- Investors should brace for more volatility next week amid growing uncertainty over the Federal Reserve’s policy outlook.

- U.S. CPI inflation, the latest retail sales figures, and a read on wholesale prices, as well as earnings from major retailers will be in focus.

- Looking for more actionable trade ideas to navigate the current market volatility? Try InvestingPro today.

- Unlock the potential of InvestingPro for 55% off this Black Friday and never miss out on a market winner again!

Investors should brace for fresh turmoil next week as the stock market faces several market-moving events, including key economic data as well as earnings from the major U.S. retailers.

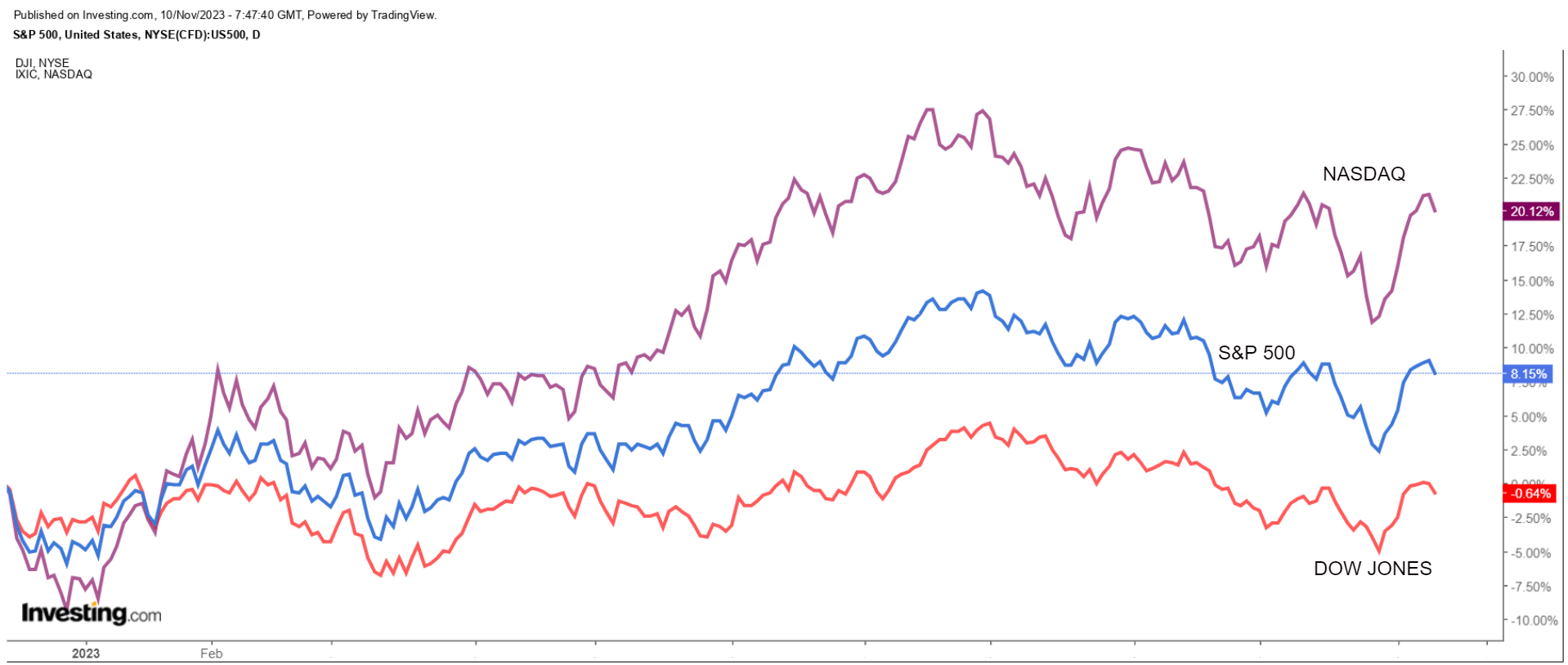

U.S. stocks slipped on Thursday, ending the longest winning streaks for the and the in two years. The benchmark S&P 500 snapped an eight-day run of gains, while the tech-heavy Nasdaq ended a nine-day string of wins.

Stocks sold off after Federal Reserve Chairman Jerome said the central bank is “not confident” it has done enough in the battle against inflation.

With investors growing increasingly uncertain over the Fed’s monetary policy plans, a lot will be on the line during the week ahead.

