Justin Sullivan

While I own Apple (NASDAQ:AAPL) shares, I have reason to believe they are a Hold rather than a Buy due to growth and valuation concerns around an otherwise top-class technology stock.

My thesis is that while the stock should appreciate in a steady manner over the next few decades, there are other undervalued and high-growth opportunities that deserve more weight in my portfolio.

Operational Considerations

The company is taking initiatives to transform its supply chain, a shift that is happening across many American companies as the country attempts to domesticate a portion of its manufacturing processes. Apple specifically is diversifying towards India and Vietnam after lessons from supply chain issues caused by COVID-19 disruptions, as well as investing in U.S. semiconductor chip foundries.

Yet, it continues to build its partnership with the Taiwanese semiconductor giant TSMC (TSM), manufacturing Apple silicon chips with the company in Arizona by 2024. This should increase the processing power and functionality of Apple products for gaming, production, and creative projects.

In Vietnam, the firm is investing in new manufacturing facilities with Luxshare Precision Industry Co. (SHE:002475). A new $330 million investment for a plant in the Bac Giang province will produce a range of Apple’s components.

In India, Foxconn Technology Group (OTCPK:FXCOF) has announced a $1.5 billion investment. This firm is Apple’s core iPhone manufacturer. Foxconn is allocating funds to an Indian construction project with a goal of shifting manufacturing from China to India. According to Morgan Stanley, Apple’s India revenue could grow seven times over the next decade to approximately $40 billion.

I think these shifts are particularly crucial to understand as they represent a strategy of geographic diversification as well as a maintenance of margins from outsourced manufacturing while still honoring the need for more domestic U.S. production, specifically in semiconductor chips as it relates to geopolitical tension with China and Taiwan.

The firm has also announced its Apple Vision Pro, an augmented reality headset that looks very much like a promising addition to the Apple ecosystem and product set, but still doesn’t remove my growth concerns outlined below.

Ming-Chi Kuo believes the product will be released in late January or early February 2024. Kuo, a renowned Apple analyst, deems this the ‘most important product of 2024.’ He also projects a total shipment of approximately 500,000 units for the year.

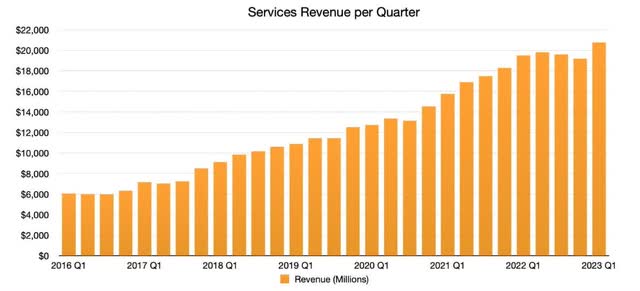

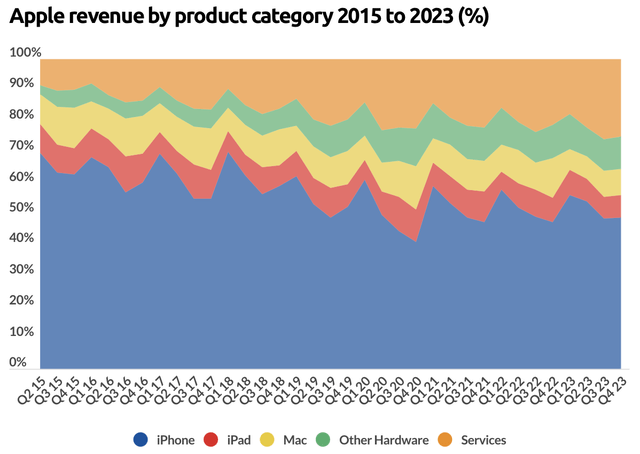

Apple services are also one of the core and fast-growing elements of its business for the future. We can see the significant growth historically since 2016 in the following chart:

Apple also ended 2023 with a billion subscribers, and revenue reached an all-time high of $22.3 billion in the final quarter ($85.2 billion annually). To compare this to other segments of the business, iPhones brought in $200 billion annually, which is a decrease from $205 billion last year. All other hardware, including Macs, iPads, and wearables, grossed $97 billion annually.

While Apple may have blamed the macroeconomic environment with high interest rates and inflation affecting consumer spending, I have my doubts and am beginning to perceive Apple in a solidified late-stage position, where it may struggle with product innovation and rely on emerging markets for its continued growth. In Q3 2023, Apple had its best-ever quarterly shipments in India.

