ozgurdonmaz

My Thesis

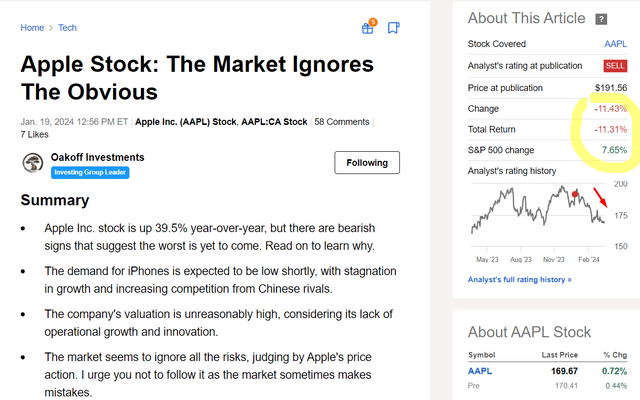

My only article on Apple Inc. (NASDAQ:AAPL) stock was published on January 19, 2024, with a “Sell” rating, as I expected relative weakness in AAPL at the time due to iPhone demand potential issues and the extremely high valuation. Since then, the stock has fallen by more than 11%, while the S&P 500 Index (SP500) (SPX) has risen by 7.65% so the timing in this case was on my side:

But today I see reasons to be more optimistic: Apple’s valuation has fallen slightly due to multiple contraction, and in early May the company will have a chance to surprise the market with a relatively good report (I expect so) against the backdrop of lowered expectations. Moreover, from a technical analysis perspective, the stock could rise again shortly. I, therefore, upgrade AAPL to “Buy”.

My Reasoning

In my last article, I talked about how Apple is lagging behind other mega-cap stocks in terms of AI innovation and its growth rates are falling while the stock looks quite expensive. But my attitude to these moments has changed somewhat. First, I’ve realized that Apple is primarily about innovation in hardware and software, and the company probably doesn’t need overly sophisticated LLM models or infrastructure to keep its products among the most desirable in the addressable markets. Second, the average business growth rate is actually declining, but as we will see when we discuss the latest financials and consensus forecasts, Apple is still growing, albeit from a much larger base. Third, the valuation is actually lower now than it was last time I looked in January – in my opinion, AAPL has lost its premium and now has growth potential equal to that premium and the combination of buyback yield and dividend yield.

Let’s start in order – with the financial analysis.

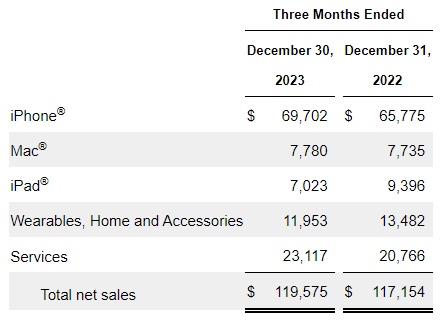

In fiscal Q1 2024, Apple’s revenue reached $119.6 billion, marking a 2% increase from the previous year and a significant 34% QoQ jump, breaking a streak of 6 consecutive quarters of declining sales. Looking at the business structure, we see that the iPhone segment triumphed with sales of $69.7 billion (+6% YoY) driven by the resounding success of the iPhone 15 series, which was praised by customers and critics alike as the CEO Tim Cook noted during the earnings call. Mac sales reached $7.8 billion (flat YoY), driven by the appeal of the latest M3 models, while iPad sales declined by more than 25% YoY in a challenging environment. Wearables, Home, and Accessories sales fell to ~$12 billion (-11.3% YoY) and were impacted by timing shifts, but the Apple Watch continued to attract many new users. Services shone with a new revenue record of $23.1 billion (+11.3% YoY), fueled by strong engagement and a thriving ecosystem:

