Nikada/iStock Unreleased via Getty Images

Apple (NASDAQ:AAPL) stock is arguably the most popular company on Wall Street and in the financial press. A technological high-growth company that also has very good debt and liquidity indicators… What else is needed for investors to be happy and rush to buy its stock? Indeed, Apple’s stock price can also keep rising for a while. But I still think that it is not good value for your money, especially given the fact it is not a growth stock anymore.

My earlier article on Apple

In my earlier article on the company, namely “Apple Stock Is For Buffett But Not Benjamin Graham” I highlighted the key principles of a value investor and mentioned that AAPL stock might not be a good choice for such an investor. Apple fulfills only two of Graham’s value criteria, namely it is really large and the company also has a sound profit growth track record. However, the last several earnings reports show that the company’s profit has declined somewhat. But by all means the company is still expensive, especially if we have a look at its valuation multiples. A lot has happened since my last article’s publication here on Seeking Alpha. But my thesis of Apple not being a value play remains intact. Let me explain why.

Apple stock – recent developments and fundamentals

The last reported set of annual earnings results was rather disappointing, in my view. The company is considered to be a high-tech growth stock but its earnings growth has stalled.

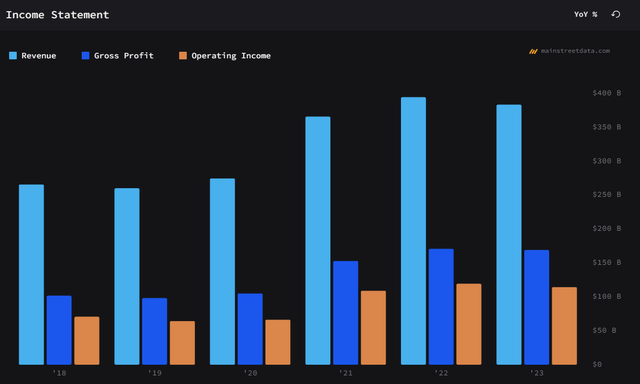

The diagram below shows Apple’s revenue, gross, and operating profits.

The data above are given for the period between 2018 and 2023. Since 2021 the company has not been growing its revenues by much. The same is true of the gross profit and operating income.

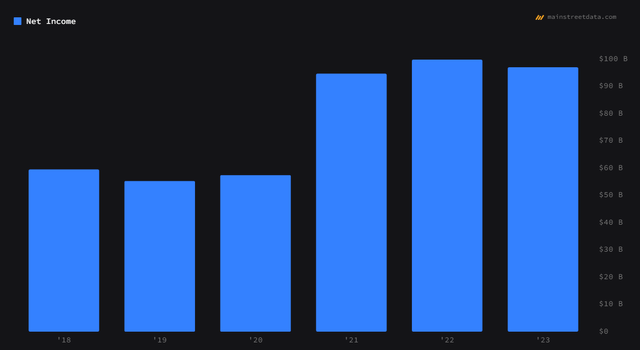

The same is true of the corporation’s net income. Its growth has stalled since 2021. Some readers might indeed argue that Apple is a mature company and does not have to record excellent growth. However, it is still valued as a glamorous high-growth company. But let us have a closer look at the high-tech giant’s sales breakdown.

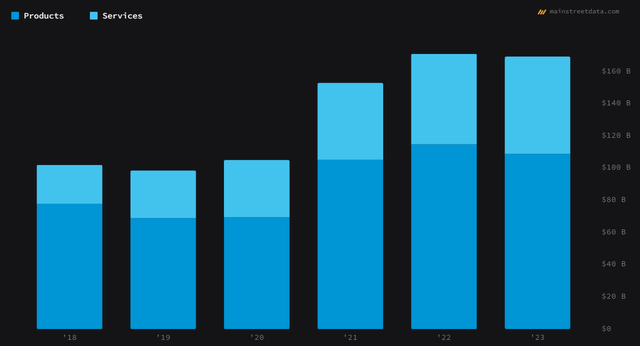

I would say that Apple’s services have been the company’s best-performing division.

