Justin Sullivan/Getty Images News

Investment Thesis:

I have written before about Apple Inc. (NASDAQ:AAPL), all four times with a Buy rating. My first article was in Sep. 2015, “Apple Watch: ‘Apple Inside’” with share price at $29.15 (split adjusted). SA Premium shows the share price has since increased by 493.17% with a total return of 553.48%. I then had a break of a couple of years before publishing three articles between March and June 2017, “S&P 500 Doubles, Earnings Flat, Selloff Inevitable: Is This True Of Apple?“, “Buffett’s Apple Buy A No-Brainer” which earned an Editor’s Pick, and “Apple For Beginners“. Earnings multiples at the time of these articles were in the 16 to 17 range. SA Premium shows total returns of over 400% in respect of those three articles. Did I expect those levels of returns when I wrote those articles? To be honest, no I did not have expectations of returns at those levels. My expectations on share price growth were based on an expectation of both EPS growth and multiple expansion. I felt Apple deserved a higher multiple than its 16 to 17 range at that time. When the market realized that and was prepared to pay a higher multiple, that would lead to share price increase, independent of earnings growth. My second consideration was Apple’s large cash balance which was doing nothing for the share price. Continuing to use surplus cash to repurchase shares at what I considered a cheap price would reduce share count and increase EPS, regardless of earnings growth. An increase in EPS coupled with an increase in multiple could drive share price increases regardless of net income growth. As regards net income growth, I think it would be fair to say at the time there was uncertainty how Apple could grow net income indefinitely. As it turned out, Apple’s net income growth was moderate between the time of my articles in 2015, 2017, and 2020, as per Table 1 below.

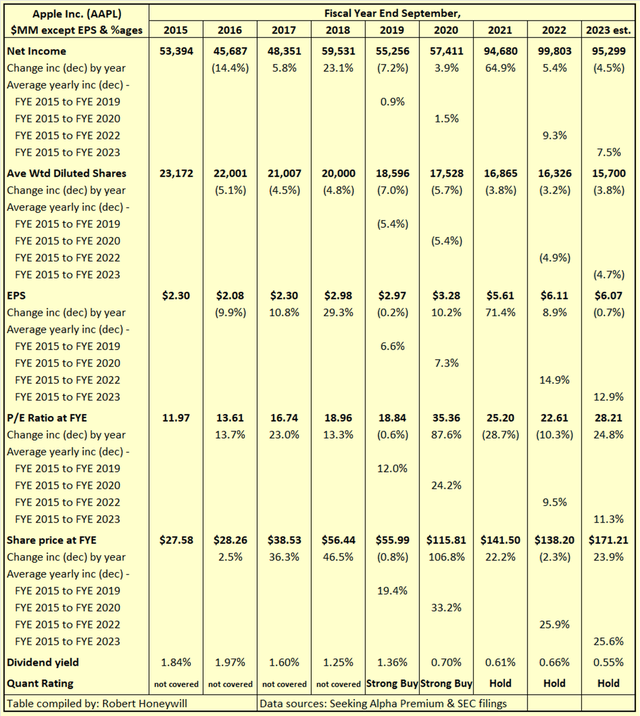

Table 1

Comments on contents of Table 1:

Periods 2015 to 2019 and 2015 to 2020:

Table 1 shows Net income grew by a mere 0.9% average per year over the four years 2015 to 2019, However, an average 5.4% yearly reduction in share count through share repurchases resulted in average yearly EPS growth of 6.6%. This 6.6% EPS growth rate was further leveraged by P/E ratio average yearly growth rate of 12.0%, resulting in an average yearly share price growth of 19.4% over the four-year period 2015 to 2019. This average yearly return of 19.4% from share price growth was further enhanced by the dividend yield. Due to increases to the quarterly dividend per share, the dividend yield on cost of 1.84% at Sep. 2015 had grown to 2.76% by Sep. 2019. The story is similar for buying in 2015 and holding through 2020 – average yearly Net income growth of just 1.5% results in share price increase of 33.2% per year, due to leverage from share repurchases and multiple expansion.

