By Clyde Russell

LAUNCESTON, Australia (Reuters) – The return of China’s key manufacturing index to positive territory for the first time in six months has sparked optimism that commodity demand from the world’s biggest buyer of natural resources is poised to accelerate.

The official purchasing managers’ index (PMI) rose to 50.8 in March from 49.1 in February, rising above the 50-level that separates growth from contraction, and hitting the highest mark since March 2023.

The data, released on March 31, also exceeded the median forecast of 49.9 in a Reuters poll, providing an upside surprise that further boosted positive sentiment for the world’s second-largest economy.

Manufacturing is a key segment of China’s economy and a major demand centre for metals such as and steel, as well as energy required to make goods.

The PMI added to other recent data that suggest China’s economy is gaining some momentum after struggling for growth in 2023.

Retail sales and factory output beat expectations in the January-February period, rising 5.5% and 7.0% respectively, while exports gained 7.1% in the first two months of the year from the same period a year earlier.

However, the property sector remains a concern, with sales by floor area sliding 20.5% in the January-February period from a year earlier, only slightly better than the 23.0% fall recorded for December.

However, the overall picture is that China’s economy does appear to have gained traction, and ongoing stimulus measures are likely to secure the momentum.

Working out how that translates into commodity imports is far more tricky.

If anything, it appears imports of major commodities have front-run the economic recovery.

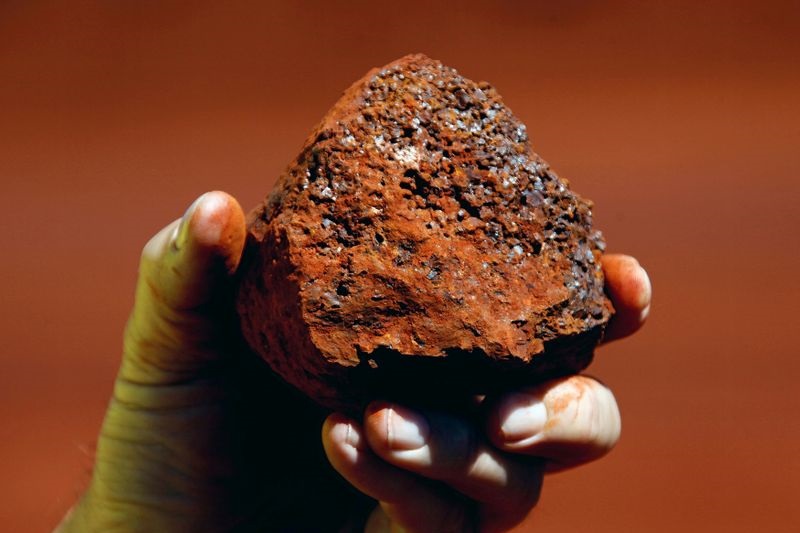

IRON ORE STRENGTH

China’s iron ore imports were 8.1% higher in the first two months of the year, coming in at 209.45 million metric tons, according to official data.

This strength appears to have largely continued in March, with LSEG estimating arrivals of 97.8 million tons and commodity analysts Kpler being more bullish with a forecast of 107.1 million.

Kpler expects imports of seaborne thermal coal to come in at 29.67 million tons, a three-month high and above the 28.62 million from March last year.

Imports of liquefied (LNG) are forecast by Kpler to be 6.62 million tons, up from February’s 5.79 million and exceeding the 5.43 million from March 2023.

Crude oil imports are estimated by LSEG Oil Research at 11.74 million barrels per day (bpd), up from 11.21 million bpd in February and the most since October.

PRICE IMPACT

It’s possible that China’s commodity importers decided to buy more in anticipation of stronger demand from a recovering economy, but it’s also likely that prices played a role.

The increase in iron ore imports came as prices trended lower, with the Singapore Exchange (OTC:) contract slipping from a high so far in 2024 of $143.60 a ton on Jan. 3 to a low of $101.99 on April 1.

Indonesia is China’s top supplier of thermal coal, and the price of coal with an energy content of 4,200 kilocalories per kilogram, as assessed by commodity price reporting agency Argus, has been trending lower since a peak of $61.70 a ton in October, ending at $55.70 in the week to March 28.

Crude oil cargoes arriving in March would most likely have been secured around December, a time when global benchmark futures dropped to a six-month low of $73.24 a barrel.

Since then Brent has rebounded to close at $88.92 a barrel amid output cuts by the OPEC+ group of exporters and ongoing tensions in the Middle East linked to the conflict between Israel and Hamas.

Spot LNG for delivery to North Asia also trended lower, going from a winter high of $17.90 per million British thermal units (mmBtu) in October to a low of $8.30 on March 1.

The price has since rallied to end last week at $9.50 per mmBtu.

It may be the case that China’s economic recovery does result in higher commodity imports, but it may not be a case of the rising tide lifting all boats equally.

Commodities where prices are still softer, such as iron ore and thermal coal, may see stronger demand than those where prices have shifted higher, such as .

The opinions expressed here are those of the author, a columnist for Reuters.