Lobro78

Investment thesis

Global tech market demand continued to recover. In Q2 2024, Apple Inc. (NASDAQ:AAPL) sold 48.7 million smartphones (-16% YoY), while the total smartphone market grew by 10% YoY to 296 million units. Apple’s share of the smartphone market decreased to 16%, down 5 by p.p. YoY, while the share of Chinese competitors Xiaomi and Transsion increased significantly.

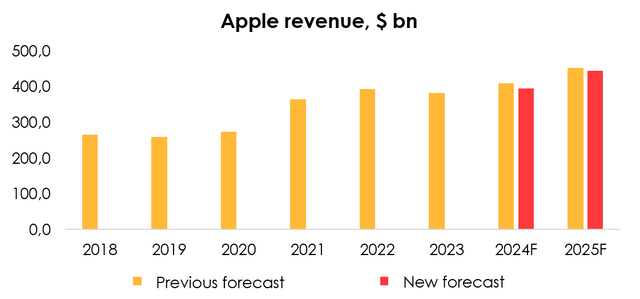

Due to rather weak sales in the smartphone and tablet markets, partially offset by solid financial results in the Mac and services segments, we expect Apple’s revenue to grow 3% YoY in 2024 and 12% YoY in 2025, resulting in $395.6 bn and $444.7 bn, respectively.

We haven’t published an analysis on this stock for almost a year now (here’s our previous article, our SELL rating was mainly based on weak iPhone, iPad and Mac sales, and we were right at the time), but we have been covering it for all this time and based on multiple methods we forecast the fair value of $171. Our rating remains a SELL, as we believe the stock is now trading above its fair value.

Smartphone market

The global smartphone market ended a string of quarterly declines last quarter that lasted for 7 consecutive quarters. Total smartphone shipments in Q1 2024 (Q2 2024 for Apple) grew 10% YoY.

Canalys

Total smartphone sales in Q1 2024 amounted to 296.2 million units. Apple’s sales totaled 48.7 million smartphones (-16% YoY) and Apple’s smartphone market share declined to 16% vs. 21% in Q1 2023 (Q2 2023 for Apple).

Developing countries in Asia, Latin America, Africa, and the Middle East remain the main drivers of smartphone market growth. Physical volume growth in Q1 2024 ranges from +16% to +27% YoY. Meanwhile, in terms of money, the US, China, and Europe are the major markets for Apple. In the US, sales declined by 6% YoY, in Europe, sales grew by 6%, and in China, sales increased by 1%.

Despite the market recovery, Apple and Samsung being luxury smartphone makers are losing market share as developed countries are their key customers. Inside China, Xiaomi was able to regain market share to 14% (+3 p.p. YoY) after the suspension of factories, while the main beneficiary of physical sales growth in developing countries is the Chinese brand Transsion, which was able to increase total sales by 86% YoY and market share to 10% (+4 p.p. YoY).

We maintain our forecast for total smartphone shipments in 2024-2025, but we have revised downwards Apple’s forecast share from 20.4% to 19% for 2024 and from 20.6% to 19.3% for 2025. The decline in physical sales volumes is partially offset by stronger growth in average tickets.

As a result, we have reduced our 2024 iPhone segment revenue forecast from $210.5 billion (+5% YoY) to $203.6 billion (+1% YoY) and 2025 revenue forecast from $224.6 billion (+7% YoY) to $223 billion (+10% YoY).

Other business areas of Apple

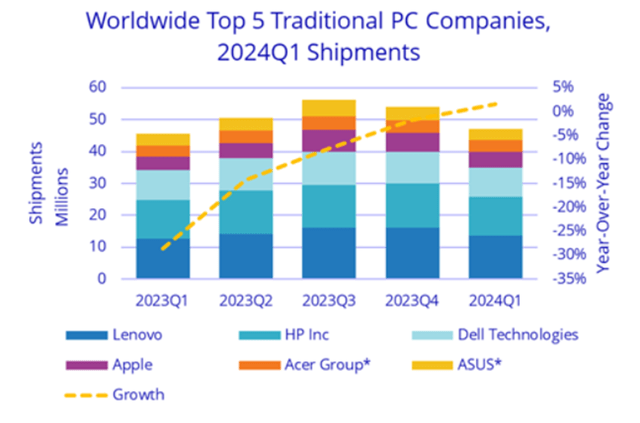

The Mac segment delivered solid financial results, with revenue up 7% YoY driven by physical shipment volume growth to 4.8 million units (+15% YoY). However, the average Mac ticket declined by 5% YoY. Apple’s overall PC and laptop market share was 8.1% (+1 p.p. YoY). With the launch of new Macs powered by M3 chips, which offer high performance compared to competitors, we expect the trend to continue. Mac was the strongest performer among competitors, given that the overall PC and laptop retail sales market grew only 1.5% YoY.

