Justin Sullivan/Getty Images News

Concerns for revenue fluctuations and the China ban are overblown

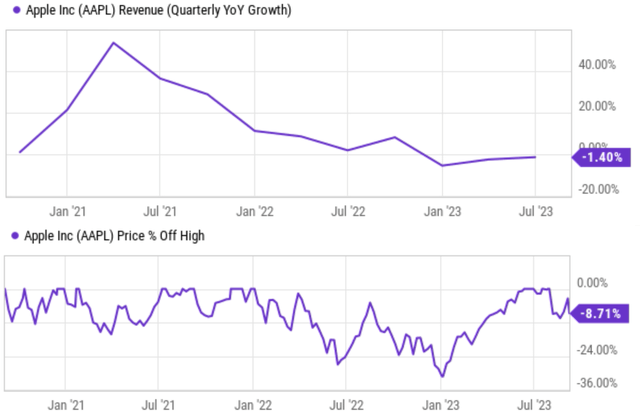

Apple (NASDAQ:AAPL) stock suffered sizable corrections since it released its 2023 FY Q3 earnings report. As seen in the top panel of the chart below, its quarterly revenues suffered a small decline (1.4% decline YoY) – the first such setback in years. Then more recently, AAPL share prices suffered another hit on the news that the China government is to ban its officials from using iPhones for their work. All told, these corrections caused a decline of its stock as deep as about 10% from its peak level as seen in the bottom panel of the chart. The stock price is about 9% off the peak level as of this writing.

Against this backdrop, the goal of this article is to urge AAPL investors to examine the fundamentals before taking action. Warren Buffett once compared his AAPL position to a high-yield farm during an interview with Yahoo! Finance. Take a look if you have not seen it before. It is a good collection of Buffett-style wisdom and humor. The following is the script for that part of the interview and the emphases were added by me.

Yahoo Finance: how closely do you follow the company? You know, people are concerned they really have not introduced any new products.

Buffett: Well, if you have to closely follow the company, you should not own it in the first place. If you buy a business, say you buy a farm, do you go up and look every couple of weeks to see how far the corn has grown up? Do you worry too much about whether somebody says this year is going to be a year of low corn prices because exports are being affected or something? You know, it does not grow faster if I go and stare at it… Although I do care over the years that it is well tended to in terms of rotating crops. And I hope yields get better.

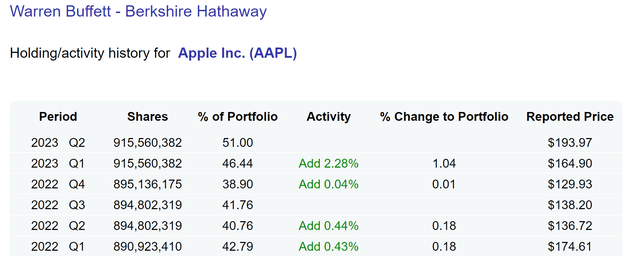

His words are certainly supported by his actions. As seen in the chart below, he has been steadily adding AAPL shares in recent years. Currently, he holds a total of 915M AAPL shares, valued at more than $178B at the current share prices, representing 51% of the Berkshire Hathaway equity portfolio. A truly concentrated bet even by the Buffett standard.

The key point here is to differentiate random jitters from business fundamentals. Quarterly sales fluctuate and will keep fluctuating, randomly. As a global business like AAPL, a small change in currency exchange rates would be sufficient to cause a 1% sales fluctuation. The market reaction to the China ban is also overblown in my view. My estimate is that the ban will create minimal impact considering that A) government officials are a small fraction of the Chinese population, B) the restriction only applies to the workplace, and C) many party officials have likely already stopped using iPhones (and/or other American products) for work due to concerns of their political image long before the ban (see this report for a more details).