Periods 2015 to 2022 and 2015 to 2023:

Net income grew by 9.3% average per year over the seven years 2015 to 2022, An average 4.9% yearly reduction in share count through share repurchases resulted in average yearly EPS growth of 14.9%. This 14.9% EPS growth rate was further leveraged by P/E ratio average yearly growth rate of 9.5%, resulting in an average yearly share price growth of 25.9% over the four-year period 2015 to 2019. This average yearly return of 25.9% from share price growth was further enhanced by the dividend yield. This period benefitted from the explosive 64.9% growth in Net income between 2020 and 2021. Growth has subsequently moderated with minimal growth expected in Net income for 2023 versus 2021. The effect of duration on investment returns is seen, with Net Income average yearly growth for the eight years to 2023 quickly falling to 7.5% from 9.3% for the seven years to 2022.

Quant Rating:

Seeking Alpha Quant rating has alternated between Strong Buy and Hold (with no Buy or Sell ratings) from the initial rating as a Strong Buy on Aug. 21, 2019. The stock was last rated as a Strong Buy on Sep. 29, 2021 and has been rated as a Hold by SA Quant since that date to the present. Figure 1 below shows components of the current Quant Hold rating.

Figure 1

It is interesting that even with an F rating for Value and a D rating for Growth, the Quant system maintained a Hold rating and did not default to Sell. I believe it is likely only the fact Apple has beaten Analysts’ EPS estimates for 19 of the last 20 quarters that has prevented Quant rating flipping from Hold to Sell.

Outlook and Conclusions:

Clearly, Apple has shown the ability to realize strong Net income growth over the longer term through intermittent significant advances in product technology that have great appeal to the buying public. The period 2015 to 2017 provided a favorable buy opportunity, with an attractive relatively low share price, and potential for reduction in share count through share repurchases at these low share prices, coupled with multiple expansion. Table 1 shows double-digit returns over 20% were possible, even without the significant increase in Net income in 2021. Today, the shares appear more than fully priced, making buybacks less attractive, although using surplus cash to reduce share count will still have an impact on EPS. The present multiple appears to have far more potential to contract than expand, limiting or eliminating the opportunity for share price growth. My analyses further below indicate, based on SA Premium analysts’ consensus EPS estimates, and a continuation of Apple’s P/E ratio at the present level of 29.06, total return of 12.3% per year is possible, buying now and holding through the end of 2024. But analysts’ EPS estimates also reflect a great deal of uncertainty, with indicative returns ranging from a low of 1.8% to a high of 20.7%. Also, if the P/E ratio fell from the present 29.06 to 24.0, the positive return of 12.3% based on consensus EPS estimate would change to 3.5% negative. My conclusion is, unlike the 2015 to 2017 period, now is not an opportune time to buy Apple shares. The P/E multiple is more likely to contract than expand, share price does not make share buybacks attractive, and we could be experiencing a flat period in Apple’s earnings growth cycle. At best, the stock is a Hold for existing long-term holders. For those with a short-term investment time frame there is the possibility of a sale and buyback on any dip in the share price. For those considering a buy, there is likely a possibility of entry at a price below current levels, if prepared to wait. Various Seeking Alpha analysts have discussed pressure on Apple’s earnings, bringing the possibility of an earnings miss for Apple’s final quarter, estimated due for release Nov.02. These concerns are added to by the following excerpts from SA News Editor, Chris Ciaccia, Oct. 16, news item:

Jefferies analysts said iPhone sales have dropped by double-digit percentage compared to the iPhone 14 Pro in China, due in part to the release of Huawei’s new Mate 60 Pro, released in August… In September, Bank of America said that strong sales of the new smartphone from Huawei, which incorporates an in-house chip that looks to perform at 5G speeds, could impact sales of the iPhone in China… Counterpoint estimated that Huawei could sell as many as 5M to 6M units of the Mate 60 Pro this year and perhaps at least 10M next year, the news outlet added.

A high P/E ratio implies an expectation of continuing high EPS growth, and if Apple’s fourth quarter EPS misses analysts’ consensus estimate, as appears very possible, that would likely put a dint in expectations, causing negative sentiment, with a consequential fall in the share price. Furthermore, if this were to eventuate, and it does appear a strong possibility, I believe it would likely tip the Seeking Alpha Quant rating for Apple from the present Hold, to Sell. Reluctantly, my overall rating for Apple stock has to be a downgrade from Buy to Sell. A more detailed financial analysis follows in support of this conclusion.