U.S. CPI Report – Tuesday, November 14

With Fed Chair Jerome Powell reiterating that his main objective is to bring inflation back under control, next week’s report will likely be key in determining the Fed’s policy moves in the months ahead.

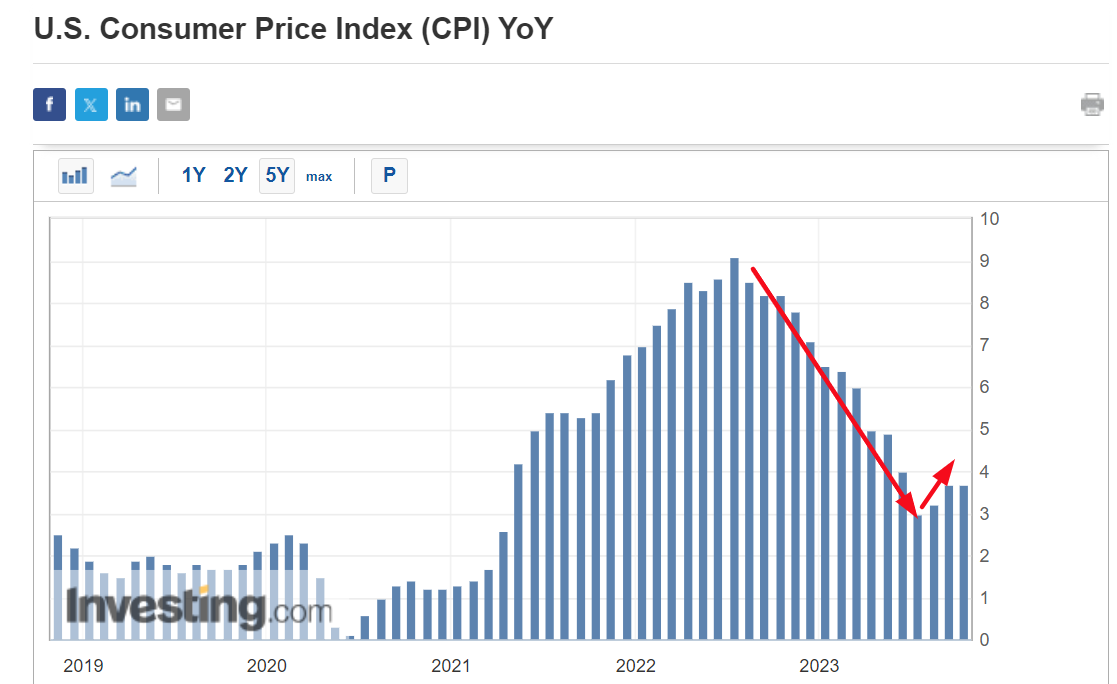

The U.S. government will release the October inflation report on Tuesday at 8:30 AM ET and the number could be hotter than September’s 3.7% year-over-year pace.

As per Investing.com, the consumer price index is forecast to rise 0.1% on the after edging up 0.4% in September. The headline annual inflation rate is seen rising 3.8%, accelerating from a 3.7% annual pace in the previous month.

Inflation has come down substantially since the summer of 2022, when it peaked at a 40-year high of 9.1%, however, prices have resumed their uptrend in recent months and are still rising at a pace nearly twice the U.S. central bank’s target.

