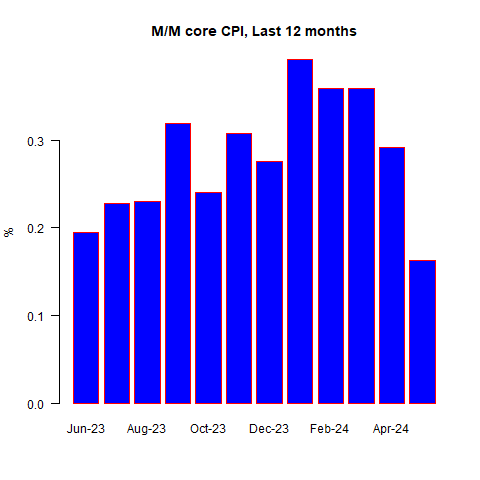

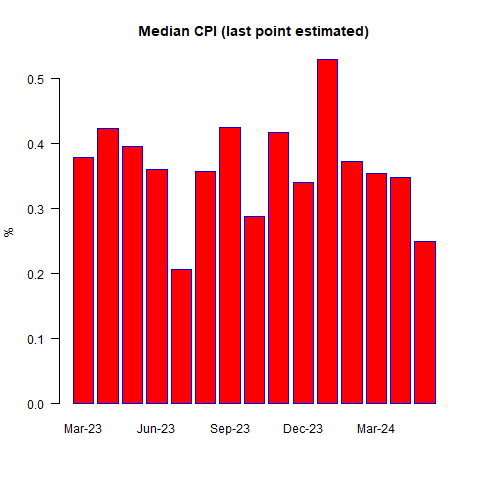

The report for May was definitely good news. In April, core CPI was +0.29% and Median CPI was +0.35%; this month those figures were +0.16% for core and +0.25% (est) for median. That would be the best median CPI print since last summer and this was the best m/m core CPI print since 2021.

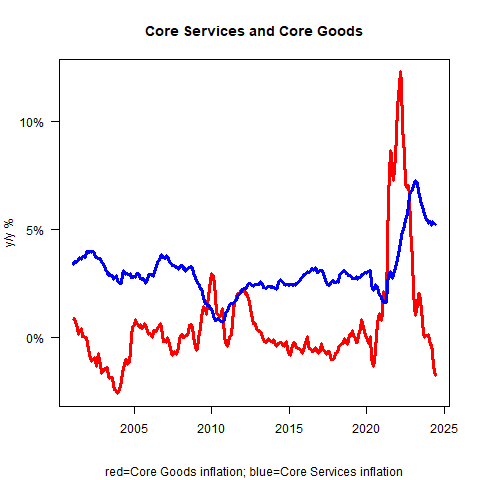

Core goods decelerated to -1.7% from -1.3%, y/y. I have long admonished that we are running out of room for deceleration in inflation to be driven by core goods as it’s hard to imagine goods deflation of a couple percent continuing for very long. Yet, so far, that is what we have gotten! Core services, meanwhile, was steady at +5.3% y/y.

But while there’s optimism in some quarters that we have seen the light at the end of the tunnel, this data was not unequivocally good news. The disinflation going forward cannot be all about goods, but in this report it mostly was. New car prices declined (although Used Car prices rose). Apparel declined, with some of the largest m/m declines in the CPI this month for its subcategories. Durable goods declined, and ‘education and communication commodities’ (things like computers, software and accessories, telephone hardware, etc) was a measurable drag. Those are all good things, but while Bullard today was talking about ‘immaculate disinflation’ (which is an idiotic term) there wasn’t really any sign of broad immaculateness. It was mostly in core goods.

As I mentioned, core services was steady year over year. But medical care – both goods and services, actually – both accelerated. I have been watching hospital services, within medical care, and it actually decelerated (7.2% y/y from 7.7%, chart below). Yay! On the other hand, the long-suffering Doctors’ Services accelerated to 1.4% y/y from 0.9%, and Medicinal Drugs rose to 3.4% from 2.6%. Boo. The +1.3% m/m rise in Medical Care Commodities was actually one of the month’s biggest gainers in the CPI.

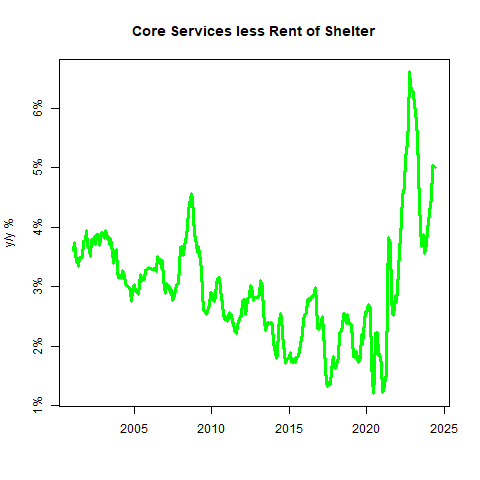

Airfares dropped -3.6% m/m! And motor vehicle insurance -0.25% in a welcome respite. And car/truck rental -1.2% m/m. Thus “supercore”, which is core services ex-housing, actually declined m/m for the first time in a very long time even with medical care services going up, and the y/y number took a very small deceleration on the following chart.

