ozgurdonmaz

On September 9, 2024, Apple (NASDAQ:AAPL) unveiled its iPhone 16 lineup, as well as other new products like the Apple Watch Series 10 and new AirPods. But the market wasn’t too excited, as AAPL stock only finished 0.05% higher on launch day. The iPhone 16 has some interesting new features, but are they enough to convince many people to upgrade? Maybe not, although the improvements are admittedly a bit more exciting than usual, which I’ll get into later on. Of course, Apple is an excellent business. However, AAPL stock’s rich valuation doesn’t provide too much room for future upside. As a result, I rate the stock as a Hold.

Apple Unveils The iPhone 16 Lineup

In this article, I’ll only be discussing the iPhone 16 launch and not the other new products, as the Apple Watch and AirPods make up a relatively small portion of Apple’s revenues (less than 10% combined). Therefore, let’s dive right into the key details about the iPhone 16, which was “built from the ground up for Apple Intelligence,” according to the firm.

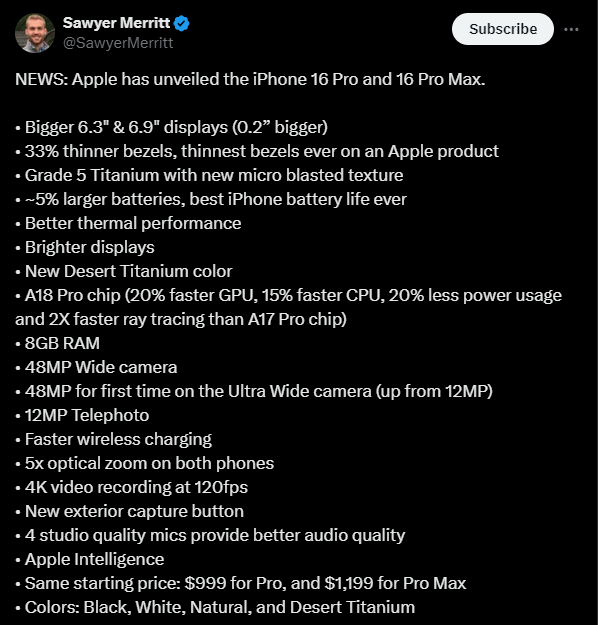

A18 Pro Chip: A key feature of the iPhone 16 is the A18 Pro chip, as it will boost performance, energy efficiency, and graphics performance. According to Sawyer Merritt on X, the A18 Pro chip has a “20% faster GPU, 15% faster CPU, 20% less power usage and 2X faster ray tracing than A17 Pro chip.”

Better battery life: Another notable improvement is the battery, which will be 5% larger. Combined with the 20% less power usage, the battery life saw a relatively large improvement.

According to Apple, the iPhone 16 Pro Max can last for 33 hours during video playback, the best battery life ever in an iPhone. This marks a 14% increase compared to the 29 hours from the iPhone 15 Pro Max. Meanwhile, for the same metric, the iPhone 16 Pro improved by 17% to 27 hours compared to 23 hours for the iPhone 15 Pro.

Better Camera: Regarding the camera, Apple stated, “The powerful camera system features a 48MP Fusion camera with a 2x Telephoto option, giving users two cameras in one, while a new Ultra-Wide camera enables macro photography.” Meanwhile, the iPhone 15 had a 48MP main camera, not fusion. Now, I’m not a camera expert, but I’ve read that the difference is that it “uses computational photography for enhanced versatility, combining data from a 12MP main sensor and a 2x telephoto lens.” This is an improvement over the iPhone 15 camera, which lacked these combined-lens features.

The iPhone 16 Pro and Pro Max models are also now capable of 4K120 fps video recording with Dolby Vision support. Plus, these models have a new 48MP Ultra-Wide camera and a 5x Telephoto camera, as well as studio-grade microphones.

A more easy-to-describe/notice feature is Camera Control. It’s a button on the side of the phone that lets users adjust zoom, depth of field, and more with just a touch.

