Despite surging interest rates, there are few signs they are impeding economic activity or causing distress amongst borrowers. It may seem strange that higher rates are not proving troublesome for an economy with such a high amount of leverage. Don’t breathe a sigh of relief quite yet. There is often a delay, called the lag effect, between higher interest rates and economic weakness.

Changes in interest rates only impact new borrowers, including those with maturing debt who must reissue debt to pay back investors of the maturing bonds. Accordingly, higher rates do not impact those with fixed-rate debt that is not maturing. The lag effect occurs due to the time it takes for the new debt issuance to bear enough weight on the economy to slow it down.

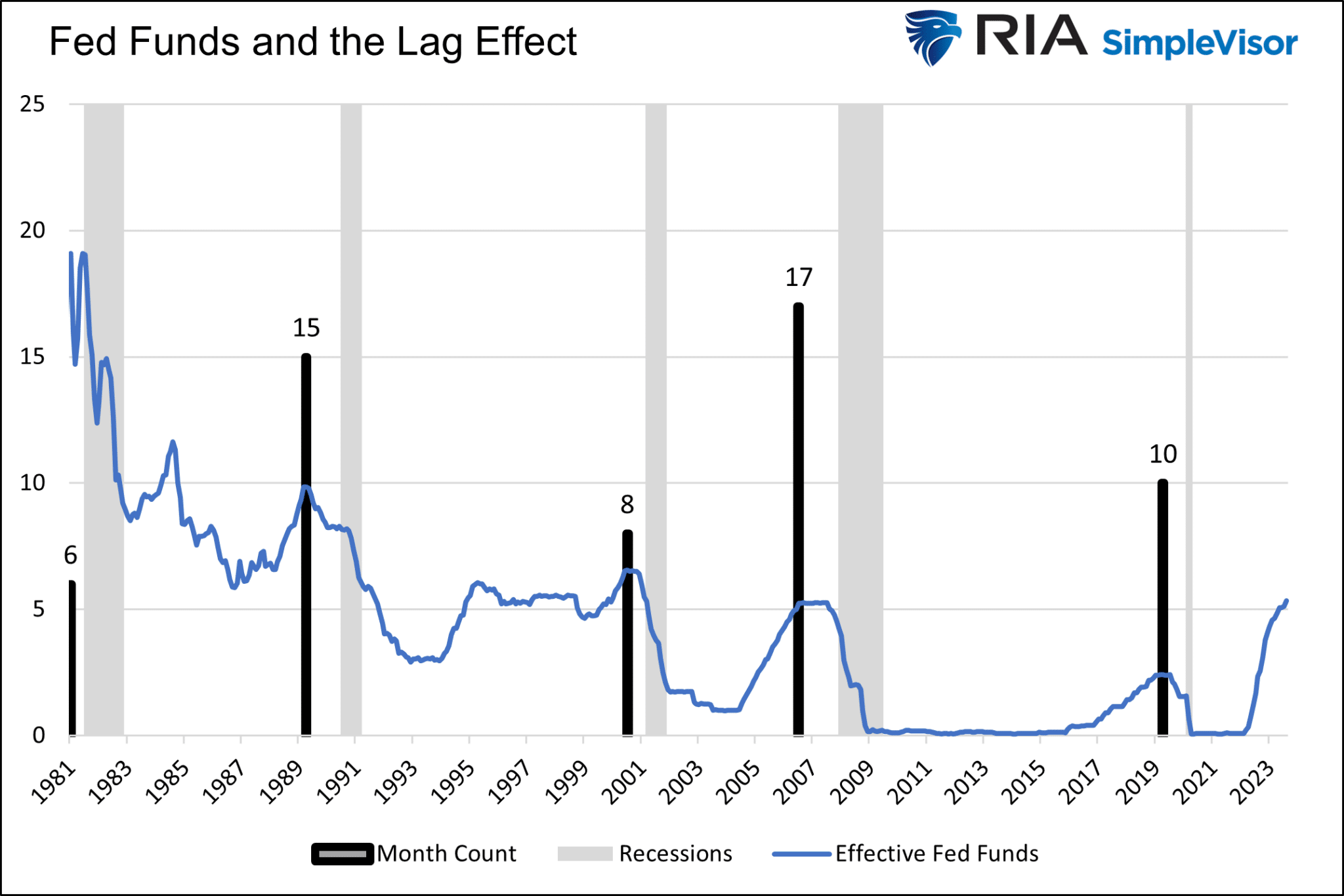

The graph below shows the Fed Funds rate and the time, as measured in months, from the last in a series of rate hikes preceding each recession since 1981. The average delay between the final rate increase and recession has been 11 months. The last Fed hike was in July 2023. Assuming that was the Fed’s final rate increase for this cycle, it may not be until June 2024 before a recession occurs.

