- Warren Buffett’s stock-picking skills are truly exemplary.

- However, gaining such a skill can be quite challenging for regular investors.

- On the bright side, there is another skill that is easier to attain and crucial for every investor to emulate: patience!

- InvestingPro Summer Sale is back on: Check out our massive discounts on subscription plans!

Interest rates, recessions, crises, bubbles, inflation, pandemics, wars – you name it, Warren Buffett has navigated through every possible event in an investor’s life.

Yet, his results are nothing short of incredible, boasting an annualized return of 19.8% from 1965 to the present, compared with 9.9% for the index. This makes him an outstanding performer and the best investor in history, thanks to the durability and consistency he has demonstrated over the years.

While Buffett’s ability to select the right stocks is often attributed to his success, it is not an easy skill to acquire, contrary to popular belief. However, there is another skill that is accessible to everyone, and that is patience. Developing patience in investing is crucial.

You won’t believe it, but Apple (NASDAQ:), which happens to be a significant stock in the Berkshire Hathaway (NYSE:) portfolio, has been held for more than seven years since its purchase in early 2016.

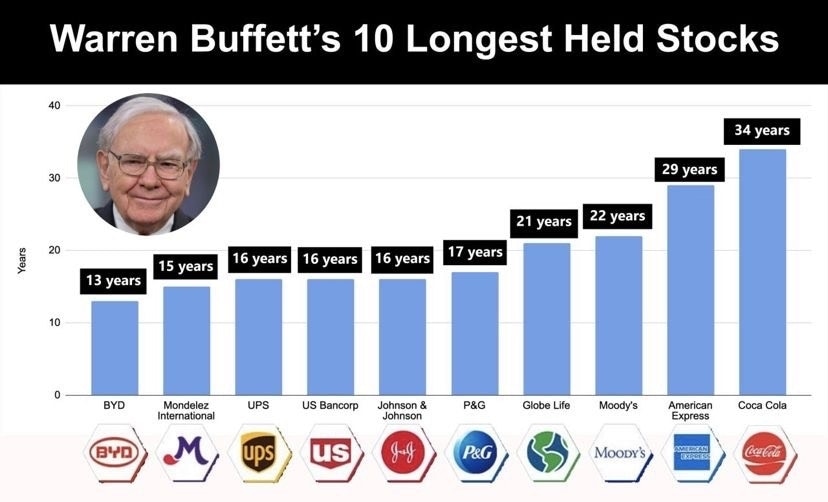

To summarize, Warren Buffett’s long-term holdings include:

- Coca-Cola Co (NYSE:) – Held for 34 years.

- American Express Company (NYSE:) – Held for 29 years.

- Moody’s Corporation (NYSE:) – Held for 22 years.

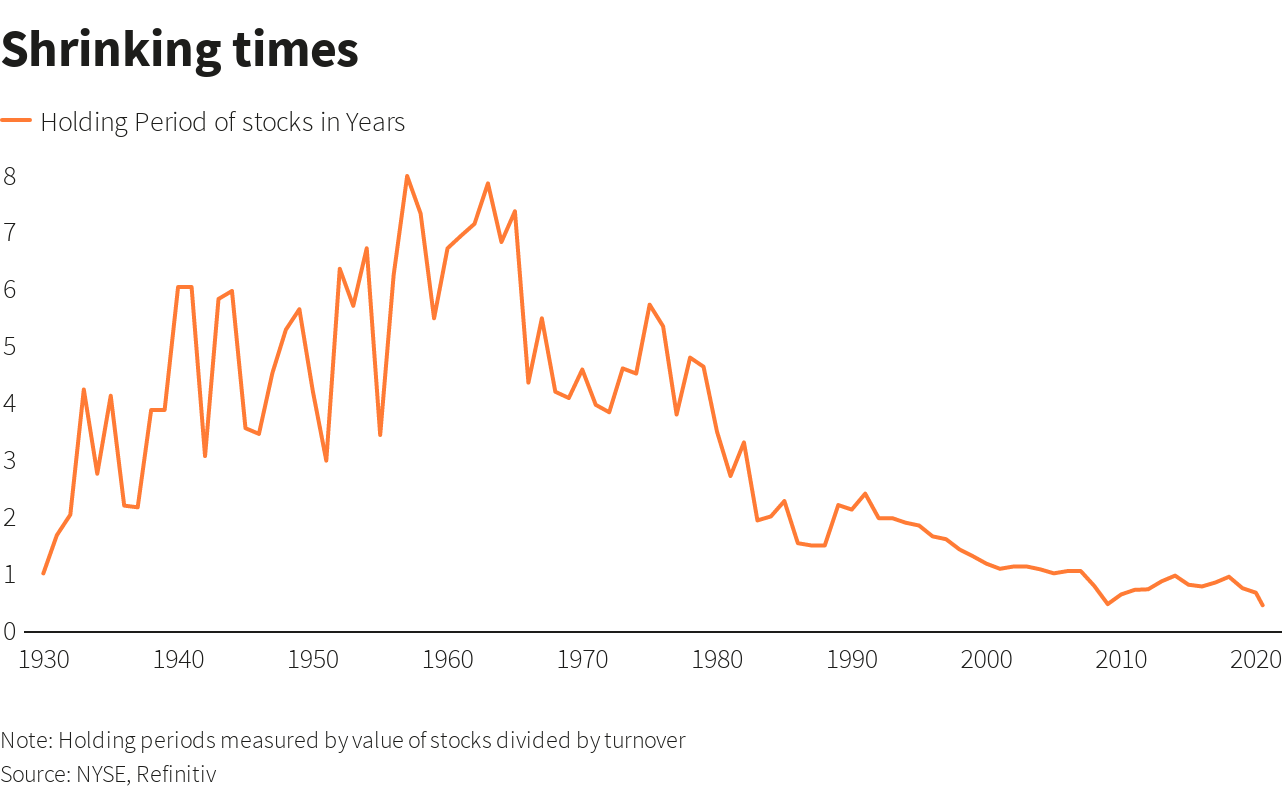

These stocks have withstood every possible event an investor can imagine. In contrast, the average holding time for securities in an average investor’s portfolio is a mere six months!

Indeed, many investors often become impatient after holding a stock for just a month, expecting immediate profits. Some even go as far as selling the stock if it experiences a slight downturn because they believe it’s not working.

Additionally, numerous investors entered the market at the peak of late 2021 and are now frustrated because, even after a year and a half, they have not yet recovered their initial investment.

The concept of patience seems to be lacking in the world of investing, especially among average investors. This starkly contrasts with Warren Buffett, whose strength lies in his remarkable time horizon: 34 years of holding certain stocks.

This extended timeframe has allowed Buffett to weather various market cycles and garner incredible returns.

You can purchase the subscription at a fraction of the regular price. Our exclusive summer discount sale has been extended!

Enjoy incredible discounts on our subscription plans:

- Monthly: Save 20% and get the flexibility of a month-to-month subscription.

- Annual: Save an amazing 50% and secure your financial future with a full year of InvestingPro at an unbeatable price.

- Bi-Annual (Web Special): Save an amazing 52% and maximize your profits with our exclusive web offer.

Don’t miss this limited-time opportunity to access cutting-edge tools, real-time market analysis, and expert opinions.

Join InvestingPro today and unleash your investment potential. Hurry, the Summer Sale won’t last forever!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling, or investment recommendation. As such, it is not intended to incentivize the purchase of assets in any way. As a reminder, any assets are hazardous and evaluated from multiple points of view; therefore, any investment decision and the associated risk remain with the investor. The author does not own the stocks mentioned in the analysis.