Growth Concerns

I think Apple’s approach to artificial intelligence is going to be paramount to its future growth. I also believe that if it fails to adopt artificial intelligence properly, it will significantly fall behind new innovative and more advanced products that come to market.

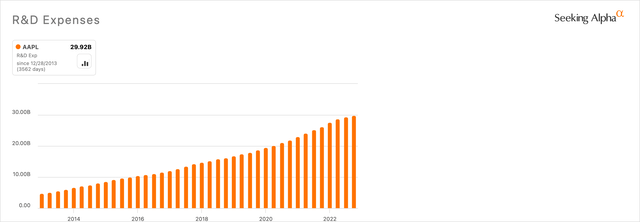

The company is well aware of this. Apple’s $22.61 billion R&D investment in 2023 reflects a proactive approach to technology adoption. The company made significant strides in early-stage AI with Siri. Tim Cook has directly mentioned that the firm has been doing research into numerous AI technologies, including generative AI, for a while. The New York Times also reported that Apple has opened negotiations with major news companies for permission to train its generative AI on their materials.

These AI developments, if not done with the direct intention of creating AI products, will likely bolster application and service revenue. These little iterations of artificial intelligence within existing products will still leave growth concerns and remain a necessary adoption to maintain relevance, rather than high-growth innovation like Vision Pro.

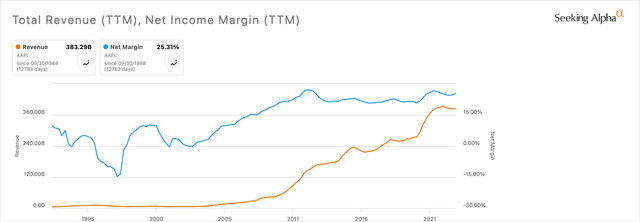

I’d like to look at the track record of Apple’s revenue and margins to get a deeper understanding of what could be affected by the current and future potential operational hazards.

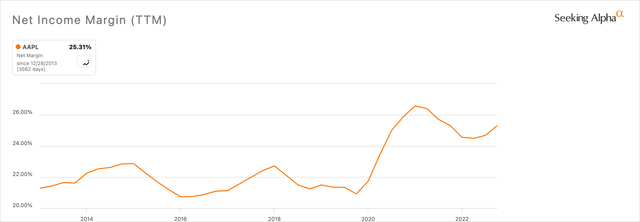

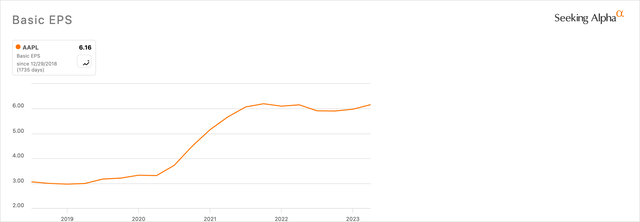

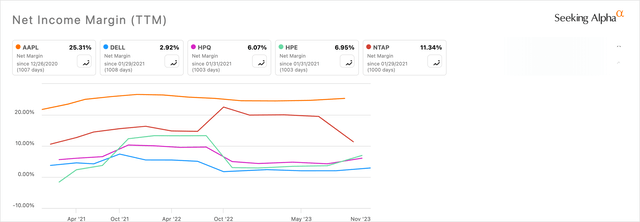

Both the net margin and revenue for the company have gone up at strong rates over all time. However, notably, in the last 10 years, the firm’s net income has struggled until 2020 onwards. This could be due to issues of scale, where the organization is struggling to improve its operational efficiency due to already-tightened procedures. However, AI could also produce more growth in the margin area if implemented effectively in design, manufacturing, and service roles, for example.

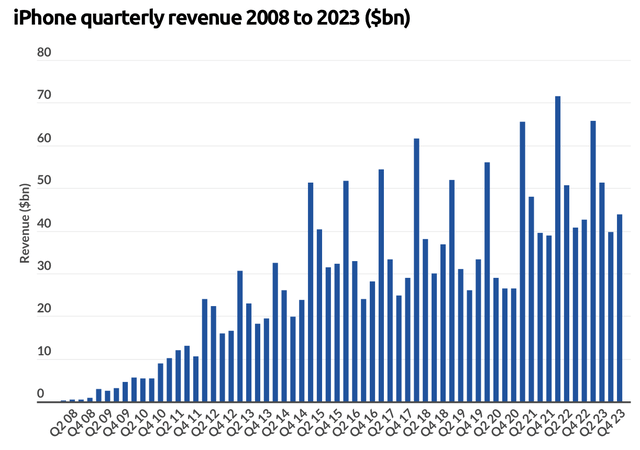

The slowdown in iPhone growth is worth delving deeper into as it is the company’s core revenue stream. In Q4 2023, the company actually saw a September quarter record for iPhone revenue, which is a strong sign for potentially continued growth to come, even amid the annual decrease in Apple smartphone revenue.

