- The Federal Reserve is expected to raise interest rates by 0.25% on Wednesday to the highest since 2001.

- Despite hawkish warnings from Fed Chair Powell, the majority of traders are betting that this will be the last and final rate hike in the current tightening cycle.

- As such, investors should brace for sharp swings in the weeks ahead due to the growing risk that Fed officials could raise rates to levels above where markets currently anticipate and keep them there for longer.

The busiest week of the summer on Wall Street has arrived, with all eyes on the upcoming , as well as earnings from some of the biggest companies in the world.

Entering the crucial week, the stock market rally has notably broadened, with the blue-chip rising for the 11th straight session on Monday to notch its longest winning streak since February 2017.

The tech-heavy , which led the market higher during the first half of the year, has actually been the laggard over the past two weeks as investors looked to non-tech stocks for bargains, lifting sectors from energy, healthcare to banks.

As such, there will be a lot on the line when the Federal Reserve announces its latest monetary policy decision at 14:00 ET (18:00 GMT) on Wednesday.

What to Expect

After remaining on hold at its June meeting, the U.S. central bank is widely expected to raise interest rates by 25 basis points following the conclusion of its Federal Open Market Committee meeting.

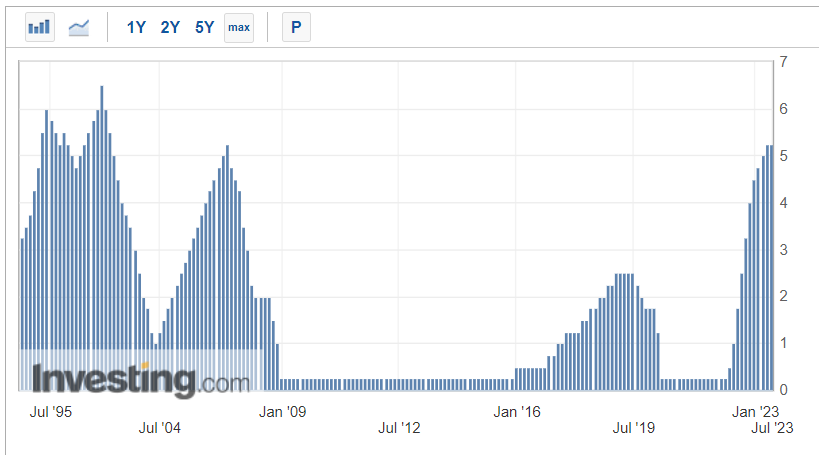

That would put the benchmark Fed Funds target range between 5.25% and 5.50%, the highest since January 2001.

Fed Chair Jay Powell will hold what will be a closely watched press conference half an hour after the release of the Fed’s statement at 14:30 ET, as investors look for fresh clues on how he views inflation trends and the economy and whether that will impact the pace of monetary policy tightening in the future.

At the previous Fed meeting last month, Powell warned the market that FOMC members saw it appropriate to raise the policy rate at least twice more this year in their ongoing battle to bring down stubbornly high inflation.

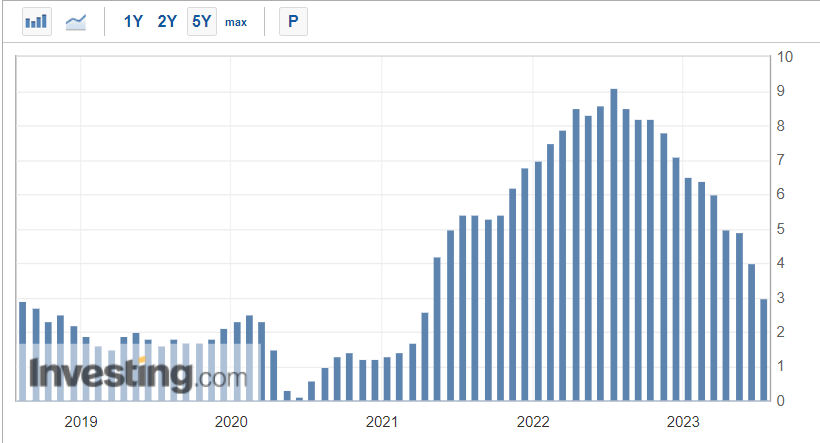

However, traders are betting that Wednesday’s move will likely be the final rate hike in the Fed’s historic tightening campaign, which began in March 2022 and saw CPI peak at 9.1% last summer.

According to the Investing.com , there is a likelihood of just 31% for an additional rate increase by year-end, while odds for a rate cut stand at about 8% despite Powell’s repeated warnings to the contrary.

Indeed, inflation is trending lower according to recent data, which revealed that U.S. rose 3.0% in the 12 months through June. It was the smallest annual increase since March 2021 and followed a 4.0% advance in May.

