Stocks were flat again yesterday as the events the rest of the week get a bit more interesting, with revisions today, on Thursday, and on Friday.

It seems clear that bond rates are waiting patiently for a signal or a reason to go higher. At this point, it seems like the will be heading sharply higher and potentially back to 5% or below 4%. However, I think 5% is more likely.

There is a lot of evidence to support the idea that rates go higher from here, being one of them.

Right now, oil is butting up against resistance at $79, and this is the fourth time oil has hit this level since the end of January. A break out could send oil back to the mid to upper $80s.

Gasoline is another reason to think that rates go higher because gasoline appears to be heading higher based on its technicals.

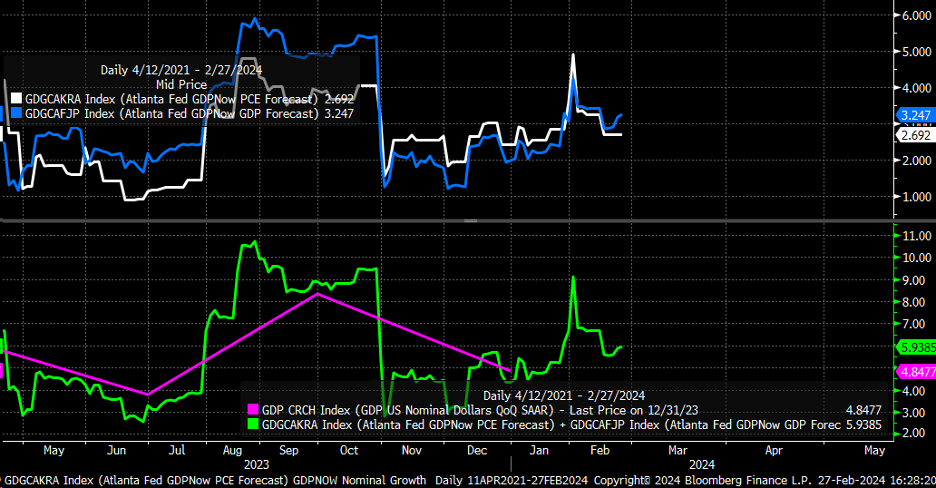

The Atlanta Fed GDPNow model suggests that nominal growth in the first quarter will be around 6%, suggesting that rates go higher.

I would think then that the would also move higher, with the pushing back to the 106 area.

The economic data and the fact that inflation is stuck around 3% will likely force the market to tighten financial conditions again.

Conditions will have to tighten because why should investors get paid a rate of interest that is insufficient given the growth and inflation outlook of the economy?

If the economy remains strong and rates rise, why shouldn’t the dollar appreciate?

If rates and the dollar appreciate, financial conditions will have to tighten unless high-yield investors accept smaller and smaller discounts on the added risk they have to take.

The corporate bond advance-decline line has already turned lower, likely because rates have turned higher, another divergence signal between stocks and just about everything else.

But we can see what happens. Things get more interesting today.

Youtube Video: