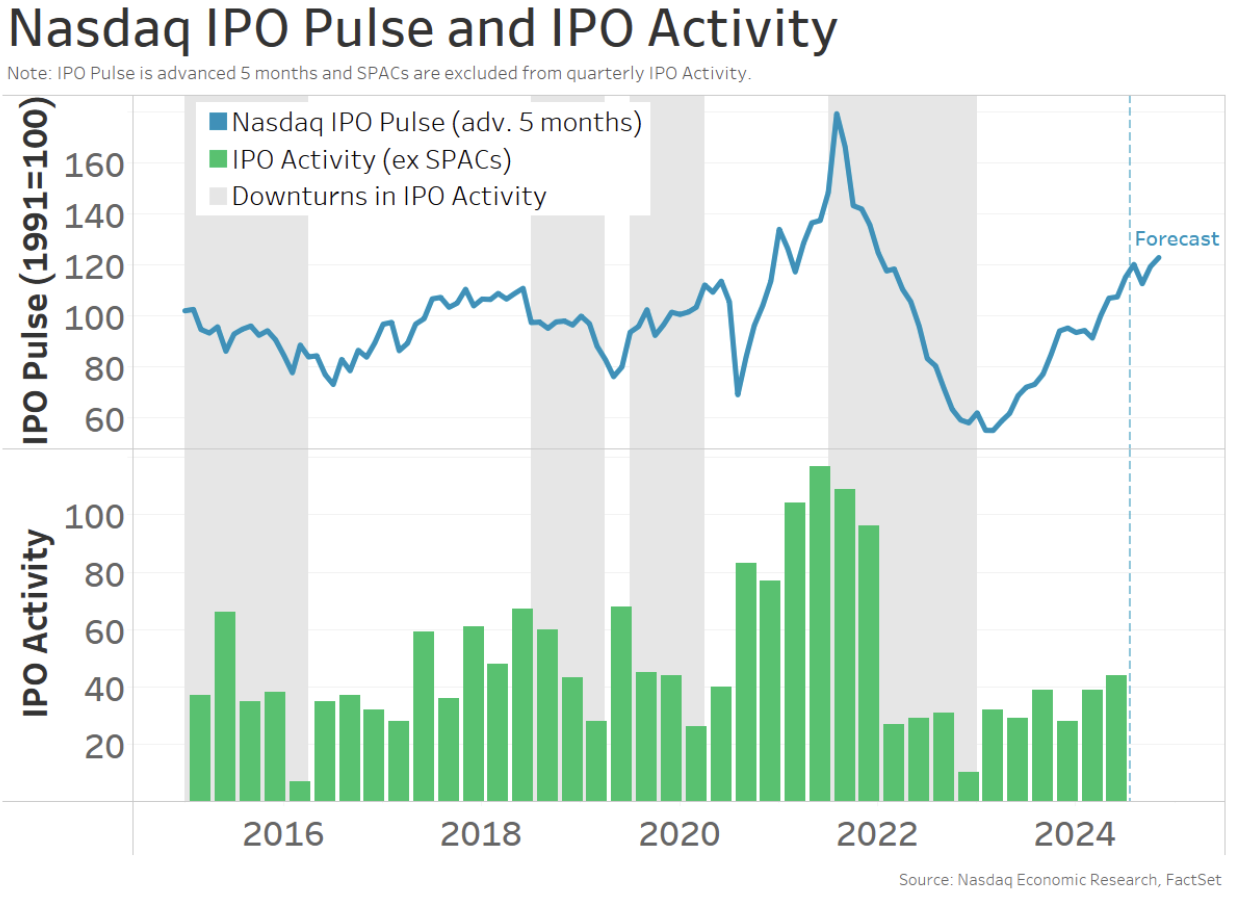

Since we launched the Nasdaq IPO Pulse Index at the start of the year, it’s been signaling an upswing in initial public offering (IPO) activity. Now that we are at the midpoint of the year, we’re guessing a lot of you wanted to see how IPO activity has actually fared!

The good news is that we are seeing more IPOs this year, and on a trade-weighted average, performance since IPO date has been positive.

