Daniel de la Hoz

Thesis Summary

Apple Inc. (NASDAQ:AAPL) stock has sold off in the last few weeks, and this seems more than justified, given the last earnings.

The company’s growth has dramatically slowed, and profitability may have peaked.

In my last article on Apple, I talked about the difficulties of bringing an AR headset to market and gave the company a neutral rating.

Following the latest fiscal Q4 earnings, it has become clear that Apple can no longer be considered a growth stock, so what is left?

At this point, Apple seems to be, in my eyes, an overvalued value stock.

2023 Full-Year Review

Over the last decade, it is true that Apple has delivered reasonable revenue growth, and even more reasonable earnings growth.

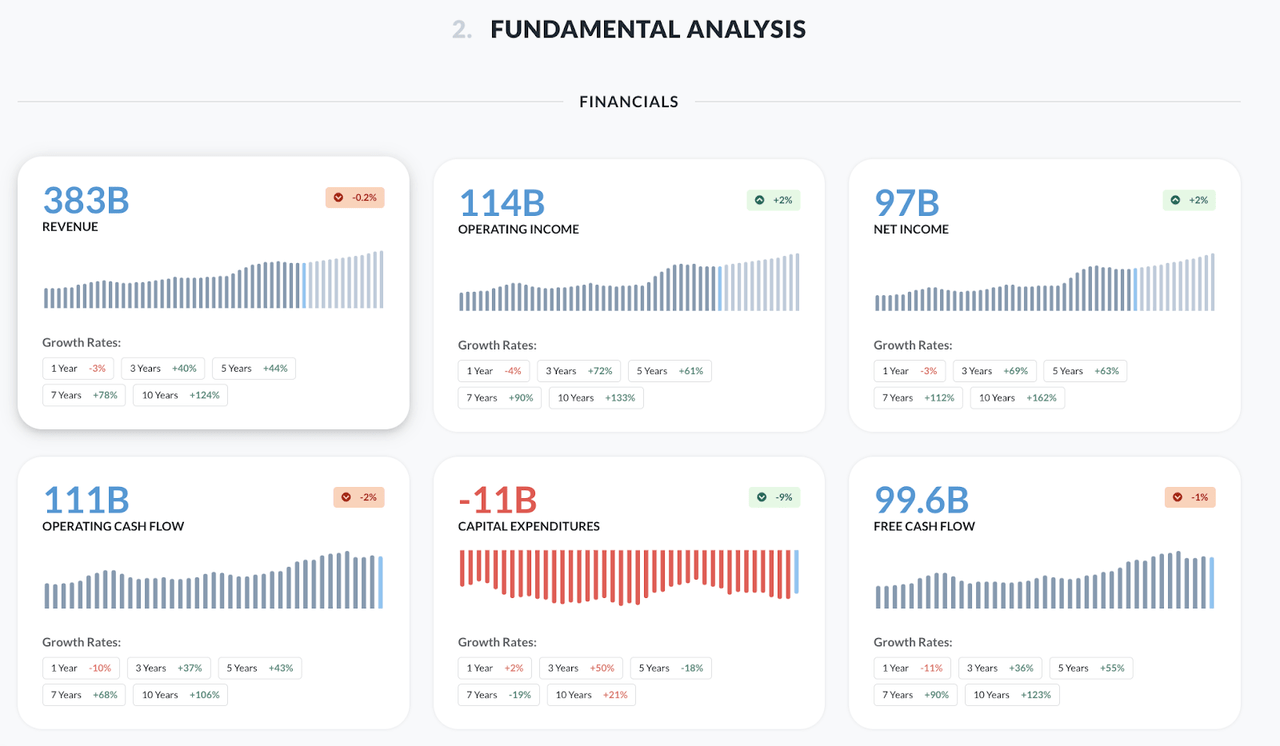

Apple fundamental analysis (Alphaspread)

The company has grown revenues at a CAGR of 8.4%. However, EPS over the last 10 years has grown at a rate of over 15% CAGR.

A pretty impressive rate of growth, especially for such a mature company. Apple has done very well to keep increasing revenues and profitability, but there’s a limit to what even the almighty Apple can do.

Signs of a slowdown are already here, and very evident if we look at the company’s performance in 2023.

