Shahid Jamil

In July 2022, I wrote an article titled, Apple: I’d Rather Buy The SPY. The piece was met with much criticism, and it’s where I learned having an “it’s going to trounce the market” opinion of Apple Inc. (NASDAQ:AAPL) is contrarian on Seeking Alpha.

What I’ve learned after writing a few more articles, and after reading a good many more, is that confirmation bias is a real thing. I’m guilty of it too. I peruse my favorite stocks looking for articles with a “Buy” or “Strong Buy” recommendation. I’m biased.

But in truth, it’s articles expressing opinions opposite of mine where I find the greatest value. They challenge my thinking, test my convictions, and force me to consider a contrarian point of view. After all, a key to a great offense is a great defense.

So, in this article I’ll go back on defense, and dig my heels in a bit deeper on Apple. I’ll make a case for why I believe the 10YR Treasury may offer alpha over Apple the next 5-7 years.

Was I Right In July 2022?

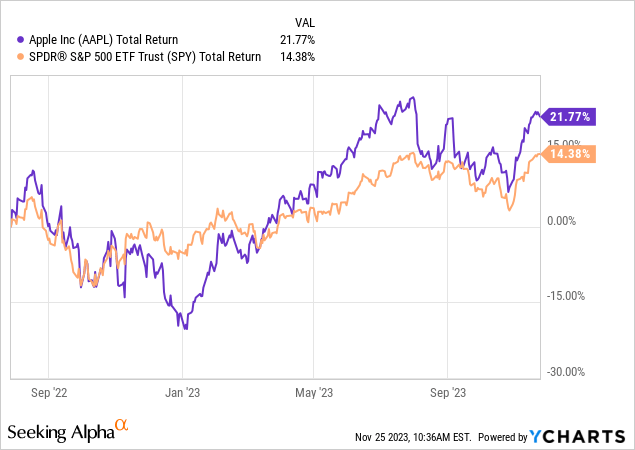

Nope, not if you can draw a final conclusion in less than 18 months. Since publishing my original article, Apple advanced 21% compared to the SPY‘s 14%. That’s 7% alpha in favor of Apple.

Apple’s advance wasn’t without its bumps. From July 2022 to January 2023, it dropped 20%. From its bottom, Apple is up over 50% in 2023. As one might expect, the SPY faired a bit better from a volatility perspective. It dropped 8% over the same period, and advanced 21% off its January lows.

Both Apple and SPY are close to retesting their highs set back in July 2023. From a P/E perspective, both appear to be rich.

Key To The Thesis

The key to this investment thesis is Apple’s current valuation near $190 per share. In my opinion, the stock is trading like it’s year 2029. From these levels, the bull case for Apple hinges on multiple expansions on a multiple that’s already expanded.

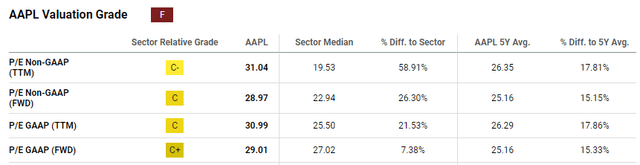

AAPL P/E Ratios (Seeking Alpha)

Per Seeking Alpha, each one of the various P/E ratios for Apple is approximately 15-20% overvalued. And the company currently scores a F for Valuation Grade.

From $190, I think it’s a lot more probable the stock will re-rate downwards than appreciate upwards. Here’s why:

Valuation

Prior to the pandemic, Apple compounded revenue at approximately 6% (2014 to 2020). During the COVID years, the company grew revenue by 33% in 2021 and 8% in 2022. This was followed by a 3% drop in 2023, and forecasted growth of 4% in 2024.

The point is, I believe Apple is reverting to its mean of flat to 8% annual growth in revenue and earnings. It sounds small, but we’re talking about billions of dollars annually.

Investors will argue Apple’s Services business is going to drive market outperformance, but even it only grew 9% from 2022 to 2023. And wasn’t enough to offset negative sales of its products YoY.