99 IPOs across nine sectors… and SPACs are back?

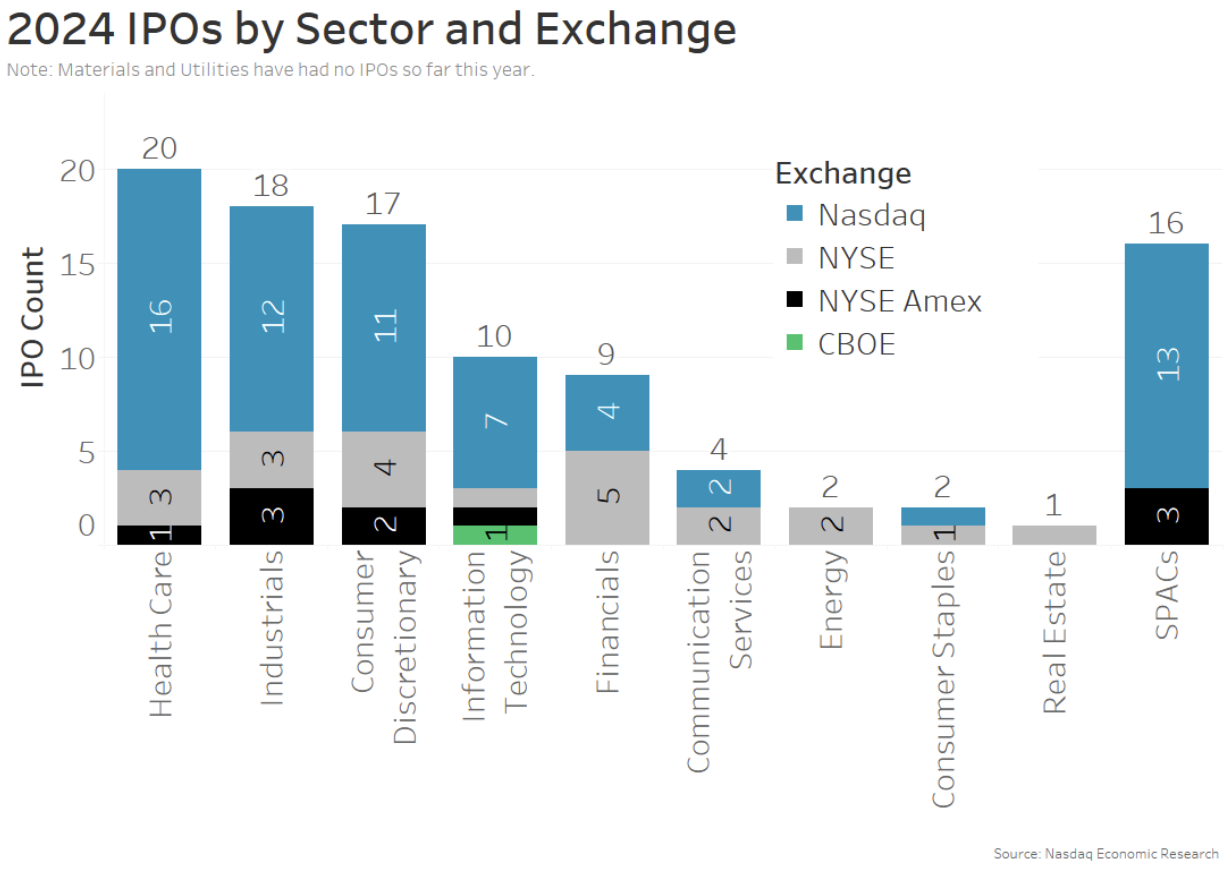

The first half of the year has seen an uptick in IPOs. In fact, we have seen 99 IPOs across nine sectors, with Health Care, Industrials and Consumer Discretionary sectors leading the way. This represents a 25% increase in average IPO activity over 2023.

The only sectors without any IPOs yet this year are Materials and Utilities. That said, the materials sector has also been one of the slowest sectors to see earnings recover.

The majority of companies continue to pick Nasdaq as their listing venue (blue portions of bars below).

One other noteworthy development is that special purpose acquisition companies (SPACs) have made a (small) comeback lately. A total of 16 IPOs have been SPACs, with seven occurring in June – the most in a single month since April 2022.

Chart 1: 2024 IPOs came from several different sectors and have mostly listed on Nasdaq