Financial Analysis and Comment

Looking for market mispricing of stocks:

What I’m primarily looking for here are instances of market mispricing of stocks due to distortions to many of the usual statistics used for screening stocks for buy/hold/sell decisions. I believe the answer is to compare projections, based on analysts’ estimates out to the end of 2024 or later, to past performance. Summarized in Tables 2 and 3 below are the results of compiling and analyzing the data on this basis.

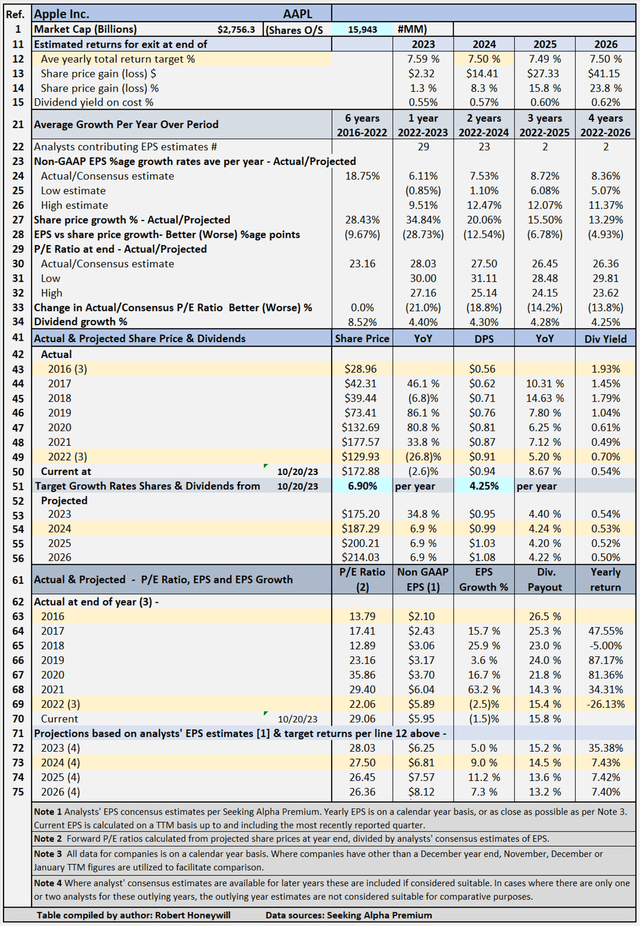

Table 2 – Detailed financial history and projections

Table 2 documents historical data from 2016 to 2022, including share prices, P/E ratios, EPS and DPS, and EPS and DPS growth rates. The table shows EPS grew at an average rate of 18.75% per year, between 2016 and 2022, while the share price grew at a far higher rate of 28.43% per year over the same period. The table also includes estimates out to 2026 for share prices, P/E ratios, EPS and DPS, and EPS and DPS growth rates. (Note – while estimates are shown for analysts’ EPS estimates out to 2023 to 2026 where available, estimates do tend to become less reliable, the further out the estimates go. These estimates are only considered sufficiently reliable if there are at least three analysts’ contributing estimates for the year in question). Based on analysts’ consensus EPS estimates, EPS is projected to continue to grow at mid to high single-digit percentages through the end of 2024. Table 1 allows modeling for target total rates of return. In the case shown above, the target set for total rate of return is 7.5% per year through the end of 2024 (see line 12), based on buying at the Oct. 20, 2023, closing share price level. As noted above, estimates become less reliable in the later years. I decided to input a target return based on the 2024 year, which has EPS estimates from 23 analysts because it allows for the impact of the projected EPS growth rates to be taken into account in the assessment of the value of Apple shares. The table shows to achieve the 7.5% return, the required average yearly share price growth rate from Oct 20, 2023 through Dec. 31, 2024, is 6.90% (line 51). Dividends and dividend growth account for the balance of the target 7.5% total return.

Apple’s projected returns based on selected historical P/E ratios through the end of 2024

Table 3 below provides scenarios projecting potential returns based on select historical P/E ratios and analysts’ consensus, low, and high EPS estimates per Seeking Alpha Premium through the end of 2024.