Business of Apps Business of Apps

The long-term growth trajectory of the iPhone looks relatively strong from the above data, and there is an argument to be made that the growth will continue as emerging economies begin to spend more on luxury technology, placing Apple products on a continued growth curve.

Valuation

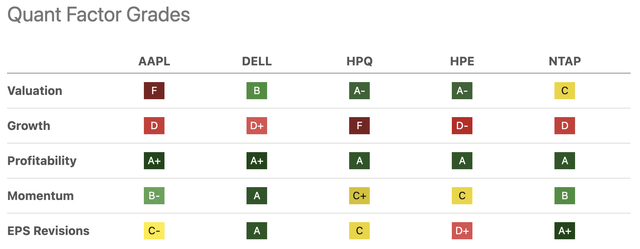

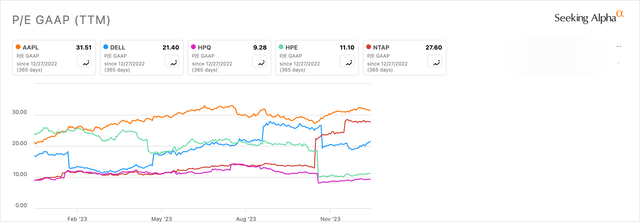

Seeking Alpha’s Quant system allocates a Factor Grade F for Apple’s valuation. But, its forward P/E ratio is a B-, at 29.48. I’ve compared this to the company’s core peers listed by Seeking Alpha to gauge how overvalued the firm might be relatively.

Apple seems overvalued relative to peers on its present, not forward, P/E ratio.

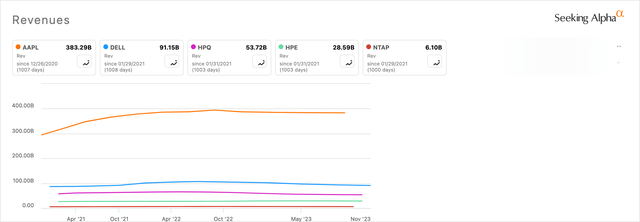

Apple is quite rightly more highly valued in relation to its earnings than its dominant peers. This is particularly true when we compare the company’s net income margins and revenues.

Author, Using Seeking Alpha Author, Using Seeking Alpha

It may be a fair conclusion that Apple is undoubtedly dominant in relation to its peer set and remains fairly valued when considering its market position. However, this conclusion doesn’t fully account for a poor PEG GAAP ratio of around 96, indicating both a slowdown in earnings growth and a present overvaluation to consider, which could also be attributed to the broader macroeconomic slowdown in the U.S. and abroad at present.

Recent Challenges Contributing to Risk

Apple recently lost its fight over USB-C against Europe’s new legislation that now mandates the use of USB-C over Apple’s Lightning ports by December 2024. This symbolizes a more direct influence of international and governmental legislation on the technological direction of Apple moving forward, something that could inhibit its growth.

Apple is also facing litigation in relation to its App Store fees, which are a significant driver of its service revenue. Epic Games, who make Fortnite, have alleged Apple is committing monopoly practices. While Apple won the case in 2021, Epic Games is asking the U.S. Supreme Court to review it. While the App Store did not legally have to change, there were valid concerns over the extortion of smaller parties dependent on Apple for distribution.

Now, Apple is facing a $1 billion lawsuit in the UK by over 1,500 app developers. The charges are led by Sean Ennis, a Professor at the University of East Anglia. Apple’s commission fees range from 15% to 30% on the App Store, which makes profitability incredibly difficult for smaller upstarts that Apple should be promoting and nurturing, in my opinion. An inevitable reversion to some form of fairness will see Apple’s services revenue decline in response to this growing concern.

The Bottom Line

My overall sentiment on Apple is strong. I perceive this company to be a staple in most portfolios, and it is famous as such.

However, the growth concerns are real, and I am concerned that the company may not be able to take the right measures (product innovation) and instead rely on financial and operational changes as well as emerging market growth for its future stock returns. For that reason, my analyst rating is Hold.