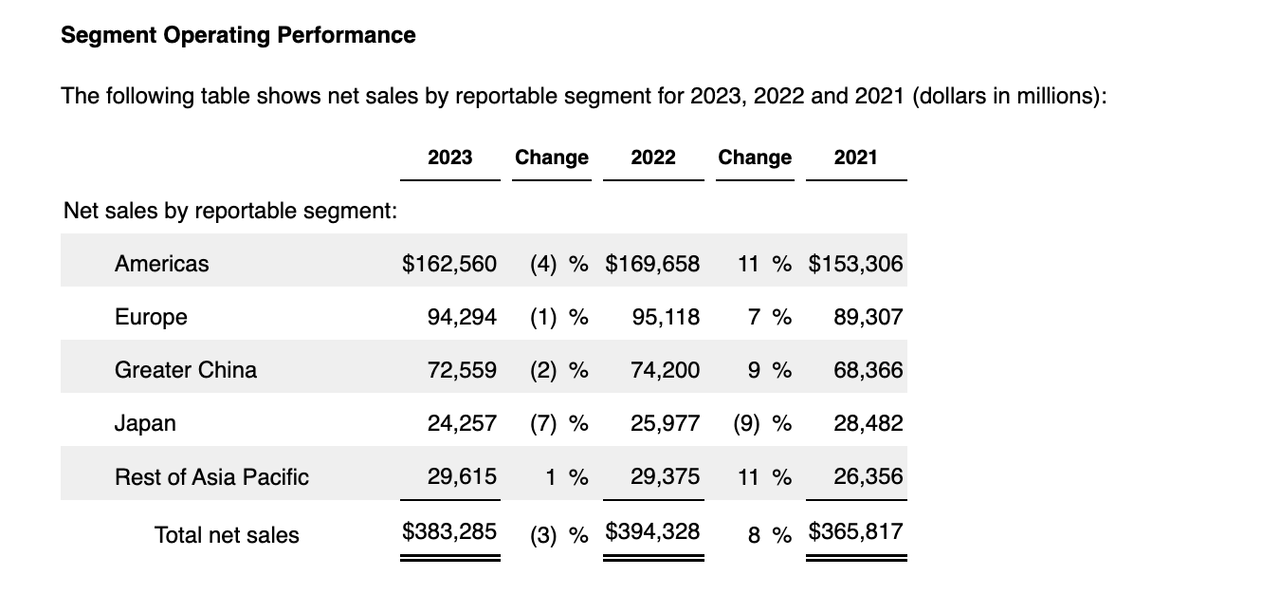

Apple sales by geography (10K)

Net sales are down across the board, with only a 1$ increase measured in the Rest of Asia Pacific geography, which is the area with the lowest sales.

