Nikada

Apple Inc. (NASDAQ:AAPL), one of Wall Street’s darlings, has no need to be introduced. It is highly popular among investors. However, the AAPL stock price recently corrected somewhat due to lower sales in China and regulatory pressures. Although Apple’s shares are trading off their all-time highs, I still would not acquire the stock, even though the company is a stable cash cow business. Here is why.

Summary of my previous article on Apple

I have been quite conservative in my forecasts of the iPhone maker for a while. In my previous article, I wrote that the business is well-established, has a very strong brand name, is highly diversified, and operates in the high-tech industry. However, it seems like its brilliant growth has stalled somewhat, while its stock is still trading very high. Well, in spite of the recent correction, my opinion on the stock is still unchanged, namely that the company is overvalued according to various valuation methods and indicators.

In my view, the stock price correction was warranted. It happened for several reasons. But AAPL is still not cheap enough for me just yet.

Why is Apple stock down?

There are various explanations for the stock’s correction.

For example, my fellow Seeking Alpha analyst, Yuval Rotem, has written a brilliant article explaining Apple’s rather disappointing news and the possible reasons for the stock’s actual correction. Among these are lower sales in China and regulatory pressures. These explanations are valid, but in my view, AAPL stock should trade lower for other reasons.

The Chinese government banned Apple’s devices for use in several government agencies.

Then, in the first six weeks of 2024, Apple’s sales dropped by 24%. This is mainly due to the fact that Huawei returned to the market while price-conscious Chinese consumers switched to Huawei’s smartphones from premium-priced iPhones.

I personally disagree that China is so important for Apple in terms of its sales, although these announcements made investors more cautious.

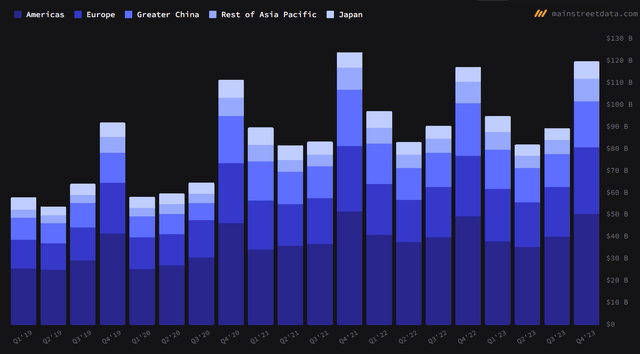

First of all, the Americas is still the biggest region, generating a lion’s share of Apple’s revenues. The second region that is accountable for the company’s sales is Europe, while Greater China and the rest of Asia Pacific are only accountable for small proportions of the company’s revenues. So, China’s demand slowdown does not have a very big effect on Apple’s sales and earnings in my opinion.

High-tech giants face that type of pressure. As concerns Apple, the EU slapped the corporation with a $2 billion fine. The problem with AAPL is that this accelerated from a couple hundred million to a whopping $2 billion fine, representing more than 2% of Apple’s net income.

Obviously, this is not only typical of the EU. Many countries’ legislation aims to protect consumers from monopolies. So, Apple does not only face risks from the European Commission but also from other countries where it operates. However, as I have mentioned before, this is typical of other companies operating in the high-tech sector. In other words, it is a general risk, but again, it is a piece of bad news for Apple’s stockholders.

- Lack of substantial AI growth

Many big tech names, most notably Nvidia, have recently shown brilliant growth thanks to their active adoption of artificial intelligence. I wrote quite a big article about NVDA commenting on its 2023 earnings. Apple, it seems, has disappointed investors on that front. In spite of the corporation being one of the top high-tech companies, it was not one of the main players in the initial stages of the AI revolution.

Indeed, I believe positive AI news would have supported investors’ enthusiasm and Apple’s stock price.

But the main problem for AAPL, in my view, is the fact that the company’s income and sales growth have stalled.

Apple’s fundamentals

Aswath Damodoran, also known as the dean of valuation, named a number of criteria as relevant when judging a firm’s attractiveness. Among these are the following:

- Sales growth.

