Cesare Ferrari

Investment Thesis

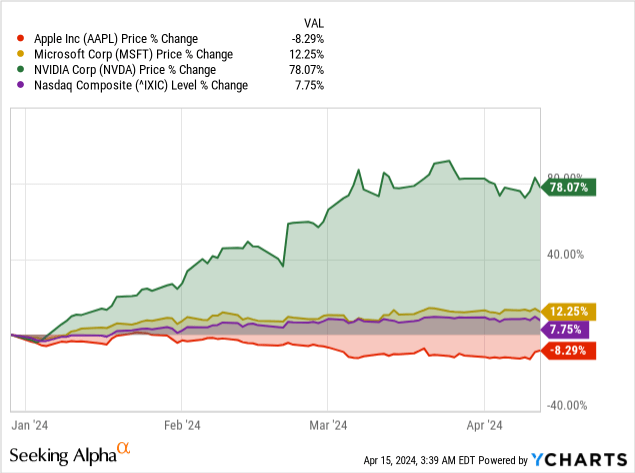

Apple Inc. (NASDAQ:AAPL) has lost the title of the world’s most valuable company, hitting its worst performance in over a decade. So far this year, the firm’s stock has been down approximately 5%. Meanwhile, Microsoft (MSFT) has surged by over 13%, overtaking Apple to the top global market value.

Since late last year, Apple has been trending lower even as the overall stock market has edged higher amid growing optimism that the U.S. Federal Reserve will cut interest rates. The selloff has come against increasing concerns over whether the company has lost its power of innovation, with its new flagship iPhone device struggling to elicit strong demand as it has in the past.

Even as Microsoft, Nvidia (NVDA), and Alphabet (GOOGL) continue to make news on AI, the iPhone maker has remained quiet, much to the concern of most people. Consequently, investors are getting frustrated amid growing fears that the company needs to do more to reignite growth as the iPhone product line struggles amid saturation in the multibillion-dollar smartphone market.

AAPL Rebounds from 2024 Dip: Double-Bottom Pattern and RSI Signal Upswing Towards $240

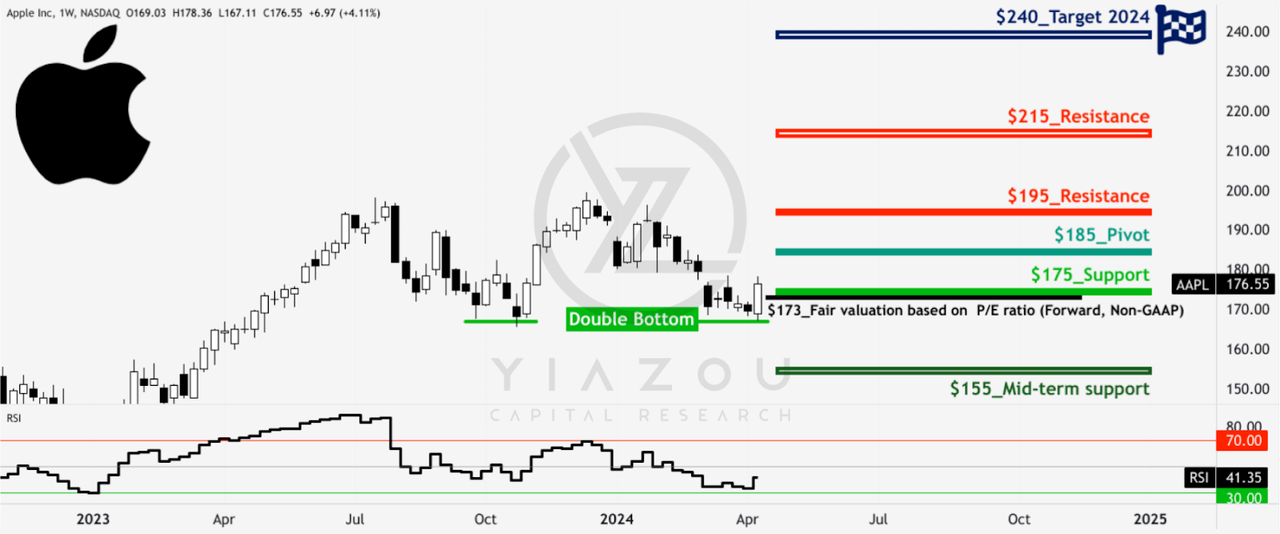

Apple’s stock price has been downward since the beginning of 2024. Recently, it has made a solid double-bottom candlestick pattern near $167, which serves as a strong bullish signal.

