Ratana21/iStock via Getty Images

Thesis Summary

Apple Inc. (NASDAQ:AAPL) stock rallied following a strong fiscal Q2 in services and the announcement of the largest stock buyback in history.

And yet, the stock is still underperforming its Magnificent peers, and concerns over the company’s iPhone sales are mounting.

Nonetheless, I think Apple’s potential, as shown in the latest earnings, lies in a lot more than phones, and I expect its services to become their main focus and source of growth over the coming years.

CEO Tim Cook could follow Tesla, Inc. (TSLA) CEO Elon Musk’s playbook and attempt to rebrand Apple as something other than a phone company.

I see a ton of potential in Apple Pay, Cloud, and Apple TV.

Apple can now sell itself as more than a phone company. Perhaps a budding Fintech or even a powerhouse in the Entertainment and Information market.

There’s so much more Apple can do to leverage its assets.

Apple Q2 Overview

In my last Apple article, which followed a sell-off associated with increased regulatory pressures, I highlighted this as a great opportunity in the face of the AI revolution.

Today, I reiterate my Buy rating, given the fact that the stock price is now at a similar level, and in the face of the new information presented in this latest quarter.

I am excited about the potential for the business services, and propose here that the company should double down on this “transition.”

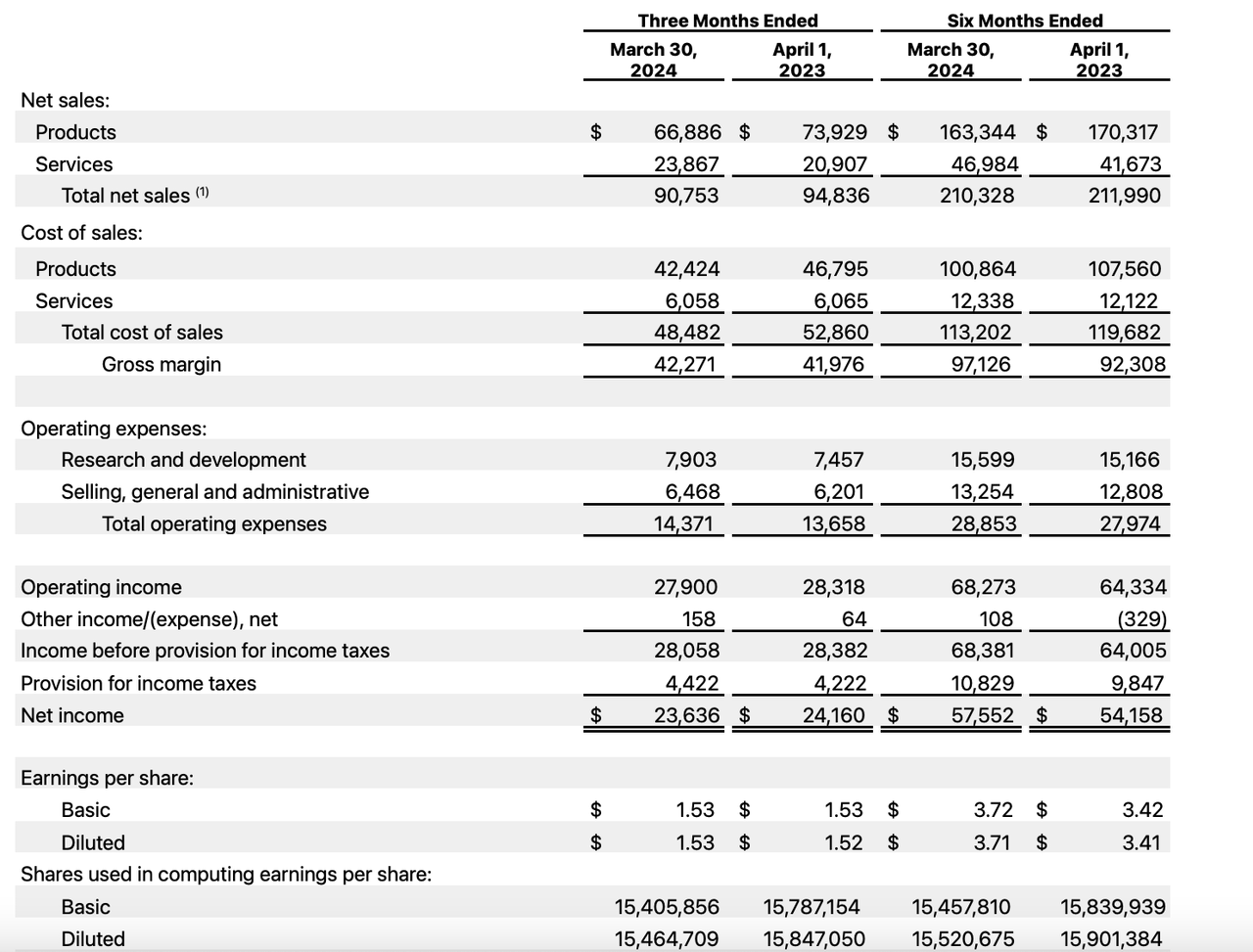

Apple’s Q2 was overall quite well received by investors. Let’s begin by looking at the income statement:

As we can see, product sales came down QoQ, but there’s definitely an element of seasonality at play here. YoY, sales were actually up by around 2%.

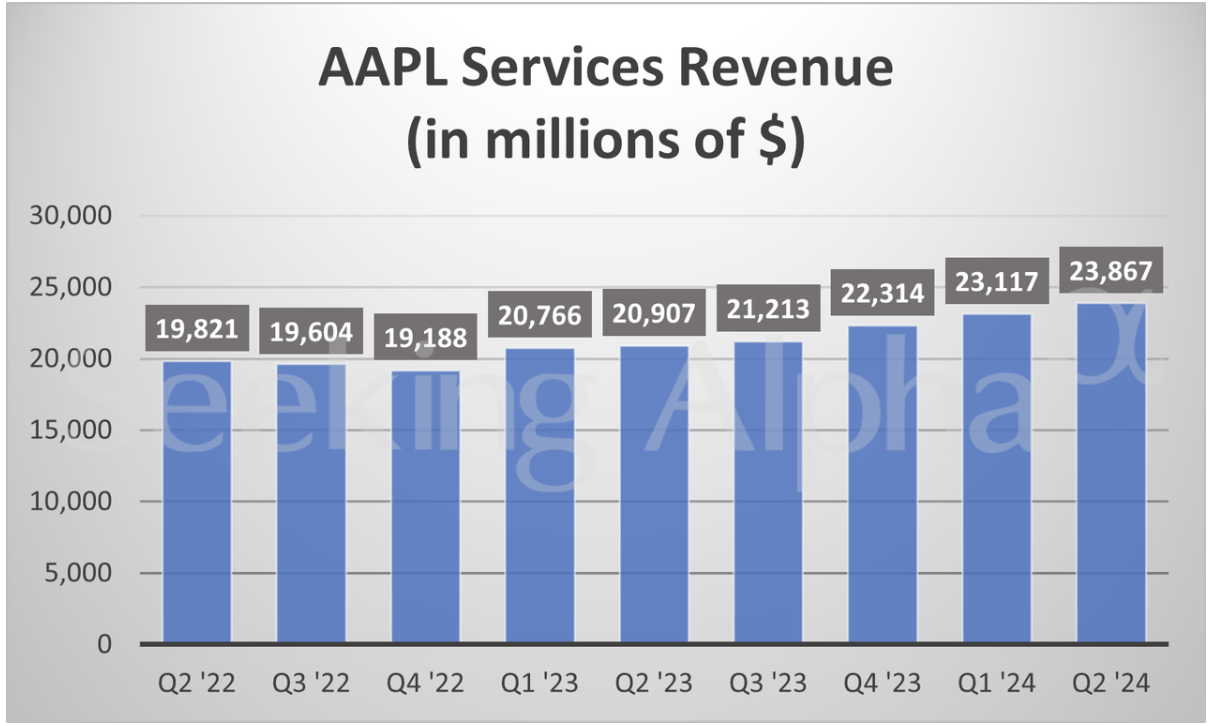

On the other hand, Service revenue was up sequentially and also YoY. This was the most positive highlight of the quarter.