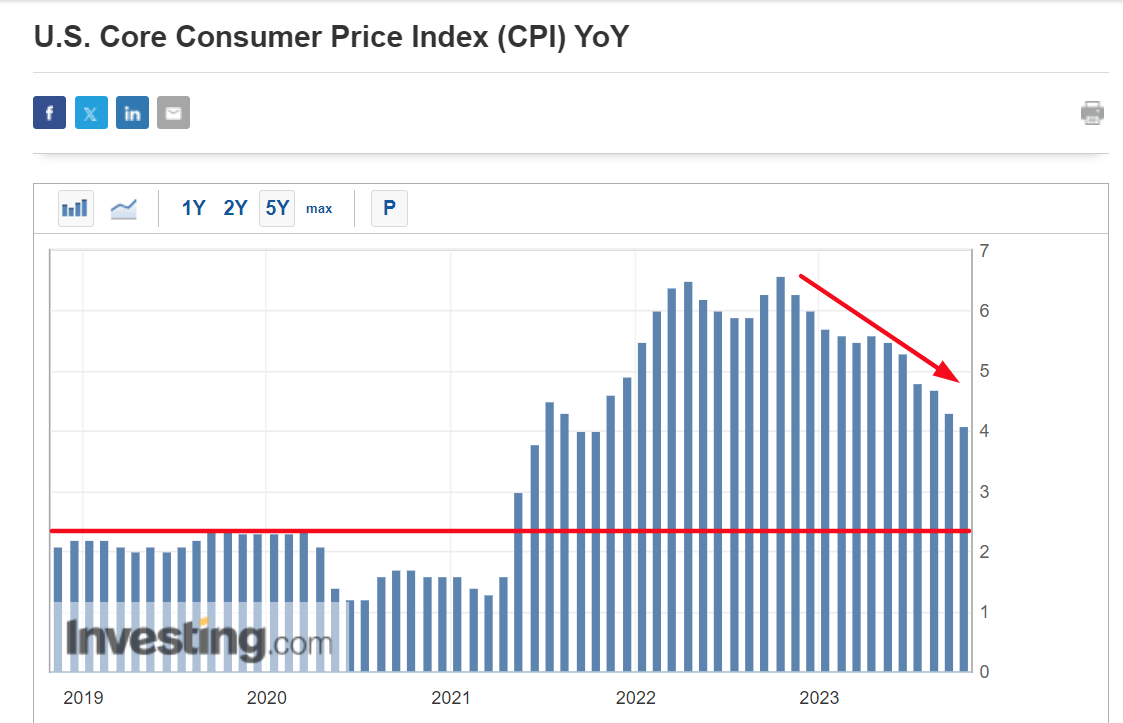

Meanwhile, the October index – which does not include food and energy prices – is to rise 0.3%, matching the same increase seen in the preceding month. Estimates for the year-on-year figure call for a 4.1% gain, registering an identical surge as observed in September.

The core figure is closely watched by Fed officials who believe that it provides a more accurate assessment of the future direction of inflation.

Prediction: I believe the CPI report will underscore the material risk of a fresh increase in inflation, which is already running far more quickly than what the Fed would consider consistent with its 2% target range.

A notably elevated figure, with annual CPI reaching 3.9% or higher, will keep the pressure on the U.S. central bank to maintain its fight against inflation.

In remarks made at an IMF event on Thursday, Powell acknowledged that U.S. inflation had come down over the past year but signaled the Fed is far from ready to accept that inflation is on a sustainable path lower.

The fight to restore price stability “has a long way to go,” the Fed chair said.

Powell added that “if it becomes appropriate to tighten policy further, we will not hesitate to do so.”

Therefore, I hold the opinion that the current environment is not indicative of a Fed that will need to pivot on policy and there is still a long way to go before policymakers are ready to declare mission accomplished on the inflation front.

U.S. Retail Sales, PPI – Wednesday, November 15

With the U.S. central bank being data-dependent, investors will pay close attention to the latest retail sales figures as well as the October producer price index report, which are both due at 8:30 AM ET on Wednesday.

After blew past expectations last month, the key question is whether consumer spending will remain strong enough for the Fed to maintain its efforts to cool the economy or will American shoppers finally show signs of stress.

Economists forecast a month-over-month decline of -0.1% in the headline number, a sharp deceleration from the +0.7% gain for September, with auto sales coming in weaker during the month.

After stripping out the auto and gas categories, are expected to show a 0.2% gain, compared to the 0.6% increase seen in the month before.