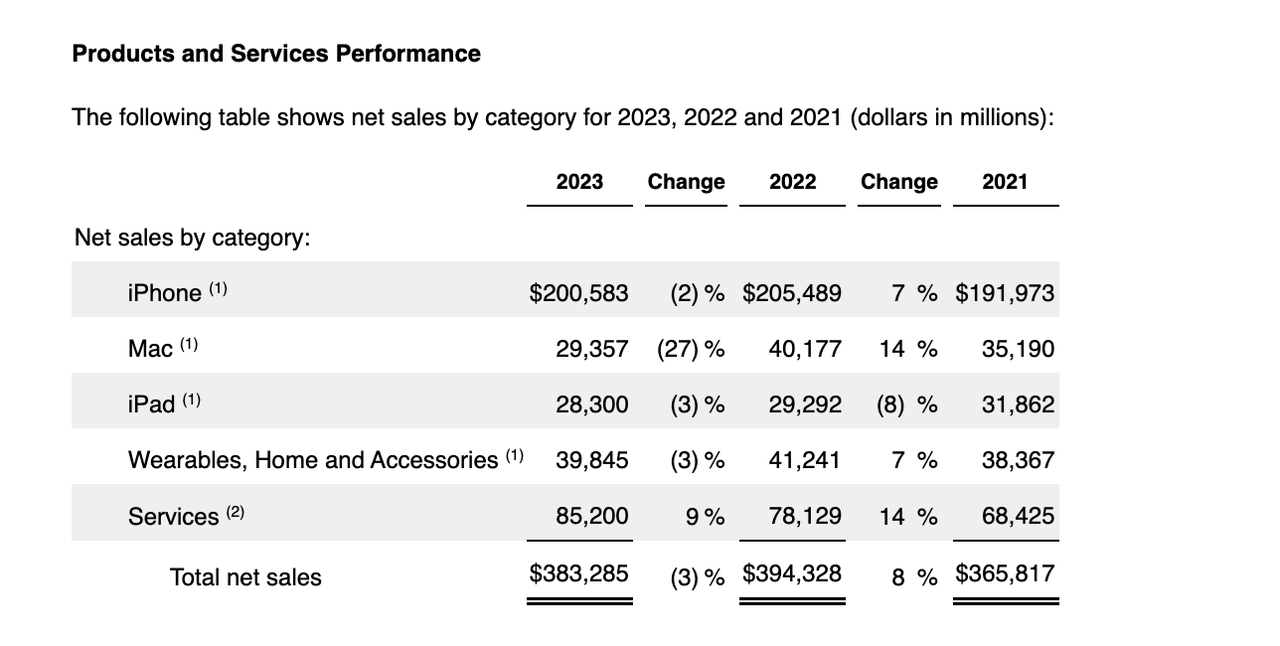

There’s no appetite for any of the products here. Interestingly, Mac sales fell a staggering 27% YoY. Even sales of the company’s flagship iPhone fell by 2%.

The only real growth area here, which could justify a premium valuation, is the services segment.

This grew at almost 10% and accounts for a little over 20% of the company’s revenues.

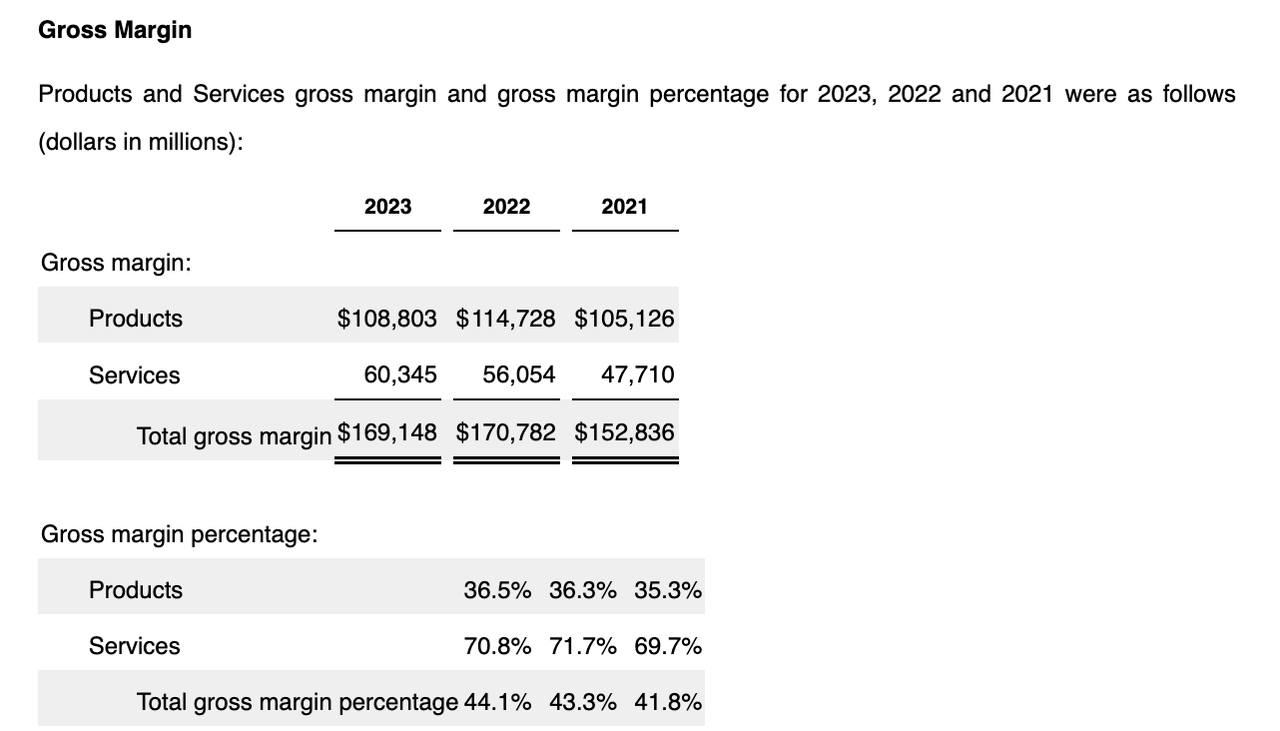

In terms of margins, product sales seem to have stabilized at around 36% gross margin. Meanwhile, we saw a slight decrease in Services Gross margin. Has profitability in services also peaked?