If I make the following assumptions, I shouldn’t expect a return much better than 3% per year for the next 7 years:

- Current share price: $190.

- Revenue CAGR of 5%.

- Net margins of 25% (23.5% is 5YR avg).

- Long-term P/E of 20x (compared to 16x avg pre-COVID).

- 3.5% annual reduction in shares outstanding (avg $105 billion in annual buybacks).

- 7% growth in annual dividends.

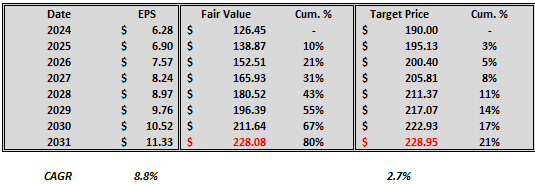

My crystal ball for EPS growth and share price would look something like this:

AAPL Forecast EPS Growth (Author’s data)

So, EPS is forecasted to grow 9% annually (largely bolstered by share buybacks). But from a starting point of $190, that represents a share CAGR of 2.7%.

The 10YR Treasury is yielding approximately 4.5% annually, which represents alpha of ~2% and comes with almost zero downside risk or multiple contraction.

Now What?

Apple is a phenomenal company, it’d be nearly impossible to argue otherwise. It earns billions per year and returns nearly all of it to shareholders via dividends and share buybacks.

But I believe it to be overvalued based on historical data and future growth prospects. I can’t make a bull case for Apple that doesn’t hinge on the expansion of the multiple to 30x or more.

From a purely return perspective, Apple is not a buy. Indeed, now may be a good time to lock in some profits. I did so a couple of weeks ago, and plan to sell more if/when the stock reaches $200.

Size Matters

I’m not bearish on Apple as a company. Quite the contrary. But it’s such a behemoth that it takes an enormous amount of sales and earnings to drive share price. As such, it’s quite difficult for it to outperform the SPY over the long term. It’s a good portion of the SPY.

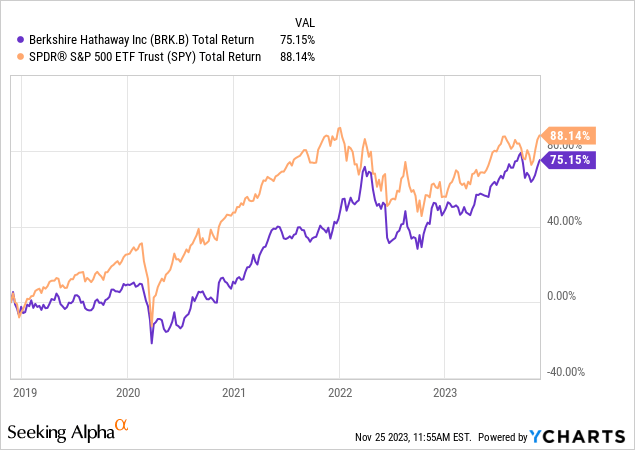

This is the same reason some people believe Warren Buffett has lost his touch, with Berkshire Hathaway Inc. (BRK.A, BRK.B) largely performing in line with the SPY in recent years. But Warren simply has too much money ($157 billion) to deploy into stocks (other than the AAPLs of the world) to obtain a market-beating return. It’s too big.

To put it in perspective for Apple, 5% growth on 2023 revenue and earnings represents $19 billion and $5 billion, respectively. Tractor Supply Company (TSCO), a totally unrelated company which I also like, had 2022 total revenue of $14 billion. Apple grows by more than one Tractor Supply each year. That’s a tough bar to climb year after year.

Conclusion

In my opinion, Apple’s current valuation near $190 per share is too rich to warrant taking up and/or adding to a position. With a potential reversion to the mean in revenue and earnings, coupled with multiple contraction to 20x (above pre-COVID levels), shares are at risk of underperforming the 10YR Treasury.

If you’re a current Apple shareholder, now may be a good time to take some off the table. With such a rich valuation, the market may give patient investors a chance to pick up cheaper shares over the coming weeks or months. Or you may consider investing those profits into risk-free T-bills while the getting is good.