Justin Sullivan/Getty Images News

Apple (NASDAQ:AAPL) has seen investors grow fearful amidst rising geopolitical tensions with China. With China ordering government agencies to ban the use of iPhones at work, investors may be wondering if the company’s Chinese revenues are at risk. Investors may be overlooking the bigger threat: the vast majority of Apple products are manufactured at least in part in China and it will take time to diversify outside of the country. It seems unlikely for these relationships to crumble in such dramatic fashion, but the mere possibility of it may pose an overhang for the stock. Experts estimate that it’ll take years, if not decades for AAPL to move its manufacturing and supply chain out of China, and such a move may negatively impact profit margins. These concerns come during a time when AAPL is trading at a premium valuation, suggesting little margin for safety. While the number of potential headwinds facing the company are growing, the strength of the ecosystem may still offer downside support for the stock. I expect the stock to underperform the broader market over the coming years as the valuation incorporates increasing risks.

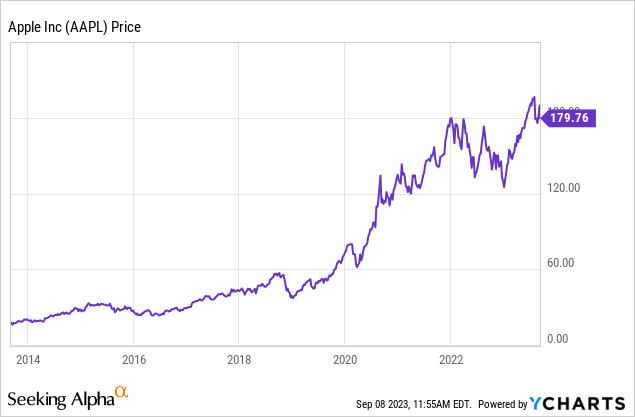

AAPL Stock Price

AAPL has been one of the biggest large-cap winners over the past two decades. The first decade was marked by innovation, and the rally in this most recent decade was spurred by an aggressive share repurchase program. The rally of the last five years has arguably been driven by multiple expansion, as investors began to give the stock respect for its loyal ecosystem.

I last covered AAPL in July where I explained why I was rating the stock a buy in spite of the premium valuation. The stock is down since then and I have come to realize that I have underestimated the geopolitical tension risk. Amidst a period in which American investors seemingly want nothing to do with Chinese stocks (just look at the valuation of Alibaba (BABA)), it is curious to see AAPL continue to command premium valuations in spite of being highly exposed to the consequences of a breakdown in US-China relationships. The strong name-brand and cash generation potential are likely to keep this story going for the long term, but I expect the stock to experience unusual downward pressure over the near and medium term.

AAPL Stock Key Metrics

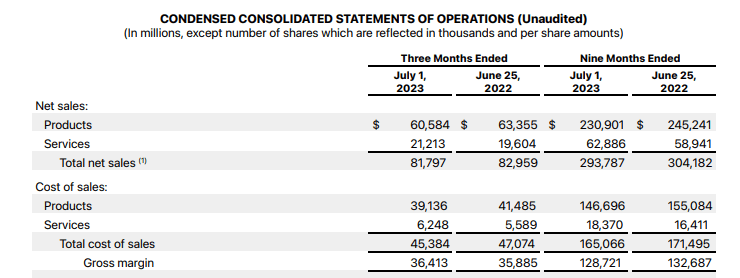

In its most recent quarter, AAPL saw revenues decline marginally YoY but gross profits increased due to strong growth in Services.

FY23 Q3 Release

AAPL was able to keep operating expenses steady, with 9.5% growth in R&D being partially offset by a slight decline in SG&A expenses. Together with a reduction in the income tax rate from 15.7% to 12.5%, the company was able to deliver a 2.3% YoY gain in net income.

AAPL continued to lap tough comparables on Mac and iPad sales and only saw meaningful growth in Services, which grew at an 8.2% clip. The high margin and recurring nature of Services revenue has been a typical bullish focal point, and these views are being validated amidst a tough macro environment.

AAPL ended the quarter with $166.6 billion of cash and investments versus $109.3 billion in debt, representing a bulletproof net cash balance sheet position. The company repurchased $18 billion worth of stock in the quarter – I expect share repurchases to remain elevated in the near term as the company continues working towards its goal of a leverage neutral position.

Looking forward, management is guiding for headwinds to persist in the third quarter. Unlike some other tech peers who are projecting foreign exchange tailwinds, AAPL expects foreign exchange to further negatively impact growth by over 2 percentage points.

On the conference call, management stated expectations for Mac and iPad sales to sustain similar weakness, but iPhone and Services to see some sequential acceleration in growth. Management highlighted increasing affordability as one of their tactics to increase market share, as they noted that over 50% of iPhones are sold “using some kind of a program, trade-ins, installments, some kind of financing.” I wouldn’t be surprised to see AAPL lean on promotional activity a bit more amidst this tough macro environment and if conditions worsen.

With regards to generative AI, management simply stated that they have been doing research “across a wide range of AI technologies” for years, but that they do not intend to discuss future products in the pipeline until they are ready to be released. It is fair to say that AAPL may be aiming to play the slow game here, similar to how it has with building its ecosystem.

Is AAPL Stock A Buy, Sell, or Hold?

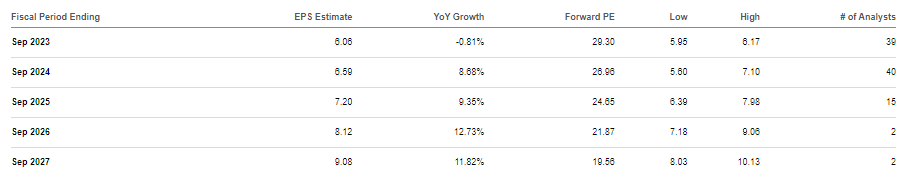

After the recent dip from highs, AAPL traded hands at around 29x earnings.