AAPL revenues (SA)

Service revenue has been steadily climbing since Q4 of 2022 and has grown almost 15% in the last year.

EPS came in at $1.53, same as last quarter, but higher over the last six months.

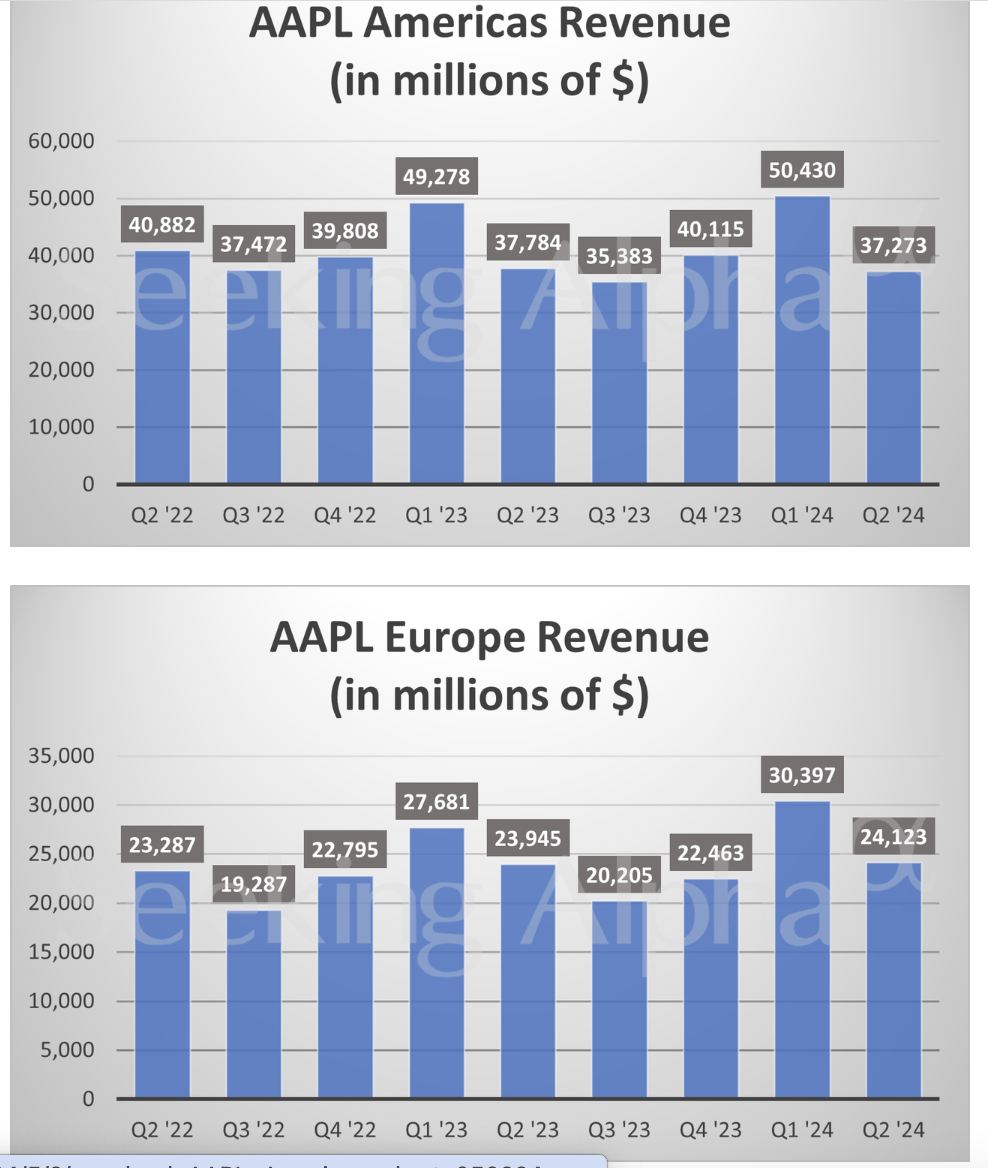

It’s also very interesting to look at the geographical breakdown.

AAPL US and Europe revenues (SA)

In America, revenues are actually down slightly YoY, while European revenues grew slightly compared to Q2 of 2023.

