Alex Wong

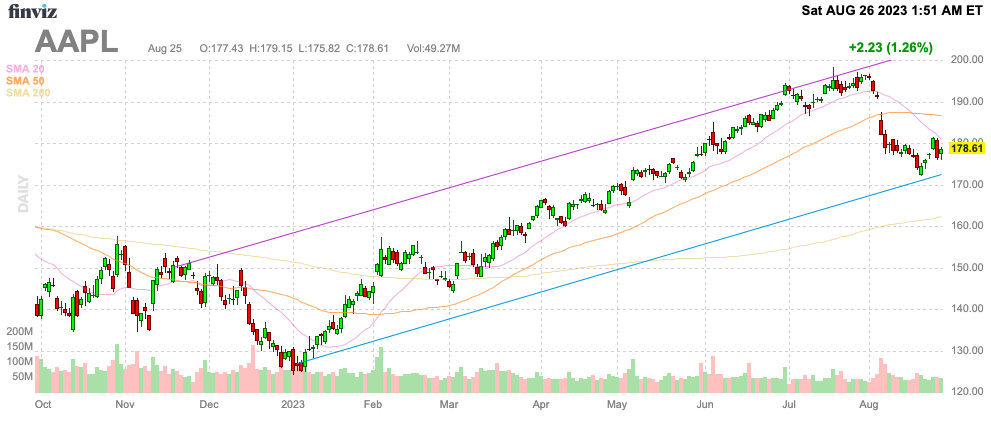

Warren Buffett is set to turn 93 on August 30. The billionaire investor has had an incredible investment life, but young investors shouldn’t follow Buffett into Apple (NASDAQ:AAPL). His investment firm Berkshire Hathaway (BRK.B, BRK.A) doesn’t invest the way that made him wealthy. My investment thesis remains Bearish on Apple despite the stock falling from the recent all-time highs.

Source: Finviz

Momentum Trader Now

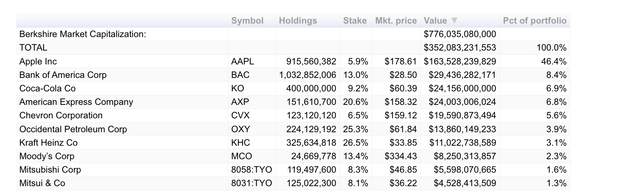

The biggest question with the Berkshire Hathaway investments are whether Warren Buffett is even making the decisions anymore. The investment guru long avoided investments in tech stocks due to not understanding the companies, but now nearly 50% of the portfolio is invested in just one company – Apple.

According to the current Berkshire Hathaway portfolio, about 50% of the market cap is invested in public companies. Currently, 46% of the public investments are in Apple with a current market value of $164 billion.

The next largest investment is Bank of America (BAC) at only $29 billion. While Buffett has long warned against diworsification (a concept of buying additional stocks to diversify a portfolio), a whole public portfolio focused almost entirely on a tech company doesn’t fit with the thesis that made him possibly the most successful investor in history.

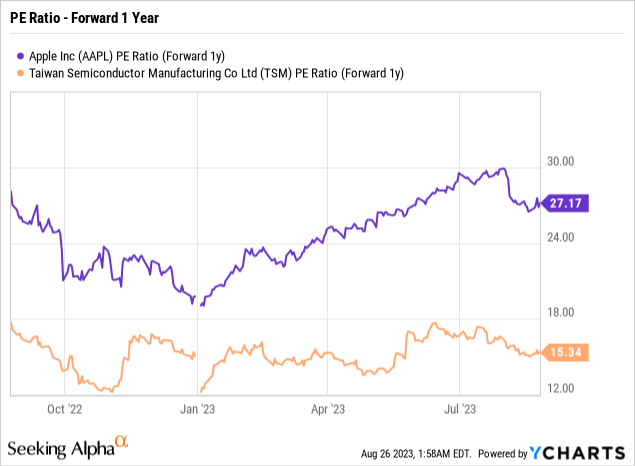

A prime example of the befuddlement surrounding the current Berkshire investments is the dumping of TSMC (TSM) due to geopolitical risk surrounding China’s aspiration to take over Taiwan. While TSMC faces extra risk, Apple is probably a bigger issue trading at nearly double the forward P/E multiple while having a larger reliance on China, including TSMC for chip production.

According to a Morgan Stanley report, Apple is still at least 90% reliant on China for production, especially the iPhone. The tech giant continues pushing iPhone production into India, but China can’t be replaced that easily.

Berkshire even ended Q2 with a cash balance of $147 billion, yet the investment firm sold out of a small position in TSMC, mostly back in Q4. The firm had plenty of cash and TSMC is a much better valued compared to Apple. In addition, the company works with Nvidia (NVDA) to manufacture and package the complex AI GPU chips leading to substantial growth opportunities in the years ahead. If anything, TSMC appears more poised to take advantage of the AI demand growth compared to Apple and the stock is far cheaper.

