Amidst all the noise, markets haven’t had time to digest 5 key macro news:

1) Elon Musk announces formation of ‘’America Party’’

2) Speaker Mike Johnson: “We’re gonna have a second reconciliation package in the fall, and a third in the spring of next year…”

3) President Trump: ‘’ “Stock markets are now at all-time high — we’re going to maintain it, believe me.”

4) Bessent: We could appoint new Fed chair in January, nominating in October

5) OMB Director Vought sends official letter to Powell saying ’’Chairman Jerome Powell has grossly mismanaged the Fed’’

Musk’s America Party might as well cost the Republicans both the Senate and House in the 2026 mid-terms. That’s a big political risk for Trump.

The response from the Trump administration is very clear – run the economy hot. More fiscal stimulus with reconciliation bills on the table again, and dovish pressure on the Fed.

The interference with the Fed independence is increasing by the day, with clear attempts to find ’’cause’’ to fire Powell (e.g. ’’gross misconduct’’ mentioned by Vought).

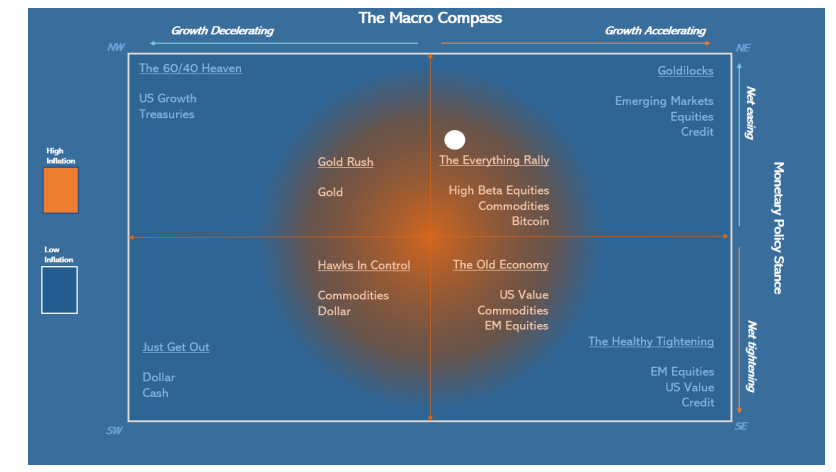

If you run the economy hot with already above target and force a dovish reaction function at the Fed, our asset allocation model moves towards the ’’Everything Rally’’ Quadrant:

Historically, the best asset mix for this scenario is to get rid of USDs and underweight long-end bonds and buy:

1) Assets denominated in that produce inflation-proof cash flows;

2) PPAs: Policymaking Protest Assets

Why do these assets perform well in such a macro environment?

Trump’s plan with tariffs, fiscal and lower front-end real rates means that real growth remains ok as the tariff passthrough hits consumer spending, but rounds of fiscal stimulus preserve real purchasing power for consumer and capex for companies. It holds fine.

Nominal growth is instead more robust in the 4-5% area as inflation remains sticky due to tariffs and fiscal. And you make sure that real yields remain compressed.

Basically: you run it hot.

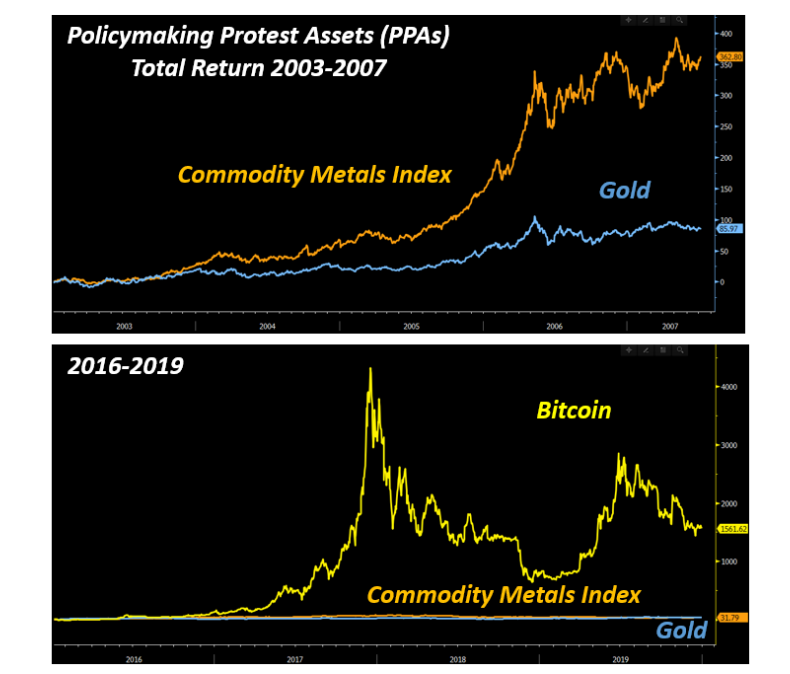

In such an environment, specific stock markets composed of companies with strong pricing power (e.g. tech) fare very well as it happened in 2003-2006 and 2013-2019 ’’Run It Hot’’ experiments. But the two prior experiments were run with inflation at or below target, no tariffs, no attacks on the Fed independence, and no hostile policymaking against the rest of the world.

Today, I believe a mix of such investments and PPAs (Policymaking Protest Assets) would work better.

PPAs are assets denominated in USD that represent a release valve against unorthodox policy mix such as forcing real rates too low vis-à-vis the level of nominal , manipulating long-end yields via reducing issuance or encouraging banks to buy (SLR reform), or incentivizing foreign countries to diversify away from USD investments.

and metals in general are the longest-standing PPAs, and needless to say is also a valid contender for PPA properties:

The questions we should all be asking ourselves are:

A) How long the USD am I in my portfolio? (Probably too much)

B) Do I have enough assets producing inflation-proof cash flows? (Probably not)

C) Do I have enough PPAs in my portfolio? Gold, metals, Bitcoin? (Probably not)

This was it for today. Be nimble, and remain hungry for macro.

***

This article was originally published on The Macro (BCBA:) Compass. Come join this vibrant community of macro investors, asset allocators and hedge funds – check out which subscription tier suits you the most using this link.