udra

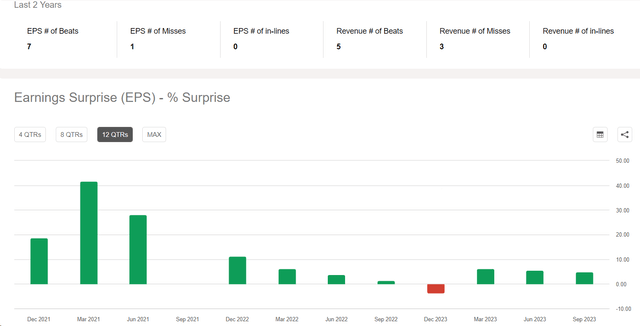

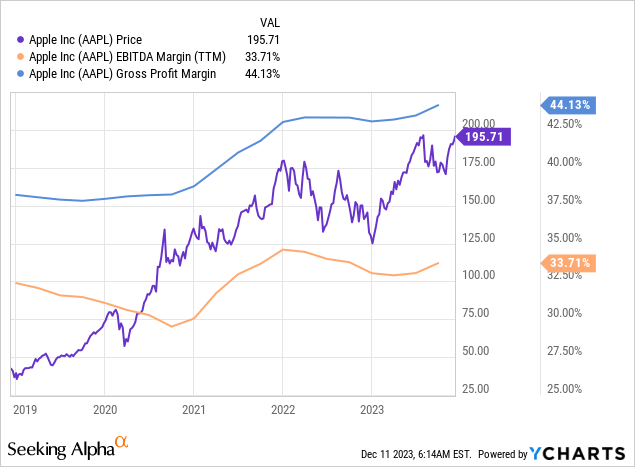

This is not the first year I have been writing about Apple Inc. (NASDAQ:AAPL) stock here on Seeking Alpha and my timing was completely wrong, although it still seems perfectly logical to me today: inflated multiples against a backdrop of declining operating growth and the emergence of new CapEx (the partial relocation of production from China), should have led to a significant drop in AAPL’s share price. That didn’t happen – to my surprise, the fastest monetary tightening in Fed history hasn’t had time to impact consumer demand, allowing Apple and other tech companies to easily outperform analyst expectations in recent quarters:

The stock has significantly outperformed the S&P 500 Index (SPX) (SP500) (SPY) since my last ‘Sell’ rating, but I remain skeptical that AAPL’s current rally is sustainable.

Why Do I Think So?

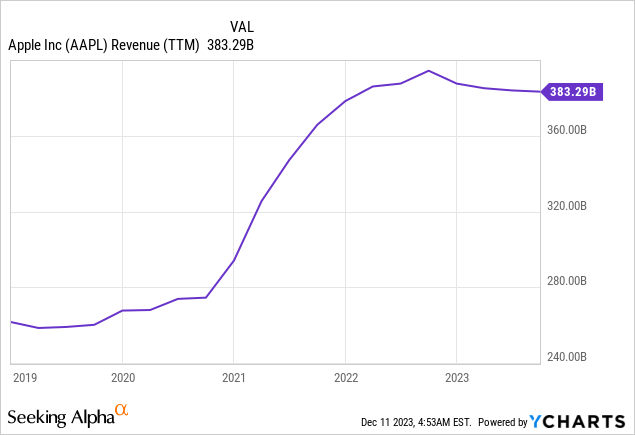

Apple’s fiscal Q4 FY2023 performance reflects a nuanced financial landscape. Revenue stood at $89.5 billion, a marginal 1% dip YoY but a notable 9% uptick from the preceding quarter, exceeding the predicted $89.3 billion. AAPL extended a four-quarter streak of annual revenue contraction, with the initial decline observed in 1Q FY2023.

GAAP earnings per diluted share demonstrated a robust 14% YoY surge, reaching $1.46, surpassing the consensus estimate of $1.39.

