As we head into the end of the year, we see that 2024 turned out to be a pretty good year for many economies, especially the U.S.

Recessions were mostly avoided, inflation returned to around 2% and labor markets remained strong but no longer strained. You could say that this year will end with economies in a bit of a “Goldilocks” state – not too hot, not too cold.

Labor markets have softened but are still generally healthy

One place where that’s evident is in labor markets.

The past four years have seen extremes for labor markets – from big spikes in unemployment during the early part of Covid then to historically tight labor markets as economies reopened, leading to a shortage of workers.

Now, unemployment is generally near historically low levels, but in many countries, it is rising (chart below). That’s a sign that the supply of labor is back in line with demand for labor. In fact, in the U.S., the number of jobs per person looking for work has fallen from 2-to-1 to a much more balanced 1.1-to-1.

That’s good for companies, as it’s getting easier to hire staff. It’s also good news for inflation, as the pace of wages growth is also slowing.

Jobs markets are “not too hot, and not too cold.”

Chart 1: Unemployment rates are low (but mostly increasing)

Inflation is back near 2% targets around the world

We all know that inflation increased dramatically during Covid. That was mostly due to supply chain disruptions caused by Covid, wage pressures from tight labor markets and the Ukraine conflict. The prices of goods, energy and food all rose. Data shows that consumer prices in the U.S. are now around 22% higher and wages are 25% higher than before Covid.

But with supply chains fixed and wage growth cooling, headline inflation around the world has fallen. It is back around 2% in many of the world’s largest economies (chart below).

In short, inflation is very close to being “just right.”

Chart 2: Inflation back near central bank targets

GDP growth just strong enough to avoid recession

The main tool central banks used to get inflation back under control was higher interest rates. Often, that slows the economy too much, leading to a recession, which many were worried about back in 2023.