Table 3 – Summary of relevant projections Apple

Table 3 provides comparative data for buying at the closing share price on October 20, 2023, and holding through the end of years 2023 through 2026. There’s a total of twelve valuation scenarios for each year, comprised of three EPS estimates (SA Premium analysts’ consensus, low and high) across three different P/E ratio estimates, based on historical data, plus a fourth P/E ratio selected to provide an alternative scenario. Apple’s P/E ratio is presently 29.06, which is well above the historical average P/E ratio of 22.34. Table 3 shows potential returns from an investment in shares of the company across the range of P/E ratios This analysis, from hereon, assumes an investor buying Apple shares today would be prepared to hold through 2024, if necessary, to achieve their return objectives. Comments on the contents of Table 3, for the period to 2024 column follow.

Consensus, low and high EPS estimates

All EPS estimates are based on analysts’ consensus, low and high estimates per SA Premium. This is designed to provide a range of valuation estimates – from low to most likely to high – based on analysts’ assessments. I could generate my own estimates, but these would likely fall within the same range and would not add to the value of the exercise. This is particularly so in respect of well-established businesses such as Apple. I believe the “low” estimates should be considered important. It’s prudent to manage risk by knowing the potential worst-case scenarios from whatever cause.

Alternative P/E ratios utilized in scenarios

- The actual P/E ratios at the share buy date are based on actual non-GAAP EPS for Q2-2023 TTM.

- A modified average P/E ratio based on 29 quarter-end P/E ratios from Q4 2016 to Q3 2023 and current P/E ratio in Q4 2023. The Q3 and Q4 2023 P/E ratios are based on share price at the end of Q3 2023 and the current share price in Q4 divided by TTM EPS for latest reported earnings through the end of Q2 2023. The average of these P/E ratios has been modified to exclude the three highest and three lowest to remove outliers that might otherwise distort the result.

- A modified low P/E ratio was calculated using the same data set used for calculating the modified average P/E ratio, and calculated on a similar basis, with the three highest and lowest P/E ratios excluded.

- A median P/E ratio is calculated using the same data set used for calculating the modified average P/E ratio. Of course, the median is the same whether or not the three highest and lowest P/E ratios are excluded. In the case of Apple, I have chosen to use an assumed P/E ratio of 26.0 in place of the historical median of 22.56 (similar to the average). I have done this to provide an idea of the impact on returns of the multiple decreasing to around halfway between the present level and the historical average.

Reliability of EPS estimates (line 18)

Line 18 shows the range between high and low EPS estimates. The wider the range, the greater disagreement there is between the most optimistic and the most pessimistic analysts, which tends to suggest greater uncertainty in the estimates. There are 23 analysts covering Apple through the end of 2024. In my experience, a range of 11.4 percentage points difference in EPS growth estimates among analysts is relatively high and suggests a degree of uncertainty, and thus decreased reliability of the estimates.

Projected Returns (lines 19 to 45)

Lines 25, 35, and 45 show T a range of historical P/E ratio levels, Apple is conservatively indicated to return between negative 36.1% and negative 24.2% average per year through the end of 2024. The negative 36.1% return is based on analysts’ low EPS estimates and the negative 24.2% on their high EPS estimates, with a negative 29.5% return based on consensus estimates. Those are the lowest of the returns under the consensus, low, and high EPS scenarios and assume a P/E multiple at Apple’s historical low multiple of 16.20. If the multiple were to remain at the present 29.06 at the end of 2024, indicative returns range from 1.8% to 20.6%, with a consensus of 12.3%. At Apple’s historical average P/E multiple of 22.34, the indicative returns range from negative 17.4% to negative 2.2%, with consensus of negative 8.9%. However, I believe the more likely outcome is a multiple somewhere between the historical average of 22.34 and the present level of 29.06. At a selected multiple of 26.0, the indicative returns range from negative 6.8% to positive 10.4%, with consensus of positive 2.8%.