Apple Intelligence/AI Features: The new iPhones will also have useful and fun AI features. For example, you’ll be able to create new emojis by typing in the description of what you want to create. The example used by Apple was a “Cowboy Frog” emoji. I actually see some upside here, particularly among teenagers. Imagine that you’re in high school and a group of your friends are able to create their own emojis but you can’t. You might feel left out and ask your parents to get you a new phone. I know it sounds crazy, but it’s not that far-fetched.

Further, Apple Intelligence will help users optimize writing. For instance, if you type out a long email, it can edit the email to make it more concise. Another helpful tool is Visual Intelligence. One example given by Apple was taking a picture of a dog and then Visual Intelligence being able to tell you some info like what type of dog it is.

Pricing and additional details: Regarding pricing, the iPhone 16 and 16 Plus will be priced at $799 and $899, respectively, while the 16 Pro and Pro Max models will be priced at $999 and $1,199, respectively. There are some other details as well, which are easily summed up in the tweet below.

iPhone 16 Pro and Pro Max Details (@SawyerMerritt on X)

My Thoughts On The iPhone 16 Unveil

Overall, I think the new features in the iPhone 16 are more impressive than usual. I’ve looked at past iPhone reveals, and this one seems to be a bit better than the others because of the AI aspect and the significant improvement in battery life.

I can picture people choosing to upgrade based on the new features, particularly if their phones are old. However, at the end of the day, people like me will see that the new features are not must-haves and will stay on the sidelines.

Here’s how I look at it. Let’s start with the A18 Pro Chip. While the speed increase stated earlier is notable, iPhones and other top-tier phones are already fast. Will most day-to-day users care about or even notice these speed differences? I have an iPhone 13 Pro, and it’s currently fast enough (and good enough in other aspects) for me to not have to replace it. Of course, this is just my opinion, but I’m sure I speak for many people around the world.

Regarding the camera, the improvements are nice, but how many day-to-day users will truly use or notice the extra features? Plus, Camera Control is cool and all, but I can already adjust the zoom and other things while recording by just touching my screen, so that seems more like a feature for enthusiasts that need extra precision.

And that’s my point. Since the phones are already so advanced, any extra improvements will be relatively small and will be better-suited for enthusiasts rather than day-to-day users. Additionally, many professional photographs/videographers still prefer to use professional cameras rather than phones, although phone cameras surely have their own use cases in the professional world.

The main improvements, in my opinion, are the battery life and AI features. They can be enough to make users upgrade, but I don’t think it will be a crazy number of people.

Is AAPL Stock Undervalued Or Overvalued?

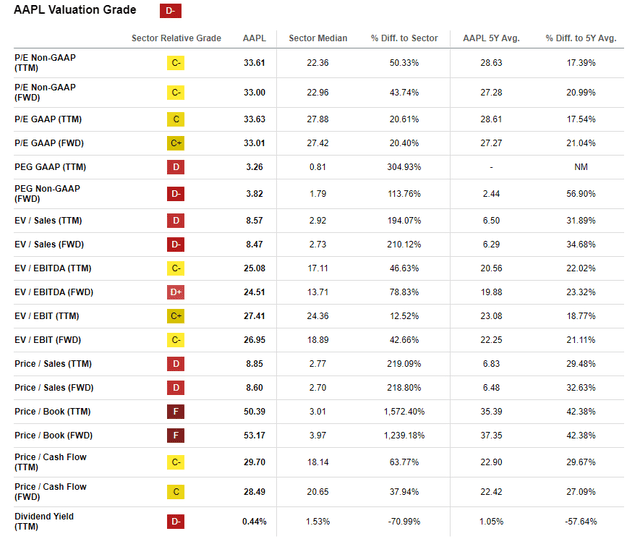

Based on probably all traditional valuation metrics, AAPL stock looks overvalued. Just take a look below. AAPL stock earns a D- valuation grade on Seeking Alpha.

