Next week is expected to be a busy one as investors continue to assess how much juice is left in the AI-inspired rally on Wall Street and when the Fed will start cutting interest rates.

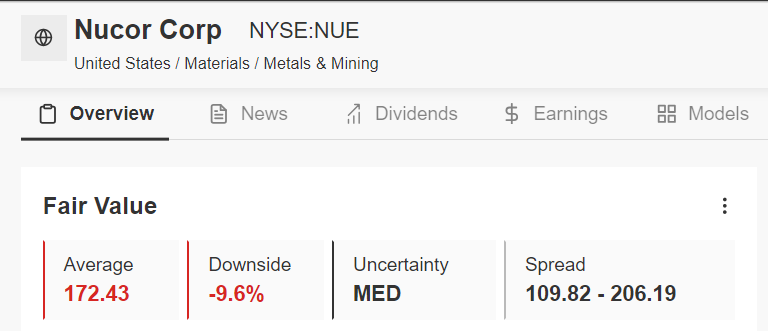

On Monday, I will be watching as steelmakers Cleveland-Cliffs (NYSE:) and Nucor (NYSE:) report earnings after the closing bell. As per the InvestingPro Fair Value models, Cleveland-Cliffs has a 43.9% upside potential, while Nucor’s Fair Value points to 9.6% downside.

Source: InvestingPro

Source: InvestingPro

If you’re trying to pick top stocks that could report stellar earnings, our predictive AI stock-picking tool can prove a game-changer. For less than $9 a month, it will update you on a monthly basis with a timely selection of AI-picked buys and sells, giving you a significant edge over the market.

Subscribe now and position your portfolio one step ahead of everyone else!

Readers of this article enjoy an extra 10% discount on the yearly and bi-yearly plans with the coupon codes PROTIPS2024 (yearly) and PROTIPS20242 (bi-yearly).

Tuesday is a classic example of the corporate earnings traffic jam. The day features quarterly update reports from:

- Tesla (NASDAQ:)

- Visa (NYSE:)

- General Motors (NYSE:)

- United Parcel Service (NYSE:)

- General Electric (NYSE:)

- Lockheed Martin (NYSE:)

- RTX Corporation (NYSE:)

- PepsiCo (NASDAQ:)

- Freeport-McMoRan (NYSE:)

