- It is easy to get carried away and attempt to time a raging bull market

- But that is the opposite of what a wise investor should do, according to the great Benjamin Graham

- Ultimately, having a ‘margin of safety’ while buying stocks is key and InvestingPro‘s screener can be of great help in that respect

- Secure your Black Friday gains with InvestingPro‘s up to 55% discount!

When the stock market is on the rise, the smart move is to resist the urge to time the market. It might seem tempting, but as Benjamin Graham wisely put it: a solid investment is one that, after a deep analysis, promises not just a good return but also safety for your invested capital. Anything less falls into the speculative category.

Now, that’s where the concept of ‘margin of safety’ comes in. Imagine: you buy a stock for $70s, but your analysis tells you it’s actually worth $100. That extra $30? That’s your safety net, ensuring you still make a profit even if your analysis isn’t spot on. The core of this strategy is intrinsic value, or fair value, which is basically what we think a stock is really worth, based on digging into the data and predicting the future.

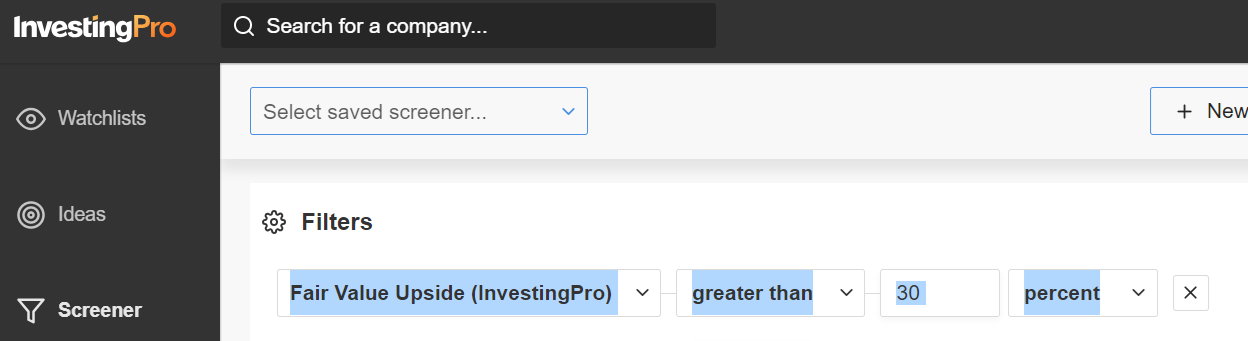

Personally, I’m all about cash flow estimates. Here’s the deal: the value of a company today is pretty much the total of its expected future cash flows. So, if I invest a hundred dollars, I’m expecting a steady flow of cash every year. For this, InvestingPro is my go-to tool. I use the “raise Fair Value” filter to spot stocks that are a good 30% or more off from what I think they’re really worth.

In a nutshell, it’s about applying these value investing tricks in real-world scenarios to make smart investment moves.

Source: InvestingPro

Determining the fair value of a security involves a mix of mathematical models like DDM, DCF, multiples, and the like. But here’s the thing: having a good purchase isn’t just about getting the price right. It’s a two-part game. We need to make sure we’re not only buying at a good price but also getting our hands on stocks that have a history of quality and future potential. That’s when you’ve got the winning combo for a solid investment.

Investor behavior matters most. Forget the idea that a stock’s price will magically align with its fair value in a day or a week. Nope, it often takes considerable time, maybe even months or years. That’s where patience, keeping a regular eye on things, and dealing with the ups and downs become crucial in your journey as an investor.

Conclusion

Investing is a straightforward concept, but it’s far from easy. As Warren Buffett rightly puts it, “It’s simple, but not easy.” It’s a blend of numbers, quality checks, and a good dose of patience that makes for successful investing.

***

Buy or Sell? Get the answer with InvestingPro for Half of the Price This Black Friday!

Timely insights and informed decisions are the keys to maximizing profit potential. This Black Friday, make the smartest investment decision in the market and save up to 55% on InvestingPro subscription plans.

Whether you’re a seasoned trader or just starting your investment journey, this offer is designed to equip you with the wisdom needed for more intelligent and profitable trading.

Black Friday Sale – Claim Your Discount Now!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.