Future Outlook

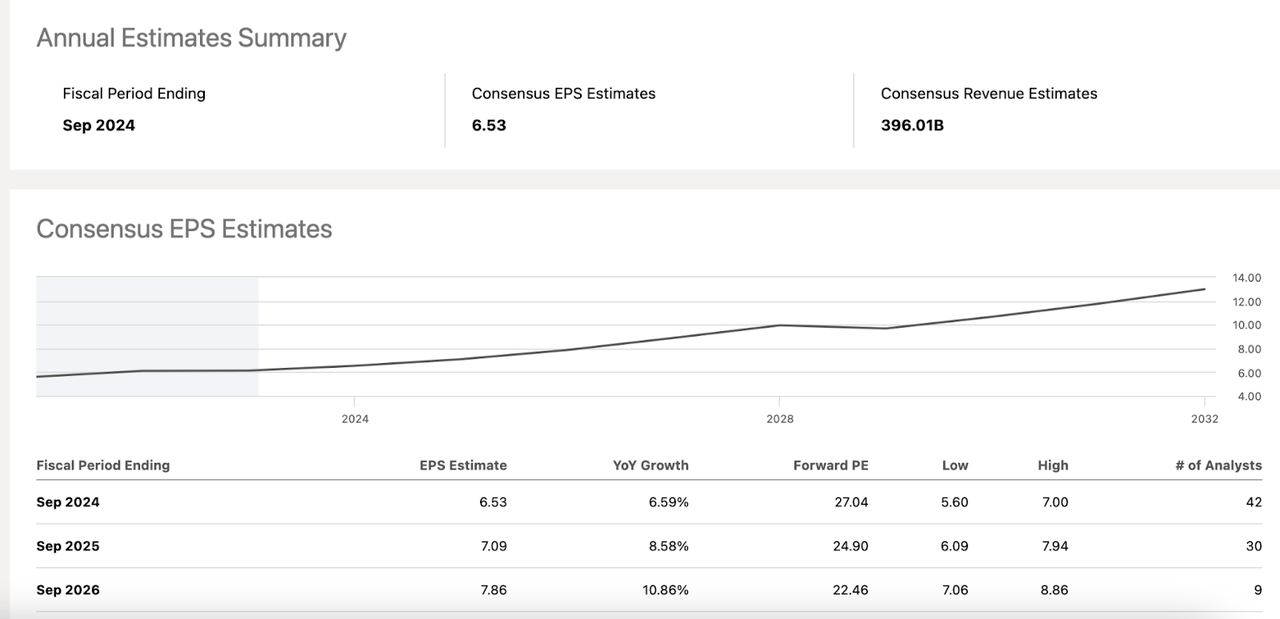

In my opinion, there is a slowdown taking place, and this is also reflected in analyst estimates.

EPS is still projected to grow at 8% CAGR over the next three years. Look out over the next 10 years; analysts expect the company’s EPS to double, delivering a CAGR of 8.3%.

This is still a pretty solid growth, and I’d expect nothing less from Apple, but this is still around half the growth rate of the last ten years, and I think investors might be starting to digest this new reality.

The only source of surprise, in my opinion, will be service revenue:

And really then, we step back and we think about why is it that our Services business is doing well and it’s because we have an installed base of customers that continues to grow at a very nice space and the engagement in our ecosystem continues to grow. We have more transacting accounts, we have more paid accounts, we have more subscriptions on the platform and we continue to add. We continue to add content and features. We’re adding a lot of content on TV+, new games on Apple Arcade, new features, new storage plans for iCloud. So it’s a combination of all these things and the fact that the engagement in the ecosystem is improving, and therefore, it benefits every service category.

Source: Earnings Call.

Now, while this statement seems positive on the outlook for services, it’s easy to turn it around.

Yes, Apple has been able to leverage its existing customer base, but that’s exactly the issue. The easy work has been done. Apple has already achieved deep penetration with its user base and will now have to work harder to acquire customers. Furthermore, with sales of its hardware falling, we’d expect its customer base to go the same way.

