- All eyes are on the US CPI report today.

- Lower-than-expected numbers could boost stocks and weaken the dollar, while a surprise surge could trigger a correction.

- We will also take a look at what JPMorgan is predicting for the markets based on the data.

- Unlock AI-powered Stock Picks for Under $8/Month: Summer Sale Starts Now!

Today’s release marks a pivotal day in the economic calendar this month, rivaled only by the upcoming on July 31.

While Chairman Powell’s stance is well understood — signaling no imminent rate moves and a data-driven approach with gradual progress yet insufficient for a cut — all eyes are on today’s inflation data.

Expected today are monthly estimates showing a modest uptick to 0.1% from the previous 0.0 percent, alongside a stable month-over-month . The annual CPI is anticipated to show a decline.

However, despite hopes for a decrease, recent trends suggest maintaining this downtrend can be challenging.

JP Morgan on How Markets Could React

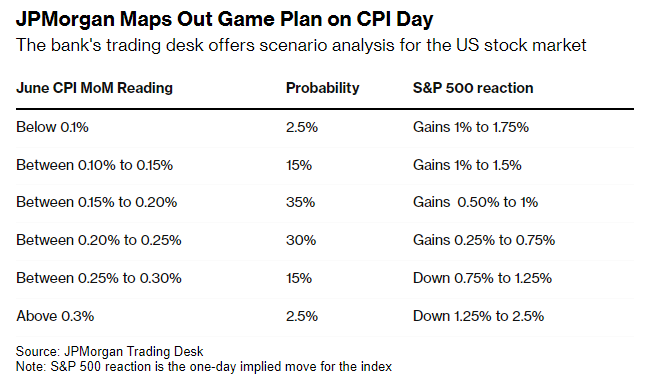

JPMorgan has forecast potential market impacts based on the inflation data:

Here’s how a potential market reaction could play out based on recent trends:

Lower-Than-Expected Inflation:

- Equity markets rise.

- Bond yields decrease.

- Small-cap stocks outperform large-cap stocks.

- Weaker against the .

Higher-Than-Expected Inflation:

The opposite effects of the above scenario would likely occur.

The Bottom Line

Today’s inflation data release has the potential to significantly influence market movements. Investors should closely monitor the figures and adjust their strategies accordingly.

***

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $8 a month!

Tired of watching the big players rake in profits while you’re left on the sidelines?

InvestingPro’s revolutionary AI tool, ProPicks, puts the power of Wall Street’s secret weapon – AI-powered stock selection – at YOUR fingertips!

Don’t miss this limited-time offer.

Subscribe to InvestingPro today and take your investing game to the next level!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.