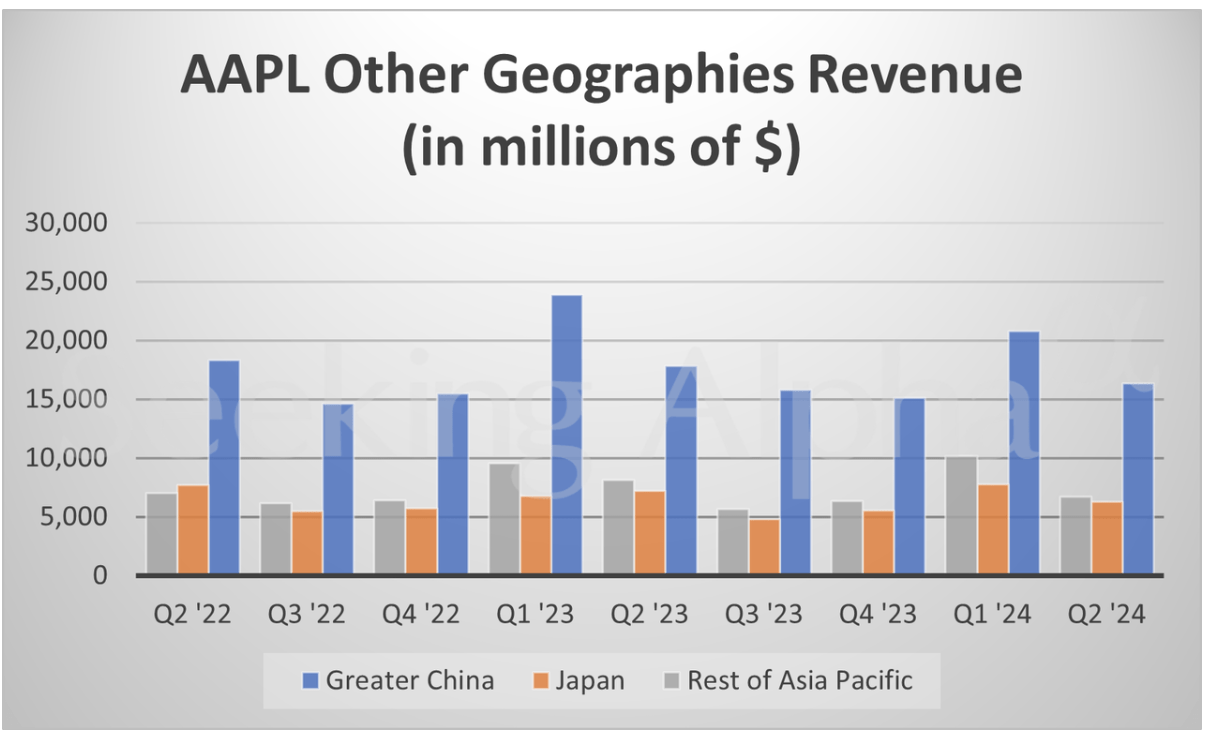

AAPL Other geographies (SA)

And while Apple is still growing well in Asia Pacific and Japan, revenues from China have been falling significantly in the last year, which is definitely something on investors’ minds.

But perhaps the most pleasing news was the dividend hike and upcoming buyback program. Apple declared a dividend of $0.25 per share, an increase of 4%, and a potential buyback of $110 billion in the coming year.

Overall, I feel the key takeaways from the earnings call were as follows:

-

iPhone revenues are stagnating; how bad could this get?

-

Service revenues are on the rise; how much can Apple benefit from this?

-

China sales are really struggling; will this trend continue?

-

Huge buyback; Is this a good use of cash?

Apple: More Than A Phone Company

It’s clear that growth in the hardware segment will be tough to maintain in the long term. Sales in this department were down across the board. Macs are the only category that is up YoY.

But even though there’s a limit to how many products the company can sell, there’s still a lot of room for growth in terms of offering their devoted customers more services.

Apple is more than a phone company. It is also a potential fintech play, a large media conglomerate, and a cloud provider.

