Justin Sullivan/Getty Images News

The last few days have been full of various events and news that in one way or another have affected Apple Inc. (NASDAQ:AAPL) stock, about which I regularly update my view here on Seeking Alpha.

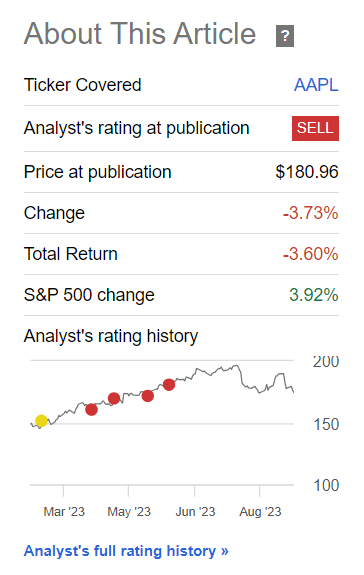

Since I turned bearish in April of this year, the stock has risen much more than I expected but has underperformed the broader market somewhat. However, after my last sell thesis, the stock began to significantly underperform the market, and there are some reasons for this that I believe will prevail for the foreseeable future.

Seeking Alpha, AAPL, author’s coverage

Why Do I Think So?

First off, a few words on the newly 4 featured models, which are all available for pre-order on September 15 and shipping on September 22. Key features across the models include upgraded Apple silicon, USB-C connectors, improved camera technology, and the introduction of Dynamic Island. The iPhone 15 and 15 Plus start at $799 and $899, respectively, offering hardware upgrades like the A16 Bionic chip, USB-C connectors, and enhanced cameras. The iPhone 15 Pro and Pro Max, starting at $999 and $1,199, boast the A17 Pro chip, USB-C connectors, titanium frames, an Action button, periscope lenses, and new color options.

Goldman Sachs [September 12, 2023 – proprietary source]![Goldman Sachs [September 12, 2023 - proprietary source]](https://static.seekingalpha.com/uploads/2023/9/14/49513514-16946681784226394.png)

Despite the abundance of new features mentioned above, Apple has decided not to raise the prices in its product line again, which came as a bit of a surprise to Goldman Sachs analysts.

Goldman Sachs [September 12, 2023 – proprietary source], author’s notes![Goldman Sachs [September 12, 2023 - proprietary source], author's notes](https://static.seekingalpha.com/uploads/2023/9/14/49513514-16946685349115763.png)

It is unlikely that this was a gesture of goodwill to customers on Apple’s part (I mean the pricing decision) – I assume that if the company had the opportunity to raise prices, it would gladly do so. Here, the question is different: In recent years, we have seen inflation that is quite high for the Western world, which in theory should be reflected in the selling prices of manufactured goods like the iPhones – so why doesn’t theory collide with practice? As I’ve written many times before, consumer spending is currently under threat for a variety of reasons, so companies are trying their best to contain interest in their brand until better times come.

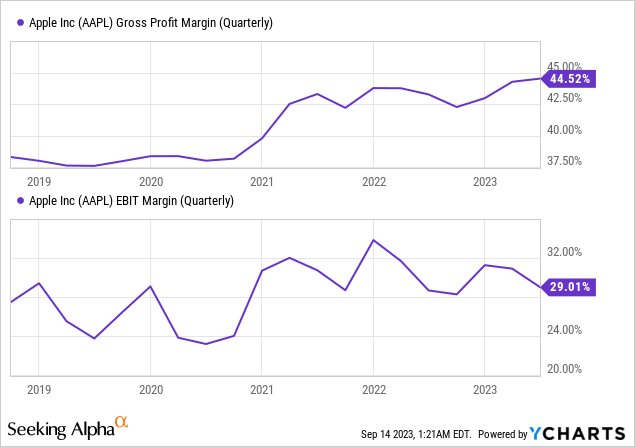

This approach has come at a cost: Apple has managed to maintain its gross profit margin thanks to more efficient monetization of non-iPhone segments, but its EBIT margin is falling quarter by quarter, and something tells me it will return to pre-Covid levels much faster than it might seem.