- Profitability.

- Risk.

- Return on investment.

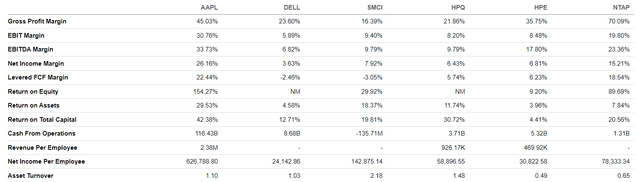

I would like to compare and contrast Apple’s key profitability measures to those of its peers operating in the US high-tech industry. I decided to take American companies, including Dell Technologies Inc. (DELL) and Hewlett Packard Enterprise Company (HPE), producing personal computers and computer equipment.

We can clearly see that Apple is a very profitable company with much higher margins than those of its rivals.

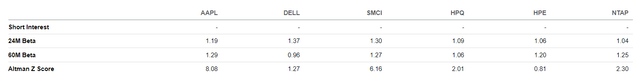

As concerns Apple’s riskiness, it is much lower than its rivals. The Altman Z Score, which takes into account profitability, leverage, liquidity, solvency, and activity ratios, sees the company as low-risk.

Return on equity

As I have mentioned above, Apple’s profitability is very high, and its net profit has been rising for a while as well. But the company’s ROE is not high just because of that. Apple heavily relies on debt, and this means it can boast a very high ROE. At the end of 2022, Apple had almost 6 times as much debt as it did equity. Therefore, it is logical why the company is able to earn high profits compared to its equity because its equity was not that high. I will present the company’s debt-to-equity history below. However, we can clearly see that Apple’s ROE has stopped rising. In 2022, it reached its peak because the company’s profit growth stalled, while the D/E ratio decreased in 2023.

ROE

|

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

|

|

ROE |

44.7% |

35.6% |

36.1% |

55.6% |

61.1% |

87.9% |

150.0% |

197.0% |

156.0% |

Source: Prepared by the author based on Seeking Alpha’s data

But let us have a look at the corporation’s revenues and profit as well as D/E ratio history.

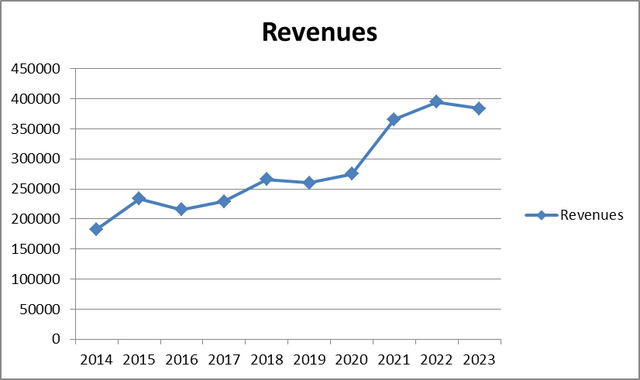

From the diagram below, you can clearly see that sales growth also reached its peak in 2022.

Revenue growth

Prepared by the author based on Seeking Alpha’s data

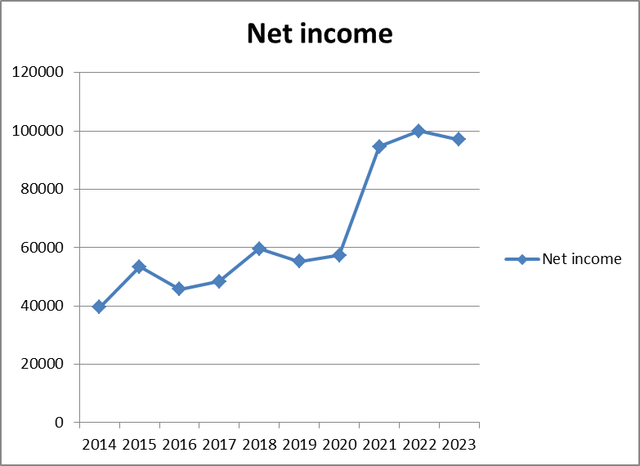

And the same is true of Apple’s net income growth. In fact, in 2023, the corporation’s net income even decreased slightly compared to 2022.

