I’m changing the way I do the monthly analysis. Doing it live for an audience was always stressful, especially with the inevitable data issues from time to time.

Of course, as an inflation investor/trader, I’ll still do it live; I just don’t have an audience.

The nice part about doing it live was that the monthly report had a very similar structure to it with the same charts all of the time, and that will change.

But it also means that I can lead with the important stuff sometimes, like this month.

So I’m going to start today’s discussion of the slightly above-consensus CPI report (+0.31% on , vs expectations for +0.25%) by saying the quiet part out loud:

Rents aren’t collapsing

They are decelerating, and they will continue to do so, but they are not going into deflation. Everyone today seems to be acting as if this is some huge shock, but it really isn’t.

The only reason to ever have thought there would be rental deflation in an environment of housing shortage was that some of the high-frequency rent indices.

These are not designed to be high-quality data; they’re data derived from a business that has been packaged as if it is high-quality data.

That suggested declines in rents and an influential article popularized the notion that you could get more information from the BLS by looking at less data.

But the cost side has never improved for landlords – in fact, it keeps getting worse – so it was hard to see how there would be a general decline in rents.

In some parts of the country, from which people are migrating away, e.g. perhaps inner cities, rents may fall.

But those people have to go somewhere. Big migration means the housing stock is now all in the wrong places, and rents go up when there’s a shortage faster than they fall when there’s a glut.

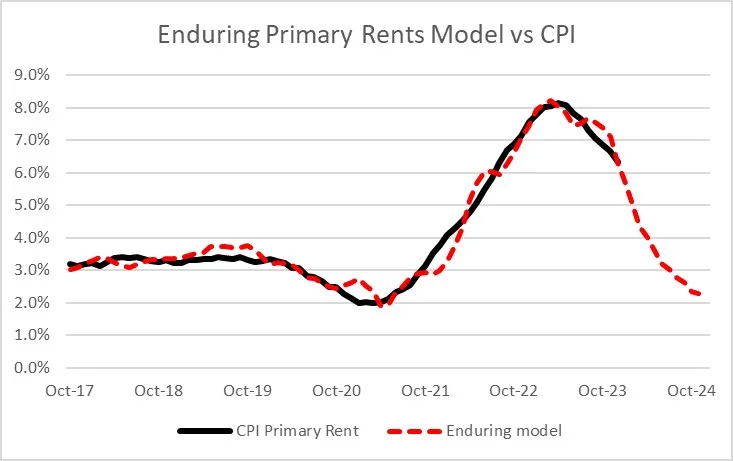

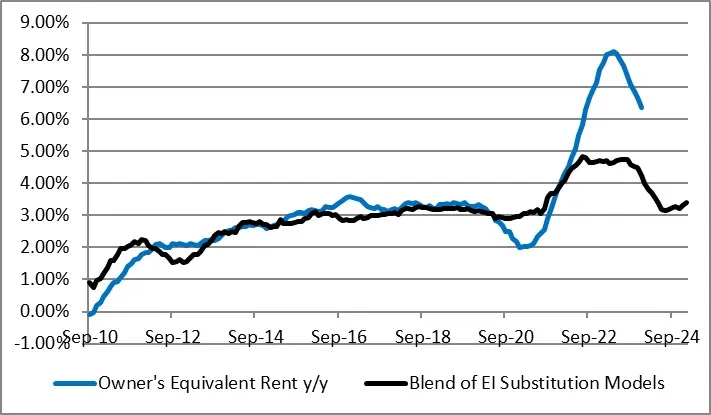

Anyway, both my costs-based rent model above and my old rent model below suggest the same destination for rents – middle of this year or just afterward, y/y rents should get to around 2-3%.

That’s a lot lower than the current run rate for rents, of +0.47% m/m for OER and +0.42% for Primary rents this month, but it’s also far above what the general expectation has been for this large part of the consumption basket.

Moreover, it appears that the longer-term pressures are for that part of inflation to scoop back higher, not lower.

So, today’s rents number was a little surprising, but not that surprising. Some are attributing the miss today to ‘just rents,’ as if it’s okay for the largest part of the CPI to have a trajectory that’s confounding many forecasts, but it wasn’t just rents.

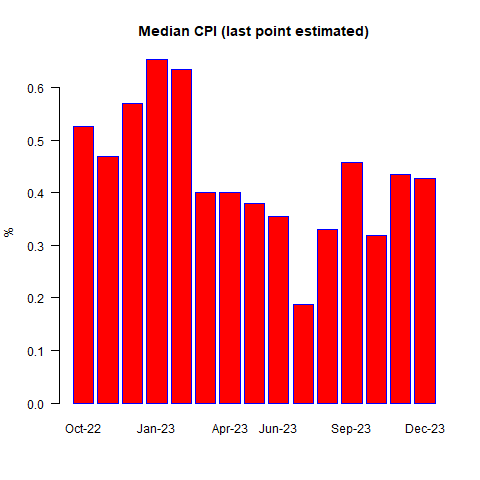

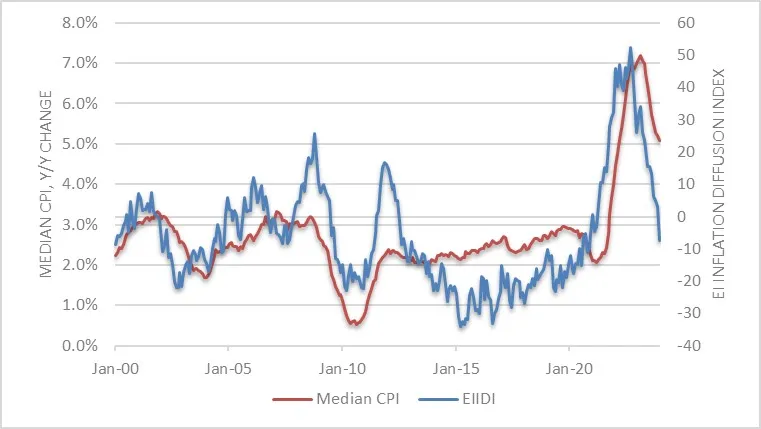

Median inflation was +0.42% m/m, keeping the y/y number above 5%. And three of the last four figures have been in that zone. The median should keep decelerating too, but it is not collapsing.

