This is the reason that serious people don’t choose a trend length that happens to fit with their narrative.

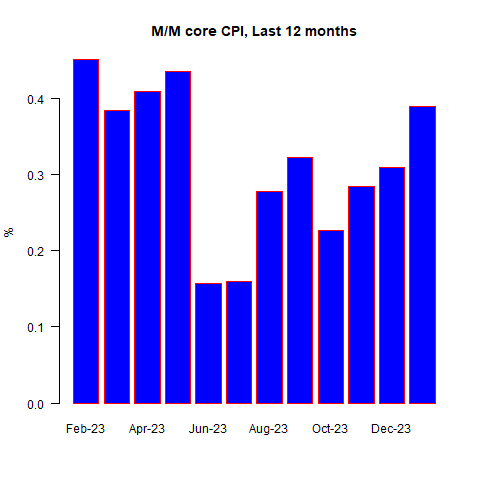

For the last few months, supposedly serious economists have crowed about how the 3-month average of seasonally-adjusted was at a new post-COVID low.

(Most of those same economists, only a few months ago, were focused on the 6-month average, but when that started crawling higher they switched to the 3-month average.)

And indeed, it was exciting. Headline CPI was down to 1.89% on a seasonally adjusted three-month average; was at 3.30%.

Victory over inflation was proclaimed! Inflation was back at target, even a bit below, so the Fed should start easing policy forthwith.

Fortunately, and maybe surprisingly, Chairman Powell is built of stronger stuff.

As a ‘Cliff’s Notes’ guide to what you’re going to read: all of those folks who loved the 3-month average when it was 1.89%, aren’t going to be as vocal about it now that it’s at 2.80%.

Core, on a 3-month average basis, is at 3.92%. The 6-month averages also rose.

Now, this doesn’t mean that inflation is necessarily headed back higher yet. I’ll get to that in a bit, but I will allow how the picture of CPI, below, might be perceived by some as discouraging.

Core CPI MoM, Last 12-Months

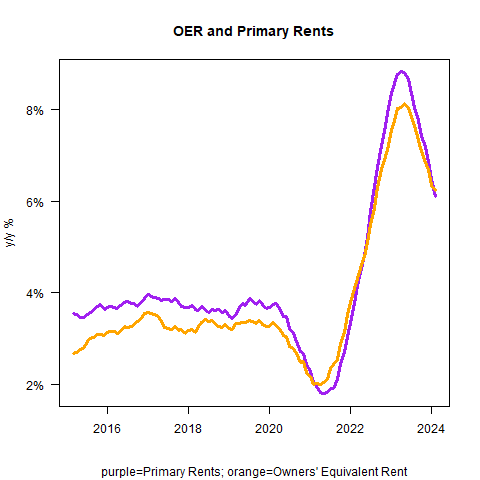

Before this figure, the consensus was for a fairly strong report, 0.16% on headline and 0.28% on core. I thought it would be softer because rents based on my model should start to decelerate soon.

But, as I said in my podcast, if rents were high then you should look past rents. They’re going to decelerate over the next 6 months or so, to around 3% y/y, and then re-accelerate.

That’s all baked in the cake, and it will flatter the inflation data. But it hasn’t happened yet! OER was a massive +0.56% m/m.

Primary Rents were more in line with what I was looking for, with a small deceleration to +0.36% m/m from +0.39% last month.

The indices are still decelerating just not as rapidly as I think anyone (myself included now!) expected.

OER and Primary Rents

Lodging Away from Home was +1.78%, which was a big m/m figure and contributed to the overall housing subindex being +0.62% m/m at a time when shelter should be decelerating.

But as I said, if this surprise was all OER then we can look past it.

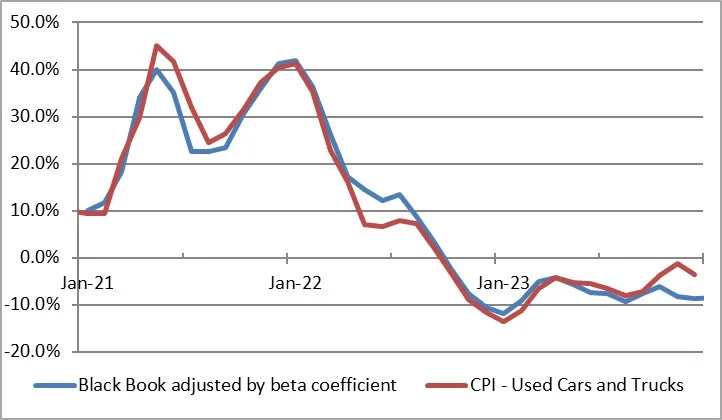

Core Goods was weak, which was a downside surprise. Used Cars fell -3.37% m/m, which is far worse than any surveys saw this month.