AAPL Stock Valuation Metrics (Seeking Alpha)

Apple is the largest company in the world by market cap, so of course it will have a premium valuation attached to it. Still, a 33x forward P/E ratio doesn’t leave room for valuation expansion gains when considering the company’s modest growth potential. Most likely, any long-term gains that will come from AAPL stock will not be from valuation multiple expansion but rather from EPS growth. Thus, let’s take a look at expected EPS growth.

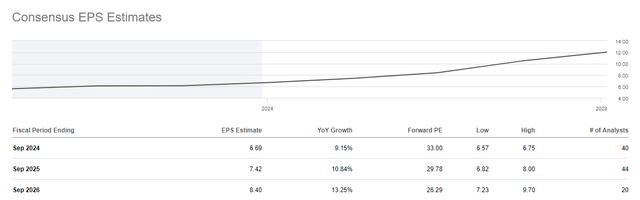

Currently, analysts expect AAPL to grow its EPS by 9.15%, 10.84%, and 13.25% in Fiscal 2024, 2025, and 2026, respectively. That’s not crazy growth, so investors shouldn’t expect crazy gains (like those of the past five years).

AAPL EPS Estimates (Seeking Alpha)

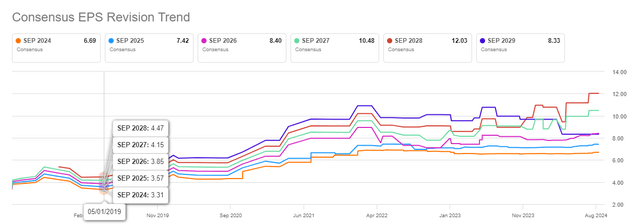

But what if Apple exceeds expectations? Sure. That’s definitely possible. Check the screenshot below. In mid-2019, analysts expected $3.31 in EPS for Fiscal 2024, and now they’re expecting $6.69 in EPS for the same year. But it’s also worth noting that the trend of upward revisions has stopped since the beginning of 2022, and it’s very unlikely that we’ll see such large upward revisions in the next five years.

AAPL EPS Revisions (Seeking Alpha)

Even if upward revisions happen (probably not to the same extent as the past five years), they can be offset by a valuation multiple contraction. I would be completely unsurprised if Apple’s P/E ratio dropped from 33.6x to 30x or to its five-year average of 28.6x. After all, in the past five years, interest rates have gone up, and Apple’s growth rate has slowed, so why should it have a higher valuation now than it did then?

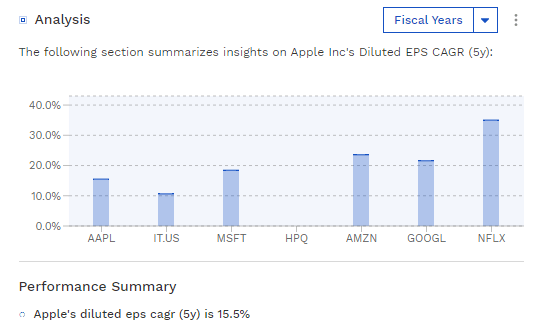

Per Finbox, Apple’s diluted EPS CAGR was 15.5% in the past five years. When you compare that to the current EPS growth estimates, you’ll notice the slowdown.

AAPL EPS CAGR Relative To Peers (Finbox)

The Takeaway

Apple has made some impressive improvements regarding the iPhone 16 lineup when compared to past iPhone events. The most notable improvements to me were the better battery life and Apple Intelligence features, and I can certainly imagine teenagers loving the emoji update. When it comes to other things such as improved speed and camera quality, I think those improvements really only interest enthusiasts for the most part, as everyday people don’t use such advanced features or need insanely fast processing speeds.

Therefore, while I believe that more people than usual will upgrade their phones because of some of the impressive developments, I can’t say with confidence that it will be a large number of people.

That, combined with the stock’s high valuation, which has room to contract, leaves me with a Hold rating on the stock. I like AAPL stock, but at this price, there are definitely better plays out there with higher upside potential.