This so-called lag effect is even more pronounced when rates were very low for extended periods before the rate hikes. We examine government, corporate, and consumer debt to appreciate the current lag effect and better gauge when it will rear its ugly head.

Government

There is over $32 trillion of U.S. Treasury debt outstanding. Simple math asserts that each 1% increase in interest rates pushes the government’s interest expense up by $320 billion. That math is wrong.

The reality is only a small portion of the federal debt matures in any given month and must be reissued. Further complicating matters, some maturing debt was issued when interest rates were similar to or higher than current levels. For instance, the bond issued on August 16, 1993, with a coupon of 6.25%, just matured in August. Reissuing debt to replace the bond saved the government about 2% of $11.50 billion, or $230 million.

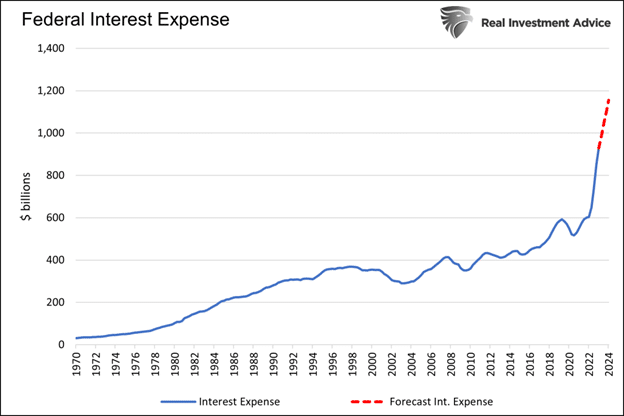

In our article, we quantified how rising interest rates affect and will affect the government’s interest expense. As we share below, its interest expense will increase more between 2022 and 2024 than in the 51 years prior!

Federal Interest Expense

Higher interest rates are unsustainable for the government. A $2 trillion deficit, as we have now, during a robust and peace-time economy with high interest rates will force the government to cut its spending. While that is good in the long run, it hurts the economy in the short run. Ergo, as each month passes and interest expenses consume more of the deficit, government spending in other areas is likely to slow.

Rather than reduce spending, the easier, albeit fiscally irresponsible, way to keep running massive deficits is to ensure inflation normalizes so rates can drop significantly and interest costs are not burdensome. That has been the Fed and Treasury playbook for the last 30 years and will continue.

Corporate Debt

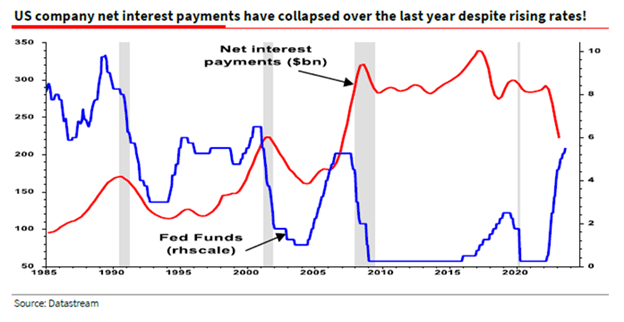

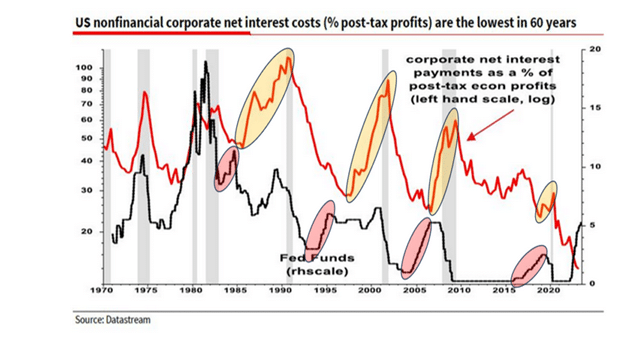

In aggregate, higher interest rates are currently helping corporate borrowers. As the graph below from Albert Edwards shows, net interest payments for U.S. corporations have fallen while Fed Funds have risen significantly. We touched on this graph recently.

To help explain why higher interest rates are currently helping corporations, consider the following quote:

Albert surmises that many companies borrowed heavily in 2020-2021 at very low-interest rates, and the proceeds remain in deposit accounts earning more than the interest on the debt. Consequently, net interest is reduced.

Corporate Net Interest Payments

The following graph, also from our Commentary, shows that such a circumstance is common when the Fed raises rates. The red circles highlight four instances in which interest costs as a percentage of profits fell while the Fed was hiking rates. The yellow circles show that interest expenses lagged but rose after the Fed stopped raising rates.