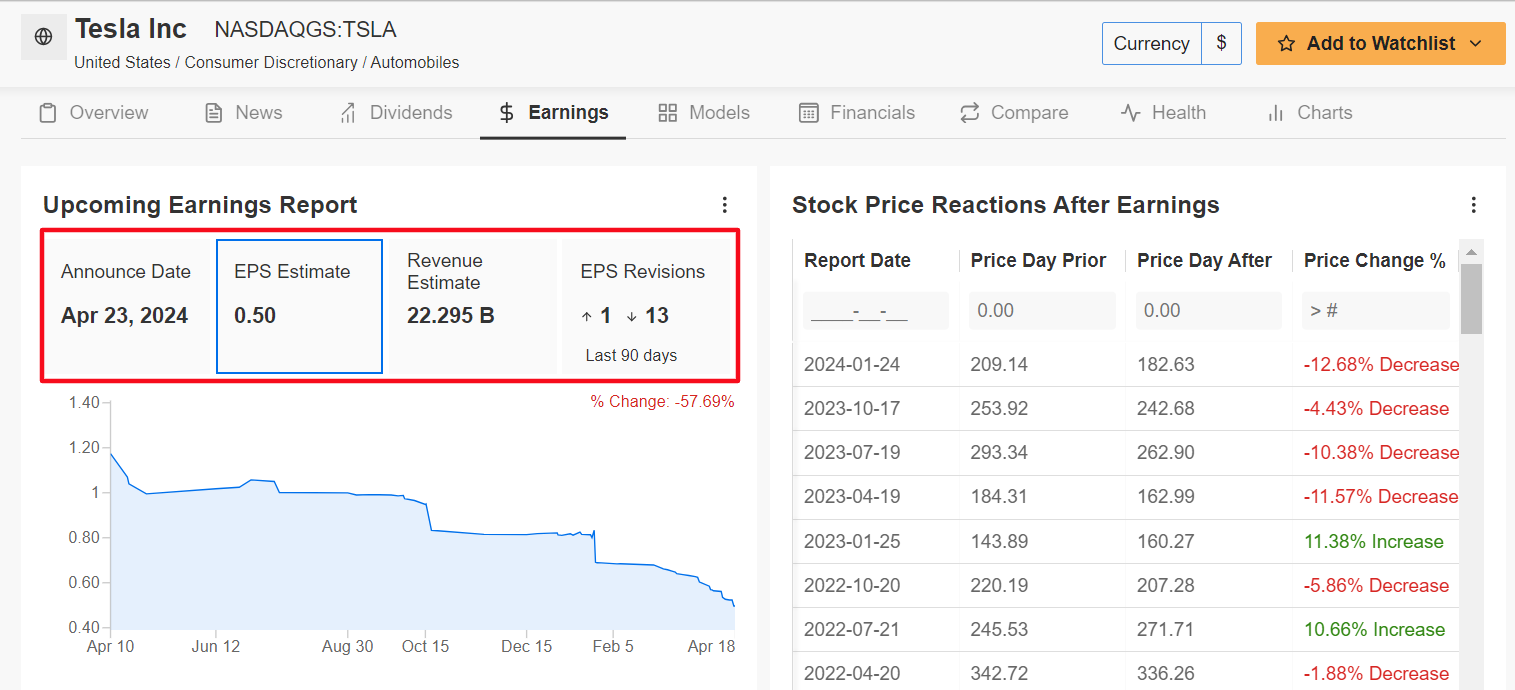

It should be noted that sell-side sentiment is extremely bearish leading up to Tesla’s Q1 report amid worries over weakening demand for its electric vehicles and growing competition from traditional legacy automakers as well as Chinese EV startups.

Source: InvestingPro

Shares of the Elon Musk-led company are down almost 40% year-to-date.