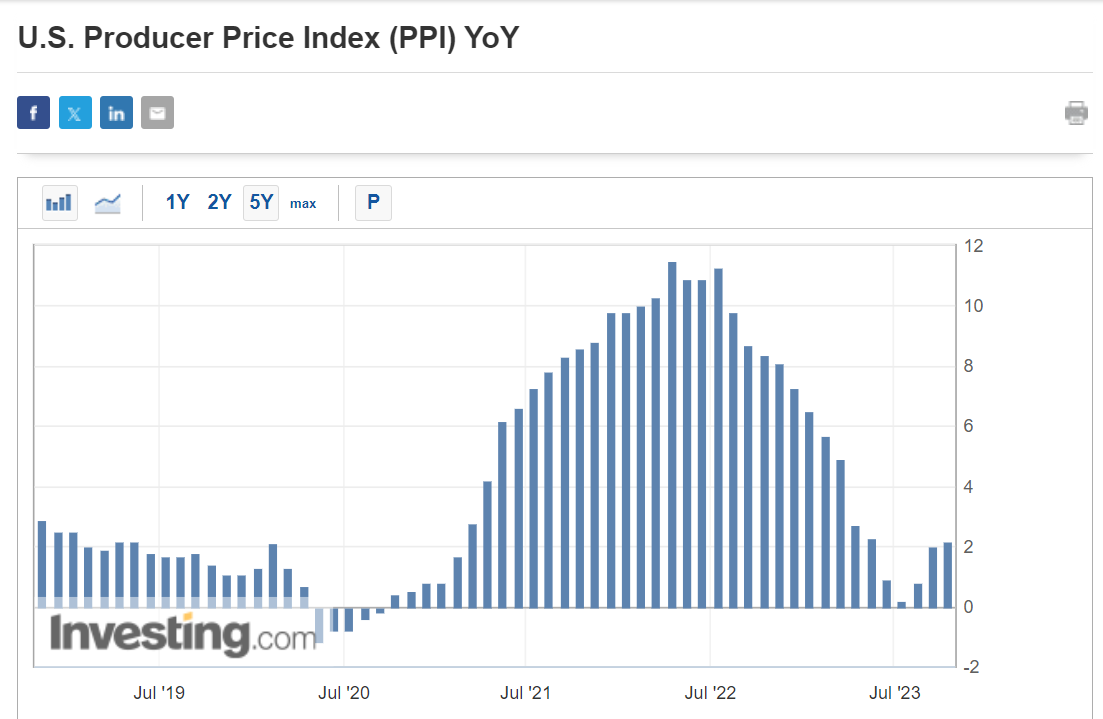

Meanwhile, the latest update on producer prices will give inflation watchers another talking point amid the recent increase in oil and gasoline prices.

The headline year-over-year October reading is expected to rise 2.3%, after edging up 2.2% in September. If that is in fact reality, it would mark the fourth straight month in which wholesale prices have picked up from the previous month.

The annual rate is forecast to hold steady at 2.7%, a level which is still too high for the Fed.

Prediction: I anticipate the pair of reports will bolster the case for keeping rates elevated to cool the economy and prevent inflation from rebounding.

Powell said Thursday that the Fed “is committed to achieving a stance of monetary policy that is sufficiently restrictive to bring inflation down to 2% over time; We are not confident that we have achieved such a stance.”

The reminder that the Fed’s hiking cycle remains alive forced traders to raise their expectations of a rate increase in December or January, however, chances are still slim according to the Investing.com .

In addition, market participants pushed out bets on the U.S. central bank’s first rate cut to June 2024, compared with an earlier forecast for cuts to begin in May.

Retailer Earnings – All Week

Upcoming earnings from the major U.S. retailers will also be in focus next week as the third quarter reporting season draws to a close.

Retailers will be the last group to deliver financial results and investors will be looking for further insight into the health of consumer spending against a backdrop of persistently high inflation and worries over a looming recession.

Topping the lengthy list scheduled to report Q3 results in the coming week are Walmart (NYSE:), Home Depot (NYSE:), Target (NYSE:), TJX Companies (NYSE:), Macy’s (NYSE:), Ross Stores (NASDAQ:), Gap (NYSE:), and BJs Wholesale Club (NYSE:).

Other high-profile retailer companies, such as Best Buy (NYSE:), Lowe’s Companies Inc (NYSE:), Kohl’s Corp (NYSE:), Nordstrom (NYSE:), Burlington Stores (NYSE:), Abercrombie & Fitch Company (NYSE:), American Eagle Outfitters (NYSE:), and Dick’s Sporting Goods Inc (NYSE:) are due to report results the following week.

Most retailers – which are perhaps the most sensitive to shifting economic conditions and consumer spending – have struggled this year amid a gloomy macroeconomic outlook of elevated inflation and slowing economic growth.