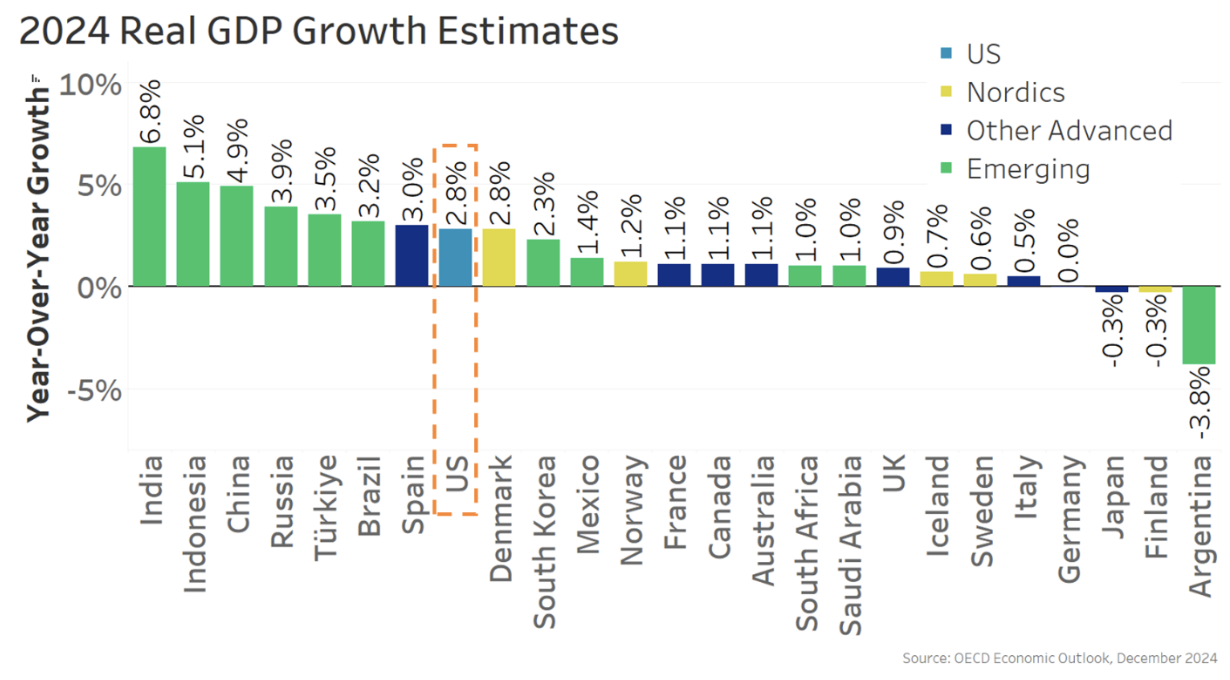

However, the data shows that, although growth is slow in some places, most countries have avoided recession. Generally, countries seem to have achieved a so-called “soft landing.”

Chart 3: U.S. stands out for its strong growth among advanced economies in 2024

So, as we exit 2024, we have what is pretty close to a “Goldilocks” economy – not too hot, not too cold.

Interestingly, the U.S. has seen one of the strongest economies in 2024, where we have a 4.2% unemployment rate, 2.4% inflation rate, and are on pace for nearly 3% real GDP growth.

Rate cuts underway, with more expected in 2025, should help boost growth

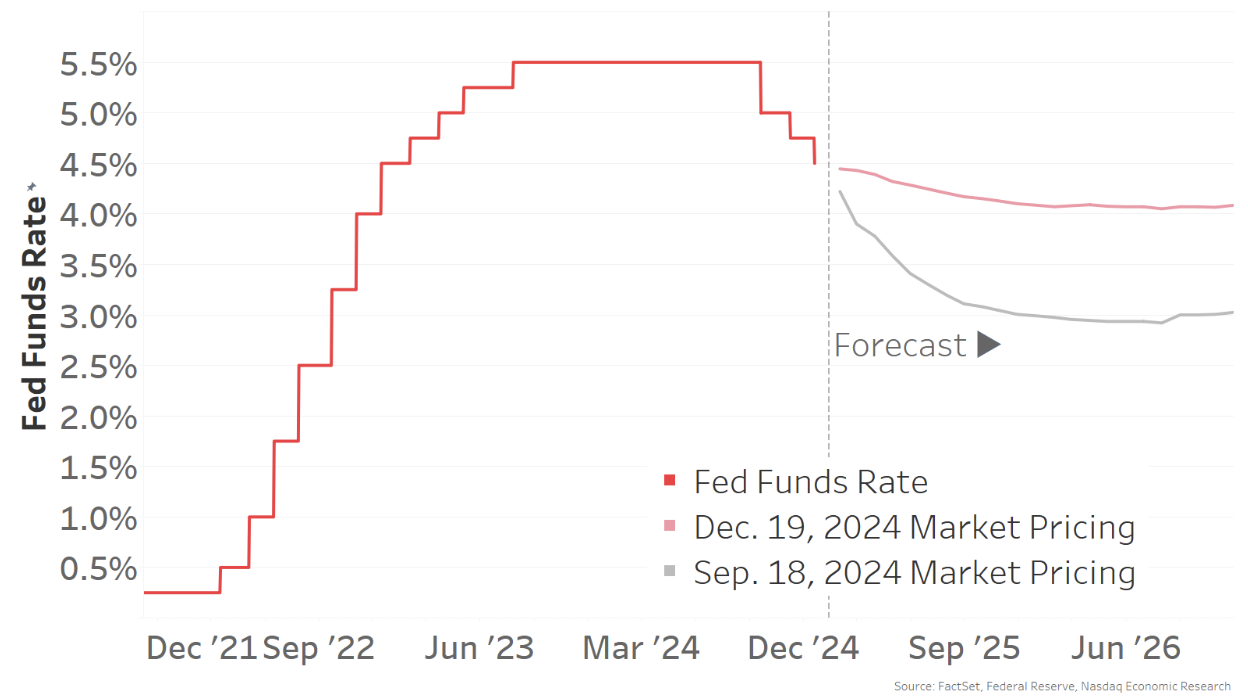

With inflation down and employment markets softer, central banks have already started to reduce rates. Based on the U.S. Fed’s own estimates, current short-term interest rates are still at levels that are “restrictive” – or above the neutral rate. As a result, rates are expected to fall more in 2025. The big question is how much.

