The ratchet down in the US curve should morph to a steeper curve, and we think it should ultimately be from both ends. In the eurozone, we find that positive growth surprises have the capacity to support an upward trend in euro rates.

A Steeper US Curve Is the Path of Least Resistance, or at Least Should Be

The at 4.2% is pretty much where it was on the eve of ’Liberation Day’ (2 April). From there it managed to snap down to 3.85% as a one-to-two-day reaction to risk-off, and heightened recession risks by implication. It then turned tail and shot up to 4.6%. Fast forward to the last few weeks, and the tariffs are absolutely ’back on’, but with far less effect this time around. The worry ahead is upside to (even if technically more a price rise than an inflation rise).

A 4% handle for inflation at some point in the second half of 2025 is quite probable (tariff impacted). Even if long yields are choosing not to fret over the financing of the fiscal deficit, they can’t completely ignore 4% inflation.

The burning question is whether the 10yr yield can break back down to 4% (or below) with inflation at the same level. It could. But there would be tension given the inflation / deficit negativities. The way to square the circle against a weakening economy (as evidenced from last Friday’s ), is for the curve to steepen. The 2/10yr curve is still only a 50bp curve. That can easily get to a 100bp curve, with both ends of the curve contributing.

A drag lower from the front end has always made sense in the past number of months (it looked high in the 4% area). But for the 10yr, while it may have a go at streaking lower, we sense any such move will be questioned by the price-rise environment ahead. Ultimately, the 10yr yield risks ending up higher than it is today as some point in the coming months.

Momentum of Eurozone Growth Warrants a Bearish Rates View

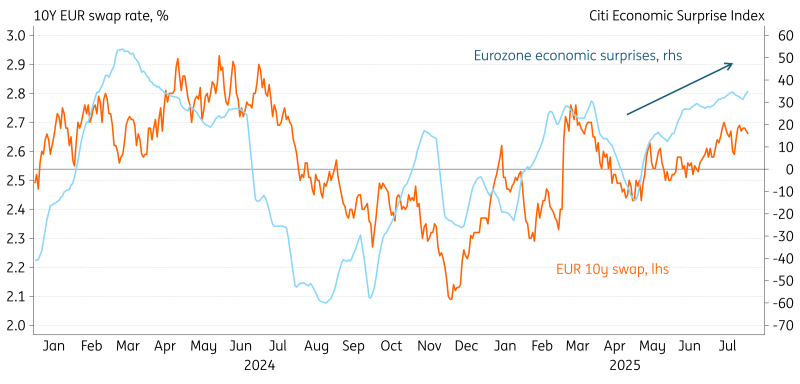

In contrast to the US, the economic data in the eurozone seems to be on a recovering trend, which of itself would still make a bearish case for euro rates. ’Liberation Day’ darkened the outlook, but since then the data has managed to beat consensus consistently. And not just soft data, also the second-quarter figures last week managed to pull-off a positive growth number (0.1% only, but still better than the expected zero). The Citi surprise index, which summarises data surprises versus consensus, is now at the highest level in over a year (see figure below). On Tuesday we get the Italian and French PMIs which may extend that positive momentum. With a US trade deal on the table, reducing uncertainty, growth should face less hurdles to gradually improve.

The stabilising outlook for euro rates is also reflected in volatility measures. The 3-month implied volatility of is now around the lowest levels since 2022 and still in a strong downward trend. Also for shorter rates the uncertainty ahead is limited, especially compared to US rates. And although the correlation with USD rates decreased significantly since Trump’s election, US developments remain a key source of risk to our outlook. For instance, we find it difficult to see the euro rates drift higher if the US were to face a bullish UST market. On the other hand, if inflation and issuance pressures push UST yield up again, then that would be an enabler for the 10Y euro swap to break the 2.8% mark later this year.

***

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more