If my above argument has convinced you that the recent market concerns are overblown, then the remainder of the article will try to convince you that AAPL’s long-term moat remains as strong as ever.

iPhone 15 release

Apple’s long-term moat in my view is built on 3 pillars: its popular product lineups, loyal fans, and ability to keep innovating. Thanks to this moat, it enjoys superb pricing power and profitability. Here I will examine this strength in more detail using its iPhone products, especially the highly anticipated iPhone 15. These same arguments can easily extend to other products as well (iPads, iMac, et al).

iPhones have a history of surprising their fans with features that they never asked for but ended up loving once they see them (speaking from firsthand observations from two AAPL fans in my household). The iPhone 13 offers a good example. No one expected features such as rack focus and/or adjustable focus on contents already captured. But once the fans (including my wife and all her friends who love posting on YouTube, TikTok, et al) saw this feature, they immediately fell in love.

I expect this history to continue and the anticipated iPhone 15 release (scheduled on September 12) to be no exception. From the limited information I gathered, I anticipate it to be another dazzling event for the billions of AAPL fans around the globe. There are so many innovations that are obviously good ideas once I read about them, such as the new chassis design (the use of titanium frame), the new lens imaging system (the use of a periscope-style telephoto lens for the high-end models), and also new bionic chips for performance/battery life improvement.

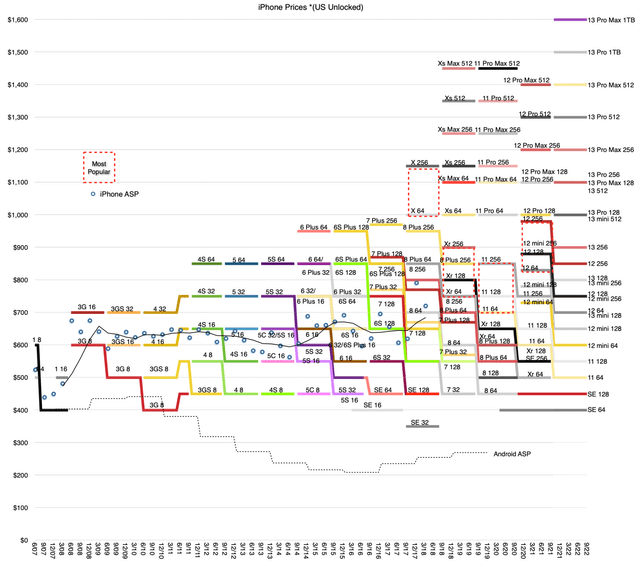

These continuous innovations have been translated into super pricing power and profitability as you can see from the following chart. It’s a chart loaded with information, but the key point is very clear. AAPL’s iPhone has been maintaining a steady price increase (at a rate of ~5% CAGR over the past 14 years), far exceeding the inflation and also the average smartphone price increase. I anticipate the iPhone 15 to continue this trend (i.e., cost an average of 5% more than the previous generation, and many other analysts project even higher prices. For example, analysts including Bloomberg and Barclays the iPhone 15 could cost $100 to $200 more than the iPhone 14 (depending on the exact model), translating to a ~10% price hike on average.

Source: GSMARENA, Evolution of iPhone prices

Valuation and risk-free rates

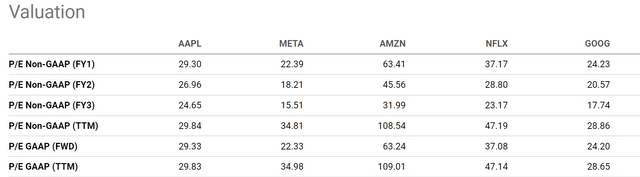

No matter how much I love AAPL stock and its products, I won’t blame you for finding its valuation off-putting. At a P/E of around 30x, it is not cheap any way you look at it.

However, since I opened this article with Buffett’s AAPL position, I will examine its valuation following his approach. I assume we are all familiar with the discount cash flow valuation model. And I further assume that many of us are aware that in that model, any valuation can be justified if we are willing to tweak the discount rate enough.

Buffett’s wisdom here is to A) stick with good businesses with stable compounding power (like AAPL), and B) then just use the risk-free rates as the discount rate. It’s simply “mathematical gibberish” in his view (see his comments below) to massage the discount rates arbitrarily.

… But we believe in using a government bond-type interest rate. We believe in trying to stick with businesses where we think we can see the future reasonably well — you never see it perfectly, obviously — but where we think we have a reasonable handle on it.