Corporate Interest Payments

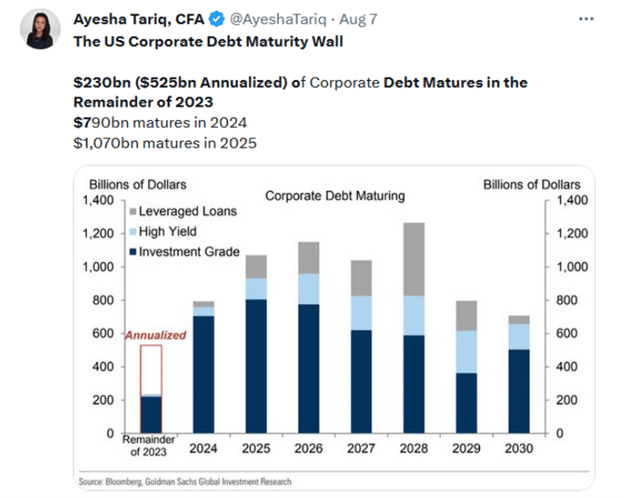

Such is the lag effect. Most companies spread out their debt, so only a small amount matures in any year. Therefore, it can take time until more expensive debt replaces cheaper maturing debt. The tweet below shows a wall of maturing debt is approaching quickly.

Corporate Debt Wall Maturities

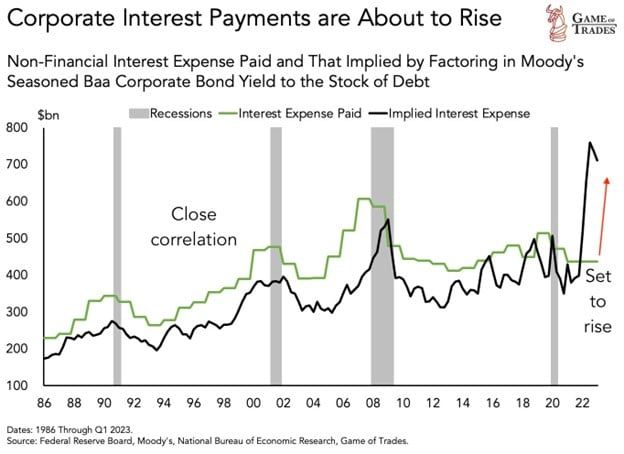

The following graph, courtesy of Game of Trades, shows what will happen to corporate interest expenses over time if rates stay at current levels. As it shows, corporate interest expenses will triple!

Corporate Interest Payments Set To Rise

Individual Debt

The impact on individuals is similar to corporations and the government. Marginal purchases on credit result in the financial recognition of higher interest rates.

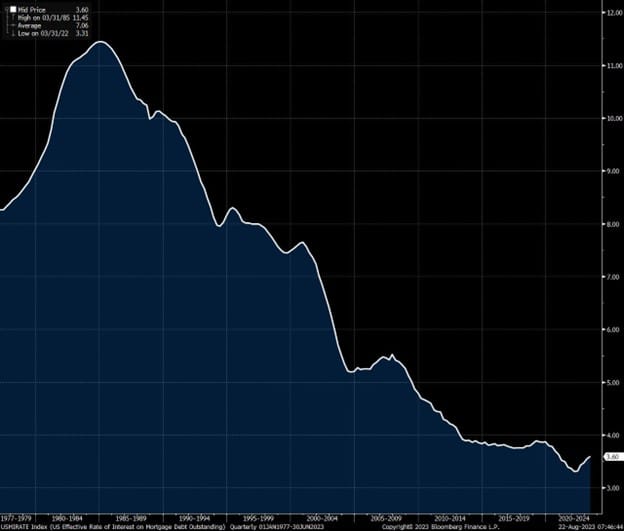

The graph below shows the weighted average mortgage rate. Currently, mortgage rates are well over 7%, about 4% higher than the lowest mortgage rates set in early 2022. Despite the sharp increase, the weighted average rate has barely ticked up.

Only those buying houses are affected by the new mortgage rates, and there aren’t many home buyers. Existing home sales are at levels last seen during the depth of the financial crisis.

Wieghted Average Mortgage Rate

Unlike houses, cars do not have as long a shelf life. Per a recent study by ISH Markit, the average length of car ownership is 79 months or just over 6.5 years. As such, about 15% of car owners will have to pay cash or borrow at high auto loan interest rates.

