Nikada/iStock Unreleased via Getty Images

Apple (NASDAQ:AAPL) reported another massive fiscal year, yet it wasn’t enough to propel shares higher on day two of the massive market rally. On 11/3/23, APPL closed down -$0.92 (-0.52%) on a day when the SPDR S&P 500 ETF (SPY) rallied 0.91%, and the Invesco QQQ Trust ETF (QQQ) climbed 1.17%. On the one hand, investors should be thrilled because the market is able to rally without AAPL leading the pack, as AAPL represents 7.19% of the SPDR S&P 500 ETF and 11.02% of the Invesco QQQ ETF. On the other hand, I don’t know why so many investors are down on AAPL, considering the main function of a business is to generate profits. I think that AAPL producing a -2.8% (-$11.04 billion) decline in YoY revenue overshadows the fact that gross margins expanded in an inflationary environment, EPS grew, and AAPL produced $97 billion in net income. In the past two years, AAPL has produced $196.8 billion in net income, which is more profits than most companies will produce in their existence. AAPL is a cash-generating machine that continues to provide value for shareholders. AAPL finished -10.89% (-$21.58) below its 52-week highs, and while shares could go lower, I believe they will be higher than the current levels this time next year. If AAPL trades lower in the short term, I think it’s a great holiday buy.

Following up on my previous article on Apple

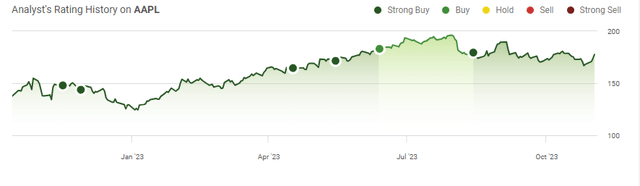

Since my last article on AAPL (which can be read here), shares have declined by -0.74% while the S&P 500 has fallen by -2.23%. In my previous article, I discussed how the future macro-environment is setting up well for AAPL, reviewed Q3 earnings, and discussed a possible year-end rally based on the valuations at the time of the article. I am following up with this article to discuss the changes to the macroeconomic environment, why it sets up well for AAPL, and why the current drawdown from AAPL’s highs is an opportunity.

After several months of additional economic data, I believe 2024 is setting up well for Apple

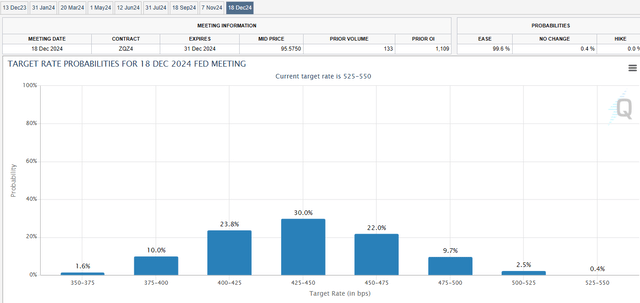

The November Fed meeting has come and gone, and rates remained unchanged once again. After listening to Jerome Powell’s speech and reading through the transcript (can be read here) I felt his tone was cautiously hawkish. He was crystal clear that the Fed understands the hardship on credit and business that higher rates cause, and they are focusing on the data. While he left the door open for another hike if needed, I have a feeling that a pivot is coming in 2024, regardless if we go another 25 bps higher in the short term.

The CME Groups Fed Watch Tool now shows that there is a 10.3% chance rates getting a 25 bps increase in January 2024, but they are now calling for a 25.9% chance that we see our first 25 bps cut in March of 2024. Looking at the end of 2024, there is a 97.1% chance that we will end the year lower with the Fed Funds Rate, and the highest probability is that the target rate is 425-450 bps. There is now an 11.6% chance that we see a sub-4 % rate in 2024. Looking out several years on the Fed dot plot, we are absolutely at the end of the tightening cycle rather than the beginning or middle, and there is a clear path to rates going possibly below 300 bps in the coming years.

