A lot can happen over the course of a week when it comes to the crowd’s fickle sentiment du jour on matters of recession. At this time a week ago the headlines warned that a contraction, if it hadn’t already started, was imminent.

Fast forward a week and you can hear a collective sigh of relief in the wake of economic news in recent days. In fact, the case for claiming recession risk had spiked was always weak, based on a broad set of published numbers.

But if you monitor economic risk based on headlines and single-factor metrics, it’s easy to get whipsawed in the art/science of evaluating the US macro trend in real-time.

The latest run of upbeat numbers this week started with encouraging inflation news and that disinflation continued in July. Yesterday’s data on jobless claims and retail sales added a positive spin to the analysis.

Some might dismiss the updates as isolated figures, but as CapitalSpectator.com reported last week (and in previous weeks): recession risk remains low when measuring conditions via a diversified set of indicators.

Although it’s tempting at times to focus on one or two indicators that narrowly define the business cycle, this approach can be misleading. Before you venture down the recession rabbit hole keep in mind that that there’s a perennial tension between timely recession signals and reliable recession signals. Unfortunately for mere mortals, enhancing one always comes at the expense of the other.

The challenge is finding the right balance. That balance will vary, depending on your preferences and expectations in business-cycle analysis. For CapitalSpectator.com, we prefer to err on the side of reliability.

Timeliness is important, of course, and your editor seeks to maximize that factor, but not at the expense of generating an excess of false signals. Yes, it’s a mix of art and science, but our weekly updates of The US Business Cycle Risk Report strive to find the sweet spot.

On that front, dare I say, the newsletter’s modeling has an encouraging track record. It’s not perfect (nothing is), but the results are competitive, to say the least and we avoid many of the rookie mistakes that plague many other efforts.

In the Aug. 10 issue, I wrote: “The debate about rising recession risk continues, but the numbers continue to speak clearly: economic contraction has not started, and the odds remain low that an NBER-defined downturn is imminent.”

That can change, of course, and at some point will. But the baseline analysis is to crunch a wide array of data sets and make an informed quantitative-based review with the numbers in hand. Rinse and repeat as new numbers are published.

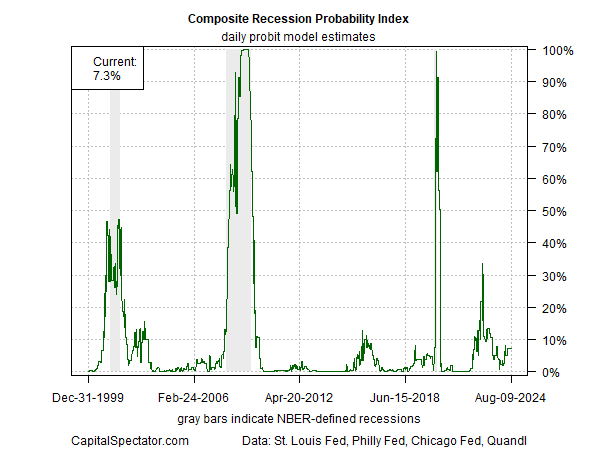

The main business-cycle index for the newsletter – Composite Recession Probability Index (CRPI) — continued to reflect a probability of less than 10% that the economy was contracting (as of Aug. 10).

This multi-factor benchmark, which reflects inputs from a range of business-cycle indicators (proprietary and external), is a tough act to beat, or so its history implies.

CRPI’s limitation is that it focuses on published data to date. Cautiously looking into the near-term future with another set of proprietary modeling points to an ongoing expansion for August and September. Looking beyond that short window becomes increasingly precarious, i.e., unreliable.

Meantime, this much looks obvious: the low-risk recession profile that’s been highlighted in the newsletter’s pages of late will likely prevail in this weekend’s update.