Net income growth

Prepared by the author based on Seeking Alpha’s data

How about the company’s debt and liquidity positions?

Well, the debt-to-equity (D/E) ratio reported for 2023 is 3.77, while a good D/E is usually between 1 and 1.5. In my view, this indicator is far too high for a large and profitable corporation like Apple.

Debt-to-equity ratio

|

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

|

|

D/E |

1.08 |

1.43 |

1.51 |

1.80 |

2.41 |

2.74 |

3.96 |

4.56 |

5.96 |

3.77 |

Source: Prepared by the author based on Seeking Alpha’s data

Apple’s current ratio is 0.99. This is rather worrying because Apple’s current assets are not even enough to meet its short-term debt if it were all due at once.

Current ratio

|

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

|

|

Current ratio |

1.08 |

1.11 |

1.35 |

1.27 |

1.13 |

1.54 |

1.36 |

1.07 |

0.88 |

0.99 |

Source: Prepared by the author based on Seeking Alpha’s data

Apple’s ROE, net income, and EBITDA margins are substantially higher than its competitors. However, it seems that the company’s income and sales growth rates have all slowed down, reaching their highs in 2022. The D/E and current ratios are not great for a large and profitable corporation like Apple.

Valuations

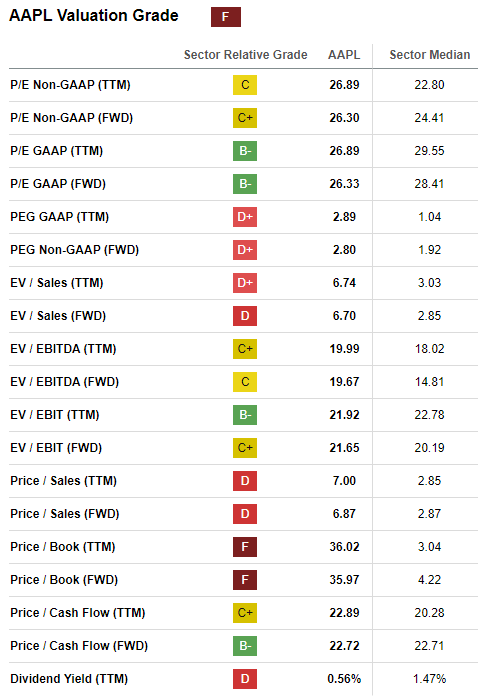

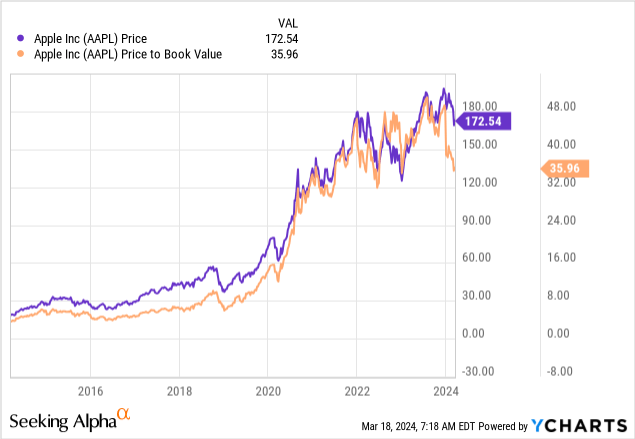

As I have mentioned before, Apple’s stock is far too overvalued. If we look at the table below, we will see that only the corporation’s P/E indicators are reasonable, thanks to Apple’s exceptional profitability. Other valuation ratios, especially the company’s P/B ratio of more than 35, are extremely high compared to the sector’s medians.