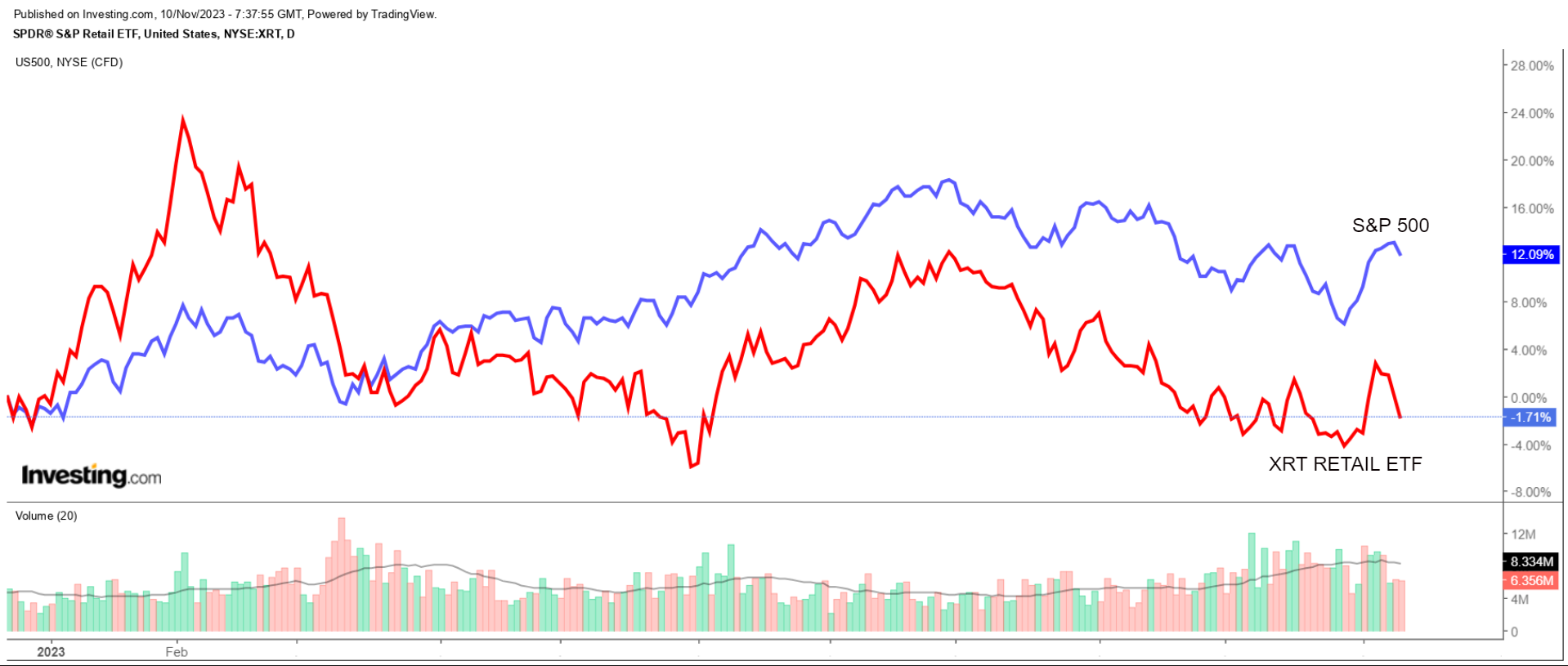

The retail industry’s main ETF – the S&P Retail ETF (NYSE:) – is down 1.8% year-to-date, lagging the S&P 500’s near 13% gain over the same period.

Underscoring several near-term headwinds plaguing the sector, shares of Home Depot, which is the top U.S. home improvement chain, are down roughly 9% in 2023, as Americans cut back spending on discretionary items due to the uncertain economic climate.

There are some exceptions of course. Take Walmart for example, whose shares are up 15.6% this year as it benefits from changes in consumer behavior due to lingering inflationary pressures that are causing disposable income to shrink.

As such, next week’s earnings updates from the retail heavyweights will be a critical topic for investors.

All things considered, investors may want to exercise caution in the very near term as the current environment in my opinion is not ideal to be adding to your exposure to equities amid a looming pullback.

***

Buy or Sell? Get the answer with InvestingPro for Half of the Price This Black Friday!

Timely insights and informed decisions are the keys to maximizing profit potential. This Black Friday, make the smartest investment decision in the market and save up to 55% on InvestingPro subscription plans.

Whether you’re a seasoned trader or just starting your investment journey, this offer is designed to equip you with the wisdom needed for more intelligent and profitable trading.

Black Friday Sale – Claim Your Discount Now!

Disclosure: At the time of writing, I am short on the S&P 500, Nasdaq 100, and Russell 2000 via the ProShares Short S&P 500 ETF (SH), ProShares Short QQQ ETF (PSQ), and ProShares Short Russell 2000 ETF (RWM).

Additionally, I have a long position on the Energy Select Sector SPDR ETF (NYSE:XLE) and the Health Care Select Sector SPDR ETF (NYSE:XLV).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.