Assessing the relative strength index (RSI), at 41, there is considerable upside as the indicator has recovered from an oversold zone near 30. Still, RSI may retest the level of 30 before reversing towards an oversold trajectory. The rationale behind this downside possibility is a lack of bullish divergence in the indicator relative to the recent lows in the price. On the downside, the price may hit $155 in the coming weeks.

Last week, the stock price made an upside move at the support level near $175. The price may rise to $185 before retesting the support. Notably, $185 serves as the pivot of the current trading range. On the upside, following the current price trend, the price may hit $240 by the end of 2024. During the bullish momentum toward the target, the price may experience considerable resistance near $195 and $215.

Currently, $175 is an ideal level to establish a long position on the stock, as this is also in line with the stock’s fair value based on the P/E ratio (forward, non-GAAP).

Facing Tough Competition in China and Consumer Upgrade Hesitancy

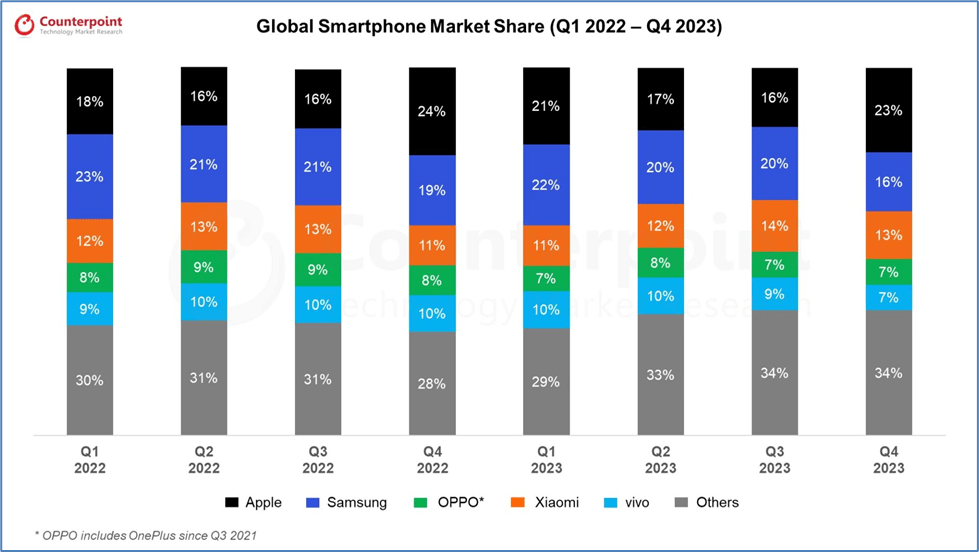

Apple could see its stock edging lower unless it addresses the growing concerns over iPhone sales, which are facing a rough run in China. The drop came as Huawei, one of its biggest competitors, posted a 64% increase in smartphone shipments.

This is another reason most people are not moving to the new iPhones, as the phones do not have any game-changing features. Smartphone saturation has emerged as a big issue for Apple, with consumers keeping from upgrading to new models. Equally, such economic tough times characterized by inflationary pressures taking an upward trajectory have also seen most people cut back on unnecessary expenditures.

Consequently, Apple has struggled to sell enough units to surpass the 2020/2021 peak. While the company often releases a new flagship phone every year, the short upgrade period also works against it. As a result, the company can no longer draw in significant sales as some consumers stick with their old phones instead of upgrading to new ones with no blockbuster features.

Apple’s top and bottom lines have stagnated lately, raising serious concerns about the company’s ability to generate long-term value. For the first six weeks of the year, iPhone sales plummeted 24% in China as Apple felt the full brunt of homegrown competition. Huawei has emerged as the biggest threat to Apple in one of its most important markets and has been a critical driver of revenues. In addition to facing stiff competition from Huawei in the high-end market, Apple is also feeling the pressure as it gets squeezed in the middle on aggressive pricing.

Oppo, Vivo, and Xiaomi keep challenging Apple in the lucrative Chinese smartphone market. While Apple did gain market share in the fourth quarter, it was pressured for the better part of last year. Finally, smartphone sales were lower in the first quarter of the year, going down by about 7% year over year. The slowdown came as consumers spent less amid deteriorating economic conditions and companies’ needing to release new products.