On the other hand, management mentions the fact that they are adding more features. That sounds like higher expenditures to me, and we’ve seen this struggle with a lot of other content providers already. The competition out there is fierce. Apple’s services are challenging Alphabet/Google (GOOGL), Microsoft (MSFT) and Netflix (NFLX), just to name a few.

Valuation

Apple’s valuation has become too rich, even for me.

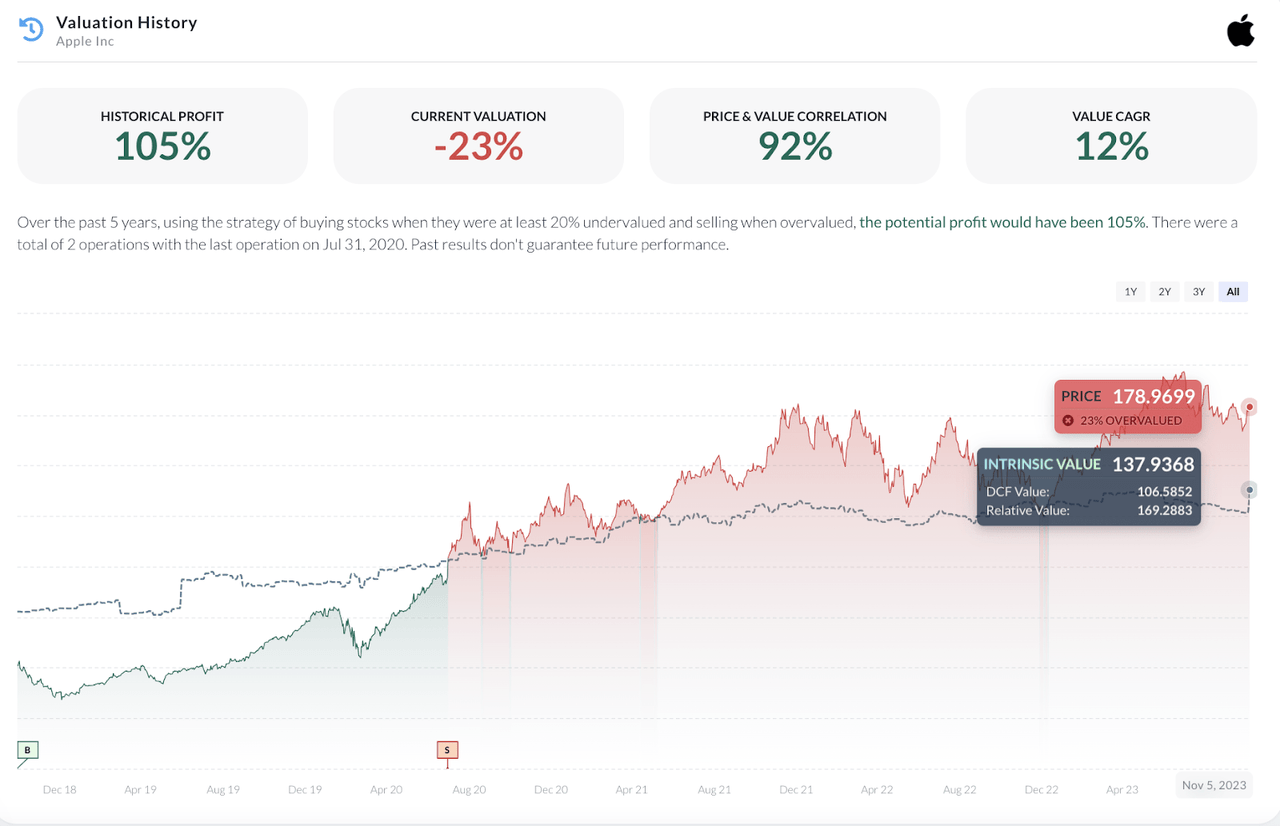

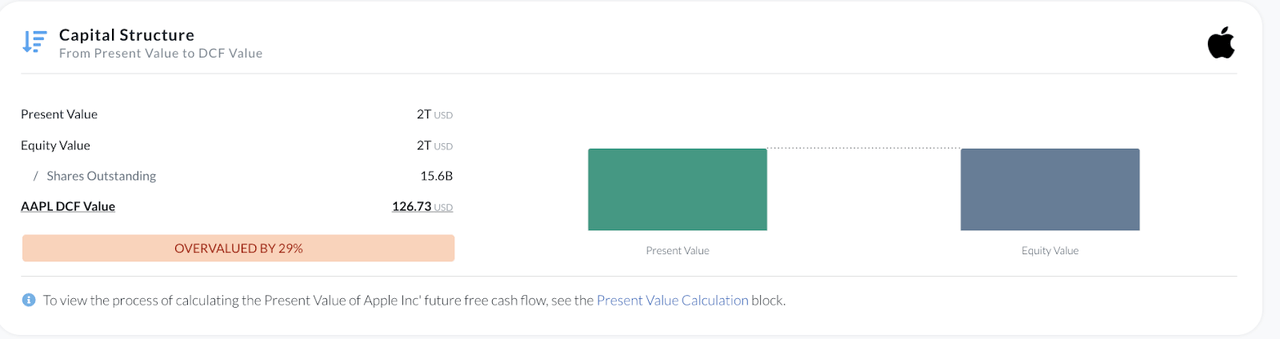