Apple The Bank

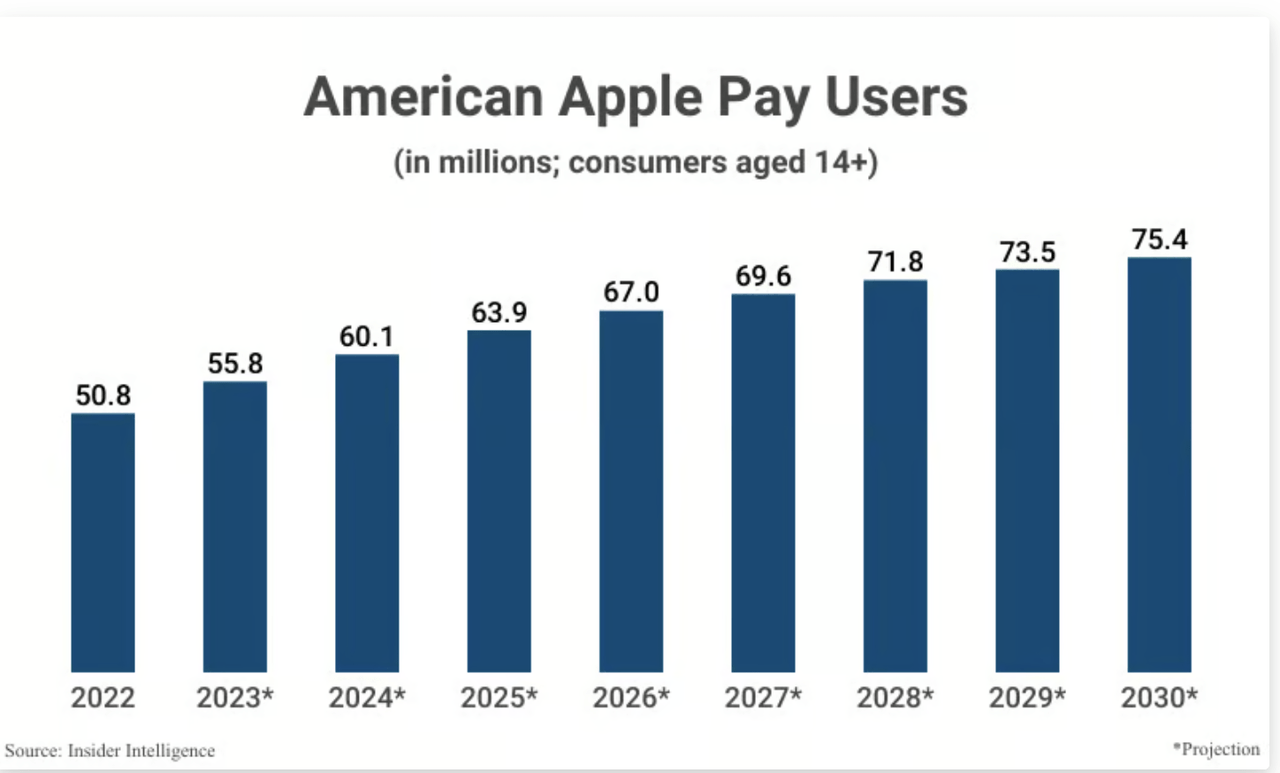

Apple Pay is a highly dominant digital payment processor in the U.S., and continues to grow at a fast pace. According to this data, it held a 92% share of the U.S. digital banking industry in 2022, processing close to $6 trillion in transactions.

Apple Pay Users (Insider Intelligence)

In 2022, Apple Pay produced a revenue of $1.9 billion, and Apple Pay’s 2023 revenue is expected to double to $4 billion. Apple charges financial institutions a fee for transactions, but it stands to do a lot more in the future.

For example, last year Apple began offering a high yield saving account, in collaboration with The Goldman Sachs Group, Inc. (GS).

A smartphone is all people need to begin banking, and being the largest smartphone producer by volume, Apple stands as a potential gatekeeper.

Apple The Cloud Provider

Apple’s iCloud has also been contributing more and more to service revenues:

There are some categories that are growing very fast also because they are relatively smaller in the scheme of our services business like cloud, video, payment services. You know, those all set all-time revenue records.

Source: Earnings Call.

It’s difficult to know exactly how much the company makes from this, as Apple does not provide an actual breakdown of its service revenues.