But as I pointed out last month, Used Cars had been surprisingly strong compared to the private surveys so this is partly a make-up and it contributed to the weakness in Core Goods.

Medicinal Drugs were also weak, -0.54% m/m and that’s also in Core Goods. Overall, Core Goods – which had shown some signs of life – dropped back to deflation y/y this month.

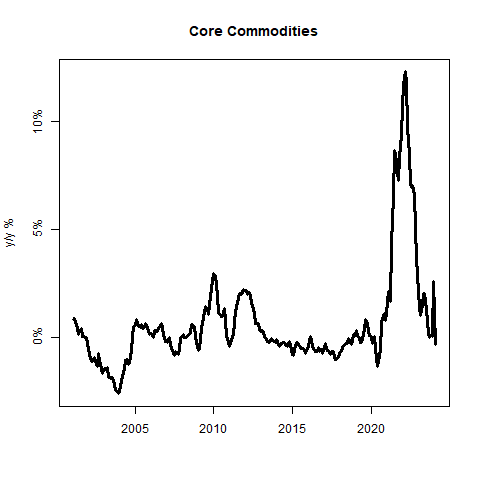

Core Commodities

Going forward, I don’t think core goods will stay in deflation.

Partly, that’s because supply chains are being stressed again due to drought in the Panama Canal and the effective shutting of the Red Sea to container traffic, but it’s also partly because there is continued interest in ‘nearshoring’ which will raise costs (after all, it was to lower costs that firms offshored stuff in the first place.

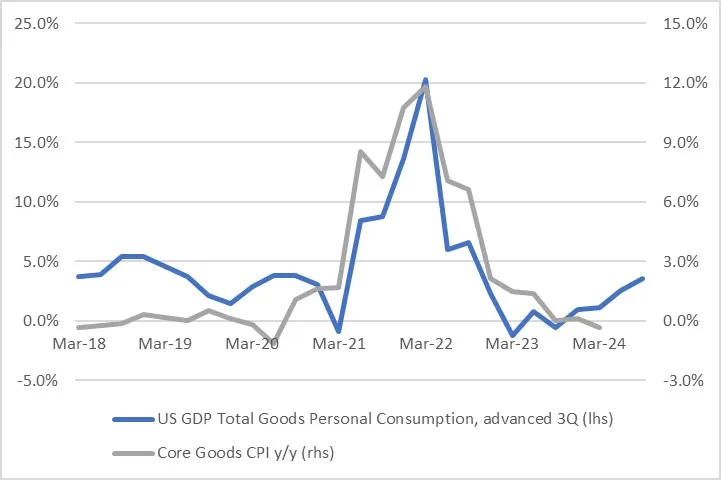

And then there’s also this, for the medium term. To be sure, this level of growth in Personal Consumption in the past was consistent with mild deflation – but that was pre-nearshoring.

The direction is what I’m interested in, but I also think that for a given amount of growth, we will see more core goods inflation in the future.

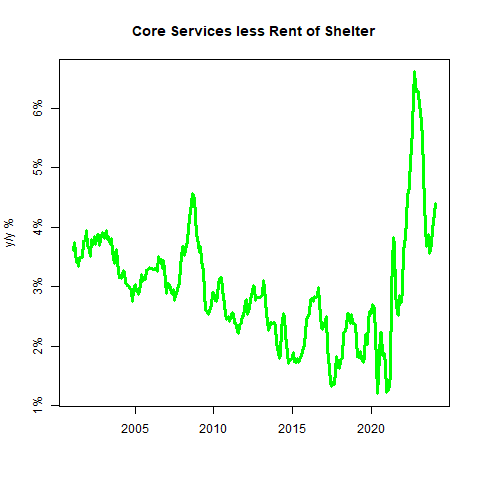

So now we turn to the really interesting part of the report, and that’s core services ex-shelter. I’ve been saying for a while that this category was going to be a sticky wicket because wages are still rising at a 5% y/y pace.