This sets up well for AAPL over the next several years. As rates decline, so will the cost of capital, and both consumers and businesses should become looser with their spending. Businesses aren’t expanding as much due to interest on debt, and consumers are being cautious due to the cost of carrying balances on credit cards. AAPL is the greatest consumer company there is, and they just launched a new iPhone and introduced a new computer line on their M3 chip. I think the combination of falling rates and new hardware could set AAPL up to benefit from a lucrative upgrade cycle in the 2nd half of 2024 that extends into 2025.

Negative revenue growth is overshadowing how strong Apple’s 2023 fiscal year was and this is a company that deserves to trade higher, not lower

To put things in perspective, Microsoft (MSFT) has generated $151.6 billion in gross income and $77.1 billion in net income over the TTM, while Alphabet (GOOG)(GOOGL) has generated $166.76 billion in gross profit and $66.73 billion in net income over the TTM.

The market wasn’t thrilled that AAPL generated $383.29 billion in revenue in its 2023 fiscal year, as this was a -2.8% decline YoY from the $394.33 billion AAPL produced in 2022. Individuals don’t go into business to generate the most amount of revenue possible, the end goal is profitability. AAPL beat the Q4 consensus estimates by $0.07 as they generated $1.46 of GAAP EPS while revenue came in line at $89.49 billion. AAPL finished the year generating $383.29 billion in revenue and produced $169.15 billion in gross profit. This placed their gross profit margin at 44.13%, which was up from 43.31% in 2022. On the bottom line, AAPL generated $97 billion in net income, placing its profit margin at 25.31% and producing $99.58 billion in free cash flow (FCF). AAPL was able to grow its EPS by $0.01 despite the loss in revenue, as it came in with $6.16 of EPS for 2023.

AAPL isn’t getting enough credit as it’s navigated geopolitical tensions and macroeconomic headwinds to retain being the most profitable company in the market. AAPL is using its profitability to reward shareholders and forge a path forward through innovations that will set the stage for the next generation of hardware. AAPL saw strong performance in emerging markets, with revenue reaching an all-time record in fiscal 2023 and double-digit growth. AAPL is expanding its presence and will add retail stores in India while implementing e-commerce in Vietnam and Chile. I thought the guidance was strong as this December quarter has 13 weeks compared to 14 weeks last year, yet AAPL expects its revenue to be similar to Q1 2023. The extra week is a big deal as last year it added roughly 7% to the quarter’s total revenue. AAPL is expecting the iPhone segment to grow YoY, Macs to grow YoY, and Services to grow at a double-digit rate, as it did in Q4.

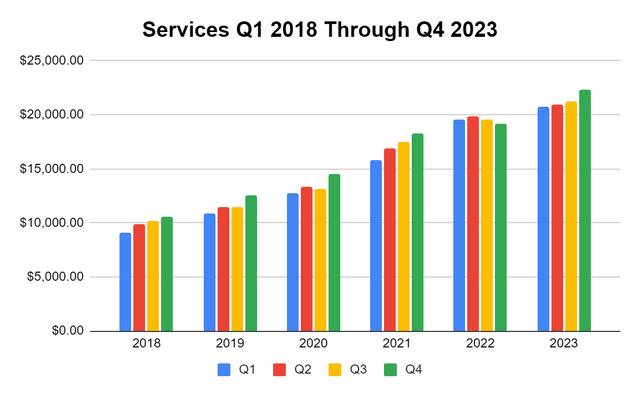

For the past several years, I have indicated that Services will become a $100 billion business on its own, and the best part is that this is reoccurring revenue. In 2023, Services generated $85.2 billion in revenue, which was a 9.05% YoY increase ($7.07 billion). At this rate, Services should become a $100 billion segment in the 2025 fiscal year. I feel that the market is overlooking this, and Services should be discussed in the same regard as AWS for Amazon (AMZN) or Azure for MSFT. AAPL built the Services business from scratch and once again proved that it can innovate with the best of them. No matter what AAPL puts its resources behind, it finds a way to dominate the sector, and the coming VR/AR computing revolution could be very underestimated as to how much revenue and profit AAPL can deliver from it.

