Stocks gained on Wednesday, rising by around 80 bps, as the and rates fell.

There is still a lot of data to come this week, with the on Friday now front and center. However, despite rates falling, the continued to steepen, as the fell by ten bps, and the fell by five bps, which pushed the 10/2 spread to -0.32% and its highest close since October 2022.

Stocks didn’t seem to care that the yield curve was steepening because the index moved higher today by around 85 bps, finally bouncing after its RSI fell below 30 yesterday, and so today’s rally, at least took the index out of an oversold position.

Could the index rally back to 4,300 in a couple of days?

That is possible, but I do not think it changes much of anything for the index overall because there seems to be a trend reversal, with lower highs and lower lows now being formed. Today’s move was merely a 38.2% retracement of the drop that started on Friday, and a rally to 4,290 would be only 61.8%.

As for now, all we have done is retest a support/resistance zone. A gap above 4,270 tomorrow sets up a rally and test of 4,290.

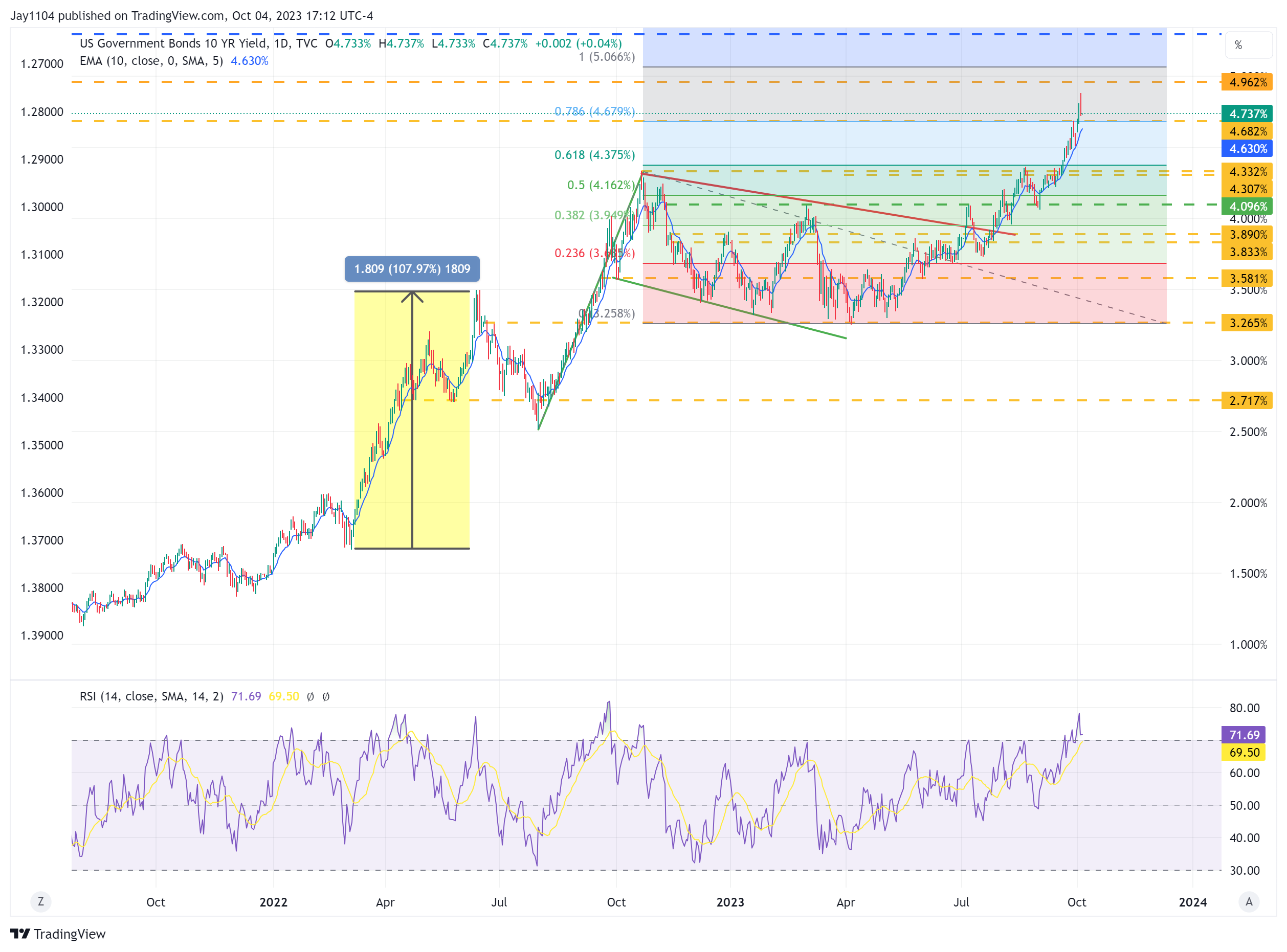

The 10-year did fall but not by much, and the big level to watch in the 10 is the 4.68% level because that was resistance on the way up, which is likely to be supported here. If the 10-year did put in a high, it seems like a strange spot, and I would think that after coming so close, it would test 5%, which would be a very big psychological level.

Additionally, it seems too early in the cycle to see the 2-year breakdown and start falling. Until the economic data starts to show trouble, I think the 2-year will stay around this 5% level, and if the yield curve continues to steepen, it means the 10-year still has to rise further.

did not participate at all, falling on the day. This would indicate that the market still fears higher rates. The one positive is that today’s RSI made a higher low despite the price making a lower low, a bullish divergence.

Meanwhile, the rose by almost 2% today but couldn’t surpass the $160.60 level. This is the neckline of the double top, which has been a region of strong resistance since September 26. It got up to resistance but couldn’t get through it, and this will be something worth watching to see if it can get through tomorrow or not.

Finally, was hit very hard today, dropping by 5.6%, and closed on its uptrend off the June low. The commodity has been a big reason why rates have been climbing, and this decline likely played a role in the move lower in rates today. If oil holds $84, it could bounce and start trending higher again; if it breaks $84, $77.50 becomes likely and could take rates down too.