- As 2024 begins, let’s take a look at what some historical stats indicate for this election year.

- Like every year, election years tend to be full of ups and downs, and investors need to retain their long-term perspective.

- The stock market has started the year on the wrong foot, but that doesn’t mean it will be a negative year.

- Looking to beat the market in 2024? Let our AI-powered ProPicks do the leg work for you, and never miss another bull market again. Learn More »

If you’ve been a longtime follower, you’ll know about my emphasis on a long-term perspective in navigating the stock market, disregarding short-term fluctuations.

Yet, delving into historical statistics offers valuable insights as we project forward to 2024.

This year carries notable significance as an election year. In November, US voters will decide on their next leader, injecting an additional layer of importance into the financial landscape.

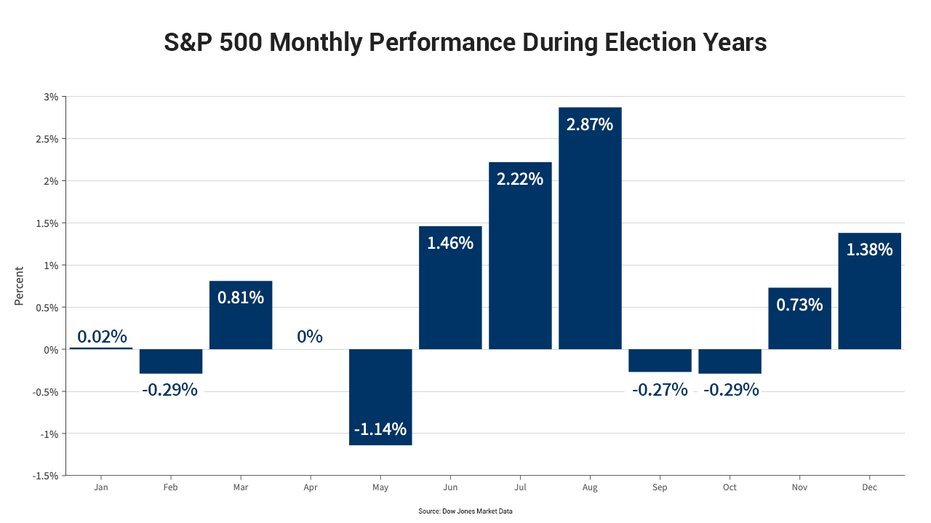

Statistically, we see that in the election year, the ‘s best periods are the summer, followed by the November-December bimonthly period.

The first quarter, on the other hand, is not so bright as January generally turns out to be a particularly flat month (like April).

February, May, September, and October are negative months.

Even if the first two months of the year turn out to be negative, it doesn’t automatically warrant a pessimistic outlook.

I made a similar point last year during the correction from August to the end of October. Market declines, even in the range of 5-10%, happen every single year.

So the sooner we learn that this is how markets work, the sooner we will learn how to invest well (I gladly leave the ability to go short, to do market timing, to others, I don’t care).

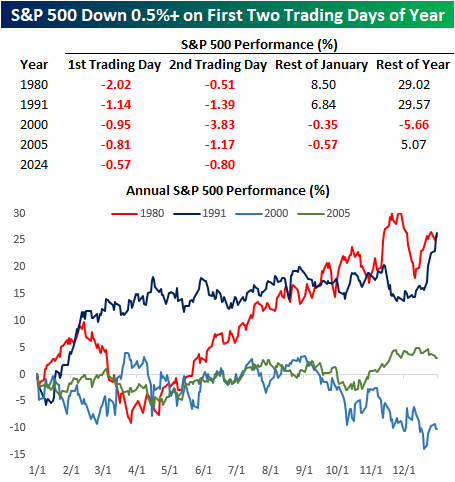

Annual S&P 500 Performance

Another interesting fact, as we see from the image above, is that we have had 4 years historically where the first days of the year have been negative.

In 3 out of 4 years (as happens in the long term) the markets have performed positively.

So as always, my suggestion for 2024 is:

- Know what you are buying and how the markets work.

- Don’t follow the crowd.

- Have patience and be prepared to handle even major declines (always helps).

- Build a plan and stick to it.

- Don’t look at the single stock market day: we will have 252 others to eye this year.

***

In 2024, let hard decisions become easy with our AI-powered stock-picking tool.

Have you ever found yourself faced with the question: which stock should I buy next?

Luckily, this feeling is long gone for ProPicks users. Using state-of-the-art AI technology, ProPicks provides six market-beating stock-picking strategies, including the flagship “Tech Titans,” which outperformed the market by 670% over the last decade.

Claim Your Discount Today!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. As a reminder, any type of asset is evaluated from multiple perspectives and is highly risky, and therefore, any investment decision and the associated risk remains with the investor.