AAPL’s 10-Q

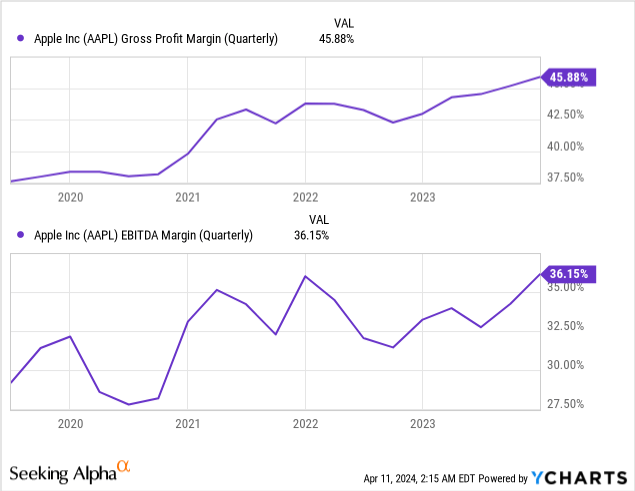

The company’s gross margin improved to 45.9%, up from 45.2% in the previous quarter and 43.0% a year ago. EBIT margin followed suit, rising to 33.8% from 30.1% in Q4 2023 and 30.7% from Q1 2023. So as far as I see it, the company’s margins look more than stable despite the massive global headwinds – the brand and pricing power obviously play an important role.

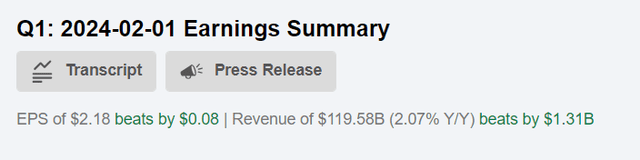

Apple’s EPS went up by 16% YoY, standing at $2.18 for Q1 2024 beating the consensus estimate by $0.08 (3.66%):

By the end of Q1 2024, Apple’s cash and short-term investments totaled $73.1 billion – up from $61.6 billion in Q4 2023. All thanks to cash flow from operating activities rising by almost 85% QoQ, which also improved the FCFF by nearly 170% QoQ:

Seeking Alpha, AAPL’s cash flow statement

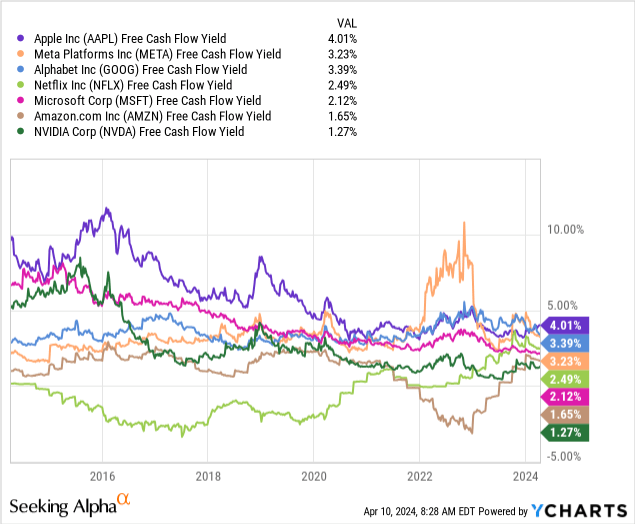

Apple continues to be a real cash flow machine. Looking ahead a little, it’s worth noting that the continued growth in FCF against a backdrop of the falling stock price in recent weeks has made AAPL the cheapest stock in terms of FCF yield when we compare it within the “Magnificent 7” group of peers:

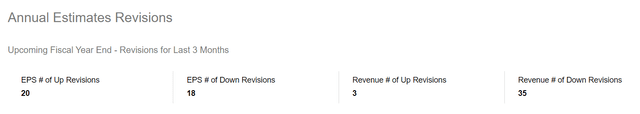

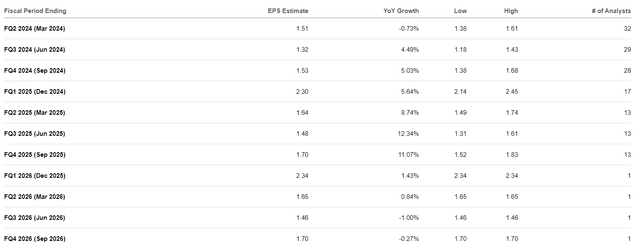

As we may find in the earnings call transcript, for fiscal Q2 2024 Apple’s management anticipates revenue performance to mirror that of the previous year’s March quarter: With the expected normalization of inventory replenishment and pent-up demand from the previous constraints, the iPhone segment’s revenue is going to be similar to the previous year’s levels (i.e. flat YoY). The Services business is forecasted to maintain its double-digit growth rate, akin to the performance observed in Q1. Gross margin is expected to range between 46% and 47% (that’s quite high, just like in Q1), while OPEX is projected to fall between $14.3-14.5 billion (slightly lower in the mid-range than Q1’s $ 14.482 billion). Other income and expenses are estimated to be around $50 million, excluding any potential impacts from the mark-to-market of minority investments, with a tax rate expected to hover around 16%. So overall, I expect that Apple’s earnings per share in the second quarter could increase slightly by 1-3% year-on-year due to all these expectations. That’s not much, but it’s more than what the market is expecting at the moment:

Seeking Alpha, AAPL’s EPS consensus

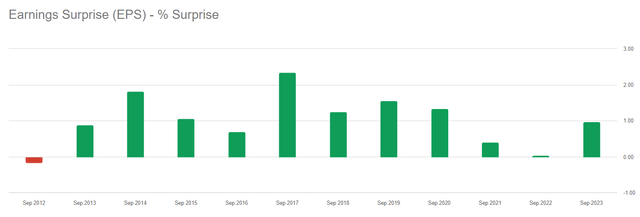

I think that the management’s forecast is more than realistic – in any case, the company has generally achieved its previous forecasts, thus overcoming analysts’ skepticism:

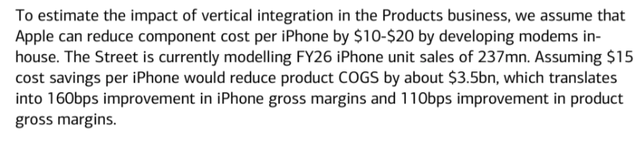

Here we see the first main reason for my upgrade today: in my opinion, the market, represented by 32 analysts, has formed too negative a forecast for Apple, creating fertile ground for another EPS beat in May. First, this “fertile ground” comes from the market’s misunderstanding of how the vertical integration of the company and the mix gives Apple the ability to maintain a relatively high gross margin over time. Yes, the company’s business is cyclical, but the gross margin looks stable, and a continued focus on vertical integration in the product business should provide the opportunity to expand it even further. This is the conclusion reached by BofA analysts in their latest note (proprietary source):

This is a gradual improvement process, but I think we will still see a stable gross margin in Q2 2024. Secondly, the historical pattern of EPS beats is in front of our eyes. In addition to that, over the last 3 months, analysts have significantly lowered their sales and earnings forecasts, creating a lower basis for comparison. Therefore, I see more chances for another beat than a miss.

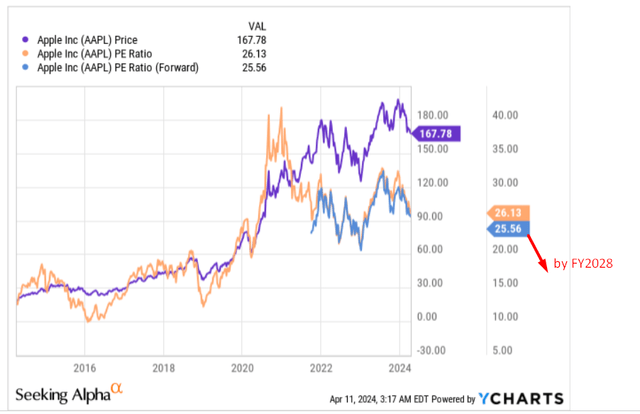

Argus Research analysts (proprietary source) expect Apple’s EPS for FY2024 to be $6.90 and anticipate further growth in FY2025, with a projected EPS of $7.21 per share. These forecasts are above the consensus, expecting annual EPS growth rates of 12.56% and 4.49%, respectively. But even if you believe the consensus data only, the company’s valuation will return to 10-year norms over the next few years (YCharts data) if the consensus is not too far from the truth.

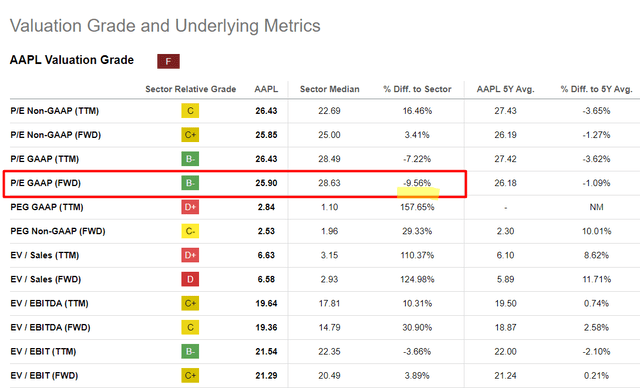

Here’s my 2nd point supporting today’s upgrade: Apple stock is starting to appear fairly valued, even though its multiples are slightly above average. So with ongoing share buybacks and a steadily rising dividend payout, Apple is already an appealing investment choice for those thinking medium-term, in my opinion. The fact that AAPL’s next year’s P/E ratio is already 9.5% below the IT sector average is further evidence of the recovery potential of the stock.