Checking Apple’s “Equity Bucket”

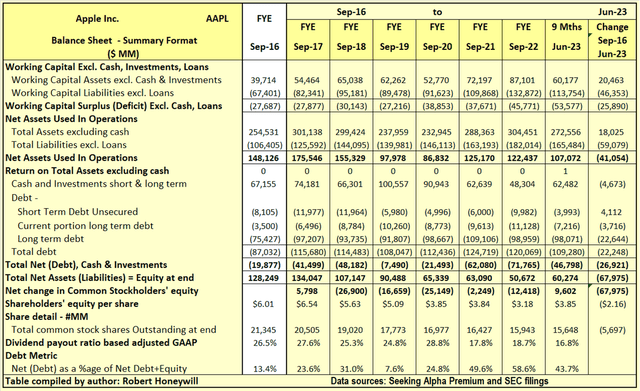

Table 4.1 Apple’s balance sheet – summary format

Over the 6.75 years from the end of September 2016 to the end of Q2 2023, Apple’s shareholders’ equity decreased by $67.975 billion. This $67.975 billion decrease, is reflected in a decrease of $41.054 billion decrease in Net Assets Used In Operations and an increase of $26.921 billion increase in debt net of cash. Net debt as a percentage of net debt plus equity increased from 13.4% at the end of September 2016 to 43.7% at the end of Q2 2023. Outstanding shares decreased by 5.697 billion from 21.345 billion to 15.648 billion, over the period, due to share repurchases offset in part by shares issued for employee stock compensation. The $67.975 billion decrease in common stock shareholders’ equity over the last 6.75 years is analyzed in Table 4.2 below.

Table 4.2 Apple’s balance sheet – equity section

I often find companies report earnings that should flow into and increase shareholders’ equity. But often the increase in shareholders’ equity does not materialize. Also, there can be distributions out of equity that do not benefit shareholders. Hence, the term “leaky equity bucket.” I look for evidence of this in my analysis of changes in shareholders’ equity.

Explanatory comments on Table 4.2 for the period end FY-2016 to end Q2-2023

- Reported net income (GAAP) over the 6.75-year period totals $489.071 billion, equivalent to diluted net income per share of $27.91.

- Other comprehensive income includes such things as foreign exchange translation adjustments with respect to buildings, plant, and other facilities located overseas and changes in the valuation of assets in the pension fund – these are not passed through net income as they fluctuate without affecting operations and can easily reverse in a following period. Nevertheless, they do impact the value of shareholders’ equity at any point in time. For Apple, these items were negative, decreasing equity by $9.792 billion over the 6.75-year period. This was primarily due to recording a loss due to a change in fair value of marketable debt securities in FY 2022.

- There were share issues to employees, and these were a significant expense items. The amounts recorded in the income statement and in shareholders’ equity, for equity awards to staff totaled $25.661 billion ($1.43 EPS effect) over the 6.75 year period. However, the market value of these shares is estimated to be $71.334 billion ($4.11 EPS effect). The understatement of expense by ~$45 billion is material in the context of GAAP earnings total of ~$489 billion over the 6.75-year period and is concerning from a “leaky equity bucket” aspect.

- By the time we take the above-mentioned items into account, we find, over the 6.75-year period, the reported non-GAAP EPS of $127.91 ($489.071 billion) has decreased to $124.65 ($433.606 billion), added to funds from operations available for distribution to shareholders.

- Distributions totaled $501.581 billion, comprised of dividends of $95.185 billion and share repurchases, net of issues to staff, of $406.396 billion. These distributions of $501.581 billion exceeded the $433.606 billion of funds available from operations, resulting in the $67.975 billion reduction in Shareholders’ equity per Table 4.1 above. The inescapable conclusion is Apple has gone beyond using surplus cash for share repurchases and are borrowing funds for this purpose.

Summary and Conclusions

Apple’s share price is supported by a multiple of 29.06 and it is believed the greater likelihood is this multiple will move back towards the lower historical average of 22.34. Even at a multiple of 26.0 indicative returns through the end of 2024 based on analysts’ consensus EPS estimates is a low 2.8% per year. The wide range of analysts’ EPS estimates suggests a high degree of uncertainty in relation to future earnings. While continuing share repurchases could continue to boost EPS the current share price does not make share repurchases as attractive as in the past, particularly where funded by increases in net debt. Taking all of the foregoing into account, Apple is downgraded from Buy to Sell.