Picsfive

Apple Inc. (NASDAQ:AAPL) is one of the best companies in the world, no one doubts that. Innovation, creativity, and efficiency have made this one of the most sought-after brands ever, and it has revolutionized our lives over the past 15 years. Customer loyalty is extremely high, to the point where they would probably give up their home rather than their iPhone.

I could write for hours about Apple’s strengths, but I think it is superfluous since they are all widely covered topics; I would not add anything new. We know its financial results, and I don’t think there is anything more to say when in a single year a company manages to generate $111.44 billion in free cash flow.

So, the reason I am writing this article is not to praise this company for the umpteenth time, but to point out a number of risks that the price per share may not have fully discounted: in particular, overexposure to the Chinese market.

Reliance on China

Over the past decades, many Western companies have seen China as a gold mine, both because of low-priced specialized manufacturing and because it is a booming market. Of course, when I talk about the risk of exposure to China, it’s not just about Apple, but so many other companies. Anyway, I think for Apple the risk is higher.

Moreover, its price per share does not present a high enough margin of safety in my opinion, which is why I am restrained from buying this stock.

Sales and assembly

China is too important a market for Apple, both in terms of revenue and in terms of manufacturing/assembly. Let us look in detail at the data on these aspects.

In terms of sales, about 19% comes from China. Since analysts expect total FY2023 revenues of $407 billion, we are talking about $77 billion. What’s more, revenues from China have a higher quality since the profit margins are better: around 35 percent. In short, this market is crucial for Apple.

However, after years of growth something seems to be changing in China, and the latest government choices are undermining the company’s future within the country. Until now there had never been bans or restrictions on the sale of iPhones in China, yet a few days ago it was decided to ban their use for all those working within the Chinese government. In itself, this news has minimal relevance, in fact less than 1% of the population would be subject to this ban, yet we cannot know how the situation will evolve in the future.

My main concern is that this ban may spread further and further until it reaches the entire population. This would be an unlikely but not impossible scenario given the relationship at an all-time low between China and the U.S.

It is undeniable that there is bad blood between the two world superpowers; after all, the world’s leading economy is at stake. We have already been accustomed to this kind of ban in recent years, as for example happened years ago with Huawei and recently with TikTok. In short, it was to be expected that this would be followed up.

China has never hidden its desire to make itself independent from the West, especially technologically, and its achievements over the past decade have been impressive. In fact, their technologies have spread to the West as well.

I do not doubt that Chinese customers are satisfied with Apple, but I am hesitant to consider the iPhone as the phone of the future in China. While the possibility of a total ban is remote today, ruling out this scenario altogether would be a mistake in my opinion.

If the Chinese government believes that banning the sale of iPhones is a way to benefit the country and the community, it will do so. For those who think Apple is too important to China, I would like to remind them that not even Chinese companies are too important to China. Tencent and Alibaba are two internationally well-known giants, and even they have not been able to deflect the Chinese government’s decisions. Both of them will have to pay $15.50 billion in common prosperity by 2025.

Having discussed the importance of China in terms of revenue, let us now look at what this country means in terms of manufacturing and assembly.

More than 90 percent of iPhones, AirPods, Macs, and iPads are manufactured in China. In particular, Zhengzhou is home to “iPhone City.” In this city, the factory owned by Foxconn, Apple’s partner, can produce up to 500,000 iPhones per day: we are talking about a crucial node in the supply chain. If this factory crashes, so does Apple, and we already encountered this last year when workers protested poor working conditions. A few days of protests triggered an underproduction of 6 million iPhone 14 Pros. In other words, it only takes a little to stop gear.

Dependence related to manufacturing is probably an even bigger problem than sales, and in fact the company has already been trying to move its production elsewhere for years. According to JPMorgan analysts, by 2025, 25 percent of Apple’s manufacturing will be outside of China. The most important countries where production will be diversified are India and Vietnam, two growing economies with still very low labor costs. This process has already begun; in fact, some newer iPhone models are already produced in India, while MacBooks are produced in Vietnam. However, there are difficulties along the way:

- Vietnam’s labor force participation rate is 74.4 percent, which is very high, but the average age of the population is expected to rise sharply until 2050. In addition, although the average wage in Vietnam is currently low, the latter is rising very fast in recent years. If the trend continues, the labor force in Vietnam may not be that cheap in the future.