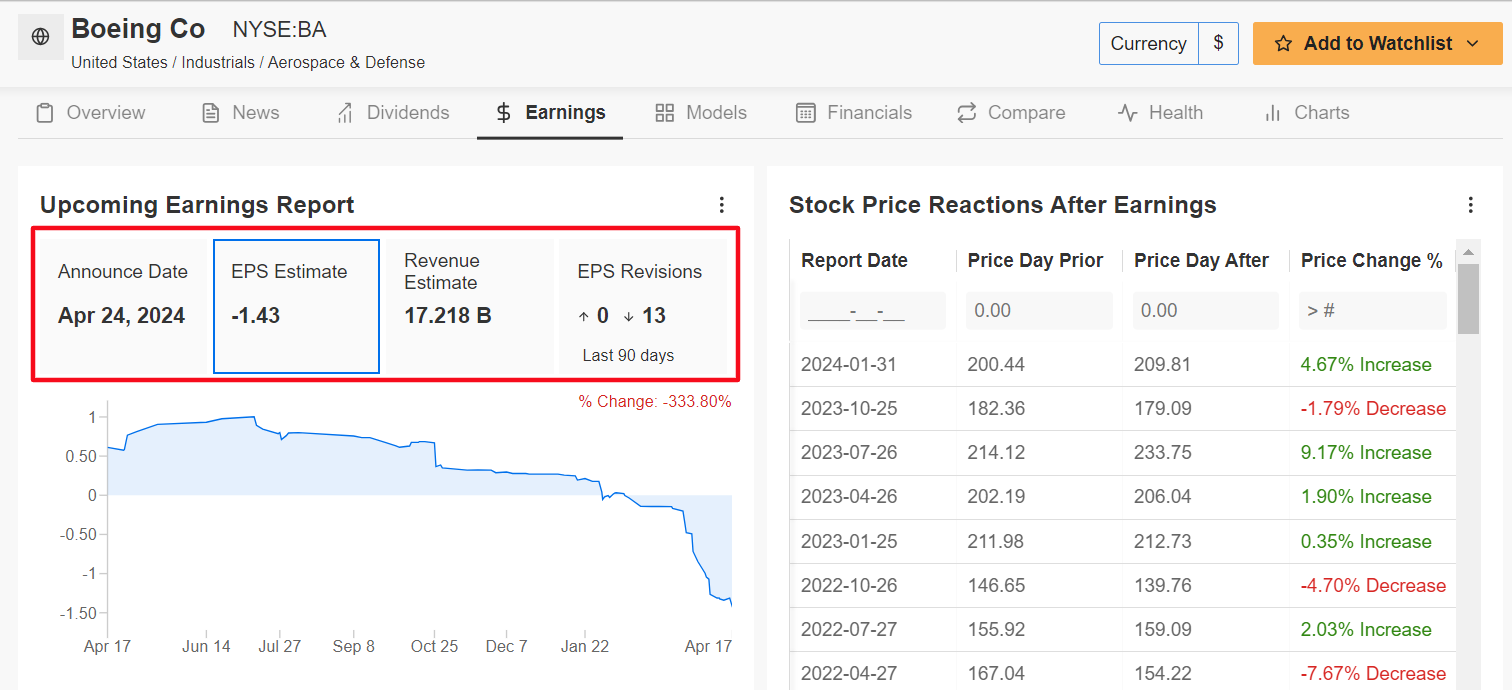

Meanwhile, Wednesday will bring earnings from IBM (NYSE:), Boeing (NYSE:), AT&T (NYSE:), Ford (NYSE:), and Chipotle Mexican Grill (NYSE:).

I will be eager to hear what Boeing executives have to say regarding the embattled plane manufacturer’s ongoing 737 debacle. BA shares are off by 35% in 2024.

Source: InvestingPro

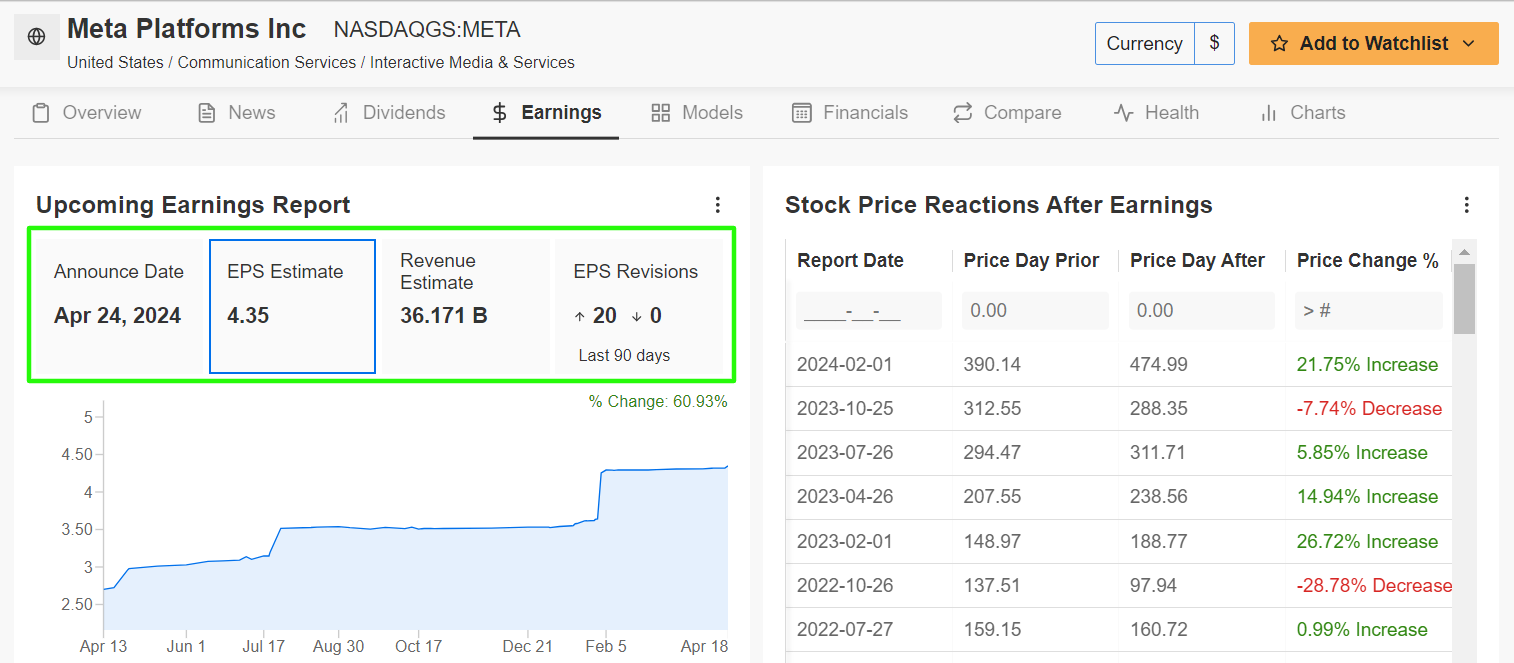

With that being mentioned, most of the focus on Wednesday will fall on Meta Platforms as the Facebook and Instagram owner gets set to report one of its most profitable quarters in its history.

