The only thing that was genuinely surprising in yesterday’s on US economic activity was the strength of the increase.

The positive directional bias, by contrast, has been relatively clear for weeks, if not longer. Assuming, of course, that you were analyzing a broad array of indicators and avoiding the rookie mistakes of estimating recession risk.

For the perennial recession forecasters, the 3.3% rise in output in Q4 was the latest blow to ongoing warnings that trouble is just around the corner.

The GDP advance beat expectations by a wide margin—the consensus forecast was 2%. Economic activity still slowed substantially from Q3, but the third quarter’s red-hot rise was an unsustainable upside outlier.

Predicting or nowcasting GDP data points with precision is challenging, but the econometric tools for estimating recession risk in real-time, and in the near term, offer more traction.

Unfortunately, the habit in the wider analytical and media worlds is to favor weak models and extreme headline-grabbing commentary. Fortunately, there’s a better way.

Once again, CapitalSpectator.com’s modeling on estimating US recession risk has paid off.

Par for the course. For much of the past nine months this modeling – updated and reviewed weekly in The US Business Cycle Risk Report – has indicated that an NBER-defined recession has been a low probability. Dumb luck? Unlikely.

Why has this modeling been accurate when so much of the commentariat has incorrectly warned otherwise through most of 2023?

The simple answer: crunching the numbers on a wide array of indicators and carefully reviewing and processing the results via multiple angles is substantially more effective than the usual routine of cherry-picking from so-called infallible recession predictors.

At the core of this idea is a long-running empirical fact that’s been verified in numerous studies and real-world experience over decades: combining forecasts/nowcasts from several sources – ideally reflecting different modeling techniques – yields better results.

Last year was yet another master class of showing the power of ensemble models that carefully draw on multiple indicators and models.

Consider, for example, this highlight on CapitalSpectator.com from late-May 2023, when an excerpt from The US Business Cycle Risk Report was highlighted on these pages, advising that recession risk remained low.

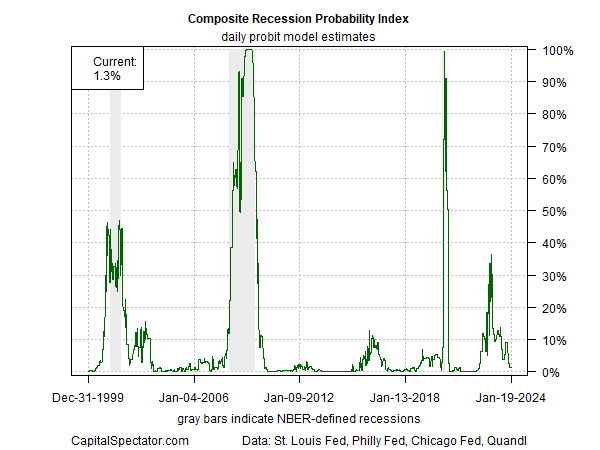

A below-10% probability, based on the Composite Recession Risk Index (CRPI), which is calculated from 14-diversified economic and financial data sets.

At the time, the recession forecasts were seemingly coming out of the woodwork. But a comprehensive review of the numbers never supported the dark outlook — a recurring theme via my modeling throughout 2023.

The positive macro signaling also applied to proprietary modeling that cautiously looks into the near future – 2-3 months, which is about as far as it goes for high-confidence forecasting of US business cycle risk.

Meantime, the perennial recession forecasters never admit defeat. Instead, they keep moving their estimates of contraction forward until, eventually, they’re proven right.

That may be a good strategy for publicity, but it’s a loser for investors and business owners trying to make sense of the business cycle outlook.

Fortunately, there’s a better way. On that front, the outlook is still upbeat. Here’s the Jan. 21, 2024 estimate of CRPI from The US Business Cycle Risk Report:

CRPI Daily Probit Model Estimates

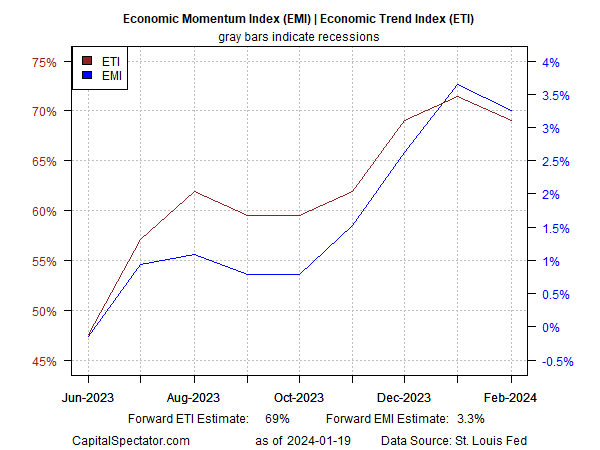

Meanwhile, the near-term modeling estimates for the Economic Trend Index (ETI) and Economic (EMI) project that the US economic bias will remain comfortably positive through February.

(Note: ETI signals recession are defined as below 50% and EMI below 0% in the chart below).

EMI and ETI Bar Chart

As new numbers are published, the real-time and ex-ante estimates are updated.

Rather than trying to forecast 6 or 12 months ahead (a hopelessly impossible task), the core focus of The US Business Cycle Risk Report is to develop high-confidence estimates of recession risk right now, and for the very near term.

Analysts are fooling themselves if they think they can reliably look much beyond that window.

History shows this approach has been productive – not perfect, but relatively dependable.

Indeed, I’ve been running these models for well over a decade and they’ve been the worst way to estimate recession risk — except when compared with everything else.

The future’s still uncertain, but for making informed macro risk estimates you could do a lot worse, as the quasi-religious order of perennial recession forecasters show us time and time again.