, for the week, the Nasdaq-100® ended the week up +2% (blue line), while 10-year Treasury yields were down a few bp to 4.15% (black line).

Next Week

Here are the top events I’m watching next week:

- Supreme Court rulings on Wednesday

- December CPI on Tuesday

- December retail sales on Wednesday

- December industrial production on Friday