Seeking Alpha, AAPL’s Valuation, Oakoff’s notes

If we include the buyback yield of 0.86% (TTM buybacks divided by the market cap) and a dividend yield of 0.60% (Seeking Alpha data), we have a medium-term upside potential of ~11% if the stock’s forwarding P/E reverses back to the average. That doesn’t look bad, in my view.

Another reason for today’s upgrade is the technical potential for AAPL stock to rebound. Upon examining the daily chart and identifying zones of support and resistance, it’s evident to me that today’s price is closely aligned with what I consider to be a robust support zone. Assuming a positive earnings report in May, which is my underlying assumption, I anticipate the stock to recover to at least $190 per share, indicating an upside potential of ~8.6% from the current price level. The target for this price target comes from the price range AAPL formed recently, as can be seen in the chart below:

TrendSpider Software, AAPL, daily chart [Oakoff’s notes added]![TrendSpider Software, AAPL, daily chart [Oakoff's notes added]](https://static.seekingalpha.com/uploads/2024/4/11/53838465-17128208764885895.png)

Risk Factors To My “Buy” Thesis

When talking about the risk factors surrounding Apple, there is no getting around the risk of litigation, which has been ignored by many in recent years. In late March 2024, AAPL’s stock continued to decline amidst the confirmation of a rumored lawsuit filed by the U.S. Department of Justice ((DoJ)), along with 16 attorneys general, alleging monopolistic behavior by Apple to establish dominance in the U.S. smartphone market. The outcome of this lawsuit, expected to unfold over at least a year, will likely determine whether Apple can effectively defend its closed ecosystem or will need to adopt a more open approach. I don’t foresee this legal action significantly affecting the company’s future net income. Nonetheless, I remain optimistic about its recovery growth prospects. I’m focusing on analyzing what can be assessed, particularly the operational aspect of the business, which appears poised to sustain modest growth and potentially deliver positive EPS surprises shortly. In general, analysts of Gimme Credit agree with me here, writing the following (proprietary source):

We hesitate to make investment decisions based on legal issues, but in our view, the charges in the lawsuit will be difficult to prove in court. In any case, a judgment is likely years away, and we think it is unlikely that Apple would choose to settle. Should Apple lose its case, it may have to pay a huge fine, and the profitability of its app store is highly likely to decline. Meanwhile, the European Commission just fined Apple EUR1.8 billion for preventing music streaming rivals from offering user promotions and subscription upgrades. The European Union is investigating Apple and others regarding a possible violation of the Digital Market Act. However, Apple has the resources to absorb any blows, with cash of more than $40 billion and marketable securities of more than $32 billion. More importantly, we project the company will produce free cash flow of $85 to $90 billion this year. As a result of better EBITDA and lower debt levels, leverage has declined steadily over the past four years, going from 1.5x in fiscal 2020 to an estimated 0.8x for this fiscal year. Although the lawsuit will be a distraction, Apple is well prepared.

Source: Gimme Credit [March 26, 2024] – proprietary source

Another concern regarding my upgrade today revolves around the assumption that Apple will consistently maintain a premium valuation. I genuinely believe in this notion because, in my view, the company’s products are of exceptionally high quality, which contributes significantly to its revenue stickiness. The strength of Apple’s brand ensures sustained demand, irrespective of market conditions, a feat few companies in the IT sector can match. However, if my assumption proves wrong and a P/E multiple of 25x for Apple is deemed excessive, the stock may face continued decline: Even robust financials may not suffice to shield investors from potential losses if the valuation multiple contracts to 15-20 times earnings in the foreseeable future.

Your Takeaway

The risks on the market have really increased significantly to date – potential investments in Apple stock are no longer as easy to make as they used to be. However, after the decline we’ve seen in recent weeks, I’m inclined to believe that AAPL stock has already become a sufficiently attractive idea for at least a medium-term purchase. First, the company’s financial metrics remain strong, and excessive concerns about macroeconomic headwinds have greatly reduced expectations for Q2 2024 results. I expect Apple Inc. to beat consensus expectations again, which will provide the necessary catalyst for the stock’s recovery. Second, I believe that AAPL has already fallen to its fair value price, which means that when the premium returns to its valuation, it should rebound. And third, my fundamental conclusions are supported by a favorable technical picture. Therefore, based on the combination of various bullish factors, I am upgrading AAPL from “Sell” to “Buy” and recommend considering the stock (at least) in the medium term.

Good luck with your investments!