Yesterday’s delivered what had been widely anticipated in previous weeks:

- The Fed decided to keep rates unchanged within the range of 5.25% to 5.5%.

- Powell maintained a strong stance on inflation, aiming toward the 2% target.

- Additionally, the Fed indicated a commitment to balance sheet easing and emphasized a vigilant, data-driven approach in their meeting-by-meeting monitoring.

Clearly, the market did not like this, as we could see in major stock market indexes:

- : -1.61%

- : -2.23%

- : -0.82%

- : -2.63%

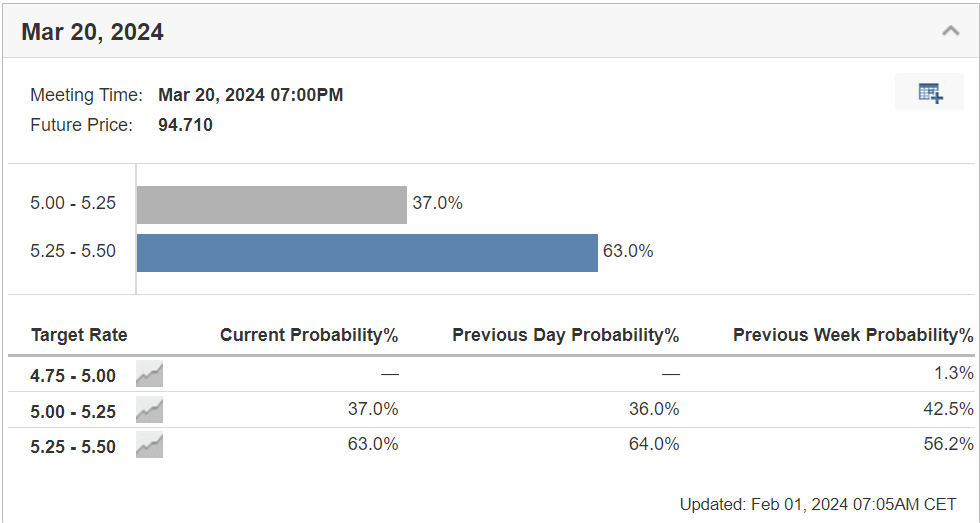

Looking ahead, our suggests a 37% probability of a first-rate cut at the next Fed meeting on March 20.

On the economic side, is advancing at a strong pace, and the labor market remains robust.

is also moving in the right direction, but before making any cuts it is good to still monitor the trend and make sure that the risk of rising prices is completely eliminated.

Quantitative Tightening is also moving forward, while the first rate cut is now highly unlikely to come in March.

Let’s remember one thing as investors, however: Powell is managing the monetary policy. He is not operating to make money for us, or because he is somehow interested in our portfolio’s performance. Powell has 2 goals:

- Maximum employment.

- Price stability.

In our pursuit of goals, the impact of whether Powell causes prices to rise or fall should not be a major concern.

As investors, our focus should shift away from the day-to-day statements of Powell or any central banker.

Instead, we should prioritize strategic asset allocation aligned with our life goals.

It’s crucial to avoid becoming anxious when a central banker takes actions that may not align with our personal opinions.

This dynamic mirrors the scenario in soccer, where everyone tends to assume the role of a coach – and in this case, central bankers!

InvestingPro: Empowering Your Financial Decisions, Every Step of the Way

Take advantage of InvestingPro ProTips and many other services, including AI ProPicks strategies on the InvestingPro platform with a discount of up to -50%, for limited time only!

Claim Your Discount Today!

Don’t forget your free gift! Use coupon code PROIT2024 at checkout to claim an extra 10% off on the Pro yearly plan.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. As a reminder, any type of asset is evaluated from multiple perspectives and is highly risky, and therefore, any investment decision and the associated risk remains with the investor.