stnazkul/iStock Editorial via Getty Images

Apple (NASDAQ:AAPL) delivered a record high service revenue of $21.2 billion with double-digit constant currency year-over-year growth in Q3 FY23. Currently, services account for approximately 26% of Apple’s total revenue. I believe Apple’s 2 billion active devices could lay a solid foundation for future service growth. In addition, I think Apple’s early investment in mixed reality might maintain their competitive advantage in the post-smartphone era.

Robust Growth in Services

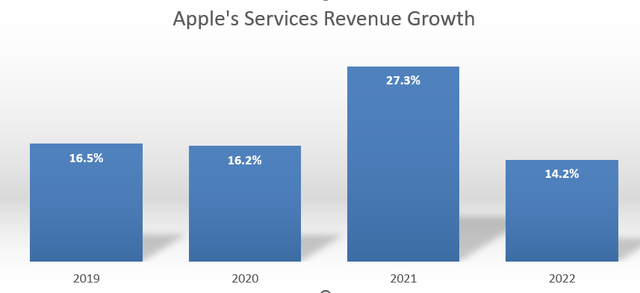

Apple’s service business has experienced very robust growth in the past few years. Service revenue accounted for almost 20% of total revenue in FY22, and this percentage grew to 26% in Q3 FY23. I believe the success of their service business is built on Apple’s massive installed base of devices globally. As of Q3 FY23, they have more than 2 billion devices in their installed base, and management expects this number to continue growing at a nice pace. Their service business provides advertising, AppleCare, cloud services, digital content, and payment services. Apple continues to add more variety to their services to better serve their device users.

Apple’s management indicates that they are experiencing increased customer engagement with their services, with both transacting accounts and paid accounts showing double-digit year-over-year growth. I would argue that Apple will continue to attract more paid subscribers, given the powerful synergy between their hardware and subscription services. I have no doubt that services will continue to be a key driver of Apple’s growth over the next few years.

Huawei’s Competition in China

Huawei lost some market share when the U.S. began restricting chip shipments to China. However, Huawei is making a strong comeback with their recent launch of the Mate 60 Pro. This new smartphone is powered by the Kirin 9000s chip, manufactured in China by the state-owned Semiconductor Manufacturing International Corp. While they are using the most advanced 7-nanometer technology, I believe that Chinese semiconductor design and foundry technology still lags 3-5 years behind the world’s most advanced technology. Nevertheless, I admire their in-house design and development speed, which has enabled them to respond quickly to the U.S. chip sanctions.

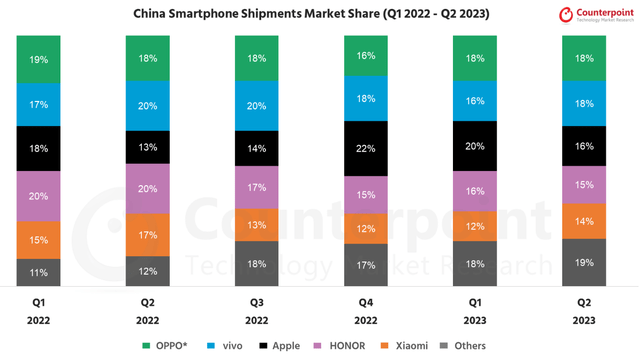

According to Counterpoint Research, Apple held a 16% market share in Q2 2023, while Huawei’s market share dropped from 20% in Q1 2022 to 15% in Q2 2023 due to the sanctions’ impact on their new product designs. With the launch of the new Mate 60 Pro, I estimate that Huawei could regain some market share, particularly from Chinese local players.

I don’t believe Apple will lose a significant market share to Huawei in the Chinese market, as Apple has always been perceived as a prestigious and luxury brand in China. It’s evident that high-net-worth individuals and affluent families in China have a strong preference for Apple products and rich Chinese prefer gifting Apple products according to Jing Daily. When Apple launched the iPhone 14 in China, they captured more than 25% of the market share, as reported by Counterpoint Research. Therefore, I anticipate that Apple’s launch of the iPhone 15 could once again have a substantial impact in China.

The Greater China region holds significant importance for Apple, accounting for approximately 19% of its total revenue. I have strong confidence that Apple can continue to grow its hardware business in China over the next few years. I believe that the growth might be driven by the increasing number of middle-class consumers in China, as well as the expansion of Apple retail stores. The rising middle class could significantly contribute to Apple’s business growth in China. Additionally, according to Bloomberg, Apple has ambitions to open more retail stores in China. The increasing number of retail stores can help Apple reach a larger population and expand into more regions within the Chinese market.

Mixed Reality in Post-Smartphone Era

While Apple currently owns 17% of global smartphone market share according to Counterpoint Research, it’s crucial to recognize that smartphones are essentially hardware devices and may eventually be replaced by new technologies in the future. Apple’s long-term success hinges on its ability to maintain a competitive edge in the post-smartphone era. It’s important to note that, at this point, it’s challenging to predict what technology might replace smartphones, and nobody has a definitive answer.