Source: InvestingPro

META shares have staged an astonishing rally over the last 12 months and are up a whopping 130% over that timeframe, with investors encouraged by recent AI initiatives as well as aggressive cost-cutting initiatives implemented by CEO Mark Zuckerberg.

Thursday is another big earnings day, with Caterpillar (NYSE:), Honeywell (NASDAQ:), Southwest Airlines (NYSE:), American Airlines (NASDAQ:), Royal Caribbean (NYSE:), Comcast (NASDAQ:), Merck (NYSE:), and Newmont Mining (NYSE:) all scheduled to release results ahead of the opening bell.

In addition, there is also important first-quarter data due Thursday morning.

Market players will then turn their attention to earnings from Microsoft Corporation (NASDAQ:), and Alphabet (NASDAQ:) (NASDAQ:) due after the close. With a combined market cap of nearly $5 trillion, results from these two tech giants will be critical to the stock market’s ongoing rally.

As always, most of the focus will be on the performance of Microsoft’s Intelligent Cloud segment, which includes Azure public cloud services, Windows Server, SQL Server, Visual Studio, Nuance, GitHub, and Enterprise Services.

With Alphabet, the market will stay focused on growth rates at its Google Cloud Platform.

But as is usually the case, it is more about forward-looking guidance than results so any commentary on what Microsoft and Alphabet executives expect for the next quarter will be crucial.

Other notable tech names due on Thursday after the bell include Intel (NASDAQ:), Snap (NYSE:), Roku (NASDAQ:), and Western Digital (NASDAQ:).

Finally, on Friday, I’ll be paying close attention to earnings from oil giants ExxonMobil (NYSE:) and Chevron (NYSE:) and what they have to say about future supply and demand prospects amid the uncertain geopolitical climate.

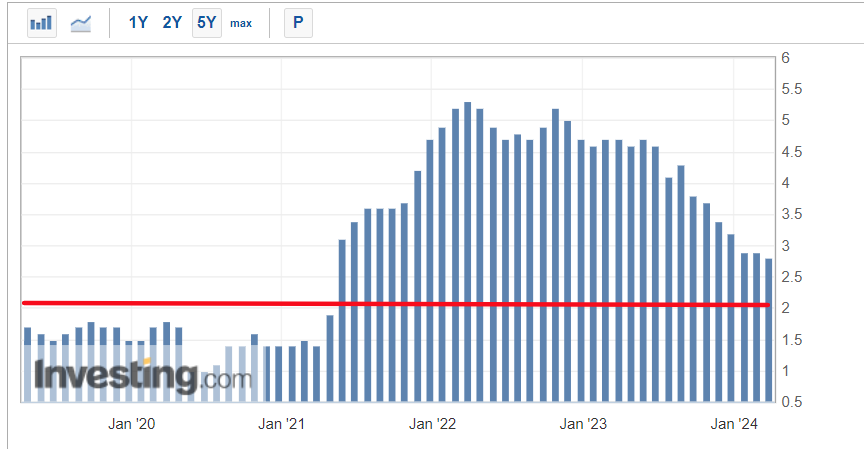

Besides earnings, the U.S. government will release the March core personal consumption expenditures () price index, which is the Federal Reserve’s preferred inflation measure.

Analysts expect the price index to rise 0.3% on the month, matching the same increase as in February. The annualized rate is seen climbing 2.7%, compared to a 2.8% annual pace in the previous month.

Source: Investing.com

A surprisingly strong reading could keep pressure on the Fed to maintain its fight against inflation, while a cooler-than-expected print, which sees the headline figure fall to 2.6% or below, would likely add to the rate-cut buzz.

Financial markets see just a 20% chance of the Fed cutting rates in June, according to the Investing.com , down from over 90% a few weeks ago. Investors are currently betting on the first rate cut to only happen in September.

What To Do Now:

You should expect that next week will overwhelm even the best of investors. It’s advisable to refrain from taking action unless you’ve already formulated a clear strategy and have a trading plan in place.

Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging backdrop of elevated inflation and high interest rates.

Subscribe here and unlock access to:

- ProPicks: AI-selected stock winners with proven track record.

- ProTips: Digestible, bite-sized insight to simplify complex financial data.

- Fair Value: Gain deeper insights into the intrinsic value of stocks.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

Disclosure: At the time of writing, I am long on the S&P 500, and the via the SPDR S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.