Seeking Alpha

That earnings multiple may look richly valued if not outright expensive relative to consensus estimates of mid to high single digit revenue growth moving forward. However, the idea here is that AAPL has earned a premium valuation akin to consumer staple stocks. AAPL has a loyal and growing user base – that loyalty not only helps to increase customer retention upon device replacement but also increases their Services revenue stream.

The real kicker is that AAPL may be able to add additional products and services to offer to that loyal ecosystem. AAPL has already seen success in its entrance into consumer banking, with management noting that customers have already made more than $10 billion in deposits. Apple Pay is rapidly taking market share and recently accounted for around 12.6% of online payments.

Apple Pay

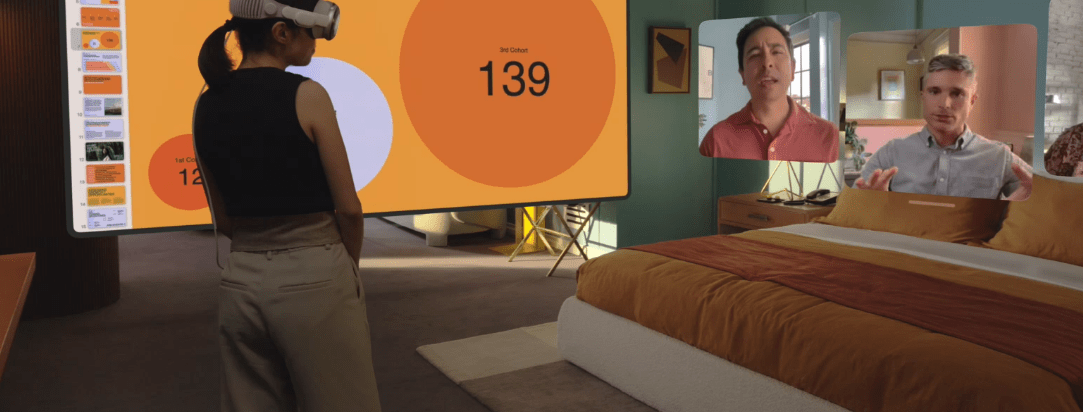

AAPL recently unveiled their upcoming Vision Pro product, though the hefty $3,500 price tag may keep adoption modest for the first release.

Apple Vision Pro

The strength and visibility of this growth story, even if the growth rates are modest, have historically justified the premium multiple. But the story has changed.

In early September, a report surfaced stating that China has banned the use of iPhones by government agencies at work. Such a measure is unlikely to be due to anything that AAPL did and instead due to general escalation of US-China tensions, but the explanations for it do not matter from the perspective of AAPL shareholders. AAPL suddenly has potential fallout from escalating US-China geopolitical tensions. China made up 19% of revenue in the latest quarter, or up to 30% of operating income in the worst case. Perhaps AAPL may be forced to lose all of its Chinese revenues. Its earnings multiple might jump as high as 42x, a hefty multiple in this higher interest rate environment. But investors may rightly point out that AAPL can grow into its valuation with time, lessening the potential impact due to the forward-looking nature of Wall Street.

But the real issues isn’t in potential lost revenues, but instead in the supply chain impact. As noted in the company’s 2022 10-K, “substantially all of the Company’s manufacturing is performed in whole or in part by outsourcing partners located primarily in Asia, including China mainland, India, Japan, South Korea, Taiwan and Vietnam.” Notice that China is listed first, as expert estimates indicate that the vast majority of products are still being made at least in some part in China. Bloomberg Intelligence estimates that it would take 8 years to move just 10% of production out of China, indicating just how catastrophic this apocalyptic scenario might be. This shouldn’t come as a surprise, however, as AAPL had been deepening its production capabilities in China in order to boost unit-level margins. At the time, there was little reason to believe that geopolitical tensions could escalate so much as to put this mutually beneficial relationship at risk. But after the Russia-Ukraine war and this latest announcement by the Chinese government, suddenly everything is on the table. In the event that AAPL is suddenly required to move all of its manufacturing out of China immediately, it isn’t clear if this is a problem that money could solve. Even if it was, AAPL would likely need to pay dearly for such a transition. Investors may point out (again rightly so) that the possibility of this scenario seems very unlikely. But that misses the point: stocks are not bid based on mathematical realities but can be swayed by fear and negative sentiment. The very possibility of negative impact may present a valuation overhang on the stock, which may be disastrous given the rich valuation of the stock today. Given the higher interest rate environment, many recurring-revenue businesses are trading at low valuations today, including around 11x-14x earnings in the net lease REIT sector, 12x-14x earnings in health insurance, 8x-10x earnings for midstream pipelines and many other examples. It wouldn’t be out of the question to see the stock re-rate downwards to 20x-25x earnings in order to work in a Chinese discount. Even at the upper end of that range, AAPL would potentially be dead money over the coming years, and that isn’t even incorporating the potential hit to earnings from the supply chain disruption.

Because I no longer have faith that AAPL can sustain let alone grow upon its premium multiple, I expect the stock to underperform the broader market in the near to medium term. Some readers may point out that we mustn’t allow fear to dictate our investment decisions, but I’d point out that when the stock trades at 30x earnings and a 3x PEG ratio, this isn’t irrational fear, it’s discipline. I am downgrading AAPL stock to underperform.