Counterpoint

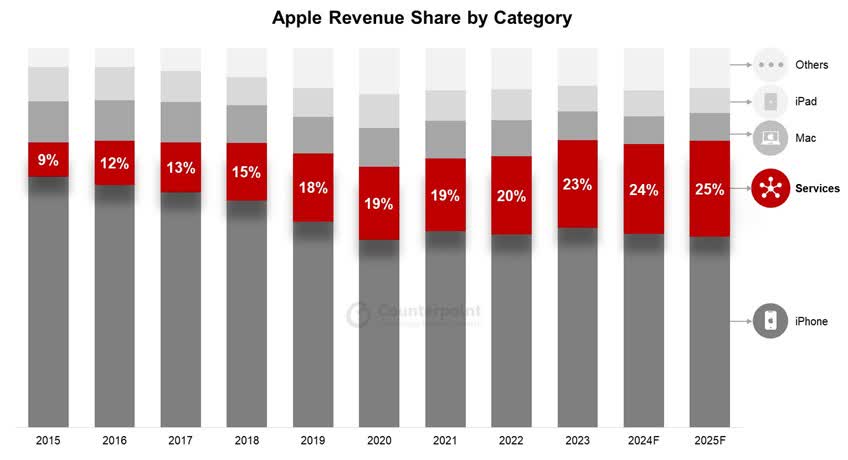

Services Segment Soars as Hardware Stalls

Amid the headwinds on the iPhone product line, the services sector has emerged as a bright spot, offsetting significant losses. Apple’s services business has continued to grow in strength even as hardware sales stagnate. As more people purchase apps on the Apple Store and other digital content, Apple has succeeded in generating significant service revenue.

In the last three months of 2023, Apple services revenue grew by 11% to $23.1 billion. In contrast, iPhone sales were only up 6% to $69.7 billion, as iPhone sales in the greater China region fell 13% to $20.8 billion. Given the robust growth, Apple service revenue will likely capture one-fourth of the company’s revenue by 2025, rising to $100 billion.

One catalyst behind the growth in services revenue is the installed base of over 2.2 billion iOS devices. The devices are locked into Apple’s ecosystem, from the Apple Store to Apple Care and Apple Music, where Apple can sell various software and digital content and generate significant revenues.

Counterpoint

Apple One is one of the critical software offerings expected to generate significant revenues in the future. The segment bundles up to six Apple subscriptions for one monthly price and is slowly becoming a hit. In addition, it is the powerhouse behind Apple’s two-terabyte iCloud+ storage, strengthening the company’s offerings in cloud computing. Apple One is well-positioned to provide consumers with a unified and homogenous software and services experience.

As iPhone sales are expected to continue capturing more than half of Apple’s revenues and remain the ecosystem’s centerpiece, the service segment is expected to fuel the company’s growth rates. Lastly, while Apple has yet to affirm its AI plans, CEO Tim Cook has already affirmed they are looking forward to introducing something that should bolster user experience and strengthen service offerings.

From AI in iPhones to Robotics Innovation and Vision Pro Headset Launch in China

Even as Apple contemplates including AI in iPhones as one way of fuelling demand, there are growing prospects for the company to venture into robotics. After failing to produce electric cars, the company is making strides in the personal robotics segment as it draws on research on its car project.

Immediate reports indicate that the company is working on a mobile robot capable of following users around the house. Robotics is an exciting venture, given that it is not an area dominated by other tech companies. The segment has enormous potential as it overlaps with some of Apple’s key research programs. While it is doubtful that the robotics segment will replace the lucrative iPhone product line, it should help complement the Apple ecosystem and enhance the company’s cross-selling efforts.

On the other hand, Apple plans to launch its Vision Pro headset in China to generate more revenue from one of its most important markets. In the U.S., where the product was launched, there was already strong interest from Walmart (WMT), Nike Bloomberg, and SAP (SAP). More than 600 apps and games are already available on the headset, designed to provide a spatial computing experience.

Finally, the launch underlines the company’s continued innovation around emerging virtual and augmented reality technology. Nevertheless, despite the $3,500 price tag, the headset is poised to compete against local headset players led by Pico, owned by ByteDance.

Concluding Thoughts

Following the pullback and underperforming the overall market, Apple is still a better pick owing to its strong cash flow, unique product line and software offering, and credibility in generating long-term value. While the company is entering slower growth in the hardware sales phase, service growth has already proved that it has what it takes to offset any losses.

Likewise, the company continues to invest in innovation as it seeks to develop new offerings that strengthen its competitive edge in hardware and software. Lastly, Apple’s work on a $77 billion buyback program affirms its commitment to returning value to shareholders, and in combination with its attractive entry point based on our technical analysis, AAPL remains a solid play for long-term gains.