Median CPI

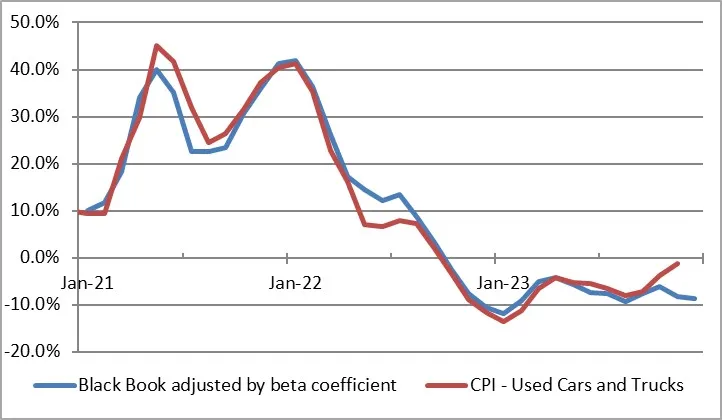

Now, I’ll note that Used Car prices were weird, again. They rose +0.49% m/m, when I (and most folks) had expected a decline.

They’ve been a bit squirrelly for a while, with official inflation printing higher than the private surveys fairly persistently for 6-9 months.

On the other hand, airline fares have been persistently squirrelly lower compared to jet fuel, so these two things were ‘errors’ in the opposite direction.

This month, airfares also rose, by about 1% m/m – but that was right about where it should have been given the change in fuel prices and not a surprise.

Now, the diffusion stuff is looking better and supports the idea that median inflation will continue to decelerate.

Such a deceleration has been and continues to be my forecast. I expect median inflation to settle in the high 3%s and low 4%s, and be hard to push much below that.

In the near term, meaning maybe by early H2 of this year, we could get some numbers a little below that as the rent deceleration continues.

But then the hook happens. It will be hard to get inflation below 3% for very long, especially if the Fed decides to stop shrinking its balance sheet and money supply growth recovers.

So the system is normalizing after COVID (and more relevantly, after the spastic and dramatic fiscal and monetary response to COVID). But normal is no longer sub-2%.

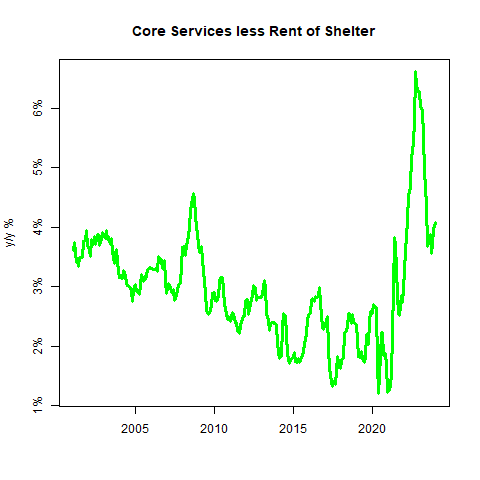

Core services ex-shelter (so-called “supercore”) abstracts both from the deceleration in housing and the sharp drop in core goods, and it is hooking higher (this is partly because Health Insurance had been artificially depressing it and that effect is waning).

Core Services less Rent of Shelter

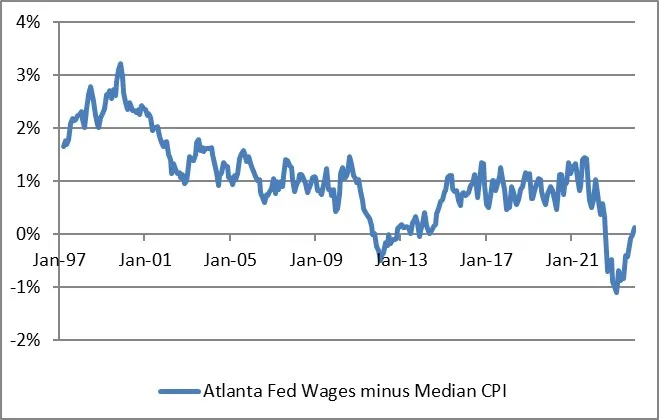

Supercore is unlikely to plunge either. Wages remain robust. The Atlanta Fed just released its Wage Growth Tracker, at 5.2% for the fourth month in a row.

The spread between median wages and median inflation, which had been stable around 1% for a long while, is heading back there (see chart).

So again, we’re looking at something around 4% for median inflation unless wages start to decelerate…and there’s as yet no sign of that.

The bottom line is that while this number was only a little bit surprising, it was surprising for all the wrong reasons.

There is nothing in this figure that suggests the Fed can comfortably abandon a tight-money policy and think about easing soon, and I don’t expect them to do so.