This Week

Happy new year everyone!

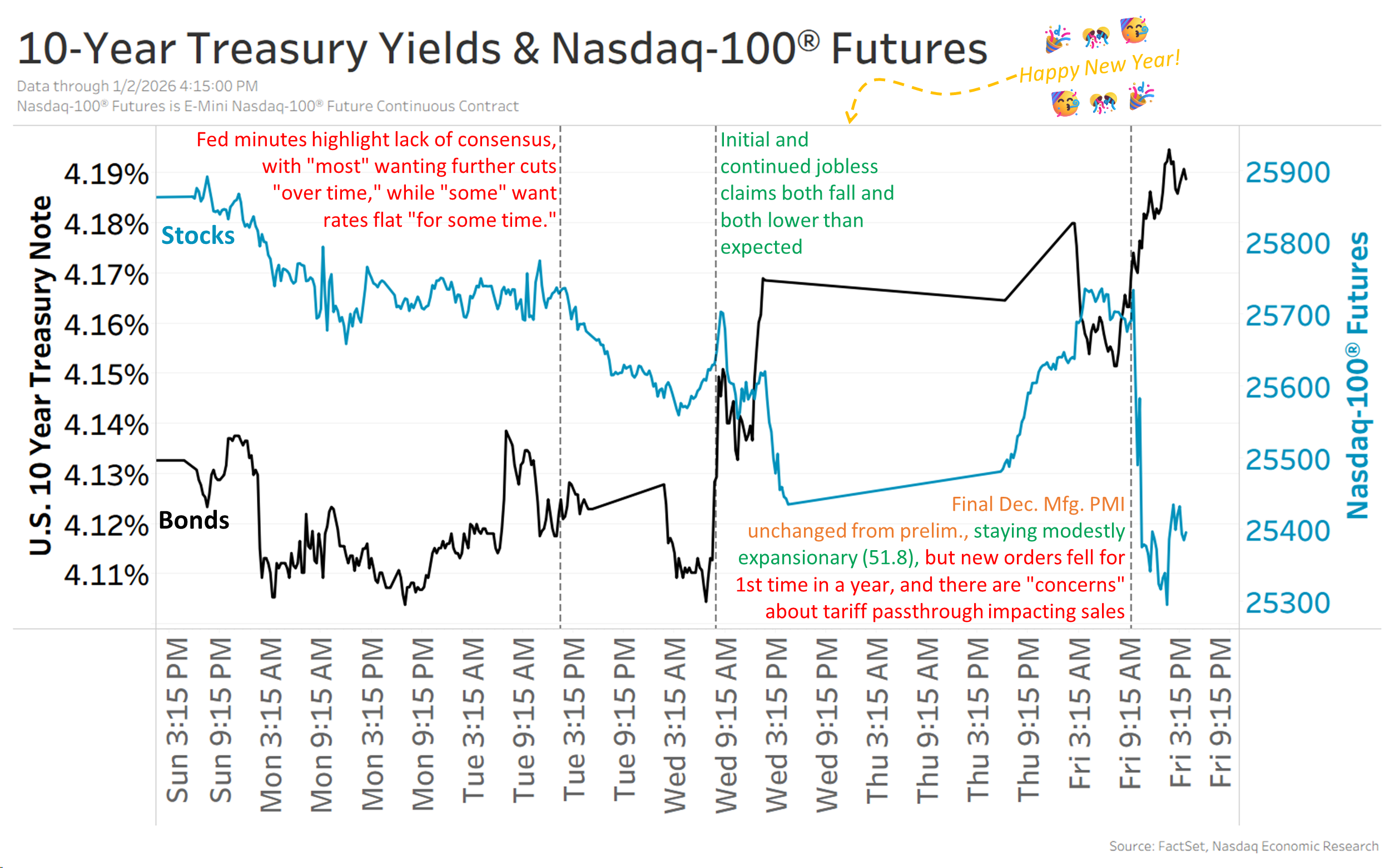

It’s been a slow week, and the little news we got mostly confirmed what we knew… layoffs are low, manufacturers are still navigating tariffs, and there’s no consensus at the Federal Reserve.

Specifically on the Fed, the December minutes showed that “most” supported the rate cut, though “some” wanted no cut, and “a few” could have gone either way. Looking ahead, “most” want further cuts “over time,” while “some” want rates flat “for some time.” At least they seem to “generally” agree that the labor market will “likely… stabilize” in 2026 as economic growth “pick[s] up…”

For the week, the Nasdaq-100® was down 2% (though its 2025 total return was +21%!), while 10-year Treasury yields rose over 5 basis points to 4.2%.

Next Week

Here are the top events I’m watching next week:

- December jobs report on Friday

- November JOLTS report on Tuesday

- December ISM Manufacturing PMI on Monday

- December ISM Services PMI on Wednesday

- Q3 productivity data on Thursday