As you can see from the graph above, in the recent couple of years (the data above are given for the period between 2018 and 2023) the services generated more profits compared to the previous years as opposed to products.

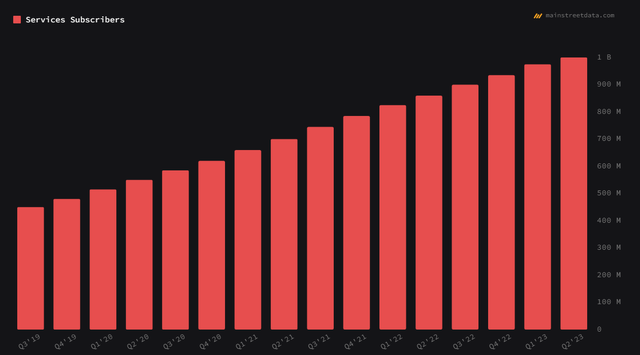

Apple’s service subscribers have been growing steadily for many quarters.

The more detailed revenue breakdown suggests that services in the last several years have been a substantial part of Apple’s sales.

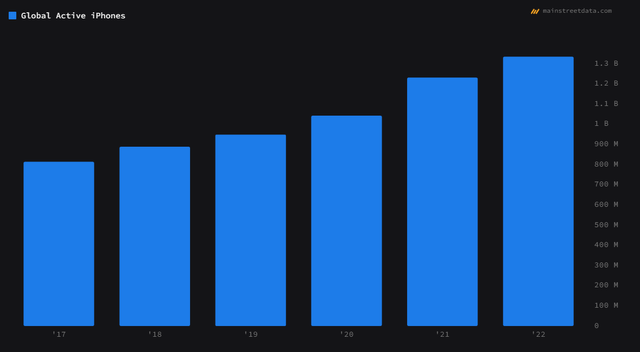

This is despite the rising number of active iPhones. At the same time, in the last couple of years or so the growth rate has decreased somewhat as can be seen from the histogram above.

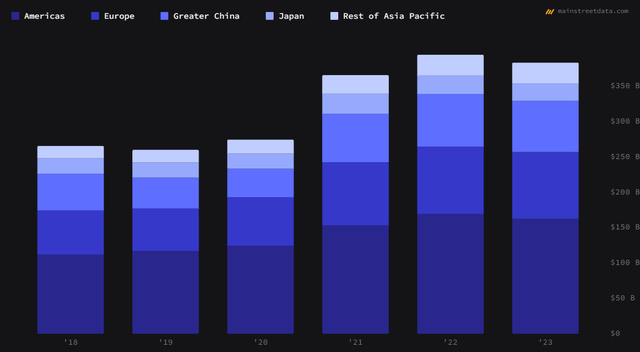

As concerns Apple’s regional growth, Greater China, Japan, and the rest of Asia Pacific were much more impressive compared to the Americas region.

But as can be seen from all the graphs above, Apple’s growth rate has substantially slowed down.

Apple’s strengths

Do not take me wrong. Apple’s business has plenty of strengths. Here are just several of them.

- The corporation has a very strong competitive moat. It has a large army of fans, meaning that a lot of consumers are willing to pay for its products and services. Each of its new product launches, including iPhones, smartwatches, and Macs, are impatiently waited upon. Apple can command higher prices for its products and services as opposed to other companies, including Xiaomi (1810.HK) and Huawei.

- The company is still very well-diversified and profitable. In other words, it does not only rely on one product, the demand for which is rapidly falling but finds other opportunities to profit from growing sectors. It also operates all over the world and is therefore geographically diversified.

- It has a demonstrated track record, meaning that investors have plenty of available market information on Apple. It is a transparent company that publishes plenty of detailed information on its operations, strategies, and finances. There is also a lot of information from third-party sources, which enables investors to conduct the proper due diligence research needed to make informed investment decisions.