Just three months ago, markets were pricing in a Fed funds rate of around 3.0% by the end of 2025 – a fall of around 1.5% from current levels.

By December, a lot had changed. Markets now only expect rates to fall to around 4.0%, and maybe not reach that level until 2026. In short, we are seeing rates staying higher-for-longer again. For interest rate-sensitive segments of the economy, that could affect investment and growth.

Chart 4: Interest rates are falling in most countries, with more cuts expected in 2025

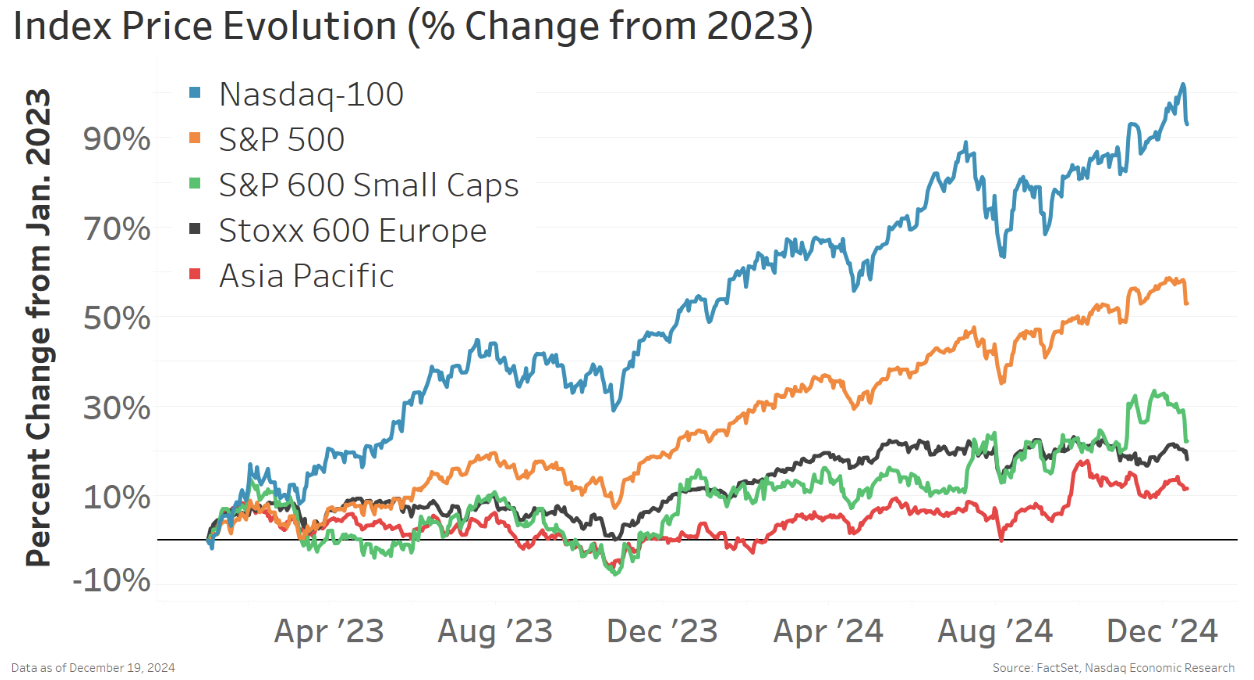

Global stock markets had a mostly good year in 2024

Overall, 2024 was a good year for stock markets. Many countries saw earnings recoveries, which, combined with lower interest rates, helped push stock valuations up.

However, returns in the U.S. large cap stocks – and especially for Nasdaq-100® stocks – were much higher than most other regions or market caps.