Alphaspread provides us with both a discounted cash flow (“DCF”) valuation and a Relative valuation. On both accounts, Apple is way overvalued, trading around 23% above where it should.

Let’s begin with the DCF.

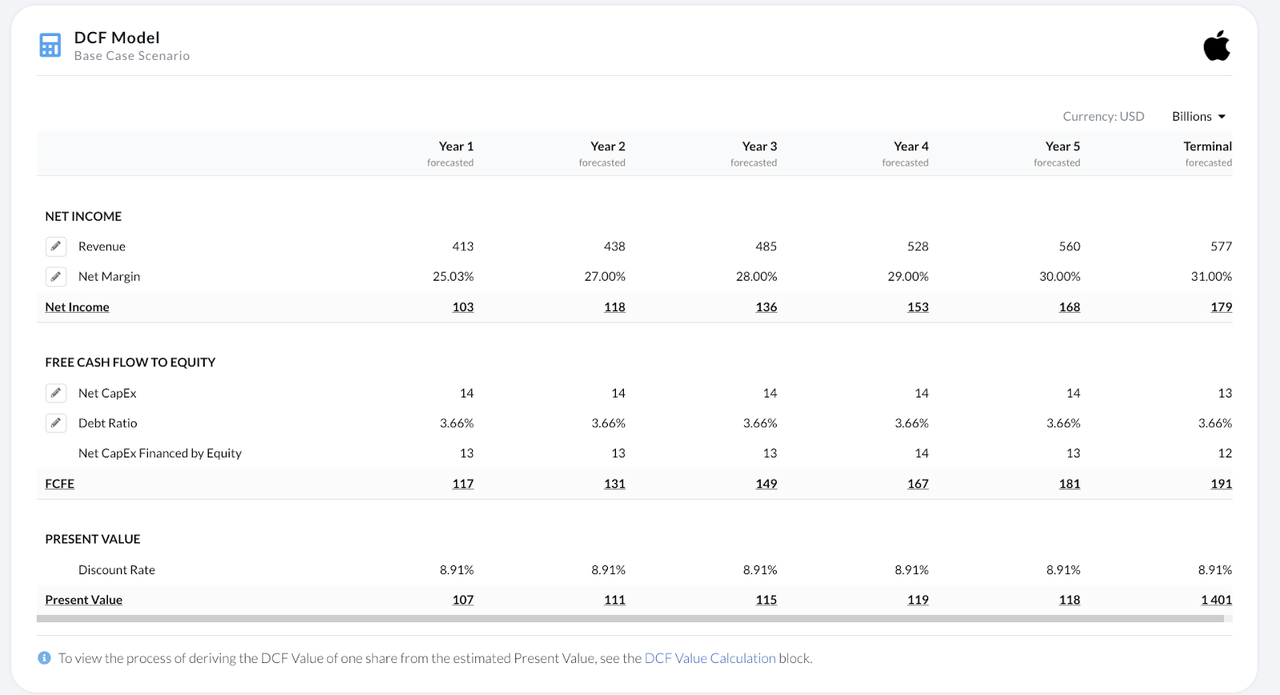

DCF (Alphaspread) DCF (Alphaspread)

Even taking revenues above estimates, and projecting an increase in the net margin to 30% over the next five years, Apple comes in at 29% overvalued (discount rate of 8.75%).

