ozgurdonmaz

Investment Thesis

Apple (NASDAQ:AAPL) continues to be a highly profitable and healthy business. Even amidst a difficult macroeconomic environment, the firm generated 2% YoY revenue growth and a solid 13% expansion in net income thanks to a better sales mix driving margin growth.

However, these growth metrics fall significantly short of analyst expectations for the firm.

This quantitative underperformance comes amidst a slurry of qualitative business setbacks such as weakening demand for their products in China and operational excellence from many of Apple’s competitors.

While these threats remain largely the same since my last update on Apple, I think the mismatch between current valuations and the firm’s earnings performance is real.

Even in a base-case scenario Apple shares appear over-bought with a 14% overvaluation being present in shares.

Therefore, I must continue to rate Apple a Sell.

FY24 Q1 Analysis

I’ve conducted a full in-depth analysis of Apple’s financial abilities in an earlier deep-dive article: “Apple: The Right Company At The Wrong Price“. I recommend reading that article to get a full understanding of the firm’s recent fiscal prowess.

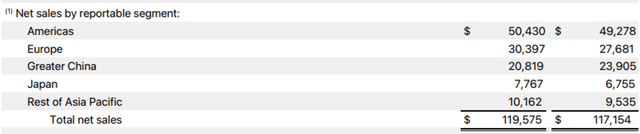

Kicking-off the new fiscal year, Apple made $119.6 billion in the first three months of 2024, which is just 2% more than the same period last year. This lackluster YoY growth came despite multiple new product releases in their iPhone, Mac and iPad businesses.

AAPL Q1 FY24 Supplemental Financials

The main driver Apple’s Products growth was the iPhone, which made $69.7 billion, or 6% more than last year. This means more people bought the new iPhone 15 and iPhone 15 Pro models, which significantly improved versions of their predecessors.

AAPL Q1 FY24 Supplemental Financials

While these devices have received great critical and user acclaim along with the new M3 Macs being some of the fastest laptops available to consumers, Apple has struggled to drive the massive growth in these product segments seen in pre-pandemic.

This is to be expected to some extent as the global smartphone, laptop and tablet markets reach peak maturity. I also believe a softening consumer has resulted in less potential customers being willing and able to spend their increasingly stressed incomes on the luxury tech products Apple produces.

Another key catalyst for Apple’s growth was their Services, which made $23.1 billion in revenue, up 11% YoY. This means more people subscribed to Apple’s online services, such as Apple Music, Apple TV+, Apple Arcade, and iCloud, which offer music, movies, games, and storage.

Personally, I am a big fan of Apple’s increasing investment and commercialization of their services segment. Businesses such as Apple TV, Music and Health present the firm with real growth opportunities and leverage the already massive reach the firm has with their physical products.

AAPL Q1 FY24 Supplemental Financials

The increase in the percentage of total revenues earned by Apple’s Services segment rose from 17% in Q1 FY23 to 19.4% in Q1 FY24.

This solid increase allowed Apple to expand their operational efficiency with falling Products COGS and a small 3% increase in Services COGS allowing the firm’s gross margin to expand 9% to $54.9B (29.8% operating margin).

Apple’s Services business offers the firm a great way to expand margins thanks to the lower capital costs associated with growth in the business compared to their hardware products segment. The segment also allows Apple to extract more revenue per user from their existing customer base even amidst a soft hardware demand environment.

On that note, Apple also claimed that it had more than 2.2 billion active users of their products and services which represents new all-time highs for the firm.

Apple’s continued strength at translating sales into a large and loyal customer base is very positive to see suggesting their products continue to accurate meet consumer demands and preferences.

AAPL Q1 FY24 Supplemental Financials

One key weakness in Apple’s Q1 report comes from the loss in sales experienced in the greater China geographic demographic. The pretty massive 13% drop in sales resulted in the region being the only contracting market for Apple.

This quantitative support of the reported weakness in iPhone sales in China amidst strong domestic competition may place some real pressure on Apple’s ability to execute on their long-term growth prospects.

Without the rapidly expanding Chinese market, Apple will struggle to offset and future market share losses through their Americas or Europe markets. While their expansion into India may allow the firm to regain exposure to a rapidly developing demand environment, this is still speculative given the lack of specific data from the region.

Q1 saw the firm reward shareholders too with the firm buying back $20B worth of shares. I must admit that these share purchases in my view present an inefficient utilization of capital given the truly elevated prices at which Apple stock is currently trading.

I would have much preferred to see this return of capital in the form of a pretty huge dividend rather than share buybacks which at current pricing levels simply does not seem like an efficient way to reduce the current share count.

Nevertheless, Apple announced that it will pay $0.24 for each share of its stock to its shareholders on February 15, 2024.

Cash flows also remain strong with the firm generating $39.9B in cash from their operating activities, up 18% YoY. These massive cash flows are not surprising but of course still welcomed and provide Apple with large amounts of freedom to maneuver fiscally.

Overall, I think Apple has made the most of a difficult macroeconomic environment. While this is not to say I am pleased by the muted 2% YoY revenue growth, I do see their bottom-line expansion, increase in services revenues and qualitative operational wins as positive progress.

In isolation Apple’s results are pretty great considering they are (theoretically at least) subject to a highly cyclical and competitive demand environment.

However, the real issue I suspect has been souring investor sentiments towards the firm comes from how these results interact with the stock’s valuation.

Valuation – Q1 2024 Update

Seeking Alpha | AAPL | Valuation

Seeking Alpha’s Quant has assigned Apple with an “F” Valuation rating. I am largely inclined to agree with this latter grade given the massively elevated multiples currently present at the firm.