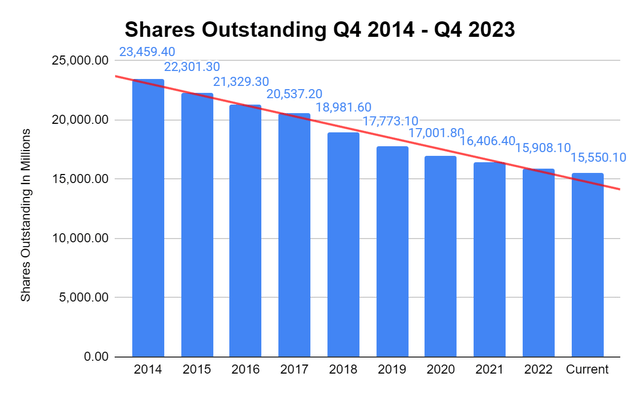

Once again, AAPL proved why so many loyal shareholders love this company. While some are focusing on the revenue decline, the real magic is in the return of capital. AAPL has returned $812.3 billion through buybacks and dividends over the past 11 years. This has allowed AAPL to repurchase 33.71% of its shares on the open market over the past decade while growing the quarterly dividend by 166.66% from $0.09 to $0.24. This is where I think people miss the true investment thesis around AAPL. Its revenue can continue to flatline or grow in the low single digits, but its profitability is so strong that it can continue to buy back shares and increase its EPS going forward while returning more capital through the dividend. When AAPL has the ability to generate additional revenue, it could act as a huge tailwind if the margins stay the same as more than 25% of every dollar is dropped to the bottom line, which could increase buybacks.

Steven Fiorillo, Seeking Alpha

Where I see Apple going in 2024

There are 42 analysts who see AAPL’s EPS increasing by $0.36 to $6.52 in 2024. I try not to look too far out as there is a significant drop off of projections after the two-year period, but the street sees a clear runway of EPS growth for AAPL. Whenever I make an investment, I am paying the present value for a company’s future cash flow as I expect them to grow their profits. When AAPL generates more EPS, it increases its ability to buy back shares and deliver dividend increases. AAPL finished the 2023 fiscal year, generating $6.16 of EPS, and is expected to reach $7.86 in 2026, which would put its forward P/E for 2026 at 22.58. I don’t think this is that expensive, considering how profitable AAPL is and its ability to grow profits or buy back shares.

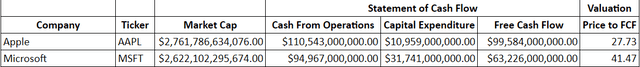

AAPL and MSFT are the two largest components of the S&P and the Nasdaq. When I look at how much I am paying for their cash flow, I am looking at their current price to the FCF over the TTM. AAPL and MSFT have very similar market caps as AAPL has a market cap of $2.76 trillion, and MSFT has a market cap of $2.62 trillion. Today, I would be paying 27.73x for AAPL’s FCF and 41.47x for MSFT’s FCF. AAPL is generating an additional $36.39 billion in FCF compared to MSFT, and when I am looking at investing in companies, I want to pay the best multiple on a company’s FCF. I feel that between AAPL’s earnings growth, the FCF history, buybacks, and the forecast for YoY growth, we could see AAPL trade at 35x its FCF in 2024. If it did, that would place its market cap at $3.48 trillion and its shares at $222.94. Considering that AAPL hit $198.23 this year, I don’t think that’s unlikely if we do get a bull market in 2024 from a Fed pivot and a more business-friendly economic environment.

Steven Fiorillo, Seeking Alpha

Conclusion

I don’t enter and exit my positions, and I can’t time the market as well as I would like. When AAPL sells off, I feel that it’s a buying opportunity as AAPL is a company I want to hold for decades to come. I am not a short-term investor, and I believe that the market is overlooking how strong 2023 was for AAPL because of the top line number declining. Everybody needs to make their own decision, and nobody ever got hurt taking a profit, but I don’t think AAPL’s best days are behind them. Services continue to grow, demand for AAPL’s products is strong, international sales, new products, and VR/AR can be ongoing catalysts, and AAPL will continue buying back shares hand over fist. I think we are going to see the markets higher in 2024, and AAPL not jumping on earnings is an opportunity because if the market rallies going forward, the chances are that AAPL will participate. I believe that AAPL has the ability to reach a $3.48 billion market cap in 2024, placing its shares at around $223.