One plausible contender for the future is mixed reality (MR). According to Microsoft (MSFT), mixed reality represents the next wave in computing, following the eras of mainframes, PCs, and smartphones. They believe that mixed reality is becoming mainstream for both consumers and businesses, offering a seamless blend of the physical and digital worlds that could potentially reduce our dependence on screens.

In early 2023, Samsung (OTCPK:SSNLF), Google (GOOGL), and Qualcomm (QCOM) announced a collaborative effort to develop a mixed-reality operating platform. This partnership appears to be aimed at competing with Apple and Meta (META) in the emerging mixed reality space. Apple is also making early investments in mixed reality technology, unveiling their plans for a mixed reality wearable computer at WWDC in 2023. They have been working on Apple Vision Pro for several years already.

It’s important to clarify that I’m not suggesting that the current mixed reality headsets can replace smartphones, as most people may not be willing to wear such devices all day. Nevertheless, I believe that mixed reality technology will continue to evolve, and these devices may become smaller and more wearable over time. In the long run, they could potentially replace smartphones.

Recent Financial Results

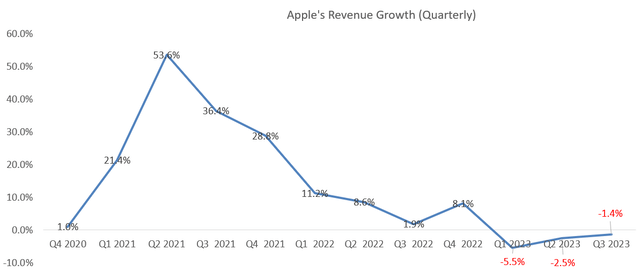

On August 3rd, 2023, Apple announced its financial results for Q3 FY23. The reported revenue declined by 1.4% year-over-year, and foreign exchange fluctuations accounted for 4% of the headwinds. Specifically, iPhone revenue remained nearly flat year-over-year in constant currency, Mac revenue decreased by 7%, and iPad revenue dropped by 20%, primarily due to the timing of the iPad Air launch last year. However, their Wearables, Home, and Accessories segment saw a 2% year-over-year growth. The most notable highlight was the continued acceleration of their service business, which grew by 8% year over year.

Looking at their balance sheet, Apple closed the quarter with over $166 billion in cash and $109 billion in debt. Consequently, their balance sheet remains robust, boasting a net cash balance of $57 billion.

During Q3 FY23, Apple returned $24 billion to shareholders, including $18 billion for share repurchases. Over the past five years combined, they generated an impressive $453 billion in cash from operations and used $387 billion to repurchase their own shares. Indeed, Apple is a real money-printing machine.

Key Risks

U.S. – China Political Risk: Apple currently generates more than 18% of its total revenue in the Greater China region. In addition to significant sales in China, Apple heavily relies on the Chinese supply chain. Any disruptions in this supply chain due to political tensions could have a substantial impact on Apple’s business. It’s important to note that geopolitical risks may not diminish in the near future, and the Chinese government could potentially enact bans similar to those imposed by the U.S. against Chinese high-tech industries.

iPhone Innovation Reaching Its Limits: It is becoming increasingly challenging for Apple to introduce significant innovations in future iPhone models. While they can continue to enhance features such as screen size, camera capabilities, performance, and user convenience, groundbreaking advancements in the iPhone may be less likely. As previously discussed, there is a growing belief that smartphones could eventually be replaced by emerging technologies like mixed reality.

Valuation

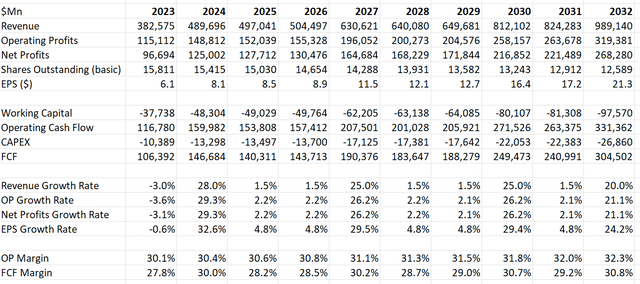

Apple’s revenue growth is closely tied to new product launches, making it non-linear in nature. During the year of a new iPhone launch, they typically experience substantial growth, which gradually slows down in the following years. Over the past decade, the compound annual growth rate of their revenue has been 9.7%. In my model, I account for this revenue growth volatility in the projections. Based on my estimates, the operating profit and free cash flow margins are expected to reach 32.3% and 30.8%, respectively, by FY32.

Apple DCF Model – Author’s Calculation

The model is using 10% of WACC, 4% of terminal growth rate and 16% of tax rate. Discounting all the free cash flow from the firm and adjusting the net cash position, the fair value of Apple’s stock price is calculated to be $205 per share as per my estimate.

Conclusions

I believe that Apple’s service business is highly sustainable and will continue to be a significant contributor to Apple’s revenue and profit growth. Furthermore, Apple’s early investments in Mixed Reality position them well for potential disruptions in the smartphone space. Taking into account these factors and the current valuation, I would recommend a ‘Buy’ rating for Apple.