According to Grand View Research, cloud computing will grow at a CAGR of 14.1%, reaching over $1.5 trillion market cap by then.

Apple TV

And of course, we have Apple TV and Music. All things said, Apple now boasts over 1 billion users across services, and while it is true that creating content can be costly, there’s no doubt that this is also a growing segment.

Apple TV is often bundled in with varying services like Apple Music and Apple Fitness and while by itself it could be detrimental to the bottom line, I think with everything else, it adds enough value so that Apple users and prospective Apple clients can be enticed.

The global video streaming market size was valued at $ 554.33 billion in 2023 & is projected to grow from $ 671.89 billion in 2024 to $ 2,486.51 billion by 2032

Source: Fortune Business Insights.

Like with cloud, this is a market growing at a healthy pace.

Restoring Investor Confidence

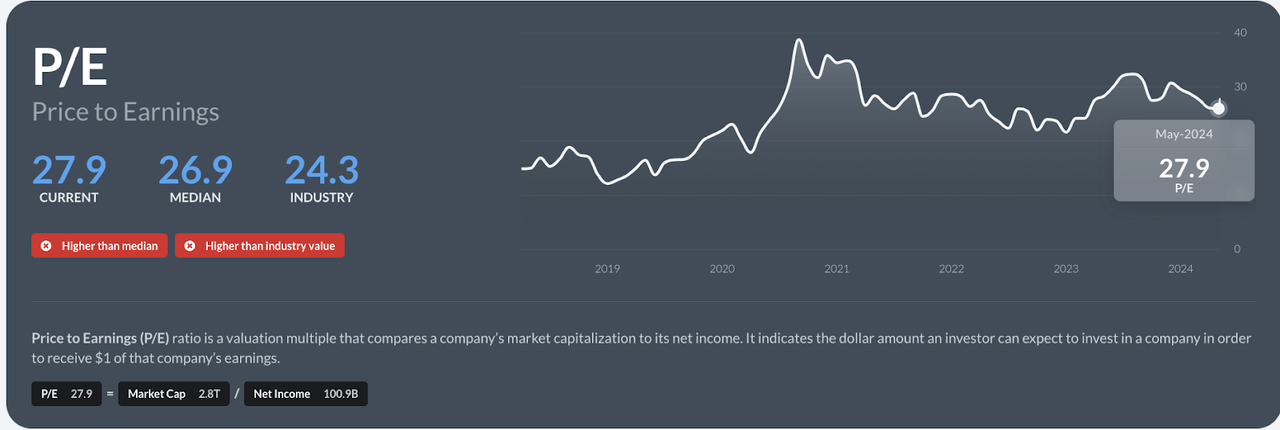

Similarly to Tesla, Apple has fallen out of favor with investors over the last year. Both in terms of stock price and P/E, Apple has been slipping, showing the lack of investor confidence in the stock.

Tesla’s stock, which had also been slipping, managed to stage a convincing rally after their latest earnings call, where Musk emphasized the company’s transition to AI and robotics.

While I am skeptical about how successful this can be, it has certainly helped the stock, and is in the right position to do this. Apple’s services are growing at a fast pace, and already represent close to over 20% of revenues.

In my opinion, Apple can really benefit from pushing forward the narrative that it is more than a phone company, showing investors exactly how it is going to take its services to the next level.

In fact, Apple, like Tesla, is also working on its own version of a personal robot, according to Bloomberg.

While this is simply a fun fact at this point, it serves to make the point that Apple can still leverage its brand and audience in so many new ways.

iPhones are just the beginning.

Risks

Undoubtedly, though, China poses a huge risk to Apple as geopolitical tensions rise. This is not merely speculation, as we can also see how sales in the region have fallen.

China represented almost 20% of Apple’s sales last year and has fallen substantially. At the start of the year, shipments fell by around 30%. In this latest quarter, sales fell by 19%

Unfortunately, this is a trend that is likely to continue and poses a significant challenge to the company.

Final Thoughts

In conclusion, while Apple Inc. stock is still richly valued, I still think it is reasonably attractive at these levels. The fortress balance sheet, upcoming buybacks, and potential of its service business are enticing enough for me to buy.