Chart 5: Most stock markets are up in 2024, but U.S. mega cap saw stronger returns

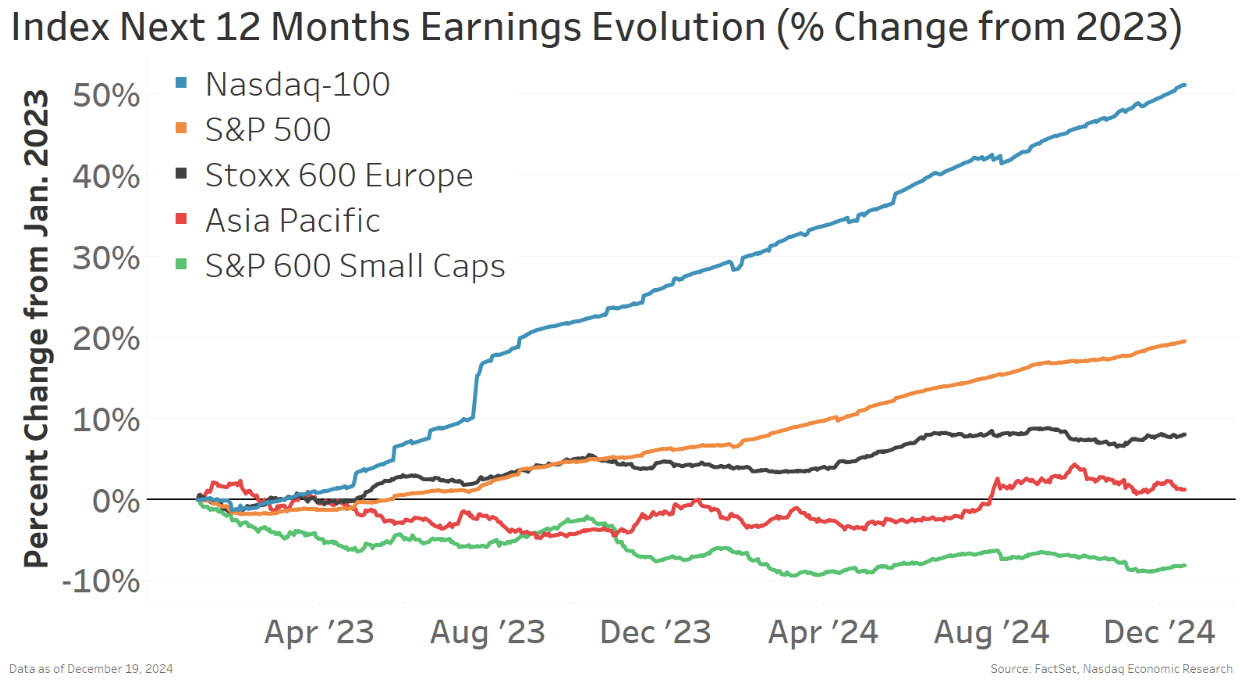

Interestingly, looking at earnings in the same indexes we see the same trends.

The outperformance of the Nasdaq-100® is supported by far stronger earnings growth. While U.S. small caps are mired in an earnings recession.