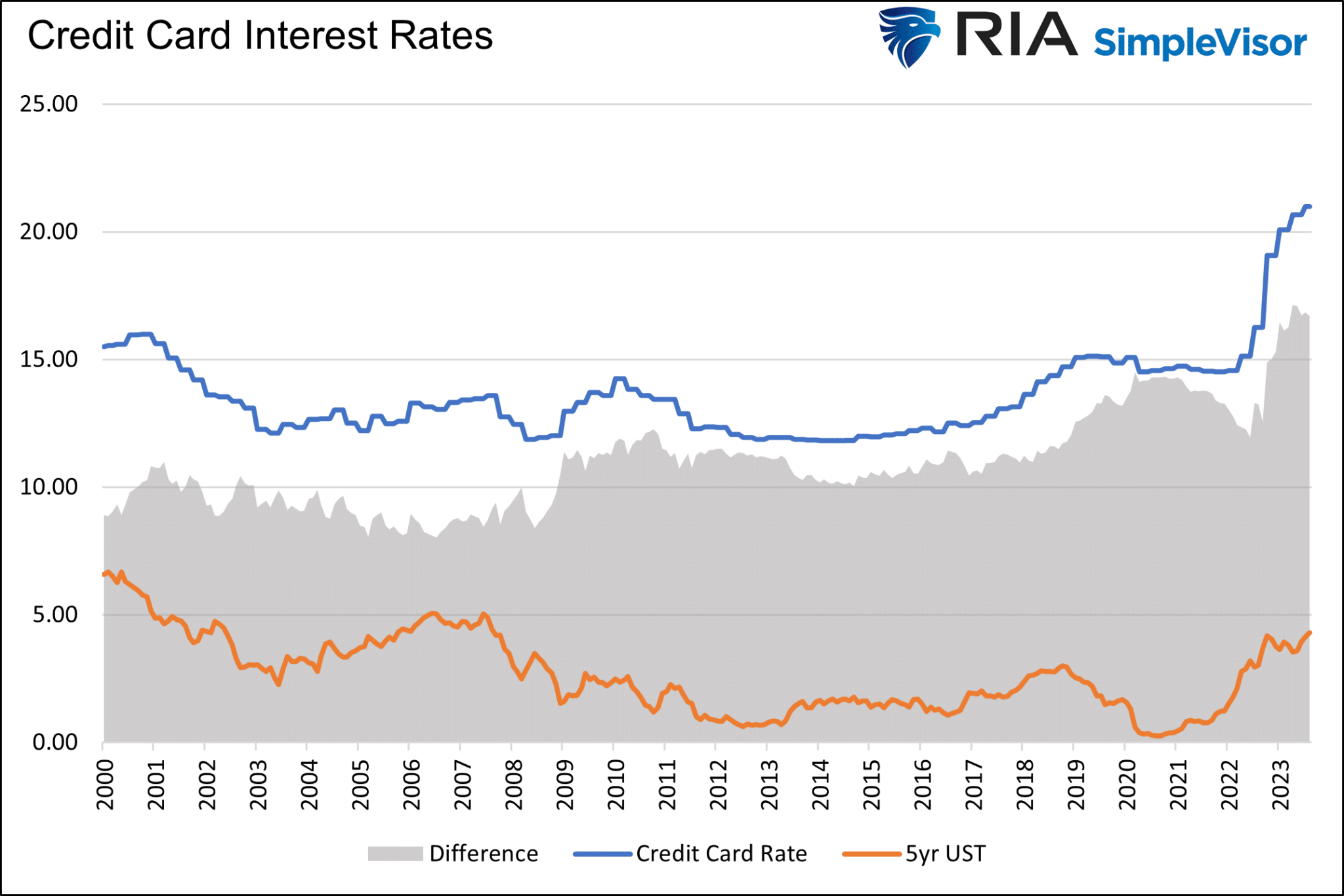

Interest rates on credit cards float monthly. Therefore, cardholders who do not pay their entire balance monthly are immediately impacted by higher rates. According to the Fed and shown below, the average credit card interest rate is 21%, up over 6% since the Fed started raising rates. Credit card rates have risen significantly more than U.S. Treasury rates and Fed Funds.

Record Low Rates Before 2022 Increase the Lag

When contemplating how corporations and individuals have thus far insulated themselves from higher interest rates, consider that when interest rates are held low for long periods, the weighted average rate for every type of loan is lowered. The longer, the more borrowers benefit. And, the less borrowers are immediately impacted by higher interest rates.

As we showed, sub 3% mortgages in 2020 and 2021 and meager rates before the pandemic allowed a large majority of borrowers to extend their debt and avoid, for a period, the wrath of higher interest rates.

Over time, however, corporate and government debt matures, people need new cars or houses, and the reality of higher interest rates hits.

Conclusion

The lag effect is a ticking time bomb. Each day that passes, another borrower feels the impact of higher interest rates. The financial impact is slow but steadily increasing. Also, remember that the various types of pandemic-related stimulus are quickly exiting the economy. Normalizing economic activity and the slow but steadily growing lag effect will likely result in a recession.

Given the leverage the economy depends upon, “higher for longer” is not possible without breaking something.