Recession talk for the US is on the march again. Although there’s still room for debate on the near-term business-cycle outlook, some indicators are highlighting decelerating growth that could be the start of trouble in the second half of the year into early 2025.

To be fair, there’s plenty of real-time pushback that suggests the economic expansion will roll on. But a set of multi-factor indexes featured in the weekly updates of The US Business Cycle Risk Report show a marked deterioration in the macro trend.

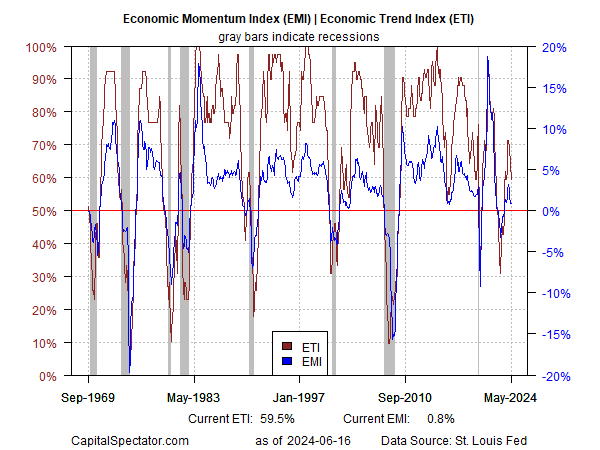

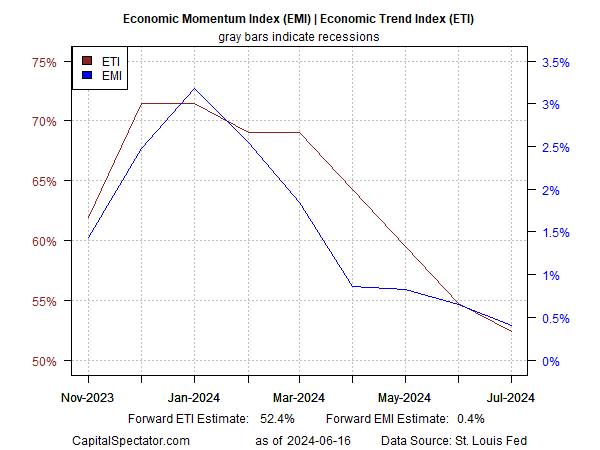

The Economic Trend Index (ETI) and Economic Momentum Index (EMI) continue to roll over after more than a year of recovery. Both benchmarks remain above the respective tipping points that mark recessionary conditions, based on data through May, but it’s clear that these indicators have peaked. Meanwhile, forward estimates suggest that the deterioration will continue.

Using an econometric technique that estimates data for each of the 14 underlying components of ETI and EMI suggests that both indexes will drop to just above their tipping points in July. The implication: recessionary conditions could start as early as August, although looking that far ahead is still mostly guesswork. (March is currently the last full month of published data for calculating ETI and EMI, with progressively higher degrees of missing numbers going forward.)

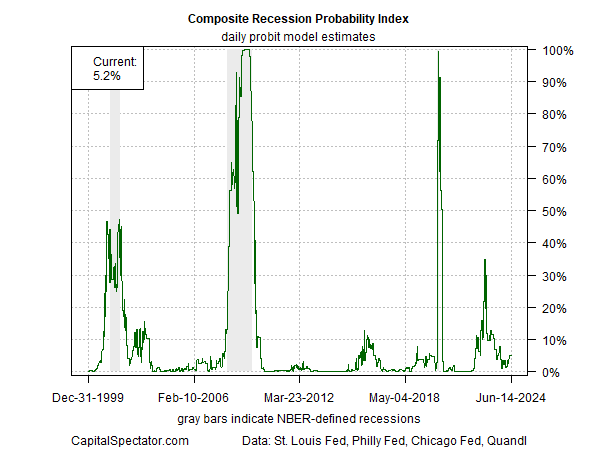

Using another methodology to nowcast US recession risk paints a brighter profile, which serves as a reminder that the path ahead for the US economy is not yet written in stone. The Composite Recession Probability Index (CRPI) is currently estimating a low 5% probability that the US is in an NBER-defined recession or will imminently fall into one.

But the recent uptick in CRPI may be an early sign of things to come. A rise above 10% in the days and weeks ahead, in concert with the recent weakness in ETI and EMI, would be a worrisome sign for the second half of 2024. (CRPI aggregates several business cycle indexes, including ETI and EMI, along with benchmarks published by other sources, including two regional Fed banks.)

For now, economists are debating if recession risk can be avoided. By some accounts, cutting interest rates would lower the threat, but the clock is ticking, advises Claudia Sahm, chief economist at New Century Advisors.

“My baseline is not recession,” she says. “But it’s a real risk, and I do not understand why the Fed is pushing that risk. I’m not sure what they’re waiting for. The worst possible outcome at this point is for the Fed to cause an unnecessary recession.”