The US inflation data is set to be released today, which is by far the week’s most important event.

Estimates suggest we’ll see both and declines in the core CPI component, while the overall CPI component is expected to drop on a basis and show a slight uptick .

Here are the specific expectations:

- Annual Core CPI: Expected to decrease slightly from 3.8 percent to 3.7 percent

- Annual CPI: Predicted to rise from 3.2% to 3.4%

- Monthly Core CPI: Anticipated to drop slightly from 0.4% to 0.3%

- Monthly CPI: Expected to decrease slightly from 0.4% to 0.3%

In terms of asset classes, if the data falls as expected, certain sectors may see revaluations. These include:

- Small Cap

- Bonds

- Precious Metals (/ Futures)

It’s common to see treasury yields decline as an initial reaction to lower-than-expected CPI figures (and vice versa).

In Italy, however, there is a saying: “Canta e suona” (that guy sings it and plays it himself), which means when someone tells stories that only they believe. Well, the market seems to me to be singing its own song about rate cuts.

So, we must consider: What if things don’t go according to plan? What if, for instance, there’s no rate cut in 2024 because inflation hasn’t been tamed yet?

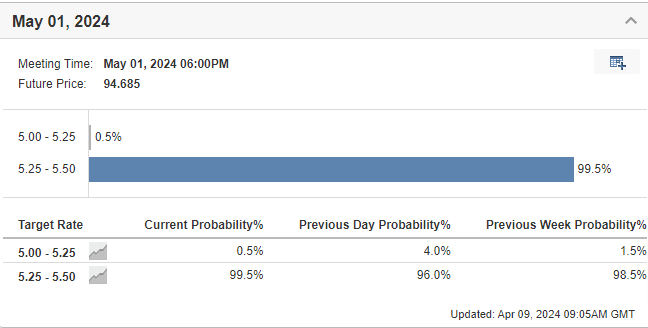

It’s worth noting that since the end of last year, markets were initially of a rate cut in March (which didn’t happen). Now, even in May, certainty keeps falling with odds for unchanged rates at 98.5%.

We don’t automatically assume a rate cut will happen. Instead, we focus on planning for different outcomes. Right now, I believe the best options are defensive portfolios, which work no matter what happens, and rotational strategies.

***

Remember to take advantage of the InvestingPro+ discount on the annual plan (click HERE), where you can uncover undervalued and overvalued stocks using exclusive tools: ProPicks, AI-managed stock portfolios, and expert analysis.

Utilize ProTips for simplified information and data, Fair Value and Financial Health indicators for quick insights into stock potential and risk, stock screeners, Historical Financial Data on thousands of stocks, and more!

Disclaimer: The author holds long positions in Paypal, S&P 500 and Nasdaq. This article was written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.”