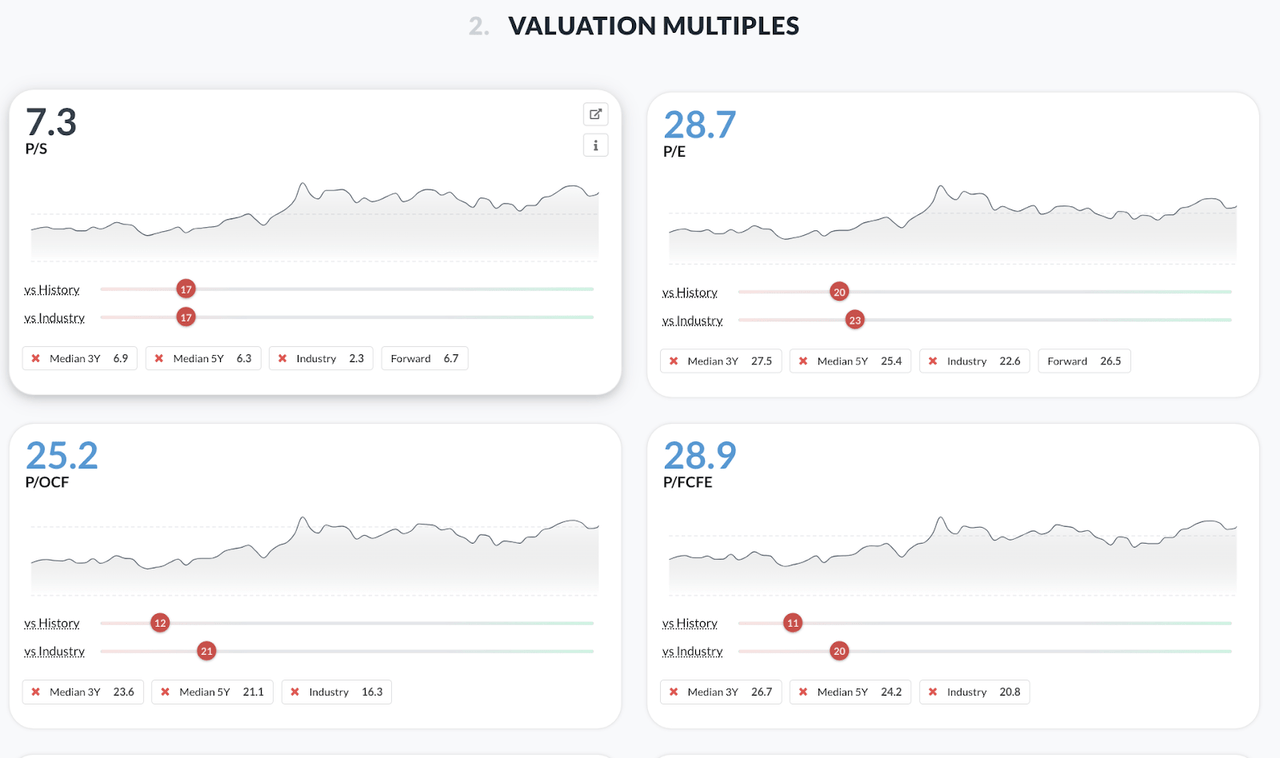

Now, let’s look at relative valuation. This takes into account various valuation multiples across the company’s history and compared to the industry average.

Apple Relative valuation (Alphaspread)

If we look for example at Apple’s P/E, the company is priced cheaper than only 21% of the company’s in its sector. On the other hand, the company is priced cheaper than 20% of the time in its history. In other words, the company is more expensive than 80% of the time. We can see that Apple is trading well above its 5Y median P/E of 25.4

All in all, it’s very hard to justify Apple’s valuation. I would have to see this drop another 10% to begin considering adding.

Risks and Other Considerations

Furthermore, I think Apple should be trading at a discount, given the looming risks from China.

Sales in China decreased QoQ on an absolute basis, and this trend could continue as the geopolitical situation worsens.

Furthermore, the company is slowly moving production away from China, and this could also have an impact on the company’s operations and profit margins.

Final Thoughts

Apple is a great company, priced like an even greater company. While the current selloff offers a better price, I still think Apple Inc. stock is overvalued.