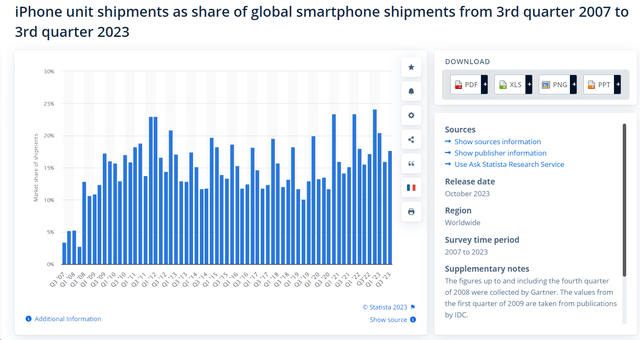

The iPhone segment exhibited resilience, generating $43.8 billion in revenue, marking a new high for September-quarters. Shipping ~53.6 million units in fiscal Q4, Apple’s market share expanded to 17.7% in the global smartphone arena, up from 17.2% the previous year. Strategic maneuvers, including broadening the gap between iPhone 15 models, contributed to this success.

Product revenue, constituting 75% of the total, totaled $67.2 billion, showcasing a 5% YoY drop in GAAP but an 11% sequential surge. Simultaneously, Services reached a pinnacle at $22.3 billion, constituting 25% of the total and reflecting a robust 16% YoY increase. Apple’s active installed base set a new record, fostering growth in the services sector. Emerging markets, experiencing double-digit percentage growth in local currencies, played a pivotal role in revenue resilience, according to the company’s earnings call.

The Mac segment, however, faced headwinds, witnessing a 34% YoY drop in GAAP revenue to $7.6 billion, amid a global downturn in PC demand. Mac’s market share slid from 12.7% to 10.6% in calendar Q3 2023. In contrast, iPad revenue reached $6.4 billion, marking a 10% YoY contraction but an 11% sequential expansion. Revenue from Wearables, Home, and Accessories amounted to $9.3 billion, demonstrating a 3% YoY decline.

As of fiscal 2023’s conclusion, cash and short- and long-term investments stood at $162.1 billion, reflecting a decrease from $169.1 billion in fiscal 2022 and $196.3 billion in fiscal 2021. Conversely, debt reduced to $114.4 billion in fiscal 2023, down from $120.1 billion in fiscal 2022. Notably, Apple’s fiscal 2023 cash flow from operations reached $110.5 billion, showcasing sustained financial prowess.

CEO Tim Cook emphasized Apple’s global outreach, citing record revenue in India and robust sales in various countries. On a net basis for the December quarter, Apple expects revenue to be little changed year-over-year, despite fiscal 1Q FY2023 being a 14-week quarter and 1Q FY2024 being a 13-week quarter.

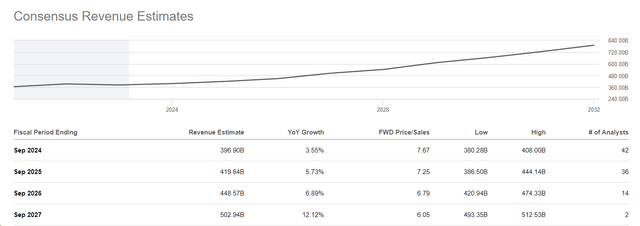

So far this year and last year, Apple has had no problems with demand, but it seems to me that the slowdown in sales growth will most likely carry over to next year – this should go against analysts’ consensus expectations:

Despite inflation moderating and the Federal Reserve signaling a pause, economic growth is cooling. According to Saira Malik [Naveen CIO], the recent jobs data, featuring a lower-than-expected unemployment rate of 3.7% and positive non-farm payrolls at 199,000 in November, supports a cautiously optimistic view. However, Malik expresses concerns about the consumer in 2024, noting rising auto and credit card delinquencies, a pullback in restaurant spending, and a potential impact on the economy driven by consumer behavior.

To be honest, I don’t see any catalysts for an increase in demand for electronic goods in 2024 either. Apple will most likely be in a period of margin contraction again despite the decline in inflation – historically this leads to a decline in the company’s shares unless there is almost free money and unprecedentedly generous stimulus measures like in the post-COVID period, which is unlikely to be the case anymore.