Valuations

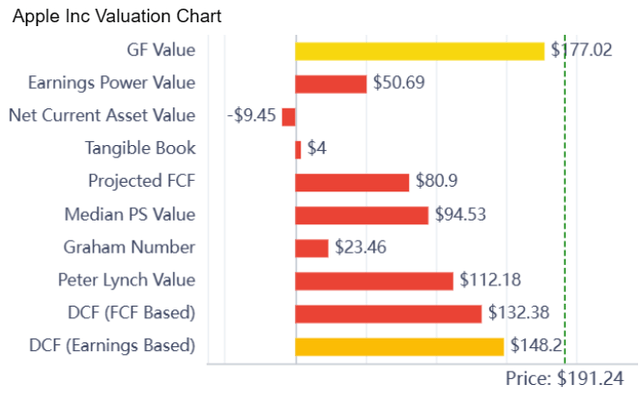

AAPL stock is highly overvalued. Most of the valuation methods, including the DCF (discounted cash flow) model, the net current asset value, the Graham number, the tangible book value, and the Peter Lynch value suggest substantial overvaluation.

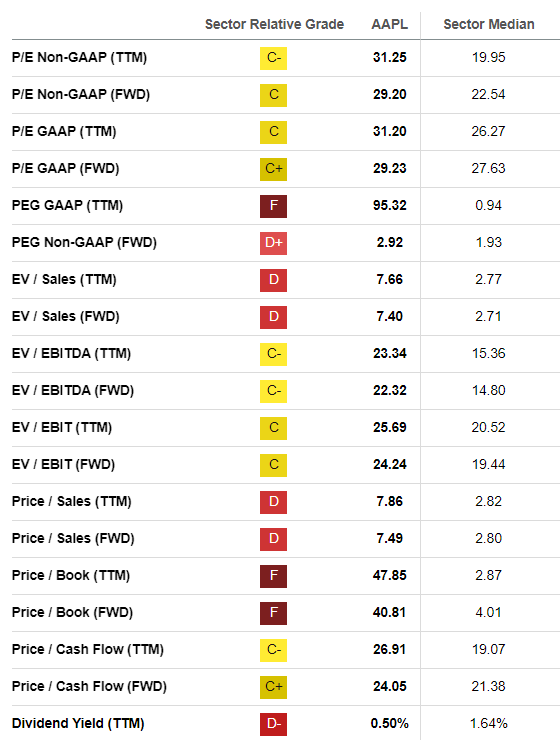

The same is true of the valuation multiples. According to Seeking Alpha’s data, many indicators, including EV/Sales, PEG GAAP, the price-to-sales (P/S), the price-to-book (P/B) ratios, and the dividend yield suggest obvious overvaluation, especially compared to other companies operating in the same sector.

Seeking Alpha

Risks

The risks are also significant. As I have just mentioned above, the first and the most apparent one is AAPL stock’s overvaluation.

Then, another risk is that of the fact Apple does not seem to be a high-growth company. Yes, it is reliable and mature but cannot be called an obvious ever-growing giant. The last couple of years suggest the growth pace has slowed down.

As I have mentioned many times before in my other articles, a recession may lead to the stock’s decline as well as a fall in demand for the company’s products. However, unlike high-debt low-liquidity companies, there is virtually no way for Apple to go bankrupt during the next economic decline.

So, I would say that the main risks are of a stock price decline due to the lack of profit and revenue growth, a likely economic recession ahead, and the market realizing that AAPL stock is overvalued.

Conclusion

Overall, I would say that Apple is a highly popular company with a great army of admirers that is also well-diversified. However, it is still priced to be a growth stock (and is therefore overvalued in my opinion). But, unfortunately, given the last earnings results, this does not seem to be true. Although I consider Apple to be a mature and sound company, it is not a great buy right now, given its stock price.