Chart 6: Earnings trends mirror stock returns

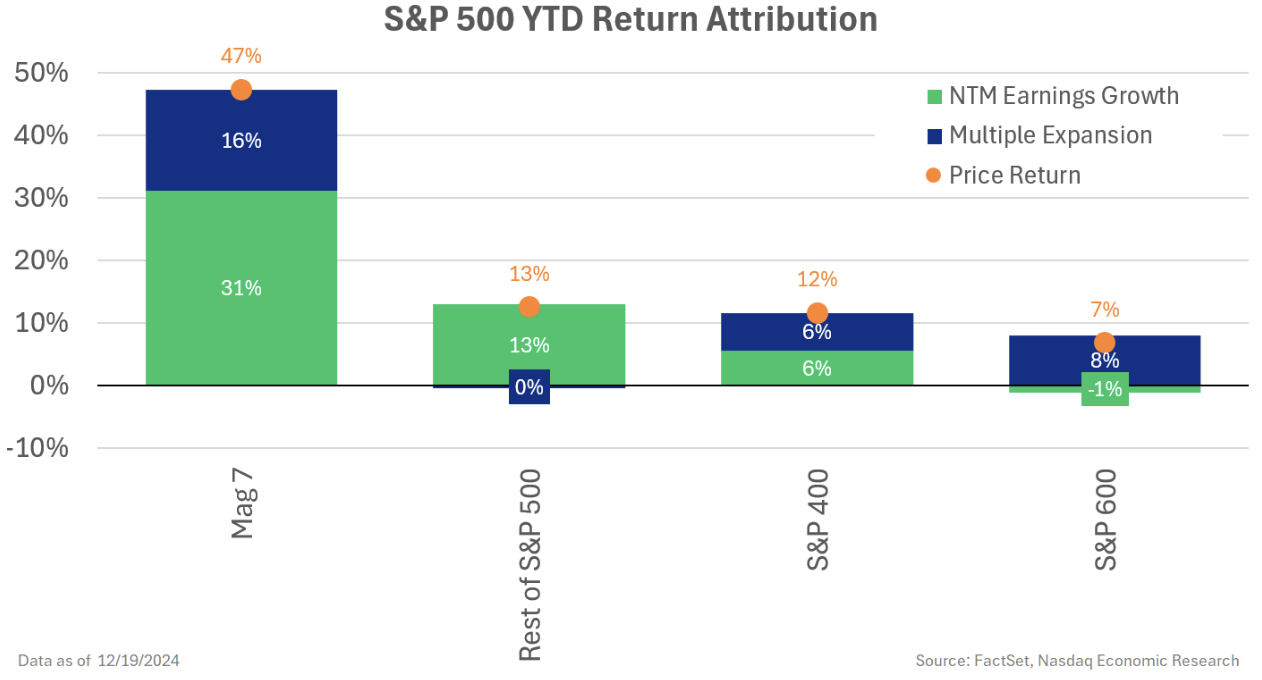

Taking a closer look at earnings in the large cap indexes, we see that earnings growth in the S&P 500 has been driven predominantly by the so called “Mag 7” stocks.

All those stocks are exposed to the spending on artificial intelligence, which some estimate is running well over $200 billion per year. Nvidia makes the GPU chips sought after for calibrating AI models. Amazon, Microsoft and Google all run cloud data centers, which are key to processing all the data, and Apple, Tesla and Meta are among the first movers using AI in their products.

Because all are Nasdaq listings, they make up an even larger proportion of the Nasdaq-100 Index® – helping the Nasdaq-100® outperform the broader S&P 500 index.

Chart 7: Large-cap earnings are driven by the Mag 7 stocks

Importantly though, as we have progressed through 2024, we have seen a broadening of the earnings recovery in the rest of the large cap stocks.