Seeking Alpha

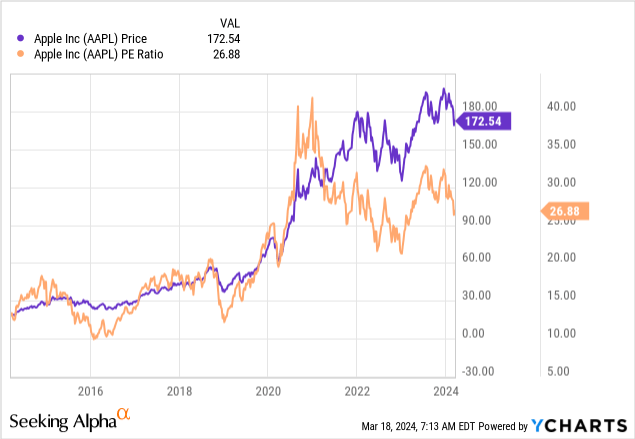

But let me compare Apple’s main valuation ratios to where they were historically. Apple’s P/E all-time high was just over 40 in 2021. Right now, Apple’s P/E is off its highs but still significantly above the 2015-2019 levels. In some instances, Apple’s P/E was about 10. So, Apple’s P/E does not suggest the stock’s undervaluation, it seems.

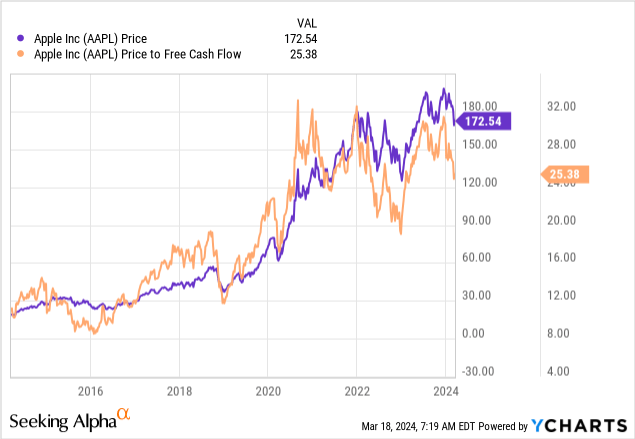

The same goes for the company’s P/FCF ratio. It is off its all-time high of 32, but substantially above the 8-level mark reached in 2016.

As the table above suggests, the sector’s median price-to-book (TTM) ratio is just above 3. Apple’s P/B is now almost 36. It is still below the 48 mark reached in 2022 but substantially above the 6-7 mark reached in 2015-2016.

Overall, we can safely say that AAPL stock is not good value for money if we compare the stock’s valuation ratios to the sector’s median ratios and Apple’s historical valuation multiples.

Upside risks

Apple’s key upside risks are the following:

- A breakthrough innovation. It is hard to overstate how important this factor is in Apple’s history. Apple was the first to introduce many different products, including the renowned iPhone and the Macintosh computer. Something similar might actually happen in the near future, which would highly likely make the stock price soar.

- Apple’s profits are still very high and may stay so for a long time.

- High perception of Apple by many investors: AAPL is a highly popular stock, while Apple is a very popular company manufacturing smartphones and personal gadgets. It has a strong brand name and an army of loyal, long-term investors. This will likely prevent AAPL from experiencing a major stock price crash.

- Soft landing of the US economy. The Fed might cut rates very soon, thus preventing a recession. In this case, all companies, including Apple, will benefit.

Downside risks

In spite of Apple’s stability and popularity among investors, some key risks remain, namely:

- The company’s earnings growth has stalled somewhat. In order to be valued highly, companies have to demonstrate very sound earnings and sales growth.

- The stock valuations remain aggressively high.

- Many economists say that recession risks are high. This will obviously be a big minus for all overvalued companies not demonstrating good growth.

Conclusion

I would not be surprised if AAPL rises after the recent correction, thanks to the company’s profitability and the stock’s popularity among investors. But this is not my base-case scenario. The company’s growth has stalled, it seems, even though the economy has not entered a full-scale recession. But the company’s stock is still richly valued according to the key valuation ratios. So, there is no margin of safety in my opinion. My rating is “Hold”