If you say I’m going to stick an extra 6 percent in on the interest rate to allow for the fact — I tend to think that’s kind of nonsense. I mean, it may look mathematical. But it’s mathematical gibberish in my view.

You better just stick with businesses that you can understand and use the government bond rate. And when you can buy them — something you understand well — at a significant discount, then, you should start getting excited.

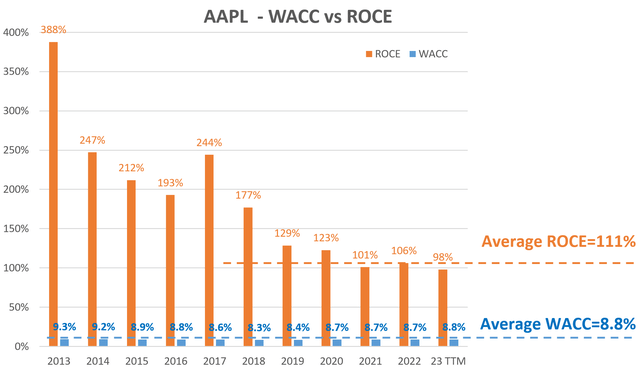

So here, rather than massaging the discount rates, I will just use the current risk-free rates (taken to be 4.3%, the current 10-year treasury bonds rate) for its valuation. I believe this is well-justified in the case of AAPL given its moat analyzed above and its superb profitability shown below in the next chart. This chart compares the cost of capital for AAPL (the so-called weighted average cost of capital, WACC) to its return on capital employed (“ROCE”). As seen, the WACC for AAPL has been in the range of about 8.3% to 9.3% in the long term. The average is 8.8%, which also happens to be its current value. On the other hand, its ROCE has been on average 111% in recent years. The wide and stable gap between WACC and ROCE serves as a strong indicator of its stable profitability and long-term compounding power.

Source: author based on Seeking Alpha data

The price dip creates an entry opportunity

With the above inputs, it is easy to plug the parameters into the discounted cash flow model and get an estimate of the fair valuation. Again, I will plug in 4.3% (the 10-year treasury rate) as the discount rate. I will use its free cash flow (“FCF”) to represent its true earnings power. And my estimate for its current FCF is around $6 per share ($6.9 of operation cash flow per share minus $0.9 of CAPEX expenditures per share). AAPL’s long-term growth rate is estimated by multiplying its ROCE (again, on average 111%) by its reinvestment rate (about 5% based on its recent financial and industry average). The end results turn out to be 5.5% (111% ROCE x 5% reinvestment rate = 5.5% growth rate).

Putting together all the above pieces shows a fair price of $181/share ($6/(5.5% – 4.3%)). Thanks to the market jitter, its stock now trades around $178 as of this writing, actually slightly below its fair valuation.

Other risks and final thoughts

To reiterate, despite all the near-term issues that are causing market concern (rightfully so), I see no long-term structural issues for AAPL. To recap, these issues include foreign exchange rates, which will very likely remain a headwind given the dollar’s strength. My estimate is that a negative impact of up to four percentage points can be caused by currency exchange (detailed analysis can be found in my earlier article here). China’s ban of iPhone can cause some impacts too. But as detailed in the first section, I expect such a ban to have only limited impact. On the macroscopic front, inflation and higher interest rates continue to erode buying power for businesses and consumers alike.

Looking past these temporary issues (and frankly also minor issues the way I see them), I see a superb business with a wide moat. I see three key pillars of this moat: its popular product lineup, loyal fans, and ability to keep innovating. Judging by its recent product releases and the information I gathered on the anticipated iPhone 15, I see all pillars remain as strong as ever. The only valid concern in my view is valuation. Amid an expensive overall market, AAPL stock is trading at a price that leaves no margin of safety. But on the positive side, it is not overvalued either based on my analysis above. Furthermore, in comparative terms, it is one of the better choices among mega-caps (for example, within the FAANG group), especially when adjusted by its profitability. As seen in the chart below, its valuation metrics are largely on par with the group average, yet its ROCE is about 2x higher than the average of this group.