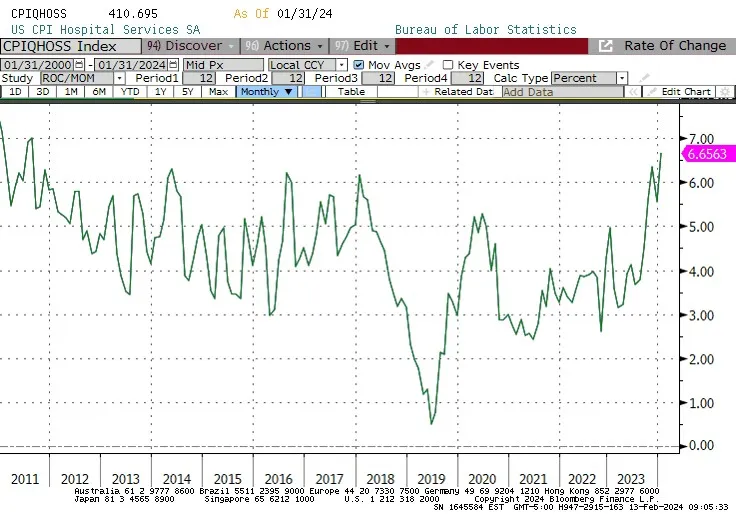

And indeed, the wicket is sticky. This month, airfares rose +1.4% (this may have been related to jet fuel tightness on the East Coast), but also again we saw a continued acceleration to Hospital Services, which rose to the highest y/y rate (+6.7%) since 2011.

Overall, core services ex-shelter (so-called “Supercore”) rose +0.85% m/m, the biggest rise in a couple of years, and the y/y measure is in an upswing.

Core Services less Rent of Shelter

Overall, this report is deflating pun absolutely, 100% intended for those who thought that inflation is settling gently back to target and that the Fed therefore can lower interest rates back to where we have a God-Given Right to have them, 2% or so.

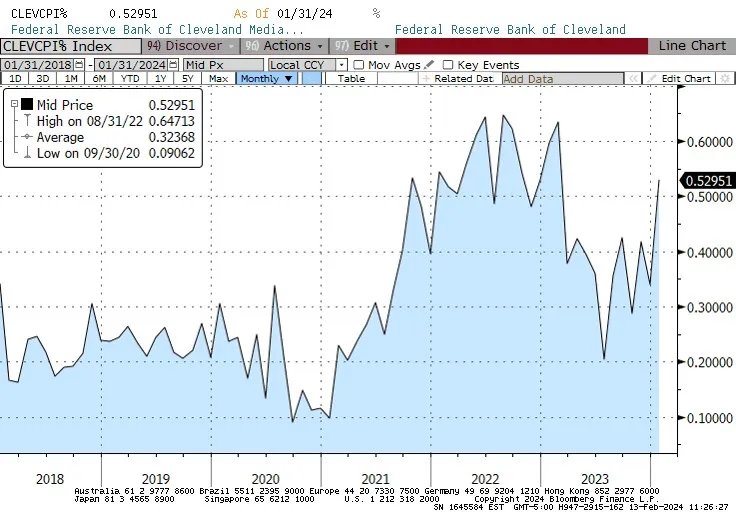

Not so fast! Median, by the way, was also a scintillating +0.53% m/m, the highest since last February. Thanks to base effects, the y/y Median CPI was essentially flat, at 4.90% y/y.

Because of the deceleration in housing, I expect, I continue to see the Median slowing to the high-3s, and low-4s over the middle of this year.

But it is going to have a hard time getting lower than that. In the short-term, we have a saucy performance from core services ex-shelter.

In the short- and medium-term, core goods are going to get out of deflation (although I don’t expect it to rise very far).

And then housing should re-accelerate, though not back to the old highs. In short, inflation is a long way from being beaten.

I am sure that somehow, that’s bullish for stocks, but I can’t figure out why. (I hear the 3-month moving average of the last four months of CPI, dropping the highest month, looks good.)