Apple stock currently trades at a P/E GAAP TTM ratio of 25.79x which represents an 11% increase relative to their running 5Y average. This ratio is way up from the roughly 20x ratios seen before 2020 and illustrates the significant multiple increase over the past few years.

While I would understand such a growth in multiples if the firm were to be producing blockbuster quarterly reports, I believe this P/E ratio remains unsupported as evidence by their most recent four quarterly reports and 2024 outlook.

Apple also has a pretty elevated P/CF ratio TTM of 25.79x and an EV/Sales TTM of 7.34x. Both of these ratios are once again 22% and 24% higher than Apple’s running 5Y average which once again supports my thesis that the letter grade implies a relatively large overvaluation in shares.

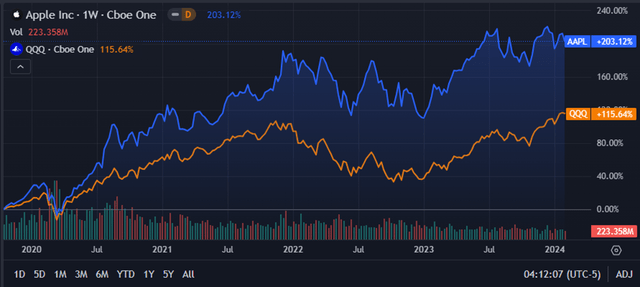

Seeking Alpha | AAPL | Advanced Chart

From an absolute perspective, Apple has had a remarkable past four years with the firm generating massive 200% returns for shareholders.

This growth has however been accompanied by significant valuation multiple increases and in recent times amid increasingly flatline revenue and income growth.

While the firm has continued to soundly outperform the tech heavy Nasdaq-100 tracking QQQ fund (QQQ), current valuations have reached all-time highs with the stock seemingly unable to break through the $200 barrier.

The Value Corner

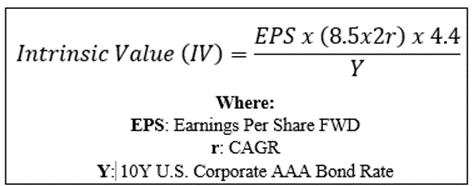

Let’s use The Value Corner’s specially formulated Intrinsic Valuation Calculation so we can better understand what value exists in the company from a more objective perspective.

Starting with Apple’s current share price of $186.86, an updated 2024 EPS of $6.62, a realistic “r” value of 0.09 (9%) and the current Moody’s Seasoned AAA Corporate Bond Yield ratio of 4.74x, I derive a base-case IV of $162.80. This represents around a 14% overvaluation in shares currently.

When using a more pessimistic CAGR value for r of 0.05 (5%) to reflect a scenario where Apple sees another relatively flatline year characterized by muted revenue growth, shares are valued at around $113 representing a massive 60% overvaluation in shares.

While this bear-case scenario really does present a worst-case for Apple, it serves as a great illustration of just how reliant the current valuations are on future growth rather than inherent present value.

In the short term (3-12 months), I find it difficult to say exactly what may happen Apple shares. Given the present overvaluation and pretty muted growth at the firm, I would not be surprised to see downward movement in the stock price for at least a few months as shares return from an over-bought condition.

In the long-term (2-10 years), I see a profitable and solid future for Apple characterized by around 7-8% YoY revenue growth and continuous margin expansion as more revenues are contributed by their Services division.

I want to reaffirm that I really like the company’s fundamental business and ability to generate profits. Apple continues to produce excellent products that meet customer demands and generate massive earnings for the company.

However, the current valuation simply leaves little room for executional error or growth short comings which therefore makes the stock unattractive to me at present time.

Apple Risk Profile – Q1 2024 Update

Apple continues to see real risks arising from the competitive nature of the business environments in which they operate along with the perceived late-start the firm has taken in the AI-race.

While they continue to make great products that resonate with both critics and consumers, Apple must ensure they do not fall behind competitors within their respective business categories.

Product line-ups such as the iPhone and Mac have seen little true innovation with regards to form factor relative to competing devices from the likes of Samsung and Asus.

Apple still has not entered into the flipping phone market with their own competitors despite most major manufacturers now offering a host of devices to choose from.

While their bet on “spatial computing” (which is Apple marketing lingo for AR/VR) with the Vision Pro may pay off, the product’s ultimate popularity, profitability and success is still speculative.

The firm has also gotten off to what seems like a pretty slow start in their machine learning and AI initiatives.

Siri continues to lag behind the capabilities of Copilot or Google Assistant with little concrete news coming out of Cupertino regarding Apple’s plans to implement generative AI into their products and services.

Given their recent slew of AI-related hirings, it would be foolish to assume Apple isn’t working on their own large language model and generative AI platform.

However, the firm must ensure they do not take excessive amounts of time to release a competing product to ensure their current generation of services and devices remain relevant within the market.

From an ESG perspective, no real change has occurred at Apple. The firm remains environmentally conscious with a promise to achieve net zero emissions and continuous to support utmost societal equality and gender parity in its workforce.

I believe Apple would still make for a solid ESG conscious investment pick given their net-zero targets and positive attitude towards societal equality and governance.

Of course, opinions may vary and I urge you to conduct research of your own into Apple’s ESG risk profile should these matters be of particular importance to you.

Summary

Apple has produced some slightly mixed results for the first quarter of 2024. While the ability to grow revenues even amidst a difficult and softening macro environment is encouraging, the firm must address their China slowdown and products sales stagnation in order to reignite their growth prospects.

The current base and bear case valuations also leave little to be desired in Apple shares. The elevated multiples and real overvaluation present in shares does not create sufficient room for a margin of safety to be present when evaluating an investment thesis in the company.

I therefore continue to rate Apple a Sell and believe better upside potential exists elsewhere in the market for 2024.