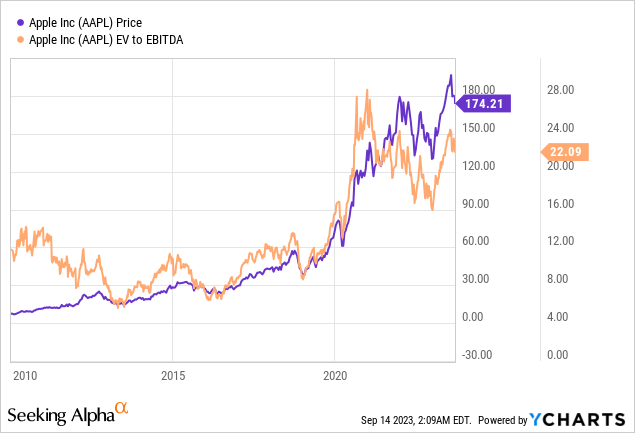

In my opinion, the historically high margin has helped Apple stock maintain its re-rated EV/EBITDA multiple, which has risen from 8-12x pre-Covid to the current 22x.

The re-rated multiple could be justified if the margin were sustainable at current levels. But that’s not what it looks like. Without price increases for products in what remains its most important business segment, wage increases, and inflation in other key operating costs, and the relocation of production capacity, I believe Apple’s margins will be hard to sustain in the new year.

The overly high current valuation of Apple stock ignores some risks that are worth mentioning. In trying to reduce its dependence on China and move production to locations with similarly low labor costs, Apple has likely angered the Communist Party. Just hours after the announcement of the 15th iPhone came news that China was extending a ban on the use of iPhones in sensitive departments:

China plans to expand a ban on the use of iPhones to a plethora of state-backed companies and agencies, Bloomberg News has reported, a sign of growing challenges for Apple in its biggest foreign market and global production base. Several agencies have begun instructing staff not to bring their iPhones to work.

Source: Time.com

By itself, this news means nothing, but in my opinion, it can be used as a signal of sorts as to what risk investors should take a closer look at before buying AAPL at its current price level. What will happen to the company’s growth and margins if CCP decides to impose new restrictions on the company’s largest foreign market?

I am also puzzled by how positively the market views the company’s foreseeable future. For me personally, it’s obvious: It will be difficult for Apple to grow its revenue in 2024 without raising prices. But Wall Street appears to be hoping for the best and forecasting relatively good business growth in 2024 and 2025:

Seeking Alpha, AAPL Goldman Sachs [September 12, 2023 – proprietary source]

![Goldman Sachs [September 12, 2023 - proprietary source]](https://static.seekingalpha.com/uploads/2023/9/14/49513514-16946758460817258.png)

According to Seeking Alpha Premium data, EPS estimates have been revised upward 76% of the time in the last 3 months (25 out of 33 times). At the same time, it is becoming increasingly difficult for AAPL to exceed the high forecasts:

The risk that we will see a repeat of 2012 in the near future (as in the chart above) is, in my opinion, growing more and more against the backdrop of existing optimism.

Concluding Thoughts

I don’t consider myself part of the “Armageddon-waiting” sect who are just waiting for the market to fall like a rock. Like most of you, I always want to be in the bull market and sleep peacefully knowing my assets are safe. But unfortunately, the reality is that this isn’t always observable.

I don’t think AAPL will stay in a bull market, although I continue to believe in the long-term success of its business model, which is based on a strong brand, efficient supply chains, and all the things that attract investors like Warren Buffett.

Right now, Apple Inc. stock is quite expensive with a bunch of internal and external risks that I don’t think the market is pricing appropriately. Too much optimism around the company causes me to remain on the sidelines for the time being – especially given the weak consumers today.

Therefore, I reiterate my tactical sell recommendation on AAPL.

Thanks for reading!