If anything, Buffett appears attracted to the safety trade of Apple similar to a Clorox (CLX) or Procter & Gamble (PG). Both of these stocks vastly underperformed the market in the last decade due to the expensive valuation multiples primarily because investors view the overpriced stocks as safety trades.

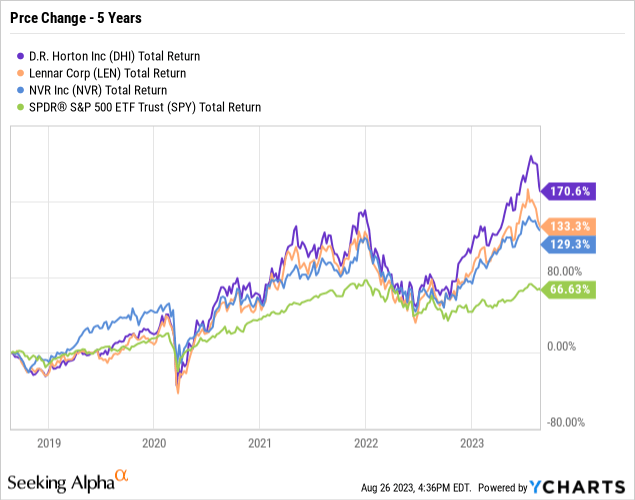

Another example of the momentum trading switch in the Berkshire portfolio is the addition of the homebuilders during Q2. Buffett bought D.R. Horton (DHI) NVR (NVR) and Lennar (LEN) during Q2 after the stocks had already seen massive gains in the prior years, especially in comparison to the S&P 500.

In essence, Buffett is piling into the expensive stocks that have worked the last few years and selling the stock deemed too risky. When blood is in the street, Buffett is now selling stocks and loading up on the overpriced stock with no growth.

Expectations Are Too High

After a year of cutting expectations, analysts now forecast Apple will produce sales growth in the 6% to 8% range over the next 3 years. The numbers appear very aggressive for a company with a target of topping $400 billion in FY24 sales requiring the tech giant to add nearly $30 billion worth of additional sales annually.

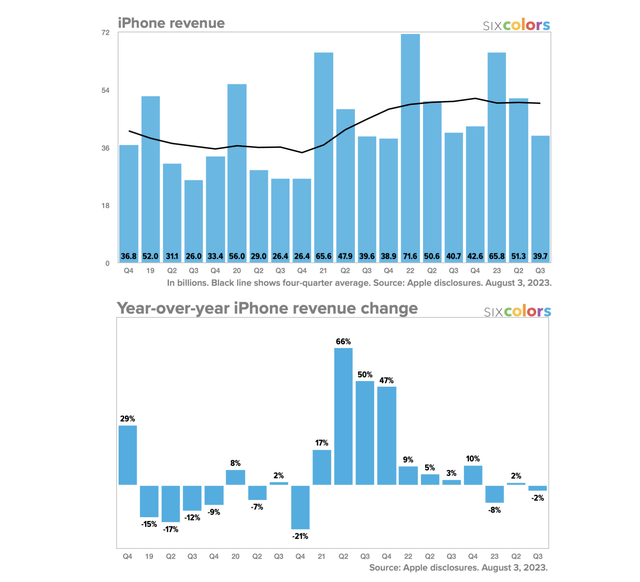

A prime example of the issue facing Apple is that iPhone revenue growth has clearly stalled. The peak quarterly revenue occurred all the way back in FQ1’22 when the company got a 5G boost and the final Covid rush.

Apple went into Covid with iPhone sales declining and the amounts have been very weak following the Covid boost in FY21. In addition, the Covid boost was mostly focused on non-holiday periods with the holiday sales in FQ1’21 matching the recent FQ1’23 sales level.

Some of the issues producing the iPhone 15 screens this Fall could lead to weak sales again. The iPhone 15 Pro Max is apparently having problems with yields due to the periscope lens and other issues could reduce production of all the various models, including the 48-megapixel cameras.

The issue isn’t that Apple is likely to report a disastrous holiday quarter, the problem is that the tech giant doesn’t appear poised to reach nearly 6% growth in the December quarter. The company needs to produce even faster growth to justify the current stock price. Without fast growth, the stock will spend years underperforming the market like Clorox and P&G the last decade.

Takeaway

The key investor takeaway is that investors shouldn’t be following Warren Buffett into Apple near the all-time highs. Investors should only buy Apple if the valuation makes sense. The stock still trading at 27x FY24 EPS targets that actually appear aggressive is a spot where the stock has any appeal to investors.