Lower rates would be good for small companies

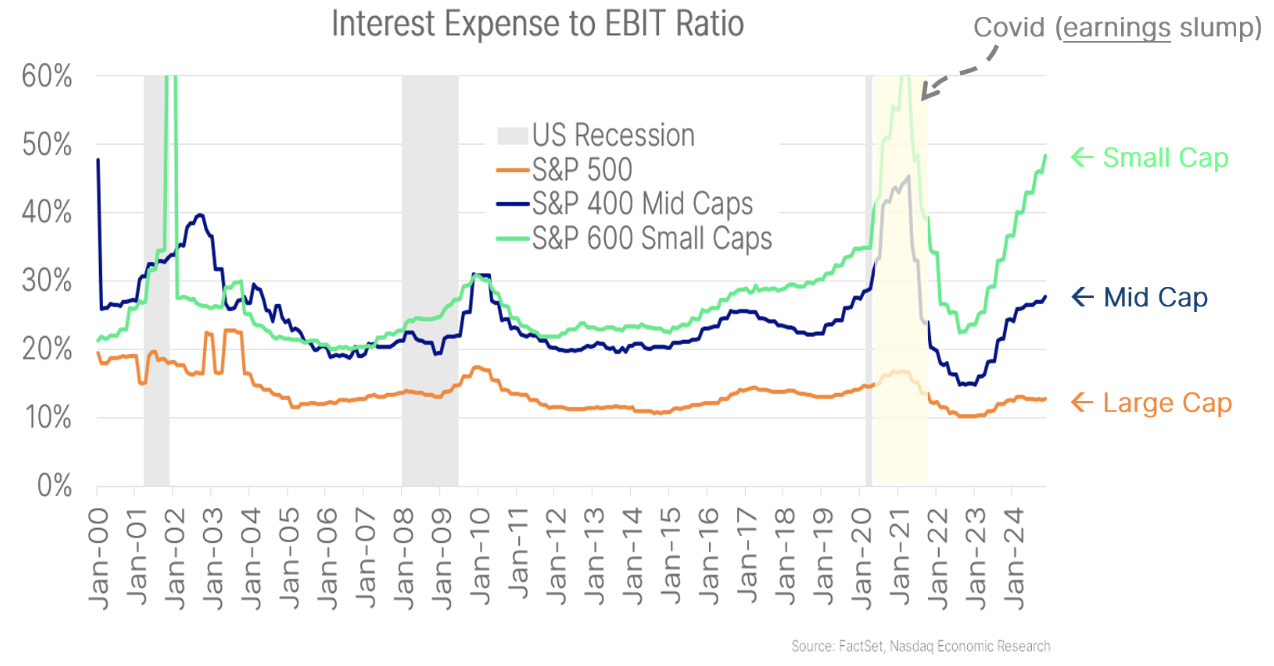

When we look at the difference between large-cap and small-cap stocks, one thing stands out. Interest expenses are reducing profits of small cap companies much more than for large-cap companies.

Some data shows that higher interest rates have especially impacted smaller companies, with interest expense/profit ratios at multidecade high levels. In contrast, the proportion of interest expense for large cap companies is near record low levels – and has hardly increased despite rising interest rates.

Chart 8: Interest rates are affecting small-cap companies much more than larger companies

