Please enable JavaScript if it is disabled in your browser or access the information through the links provided below.

January 12, 2024

Federal Reserve Board announces preliminary financial information for the Federal Reserve Banks’ income and expenses in 2023

For release at 2:00 p.m. EST

The Federal Reserve Board on Friday released preliminary financial information for the Federal Reserve Banks’ income and expenses in 2023. The 2023 audited Reserve Bank financial statements are expected to be published in coming months and may include adjustments to these preliminary unaudited results.

Information related to the 2023 preliminary financial results for the Reserve Banks include:

- The Reserve Banks’ 2023 sum total of expenses exceeded estimated earnings by $114.3 billion. In 2022, net income was $58.8 billion;

- Interest income on securities acquired through open market operations totaled $163.8 billion in 2023, a decrease of $6.2 billion from 2022 interest income of $170.0 billion;

- Total interest expense of $281.1 billion increased $178.7 billion from 2022 total interest expense of $102.4 billion; of the increase in interest expense, $116.3 billion pertained to interest expense on reserve balances held by depository institutions and $62.4 billion related to interest expense on securities sold under agreements to repurchase;

- Total interest income earned on loans to depository institutions and other eligible borrowers, including from the Bank Term Funding Program and Paycheck Protection Program Liquidity Facility, was $10.4 billion;

- Operating expenses of the Reserve Banks, net of amounts reimbursed by the U.S. Treasury and other entities for services the Reserve Banks provided as fiscal agents, totaled $5.5 billion in 2023;

- In addition, the Reserve Banks were assessed $1.0 billion for the costs related to producing, issuing, and retiring currency; $1.1 billion for Board expenditures; and $0.7 billion to fund the operations of the Consumer Financial Protection Bureau.

- The Reserve Banks realized net income of $0.1 billion from emergency credit facilities established in response to the COVID-19 pandemic;

- Additional earnings were derived from income from payment and settlement services of $0.5 billion;

- Statutory dividends totaled $1.5 billion in 2023.

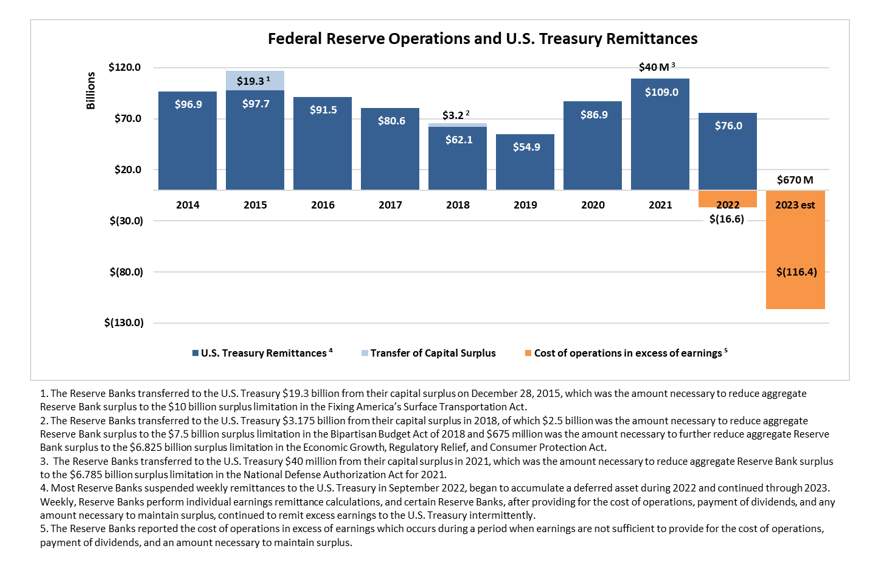

The Federal Reserve Act requires the Reserve Banks to remit excess earnings to the U.S. Treasury after providing for operating costs, payments of dividends, and an amount necessary to maintain surplus.

During a period when earnings are not sufficient to provide for those costs, a deferred asset is recorded. In 2023, the Reserve Banks increased the deferred asset by $116.4 billion resulting in a cumulative deferred asset at year-end of $133.0 billion. The deferred asset is the amount of net excess earnings these Reserve Banks will need to realize before their remittances to the U.S. Treasury resume. A deferred asset has no implications for the Federal Reserve’s conduct of monetary policy or its ability to meet its financial obligations. The attached chart illustrates the amount the Reserve Banks distributed to the U.S. Treasury from 2014 through 2023 (estimated).

For media inquiries, please email [email protected] or call 202-452-2955.

Last Update:

January 12, 2024