As a result, we have revised upwards our 2024 Mac segment revenue forecast from $32.5 bn (+11% YoY) to $33.5 bn (+14% YoY) and 2025 Mac segment revenue forecast from $40.5 bn (+25% YoY) to $41.7 bn (+24% YoY).

The iPad segment continued to stagnate as current models became outdated. Segment revenue amounted to $5.6 bn (-17% YoY). We expect Apple to announce new iPads this year, which should restore sales in the segment.

Revenue from wearable devices, which includes Apple Vision Pro, totaled $7.9 bn, after a 10% YoY decline. Apple has significant growing competition in the smartwatch and wireless headphone market from Chinese competitors and the Nothing brand, which have gained a lot in terms of technology and design over the previous year.

Apple Vision Pro sales have come in well below expectations, although the exact sales figure has not been revealed. The price of the basic model on eBay has dropped to $2400, and the advanced 1 TB model with full accessories to $3200, which is $2000 less than a similar model in the Apple Store.

At the moment, Apple Vision Pro can be called an experimental model, the demand for which comes mainly from companies that are trying to test it and adapt it to their own needs.

Financial results of Apple

We have revised downwards Apple’s revenue forecast from $409.3 bn (+9% YoY) to $395.6 bn (+3% YoY) for 2024 and from $452.9 bn (+11% YoY) to $444.7 bn (+12% YoY) for 2025 due to weaker expected sales in the smartphone and tablet markets, partially offset by higher sales forecasts in the Mac and services segments.

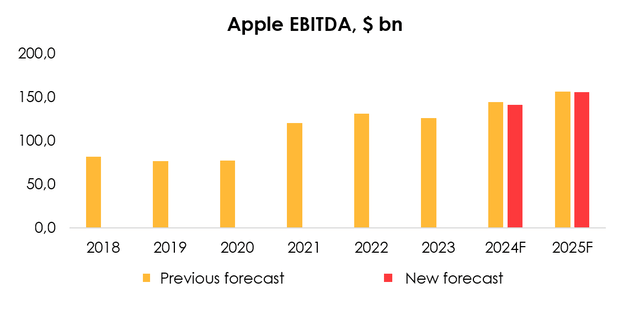

We have revised downwards our 2024 EBITDA forecast from $144.1bn (+15% YoY) to $140.7bn (+12% YoY) and the 2025 EBITDA forecast from $156.3bn (+8% YoY) to $155.8bn (+11% YoY) due to lower revenue guidance, partially offset by higher service segment margins.

Valuation

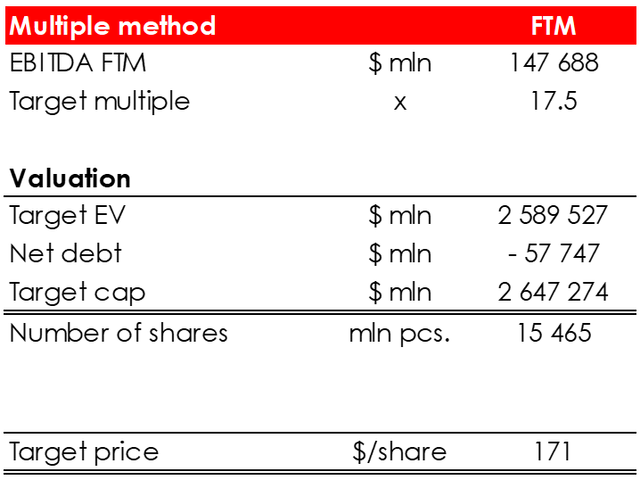

We have revised upwards our target price on the stock from $154 to $171 due to:

•Downward revision of EBITDA and FCF forecast in 2024-2025;

•Removal of FCF Yield valuation methodology;

•Reduction of net debt from $35 to ($58) bn;

•FTM valuation shift.

The rating is SELL.

We have eliminated the FCF Yield valuation methodology consistently across all US blue chips, as the market does not react to rising US 10Y bond yields by responding with a reduction in the required yield premium.

We also include Apple’s long-term investments in the net debt calculation, as Apple announced a $110 bn (4% of current capitalization) buyback program. Apple has only $67bn of short-term liquidity for the buyback, so we believe that Apple will reclassify long-term investments as short-term to pay for the buyback program.

Key risks

The main risk for Apple is potentially weak sales of the Apple Vision Pro and stagnation in the smartphone market due to its focus on developed markets. The main growth in the smartphone market is coming from emerging markets, where consumers are opting for cheaper models from Chinese competitors.

Main drivers

The key drivers are the introduction of AI into Apple products and a return to growth in the Mac and iPad segments through product upgrades and the integration of its own high-performance M chip.

Conclusion

Apple is a high-tech company that is actively developing its own ecosystem. However, recent trends in the smartphone market significantly limit its upside potential. The rating remains a SELL.

To manage your positions, we recommend following Apple’s earnings releases and market updates.