A month ago the trend in global markets remained bullish despite the fallout from a correction that started mid-summer, based on several sets of ETF pairs. Following yesterday’s upbeat Federal Reserve news, however, the upbeat outlook has strengthened.

The central bank left its policy rate unchanged for a third time while suggesting that a round of rates cuts is on the table for 2024. “While the weather is still cold outside, the Fed has suggested a potential thawing of frozen high interest rates over the next few months,” says Rick Rieder, chief investment officer of global fixed income at BlackRock (NYSE:).

Markets cheered as prices for both US stocks and bonds surged on Wednesday, Dec. 13. In fact, a bullish trend has been visible all along via several ETF pairs that track various facets of global markets.

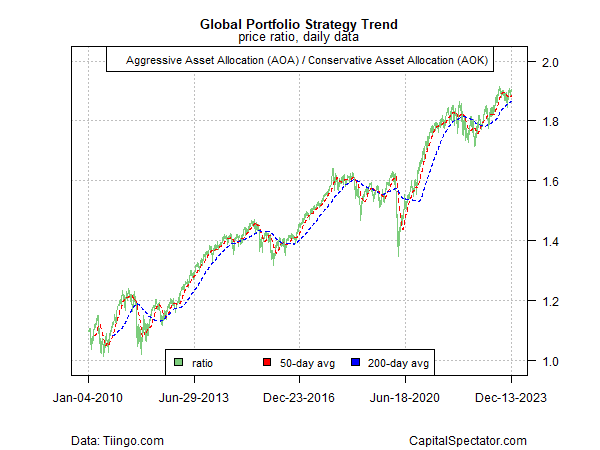

For a top-down perspective, consider the ratio for an aggressive global portfolio () vs. its conservative counterpart (). Although the trend wavered due to turbulence in 2023 and this year’s summer/fall correction, the upside bias has persisted, suggesting that a risk-on signal remains intact for global asset allocation strategies.

Global Portfolio Strategy Trend

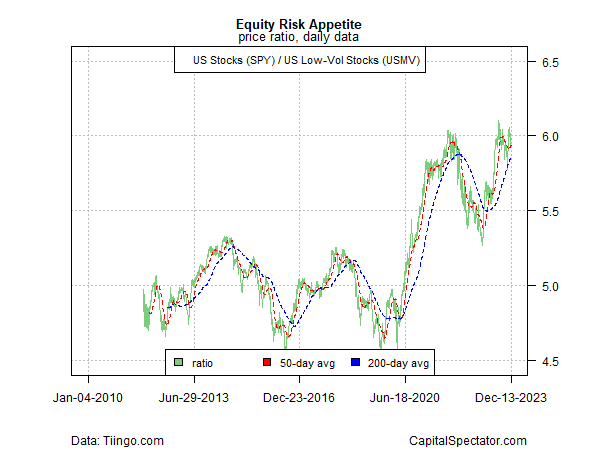

Focusing on US stocks reflects more volatility, but the recent rebound in the ratio of the broad market () vs. a low-volatility portfolio of equities () continues to skew positive.

Equity Risk Appetite

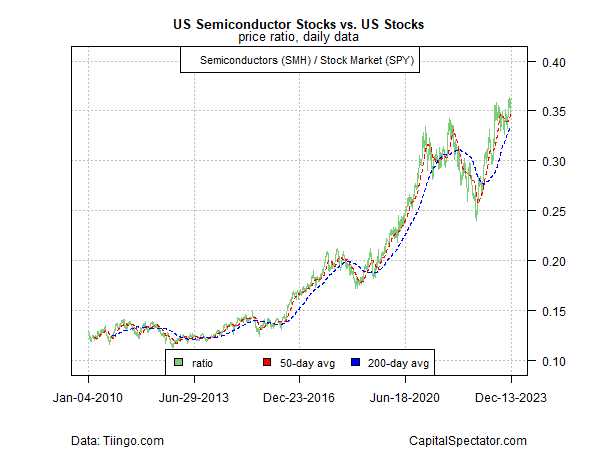

Using the relative performance of semi-conductor stocks (), a business-cycle proxy, vs. US shares overall (SPY) also paints a bullish trend.

US Semiconductor Stocks vs US Stocks

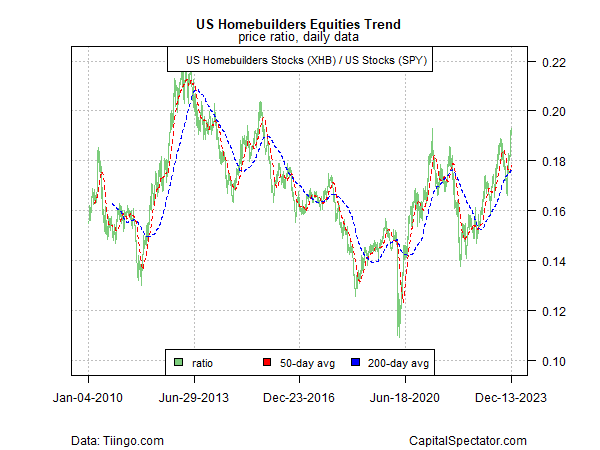

Meanwhile, one of the hardest hit industries in recent history — homebuilders () — are rebounding relative to the US stock market (SPY). The critical factor: expectations that interest rates will fall suggests relief is coming for home buying and residential construction.

XHB vs SPY Chart

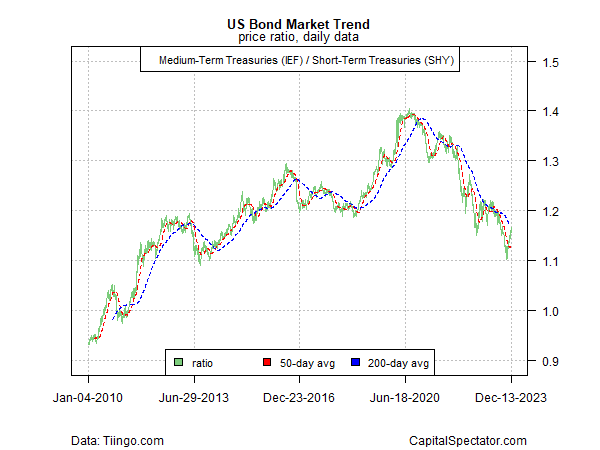

The risk-on party in bonds is still mixed, according to the ratio of medium-term Treasuries () vs. their short-term counterparts (). But the sharp rebound in recent days suggests that this key market signal is on track to revive after a long run of bearish trending. If this ratio turns decisively positive in the weeks ahead, the shift would mark one of the last market components to go all-in on risk-on.

IEF vs SHY Chart

Markets can be wrong, of course, and so the analysis above shouldn’t be confused with an infallible all-clear indicator. On the other hand, betting against the trend isn’t riskless either. What is clear, at least in relative terms, is that market trends are still leaning into a positive bias. As a result, the odds favor a risk-on positioning.