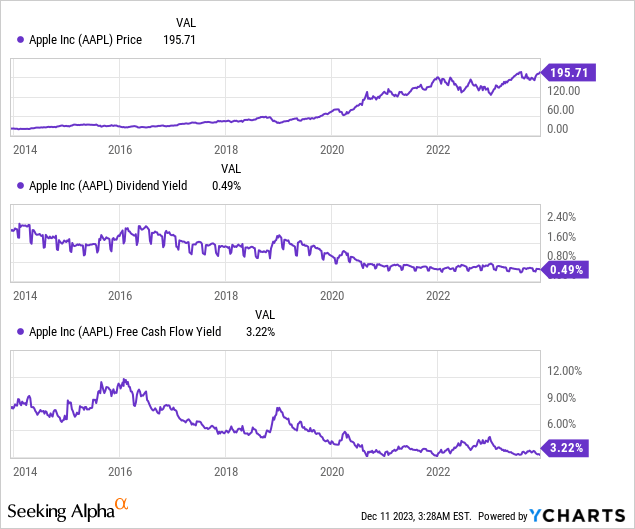

Despite an anticipated 8% dividend hike, Apple raised its quarterly dividend by 4% to $0.24 per share in April 2023, contributing to its ongoing dividend growth trajectory.

However, Apple’s most important instrument for shareholder returns continues to be buybacks, which the company carried out in the fourth quarter of the 2023 financial year in the amount of $15.5 billion. However, against the backdrop of the ongoing decline in sales, these buybacks will no longer be effective, as the “total shareholder return of 2.5% (which I calculated by dividing the sum of dividends and buybacks for one year by market capitalization) looks too modest from the point of view of the company’s “weight”. The FCF yield says the same thing – AAPL is too expensive a company for the return it can offer investors.

Please note – I’m not even talking about P/E, EV/EBITDA, or P/S, which of course look very high in the case of AAPL stock. It’s just that investors are trying to justify the high valuation multiples by saying that the buybacks are saving the day, but I want you to see clearly that that’s not entirely true.

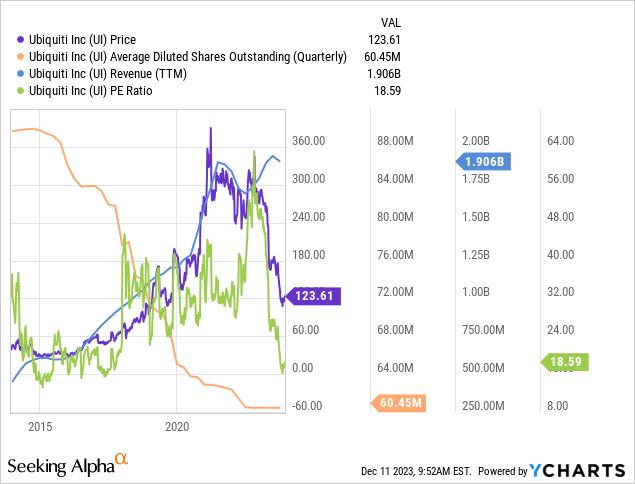

There are many examples of stock buybacks not saving the market, but for some reason, the first one that comes to mind is Ubiquiti Inc (UI). I’m not comparing AAPL and UI operationally at all, but rather using UI as an example of how the company’s valuation is contracting rapidly due to shrinking margins despite increasing sales and ongoing buybacks.

The Verdict

AAPL’s margins already look near all-time highs in a historical context, while the slowdown in demand that should have occurred in the second half of 2023 due to a decline in excess ‘COVID savings’ and as a result of tight monetary policy is still to come, in my view. But the market is pricing things in as if all these negative developments won’t happen at all, which sounds illogical (at least to me).

Apple is a great company that has earned its place as the most valuable company in corporate America (and the world as a whole). But everything has a price. AAPL stock doesn’t just look expensive from a traditional valuation metrics perspective, which could be explained by the high shareholder yield (buybacks + dividends). The stock is also overvalued in terms of the overall return that investors receive if they buy AAPL at the current price levels because instead of 2.5%, you can still get around twice that from treasury bonds today.

There are upside risks to my thesis, because if demand remains at the same level as today, Apple could more easily weather a difficult time for itself, and analysts’ expectations for FY2024 and beyond may even prove too pessimistic in their current form.

Nevertheless, I still see more risks than benefits for Apple’s share price in the medium term, even though I like the company as a long-term investment.

I confirm my previous rating of “Sell”.

Thanks for reading!