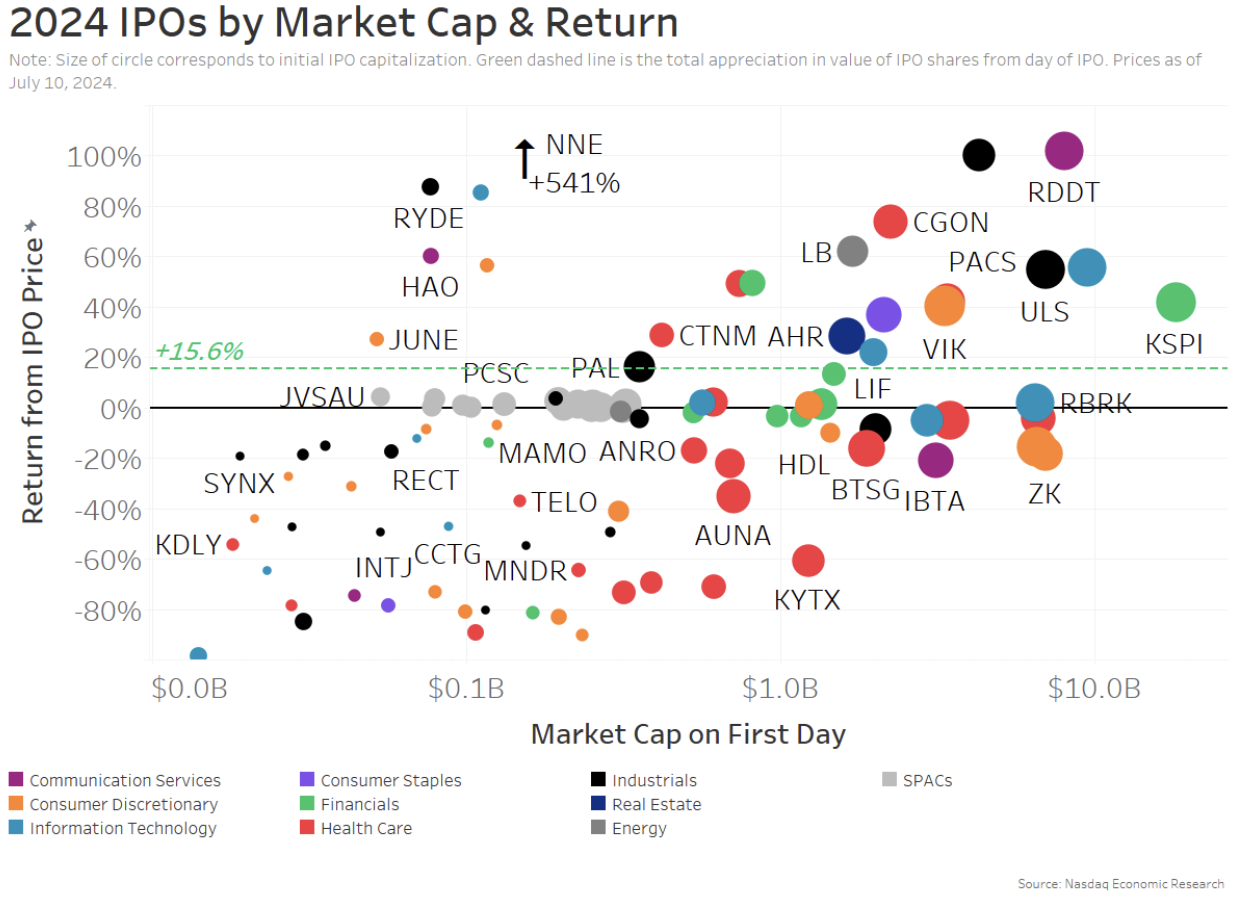

27% of IPOs this year have been unicorns

The data shows that over a quarter of 2024 IPOs have been unicorns, with a first-day market cap over $1 billion. In fact, 8% had a market cap of at least $6 billion.

Importantly for investors and companies considering IPOs, this year’s IPOs have performed well.

The data shows that the IPO-issue-weighted return on IPOs this year is over 15% (dashed green line). Notably, it has helped that the larger companies have the majority of IPOs with the best year-to-date returns.

Chart 2: More than a quarter of IPOs have been unicorns and larger IPOs have performed best

IPO Pulse remains positive for the second half of 2024

The improvement in the IPO market is consistent with the message from the Nasdaq IPO Pulse since its launch.

Looking toward the second half of 2024, it looks like the rebound in IPOs we saw to start the year should continue well into the second half of this year. In fact, we see that in June the IPO Pulse rose to a nearly three-year high (Chart 3). That shows that the cyclical drivers of IPO activity remain supportive for IPOs through late 2024.

Chart 3: At a nearly three-year high, the IPO Pulse points to a continued rebound in IPO activity

It’s also worth remembering that presidential elections often lead some companies to IPO earlier than they would in a normal year in order to avoid uncertainty around the election. That could boost third-quarter IPOs, but we’ll have to wait and see if that holds true this year.

Michael Normyle, U.S. Economist at Nasdaq, contributed to this article.