- In India, there are problems in increasing production, and the main causes are logistics, tariffs, and infrastructure. Although this country is set to be among the world’s leading economies, it is currently still a long way from being considered mature.

Finally, one problem that both India and Vietnam share is the lack of know-how. Apple is sending designers and engineers from California and China to train locals, but there is still a long way to go to bridge the gap: the Chinese workforce is hard to replace. In this respect, I think Tim Cook’s speech during an interview in 2012 is emblematic:

The truth is, the tool and die maker skill in the US began to go down in the late 60s, early 70s, and how many tool and die makers do you know in the US now? I could call a meeting around the United States and say, every tool and die maker come to this room tonight, we wouldn’t fill the room. In China, you would need several cities to fill with tool and die makers.

The tension with Taiwan

The tension between China and Taiwan is the main subject of the second risk facing Apple.

As we all know, President Xi Jinping has repeatedly reiterated his desire to annex Taiwan to China, and the situation could escalate at any moment. After a period of high tension in late 2022, the situation seems to have calmed down, but concerns remain. In fact, should China succeed in its plan it would increase its power disproportionately.

Taiwan is home to Taiwan Semiconductor Manufacturing Company Limited (TSM) aka TSMC, the world’s largest semiconductor company. Ninety percent of the most advanced processor chips are produced in a series of factories in Taiwan, and all the most technologically advanced companies are dependent on it. Apple is its main customer, since without these chips it could not sell such powerful electronic devices. In short, TSMC is the most important piece in its supply chain.

In case of a conflict between China and Taiwan, the consequences would be disastrous for Apple and the whole world, but I want to rule out this scenario for the time being. Anyway, depending so much on one trading partner represents a weakness, as TSMC may decide to raise the prices of its chips, thereby reducing Apple’s profit margins.

Because of the tension with China, TSMC’s management is diversifying production to other countries, including the U.S.: a $40 billion investment has been made in Arizona to create two new operating plants starting next year. This is an important step but one that will not make significant changes in the production of the most cutting-edge chips: the latter will still be produced at plants in Taiwan.

In short, the evolving relationship between China and Taiwan affects Apple directly given its dependence on TSMC. While it is true that Apple is its largest customer-responsible for 23 percent of total revenues-the Cupertino company cannot do without TSMC. Between the two, it is TSMC that has the upper hand.

Valuation

As mentioned earlier, I respect this company a lot, but that does not mean it should be bought regardless. Even the best business in the world can be overpaid and turn out to be a bad investment. Even if Apple presents a dominant position, investing in it is not a risk-free option.

The price per share of the stock has risen a lot in recent years, competition is fierce, and a key country like China is raising a number of concerns. We do not know how far the tension between China and the United States will go, but at this rate it does not bode well for companies heavily dependent on the East. Unfortunately, Apple is one of them, and to assume that everything will be resolved in the future is a dangerous assumption.

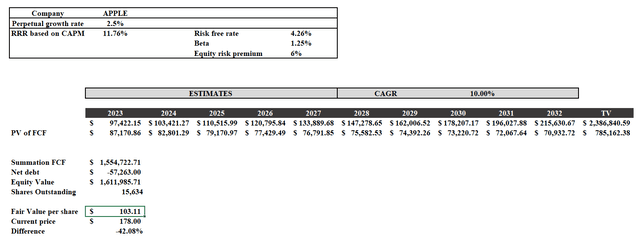

To calculate Apple’s fair value, I used an FCF model whose discount rate is calculated through the CAPM. In addition, here is the calculation of annual free cash flow estimates:

- For the first 5 years, I took Street Estimates of revenues and multiplied them by the average free cash flow margin for the last 5 years, 25.42%.

- For years 5-10, I considered a 10% growth rate. I personally think this is a rather generous outlook considering how big this company is today.

The result is a fair value of $103.11 per share; therefore, Apple is overvalued according to my estimates. For such a dominant company, I am willing to pay a premium, but not $180 per share.

However, just because I think Apple Inc. is overvalued does not necessarily mean it is a sell. My rating is more of a “avoid buying at the current price.” There are many other factors to consider before selling, such as the time horizon of the investment and the average purchase price. These aspects should be evaluated on a case-by-case basis.