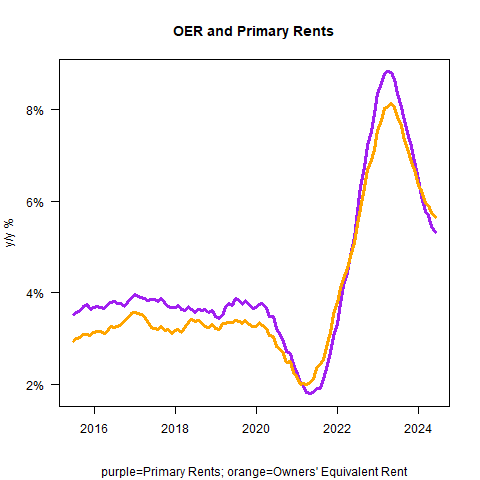

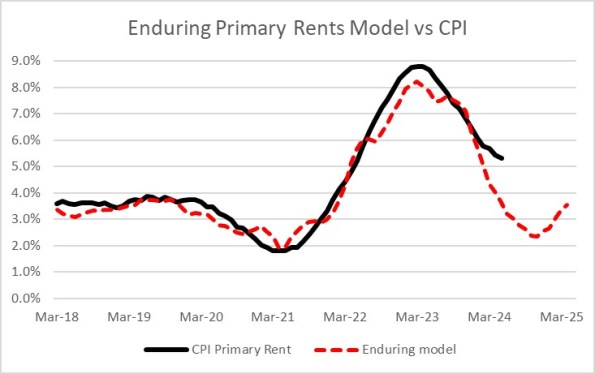

That is welcome news, to be sure. But if goods prices were down and core services ex-housing were down (collectively), then obviously the fact that the overall inflation number was positive means rents are still percolating. Primary rents rose +0.39% m/m, and Owners’ Equivalent Rent rose +0.43% m/m. Those are both accelerations compared to the prior month, which is not expected! Y/Y, the numbers are still slowing, but not as fast as anyone would like.

This has led some people this morning to say that inflation right now is still ‘all about rents,’ and dismiss the 40% of the consumption basket that ensures people don’t get wet when it rains. What’s funny about that is that a few months ago, economists were pointing to rents as being the main reason to be optimistic about inflation because it would soon be in deflation! Remember?

Rents are decelerating y/y, but they’re not even decelerating as fast as I thought they would (and I was on the side of ‘they’ll go down a lot slower than you think, and not as far’).

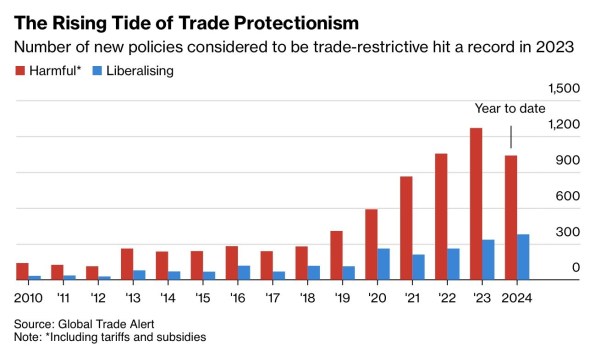

The optimist here will say that the part we don’t have a long lead time to forecast – core goods and to some extent core services ex-rents – are looking good and ‘we know’ that rents will get better so ring the bell, the Fed’s job is basically done. That would be valid, if there was reason to think that core goods would continue to contribute the deflation that we have seen recently while rents continue to decelerate. But rents are sticky, and goods are not. To that point, consider the story of Wal-Mart (NYSE:), which announced last week that they will be replacing paper shelf labels with electronic labels over the next couple of years. You don’t do that to make it easier to lower prices. Typically, sellers try to raise prices quickly and lower them slowly. If you think goods prices are going to go back to the old regime of basically flat, with a small downward tilt, you’d keep using a slow pricing gun.

On the goods side, we also have to deal with the rising tide of global protectionism over the last few years (see picture, source Global Trade Alert), and the mass immigration to the US which puts pressure on demand long before the new source of labor contributes to supply (as with: housing). So far, a dollar which has generally risen over the last decade has helped to blunt those effects. But that won’t be the case forever.

The bottom line is that while this is a good CPI report – in some ways, one of the best reports we have had in some time – it is not an unvarnished positive. The failure of rents to decelerate according to plan, and the stickiness of wages so far at a fairly high level, is the underlying story. Goods and airfares are what painted the pretty picture this month. But if the picture keeps getting pretty over the balance of this year, it will be using paints from a different palette. I continue to expect housing costs to decelerate some (before re-accelerating), but I am not sanguine that goods and airfares will continue to drop at the pace which made today’s report so pleasant. Indeed, I expect that next month some of these categories will likely have some give-back so unless rents start to drop faster we could have a surprise in the other direction.

Naturally, as I always admonish, it is wise to not make major investing decisions based on one data point. One month’s figure should never cause you to change your medium-term forecast, unless it represents an accumulation of data that causes you to reject your prior hypothesis. This data point does not do that, since after all it is really the first really positive data point we have had in a while. I continue to expect median inflation to settle in the high 3s, low 4s. And as I said in our Quarterly, and in the podcast recently, I think that while the FOMC has no real reason to ease they likely will lower rates a token amount, at least once over the next few months prior to the Presidential election.