, which excludes volatile food and energy prices, eased to 4.8% on an annual basis last month, moderating from a 5.3% increase in May. That was also the smallest annual gain in more than two years.

Despite signs of cooling inflation, it is important to note that consumer prices continue to run well above the central bank’s 2% target. In addition, some Fed officials remain concerned that the current moderation in inflation will be temporary and underlying price pressures could persist.

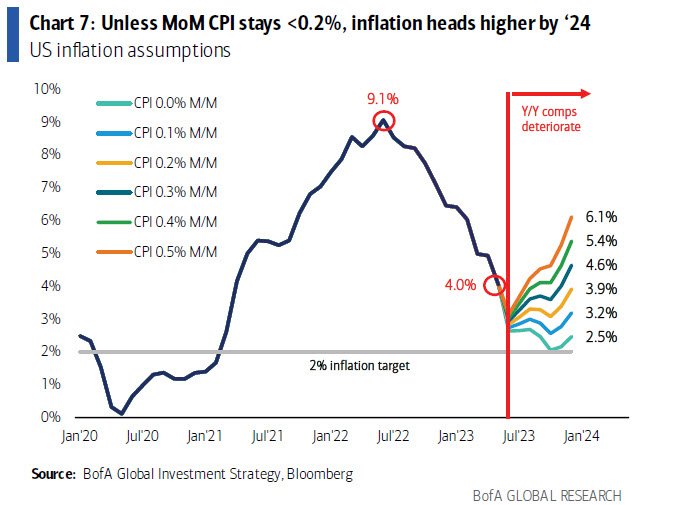

The last thing the Fed wants to see is a re-acceleration in inflationary pressures just as it signals an end to its tightening campaign. Indeed, with and prices surging higher in recent weeks, there is a distinct possibility that CPI could rise back towards a 3.9%-to-4.6% range by the end of the year.

Source: BofA

Furthermore, the economy continues to hold up much better than expected in the face of higher rates. Despite widespread expectations of a potential U.S. recession this year, the economy has proven considerably more resilient than anticipated by many on Wall Street amid a strong labor market and robust consumer spending.

Taking that into consideration, I expect Powell will reiterate that an additional rate hike later this year will be necessary, and that the U.S. central bank remains strongly committed to bringing inflation back down to its 2% goal.

As such, it is my belief that the market is getting ahead of itself and there is still a long way to go before Fed policymakers are ready to declare mission accomplished and signal an end to rate hikes.

All things considered, I anticipate the U.S. central bank will leave the door open to another rate increase either in September or November, while stressing that the decision will remain data-dependent.

If anything, the Fed has more room to raise interest rates than to cut them, presuming it follows the numbers. The U.S. central bank is at risk of committing a major policy error if it starts to ease policy too soon, which could see inflationary pressures begin to reaccelerate back towards last year’s highs.

Overall, I reckon the policy rate will need to rise at least another half of a percentage point to between 5.75% and 6.00%, before the Fed entertains any idea of a pause or pivot in its battle to restore price stability.

As such, there is a growing risk that Fed officials could raise rates to levels above where markets currently anticipate and keep them there for longer as there is still more work for them to do to slow the economy and cool inflation.

What to Do Now

A hawkish message from the Federal Reserve amid a relentless stock market rally is presenting investors with a dilemma: how to maintain exposure to rising equities while also protecting against the possibility of a looming correction.

While I am currently long on the Dow Jones Industrial Average, , and the via the SPDR Dow Jones Industrial Average ETF Trust (NYSE:), SPDR S&P 500 (NYSE:), and the Invesco QQQ Trust (NASDAQ:), I have been cautious about making new purchases amid the current environment.

Overall, it’s important to remain patient, and alert to opportunity, especially as earnings season enters full swing. Not buying extended stocks, and not getting too concentrated in a particular company or sector is still important.

Taking that into consideration, I used the Investing Pro stock screener to build a watchlist of high-quality stocks that are showing strong relative strength amid the current backdrop and which are still undervalued.

Not surprisingly some of the names to make the list include Google-parent Alphabet (NASDAQ:), Meta Platforms (NASDAQ:), Adobe (NASDAQ:), Cisco (NASDAQ:), Netflix (NASDAQ:), Comcast (NASDAQ:), Qualcomm (NASDAQ:), Applied Materials (NASDAQ:), Analog Devices (NASDAQ:), and Lam Research (NASDAQ:) to name a few.

Source: InvestingPro

InvestingPro’s stock screener is a powerful tool that can assist investors in identifying cheap stocks with strong potential upside. By utilizing this tool, investors can filter through a vast universe of stocks based on specific criteria and parameters.

Start your 7-day free trial to unlock must-have insights and data!

Get the Full Data Here

***

Disclosure: I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.