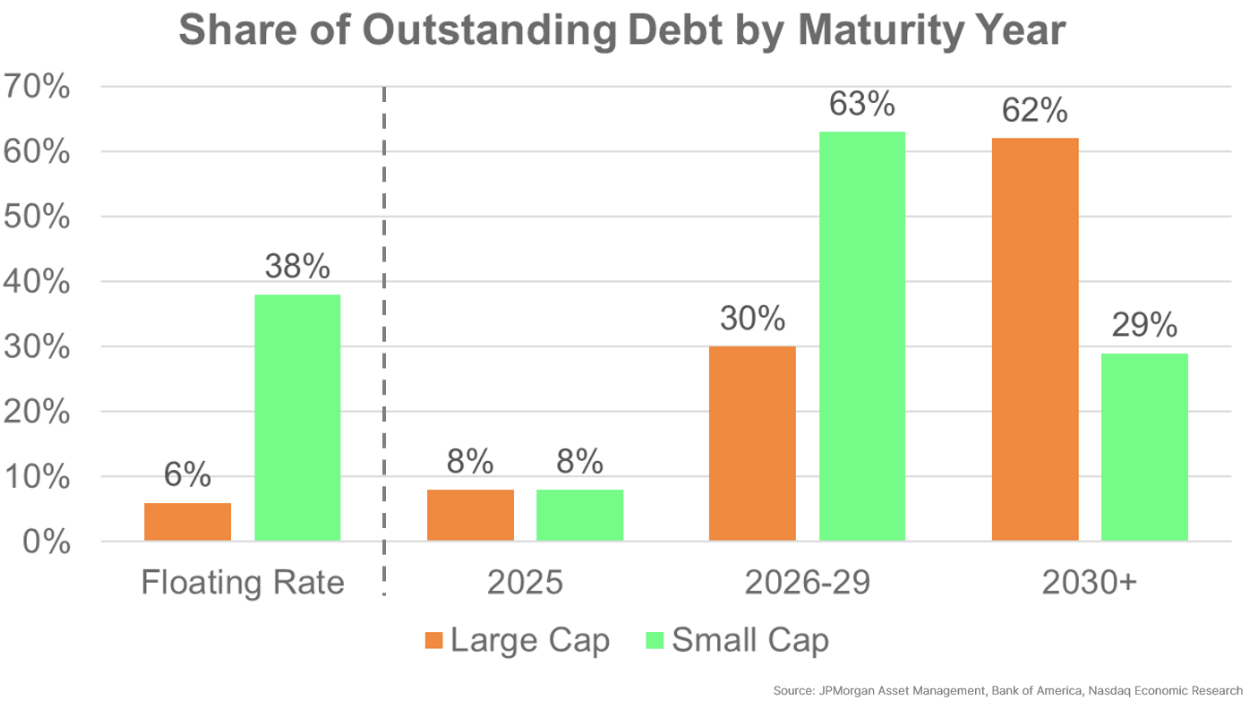

The different sensitivity to interest rates is supported by looking at company debt financing across market cap. We see that large-cap companies have very little floating rate debt, which has insulated them from Fed interest rate increases. In fact, large-cap companies seem to have fixed rates on the majority of their debt, at low rates, out to at least 2030.

In contrast, small-cap companies have around a third of their debt at floating rates, with a large proportion of fixed rate debt scheduled to refinance starting in 2026. Clearly, small-cap companies will be more impacted by rates staying higher-for-longer.

Chart 9: Small-cap companies are much more exposed to higher short-term interest rates

2025: No signs yet of consumer weakness

Overall, the reason the U.S. economy performed so well in 2024 was because the U.S. consumer remained strong. Real spending (adjusted for inflation) is up almost 15% compared to right before Covid. That’s a lot better than Europe, where real spending has barely increased.

Chart 10: U.S. consumer spending stands out among other advanced economies

A number of factors have helped maintain consumer spending growth in the U.S.

Firstly, after experiencing the Credit Crisis back in 2008, most U.S. households have now locked in long-term fixed mortgage rates. Just like large-cap companies, despite the Fed increasing official interest rates and new mortgage rates almost tripling, the average interest rate on outstanding mortgages barely increased – and remains around 4%. That has left more money in people’s pockets – and means monetary policy has had a more muted impact on consumers.

Secondly, with wage gains that started in the “Great Resignation,” and then broadened to include most workers, real wages have also grown. That, combined with strong employment and low risks of layoffs, has given the consumer the confidence to keep spending.

With interest rates higher, even savers are earning more income.

Finally, higher house prices have also left household balance sheets in a strong position. Recent data showing increases in home equity loans (HELOCs) suggest some might finally be tapping into debt markets, allowing spending to persist.

So far, there are few signs of weakness. Credit card debt, although at new highs, is relatively low as a proportion of income and household net assets. In fact, even the increase in unemployment (Chart 1) that the U.S. has seen is mostly due to more workers looking for jobs. Layoffs, which more typically lead into recessions, remain near multidecade low levels.

Chart 11: Low layoffs have helped consumers keep spending

2025: Strong underlying economy with a chance of uncertainty

There are a lot of positive signs for the U.S. economy and the stock market heading into 2025.

The consumer remains strong, thanks to robust household balance sheets and a strong job market.

Company earnings are recovering. Expected tax cuts and looser regulation in 2025 should help boost earnings, too. Although some uncertainty exists for companies that have to deal with higher longer-term interest rates, possible new tariffs and potential new labor shortages.

Looking at the bigger picture, further interest rate cuts, combined with tax cuts and net positive government spending, should keep the U.S. economy growing for at least another year. That should also be good for stocks.